Millionaire Mindset: Investing in Stocks – Rule 1

Diversification is a crucial principle in investing and one of the most essential rules for novice traders to master. It involves dividing your investment capital into equal parts or amounts and spreading it across different stocks or other assets.

For example, if you have a portfolio of $100,000, you would divide it into ten equal parts, each consisting of $10,000. This helps spread the risk and ensures you are not too heavily invested in any stock or sector. These lots can then be divided into smaller sub-lots depending on market conditions. For example, if you are following a strategy that involves opening multiple positions, you could divide each $10,000 part into 3-5 sub-lots, with each sub-lot ranging from $2,000 to $3,300

Total Pending Plays. Don’t be overly concerned about the quantity.

Don’t let the number of pending plays overwhelm you. It’s important to note that not all of these plays will be triggered, as we are targeting extreme entry points. However, the primary reason we provide numerous plays is to offer options for everyone. These plays are categorized by risk level: green text indicates lower risk, baby blue denotes medium risk, brick red signifies high risk, and bright red denotes very high-risk plays.

If you’re new to this, begin with low-risk candidates and choose around 10-15 plays to monitor. As you become accustomed to our approach, you can tailor the system to your preferences. Most subscribers review the list of pending plays and pick the ones that resonate with them. Additionally, subscribers often choose 1-2 portfolios to track, such as the Bread and Butter and ETF portfolios. The key is to start slowly and gradually build confidence. Remember, you can contact us and engage with fellow subscribers in the forum.

Strategic Investing: Balancing Risk and Reward for Optimal Returns

It’s important to note that you should never commit all your funds in one shot, as this increases your risk. Instead, divide your funds into smaller lots and deploy them gradually, as stated above. When we issue instructions to purchase a stock, we will always indicate how many sub-lots should be deployed. For example, deploy 1/5th in the 40-45 range and the second 1/5th in the 37-39 range.

Another key principle is never to open a position at market price but at the best possible price. Our risk-to-reward models make this determination. This way, you can increase the chances of a profitable outcome while minimizing the risk. It’s also essential to have a good understanding of the markets and the individual securities you’re investing in and a risk management plan.

When it comes to managing your portfolio, it’s essential to have a plan in place for how to deploy new cash that comes in. One approach is to divide the new cash equally into the ten existing main lots. For example, if you received an additional $20,000 and already have ten lots of $10,000 each, you could divide the new cash equally into those ten lots, increasing each lot by $2,000.

Diversifying Investments: Creating New Lots for Increased Flexibility

Another approach is to create two new lots of 10K each with the new cash. If you received an additional $20,000 and have 1o lots of $10,000 each, you could create two new lots of $10,000 each. Now instead of ten main lots of 10K, you would have 12 lots of 10K.

Maintaining some cash is always a good practice as it provides flexibility and liquidity to take advantage of attractive investment opportunities that may arise unexpectedly. This is particularly important when the market is in an overbought range. After it lets out some steam, you can invest in undervalued securities.

If you fall in the low to medium-risk categories, it is advisable to maintain 20%-25% cash in your portfolio. This allows you to take advantage of potential opportunities while preserving your capital and limiting risk.

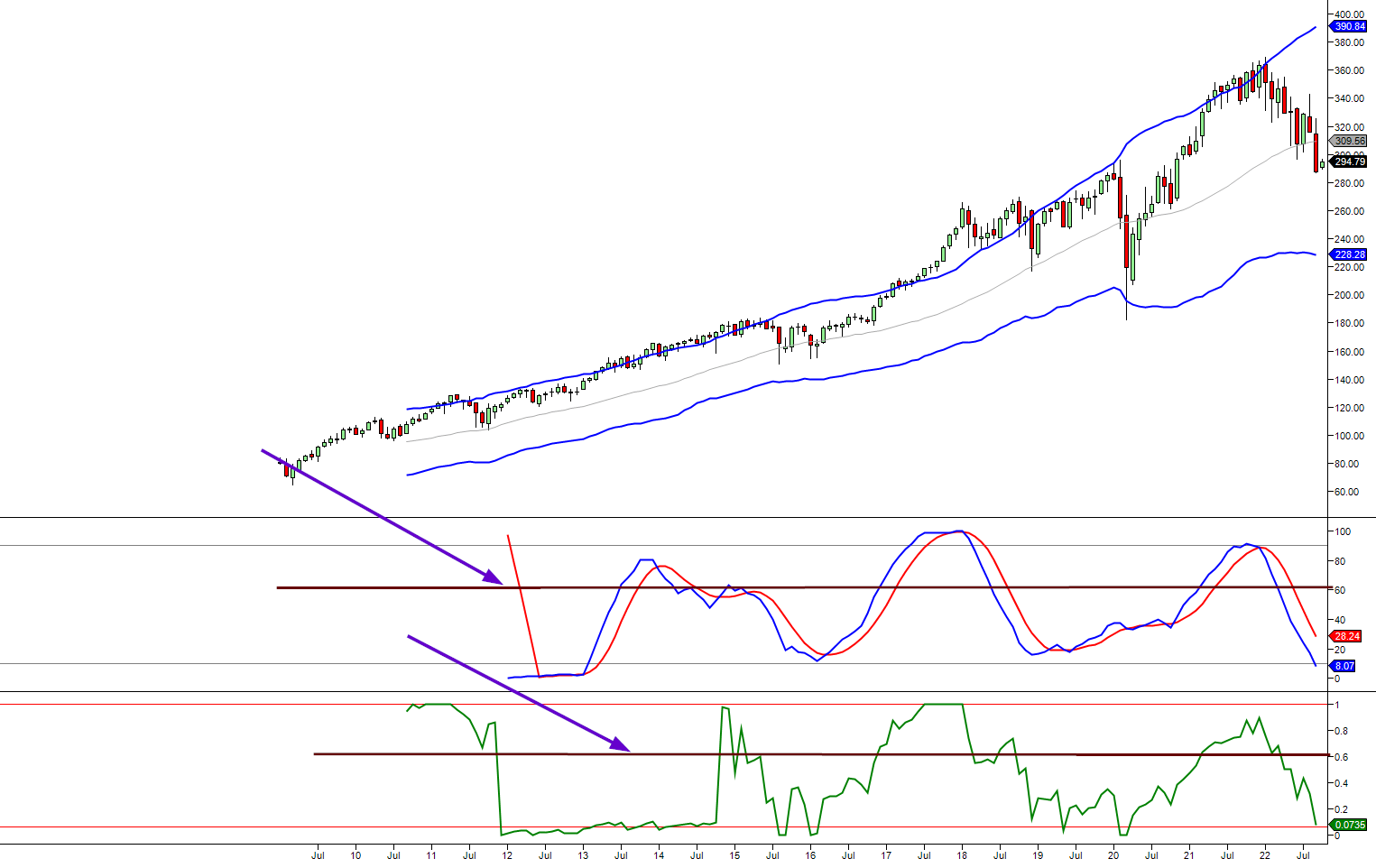

The Monthly Chart of DIA: Unveiling Insights and Trends

Deciphering Slightly Overbought Ranges: A Guide to Market Trading Analysis

You can use technical indicators such as the MACD and RSI to determine when the market is in slightly overbought ranges. These indicators have 0 to 100 and 0 to 1, respectively. When the indicator trades in the 60% range, conservative traders should build a 10-15% cash position. When it’s trading in the 80 to 90 per cent range, cash can compromise as much as 25% of their holdings. Tradingview.com is an excellent resource to use for finding indicators and educational materials. Additionally, it offers more indicators and historical data than other websites, such as stockcharts.com, and it’s cheaper if you opt for the premium service.

No new positions should be taken when a portfolio says “Hold” in the comments section. Until the word “hold” is removed, no new money should be invested in that position. It is essential only to enter a stock or options trade when it is trading at or close to one of the suggested entry points. If a stock trades above the suggested entry points, it is best to avoid the trade until new instructions are issued.

However, if the stock trades at or below one of the suggested entry points, it may be an excellent opportunity to enter a trade with one lot. For example, if we have two positions in company XY, one at 45 and one at 36, and the stock trades at 51, then avoid this play unless new instructions are issued. However, if XY trades at 40, you can deploy one lot as it is still trading below one of the suggested entry points.

Rule 2 of the Millionaire Mindset: Equally Allocate Funds to Each Investment

Allocate the same amount of money to each position.

Investing the same funds in each position is crucial to maintain a balanced portfolio. This principle is fundamental for those with a millionaire mindset, as it promotes discipline and reduces risk. Never invest more in any one recommendation unless you are a seasoned trader or are knowingly willing to take on more risk. Most investors tend to lose money not due to bad choices but rather to lacking portfolio management skills. Therefore, spreading your money unevenly over your investments can lead to fast losses.

Rule 3 of the Millionaire Mindset: Navigating Options with Care

Before getting into the options market, studying it extensively and paper trading is essential. It is better to understand and master the concept of buying and selling stocks before venturing into options, as they can be a fast way to make money and a fast way to lose a lot.

To minimize the risk, it is recommended not to dedicate more than 20% of your portfolio to options if you are not a professional options trader and not exceed 25% if you are. Novices should not allocate more than 15%. Additionally, suppose your options portfolio surges and represents more than 40% of your portfolio. In that case, it is advisable to take some money out and reassign it to lower-risk portfolios, except if you are dealing exclusively with selling cash-secured puts. When buying puts or calls, try not to invest more than 2%-3% of the money for options trading into a single option position.

Options can be a safe investment instrument, especially when using strategies such as selling cash-secured puts and covered calls. Unlike buying calls and put, these strategies do not involve using margin or speculation. When using these strategies, the 25% rule does not apply. It’s important to remember that a millionaire mindset only takes risks with money they can afford to lose, so it’s recommended never to invest your principal money into options. Instead, only use profits from other investments to trade speculative options like buying calls and puts. However, non-speculative strategies such as selling cash-secured puts and selling covered calls are exceptions to this rule.

Safeguarding Investments with Stop Orders

Using limit stops instead of standard stops is crucial to prevent potential losses when placing stop orders. A standard stop order triggers immediately when the stock reaches the stop price and is treated as a market order. This means the stock is sold at the current market price, which could be lower than the stop price.

On the other hand, a limit stop order will only be triggered when the stock trades below the stop price, and the order will be filled at the stop price or better. However, some brokers may not offer this option; in this case, you should consider using a mental stop or switching to a broker that does offer this option.

Unlocking the Power of Stop-Limit Orders: An In-Depth Explanation

A stop-limit order combines two order types: a stop price and a limit price. Traders use a stop price to trigger a limit order, which buys or sells at a specific or better price. For example, a stop price of £25 with a limit price of $24.50 means the order activates at $25 but fills at $24.50 or higher. If the price falls below the limit before the order is filled, the remaining shares may incur larger losses.

It’s important to note that this type of order could trigger but not fill depending on the limit price entered, so traders must be aware of that risk. For a more in-depth understanding of this type of order, it is recommended to read educational materials such as “Understanding Limit, Stop Limit and Market Orders” to understand the nuances of this type of order.

Setting Profit Targets for Success

It is important to note that the following strategy is optional and intended for traders who want to take their skills to the next level. In any case, entry and exit instructions will always be provided for every position in the portfolio, so traders will never be left in the dark.

When setting a target, you must consider what you are comfortable with and stick to it. Some traders may be happy with 20% gains, while others may be satisfied with 15%. It’s important not to force a target on yourself, but at least for half of your position. It’s also essential to set a target as soon as a position is opened, as changing it later can lead to uncertainty and turn a good trader/investor into a “pig” who always gets slaughtered.

When setting a target, you must consider what you are comfortable with and stick to it. Some traders may be happy with 20% gains, while others may be satisfied with 15%. It’s important not to force a target on yourself, but at least for half of your position. It’s also essential to set a target as soon as a position is opened, as changing it later can lead to uncertainty and turn a good trader/investor into a “pig” who always gets slaughtered.

Exit Strategy: A Key Element of Financial Responsibility

It is important to remember that while we do our best to provide the best entry price, paying attention to the exit strategy is also essential. It’s important to remember that nobody cares more about your money than you. Our profit strategy might also not align with your goals and risk tolerance.

It’s important to note that the higher the profit target, the more volatile the ride and the higher the risk. If you hit your targets earlier, consider it a bonus and take the time to enjoy other aspects of life. A millionaire mindset involves having both a profit and loss target and giving equal attention to both, as it is an essential part of the investing cycle.

Rule 4 of the Millionaire Mindset: Trading Emotion-Free in the Market

One should never forget that the market has no mercy for emotional investors. Fear and euphoria are two of the worst emotions to have when investing. Emotional traders nearly always end up losing money. Understanding the basic concepts of mass psychology can significantly enhance your trading experience.

A millionaire mindset involves refusing to allow emotions to enter the equation. When emotions drive trading decisions, it can lead to losing money. It’s crucial to trade calmly and avoid making impulsive decisions. As the saying goes, “Revenge is best served cold,” which applies to trading. Traders who act impulsively and emotionally often end up broke, unable to stay in the game. The stock market can be considered a war. One may lose several battles, but one can still win the war with a clear head and a long-term perspective.

Decoding Color Codes: Unveiling the Dynamics of Pending Stock Plays

The colour coding system indicates the risk level associated with a stock or ETF play. Green carries the lowest risk, and brick red or bright orange is the highest. Before moving on to the secondary candidates, new subscribers should focus on the primary candidates associated with lower risk. The primary candidate sections of the Trend and ETF Trend portfolios are considered to have the lowest overall risk.

The least risky portfolios are the primary candidate’s section in the Trend Portfolio and the primary candidate’s section under the ETF Trend Portfolio.

Mastering the Stop-Loss Strategy: Maximizing Exit Efficiency and Profits

The stop-loss strategy used is “end-of-day stops.” It triggers a stop loss if the stock closes at or below the suggested price. If triggered, a GTC limit sell order is placed at or close to the stop price the next day. It’s important to note that stocks often rise after the stop is hit, resulting in a better exit price. However, if the stock drops below the stop, a GTC limit sell order is placed at the best price. The average exit price is determined using subscriber data. Visit the provided link for more information on “stops.” Detailed Info on Stops.

New and inexperienced investors should focus on patience and discipline when buying and selling stocks. Chasing stocks often leads to higher costs and lower profits. The Tactical Investor identifies solid setups and buys at the best prices possible.

Frequently Asked Questions

Q: What is diversification in investing, and why is it important?

A: Diversification involves dividing your investment capital into equal parts and spreading it across different stocks or assets. It helps reduce risk and prevents overexposure to any single store or sector.

Q: How can I implement diversification in my portfolio?

A: For instance, if you have a $100,000 portfolio, divide it into ten equal parts of $10,000 each. These lots can be further divided into sub-lots based on market conditions.

Q: Why should I avoid investing all my funds in one go?

A: Investing gradually reduces risk. Instead of committing all your funds simultaneously, divide them into smaller lots and deploy them gradually, following the instructions.

Q: How should I manage new cash in my portfolio?

A: One approach is to divide new cash equally among the existing main lots. For example, if you receive $20,000 and have ten lots of $10,000 each, increase each lot by $2,000.

Q: What are the recommended cash allocation levels in a portfolio?

A: Low to medium-risk investors are advised to maintain 20%-25% cash in their portfolios, providing flexibility and limiting risk.

Q: How can I determine if the market is in an overbought range?

A: Technical indicators like MACD and RSI can help identify slightly overbought ranges. Conservative traders may consider building a cash position when the indicator trades in the 60% range.

Q: What should I consider before opening a new position?

A: Avoid opening positions at market price and strive for the best possible price. Understand the markets and the securities you invest in, and have a risk management plan.

Q: What stop orders should I use to safeguard my investments?

A: Lim stop orders should be used instead of standard stops to avoid potential losses. Limit stops are activated when the stock trades below the stop price, ensuring that the order is filled at the stop price or a better price.

Q: How does a stop-limit order work?

A: A stop-limit order combines a stop price and a limit price. When the stock trades below the stop price, it triggers a limit order to buy or sell at a specific or better price.

Q: How can I set profit targets for my trades?

A: Setting profit targets should be based on your comfort level. Consider your desired gains and set targets for at least half of your position to maintain discipline.

Q: Why is it essential to have an exit strategy?

A: While entry prices are crucial, paying attention to the exit strategy is essential. Nobody cares more about your money than you do, so having a clear plan is vital.

Q: How can I trade without emotions affecting my decisions?

A: Emotional trading can lead to losses. Maintain a calm and disciplined approach, avoiding impulsive decisions. A long-term perspective and a clear mindset are key to success.

Q: What do the colour codes in stock plays indicate?

A: The colour coding system shows the risk level associated with a stock or ETF play. Green represents the lowest risk, while brick, red or bright orange signifies the highest risk.

Q: What is the stop-loss strategy used by the Tactical Investor?

A: The “end-of-day stops” strategy triggers a stop loss if the stock closes at or below the suggested price. A GTC limit sell order is then placed for an efficient exit.

Q: How should new and inexperienced investors approach stock trading?

A: Patience and discipline are vital when buying and selling stocks. Avoid chasing stocks and focus on identifying solid setups and buying at the best possible prices.

Other suggested articles

Tactical Investor Stock & Option Selection Process

Important Info To Read Before Getting into Options

How to Purchase Options on Stocks We have not issued any plays on

Brainwashing Institutions and the manipulative media

- It’s important to note that diversification does not guarantee a profit or protect against loss. Still, it can help mitigate risk and be crucial to achieving long-term investment success. It’s also essential to understand the markets and the individual securities you’re investing in and a strategy for managing risk.