The Rent is Still Too High: An Updated Look at the Housing Crisis

Updated Dec 2023

Despite the economic recovery and wage growth in recent years, the issue of high rent continues to plague many American households. According to current data, many renters in the U.S. are still grappling with the burden of housing costs.

The latest reports indicate that the percentage of cost-burdened renters, spending more than the recommended 30% of their income on rent, remains alarmingly high. This issue is not confined to high-cost cities but is prevalent across various geographies, particularly affecting low-income renters. The typical low-income renter faces a severe rent burden, which has grown substantially over the past few years.

In addition to the high rent, renters are also dealing with a “dizzying array” of additional charges, from application fees to pet fees, which are rising faster than rent. This further exacerbates the financial strain on renters.

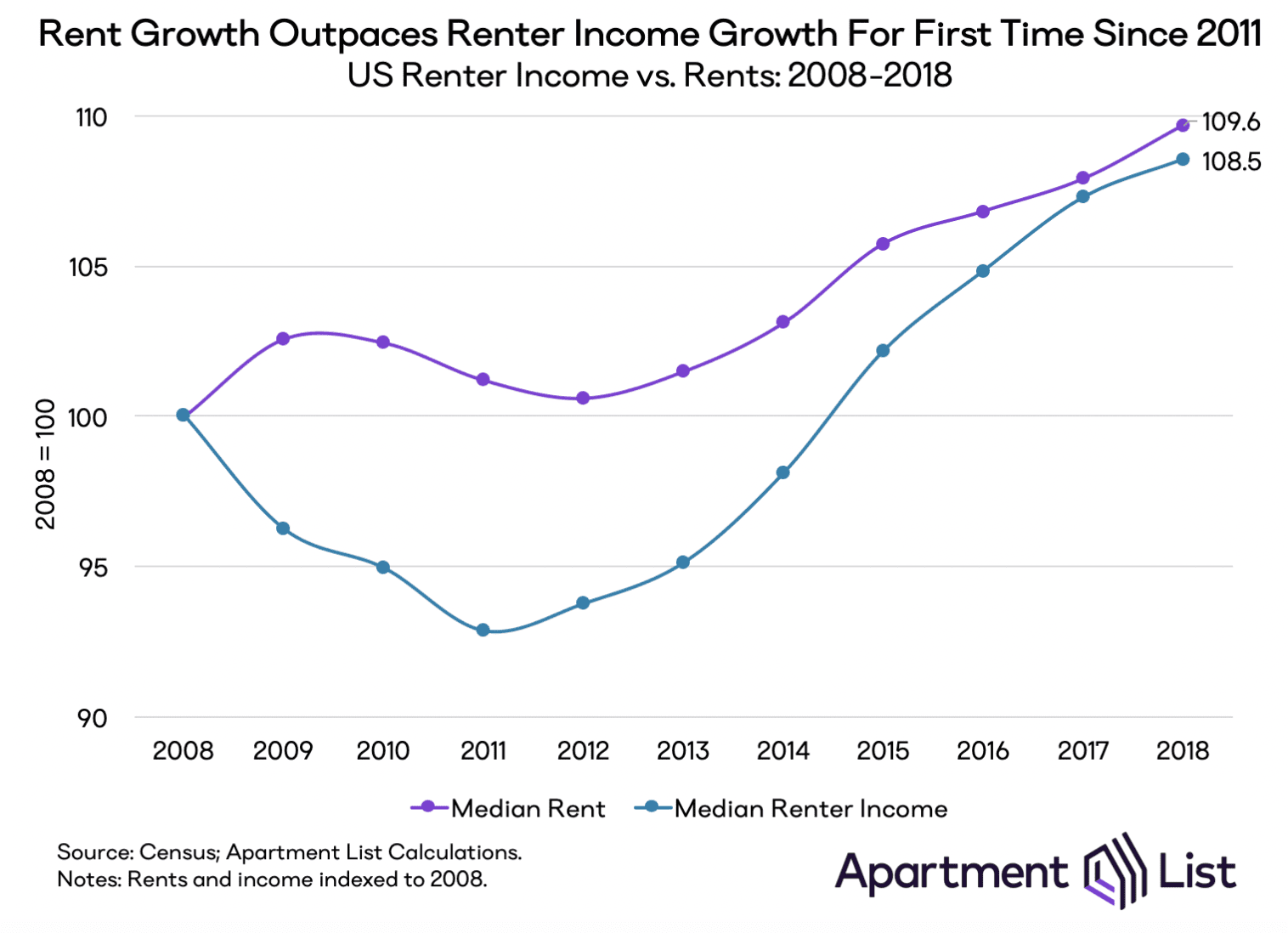

The problem is not just about high rent but also about stagnant incomes. American incomes are not keeping pace with rent, making it increasingly difficult for many to afford their housing costs. This issue is further complicated because asking rents have risen faster in some cities than in any other large city in the country.

The pandemic has also had a significant impact on the rental market. While median rents plunged at the higher ends of the market during the pandemic, low-income tenants saw no such relief. For them, the rent never stopped being too high.

In conclusion, the issue of high rent continues to be a significant concern for many American households. Despite economic recovery and wage growth, many are still struggling with housing costs, and the problem appears to be worsening. It’s clear that more needs to be done to address this ongoing issue and ensure that everyone has access to affordable housing.

Let’s continue this exploration against a historical backdrop. Failing to learn from history leads to reliving it.

The rent is too damn high: Study Agrees With This Statement.

Olyvia Ruhlmann, Apartment List

Look back on 2018: a year of record-low unemployment and increasing wages. Yet, according to a new study by Apartment List, virtually half of American renter households are still struggling with housing costs.

Apartment List’s 2019 Cost Burden Report finds 49.7% of American renters are cost-burdened, meaning they spend more than the recommended 30% of their income on rent. This share of renters has increased slightly from 49.5% in 2017. Of these cost-burden renter households, 24.8% are severely cost-burdened, meaning they spend at least half of their income on rent.

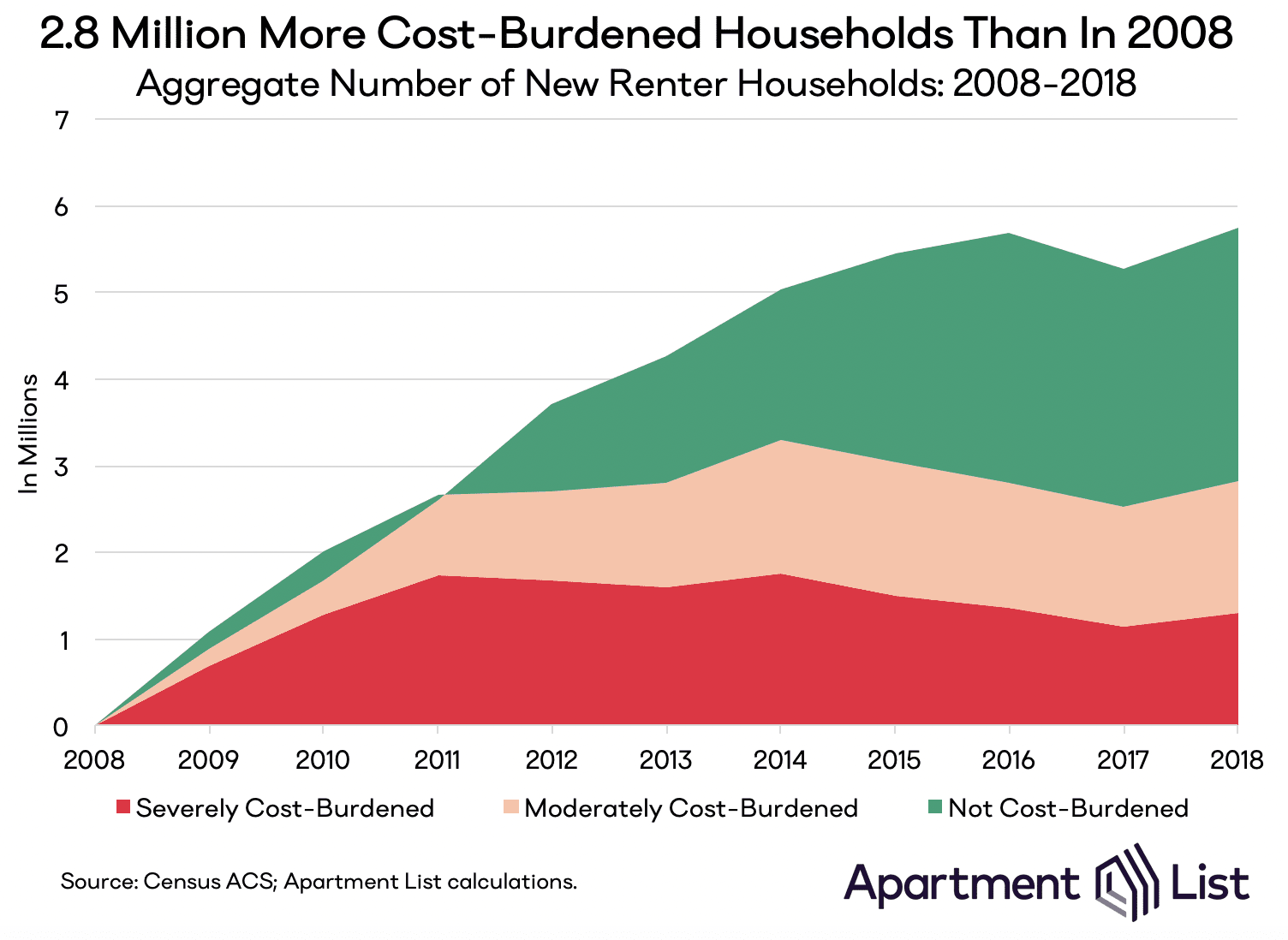

For the first time since 2014, the national cost-burden rate has increased. Between 2017 and 2018, the number of cost-burdened renter households jumped by 299,000. Since 2008, there’s been an overall increase of 2.8 million cost-burdened households.

With the national cost burden rate at 49.7%, it’s safe to say the cost-burdened renter is becoming the norm, and unfortunately, lower-income renters are taking the brunt of this burden.

Although the national cost burden rate has fallen significantly from its 2011 peak, much of this improvement has been driven by an influx of high-income households to the rental market. The number of cost-burdened renter households grew by 299,000 this past year, a 0.8% increase from the number of cost-burdened households in 2011.

Many at the low end of the income distribution have seen their housing costs grow disproportionately over the past decade, while the highest earners have seen their housing costs fall.

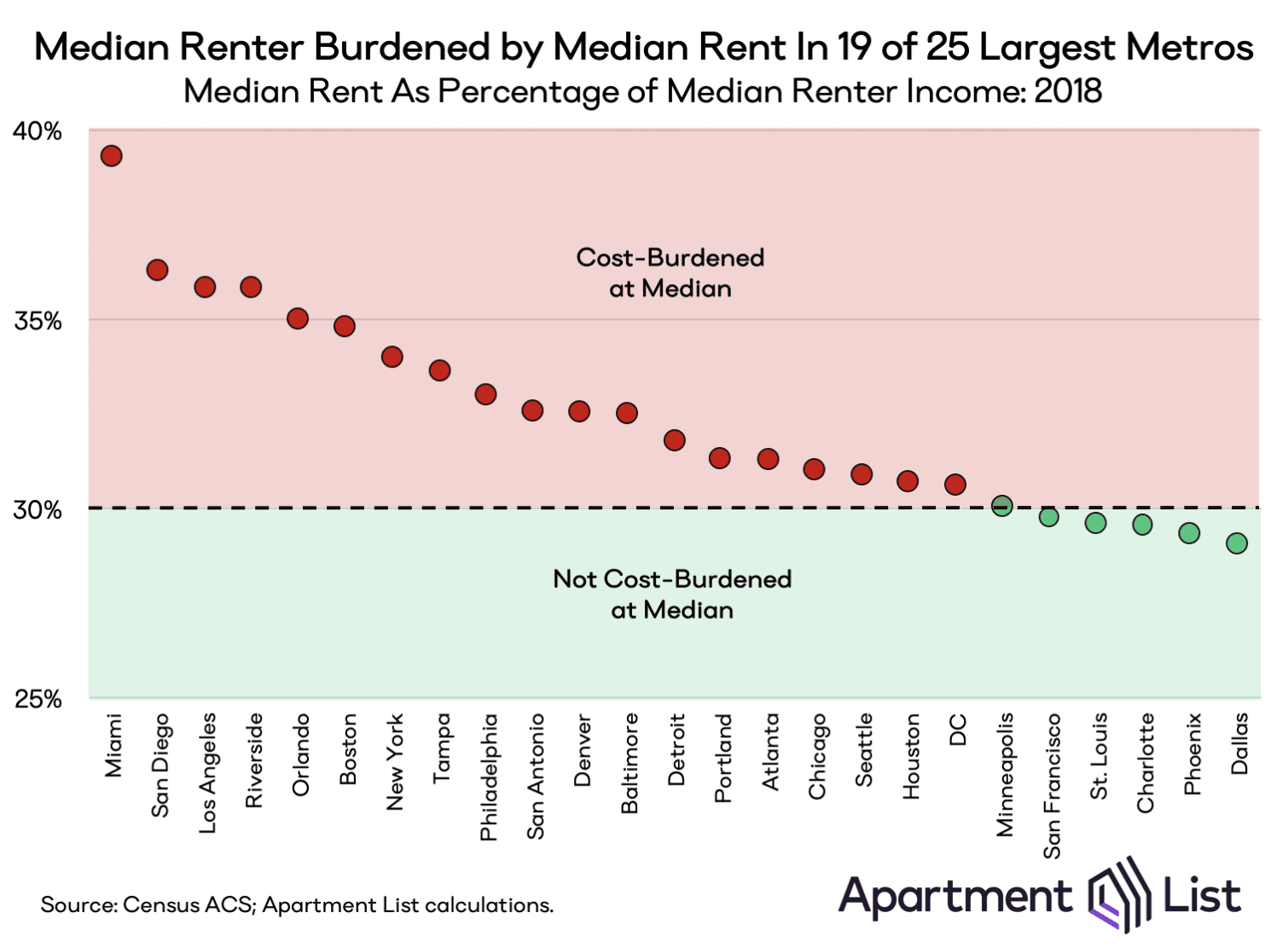

In fact, Apartment List researchers found a renter earning the national median salary ($40,531) would be burdened by the nation’s median rent ($1,058). This holds across the metro level as well; in 19 of the nation’s 25 largest metros, a household earning the median income is burdened by the metro’s median rent.

Only in 6 of the nation’s 25 largest metros—Dallas, Phoenix, Charlotte, St. Louis, San Francisco, and Minneapolis—can the median renter household comfortably afford the median rent.

Overall, the study finds one-third of cost-burdened renter households live in Florida, New York, or California. Florida tops the list for the highest state cost burden rate at 56.5%.

The metros with the highest percentage of cost-burdened renters:

- Miami, FL (62.7%)

- New Orleans, LA (60.1%)

- Riverside, CA (59.2%)

The metros with the lowest percentage of cost-burdened renters:

- Harrisburg, PA (41.4%)

- Des Moines, IA (40.8%)

- Ogden, UT (39.9%)

Other Stories of Interest

What Is Fiat Money: USD Is Prime Example Of Fiat

Stock Market Forecast For Next 3 months: Up Or Down?

Market Timing Strategies That Worked: Let’s Rock ‘n Roll!

Smart Money, Smart Kids: Kickstarting the Next Generation

Smart Money Concepts: Trading with Intelligence

How to Get Out of the 9-5 Rat Race and Achieve Financial Freedom

Timeless Fortune: Exploring How Savings Bonds Operate After 30 Years

Decoding the Mystery: Where have bonds been when the stock market crashes?

The Ebb and Flow of Investor Sentiment: Bull, Bear and Stock Market Crashes

What are the three investments one can make to beat inflation?

US Stock Market Crash Date: Experts Discuss, But Where’s The Action?

Unlocking the Benefits of Investing in Precious Metal Stocks

Mastering Emotional Control for Successful Stock Market Investing

Preferred Stock Market Valuation Is Based Primarily Upon

Mastering Options Trading: Unveiling the Real Secrets

Which of the Following Is an Example of Collective Behavior?

4X ETF: Deadly Risks and Realities