![]()

Semiconductor Outlook: A Promising Investment Opportunity for Long-Term Investors

Mar 21 2023

Looking towards the future of the tech industry, it’s impossible to ignore the pivotal role that semiconductors play – and with the current semiconductor outlook indicating a range of promising investment opportunities, it’s more important than ever to understand the market trends and potential for growth.

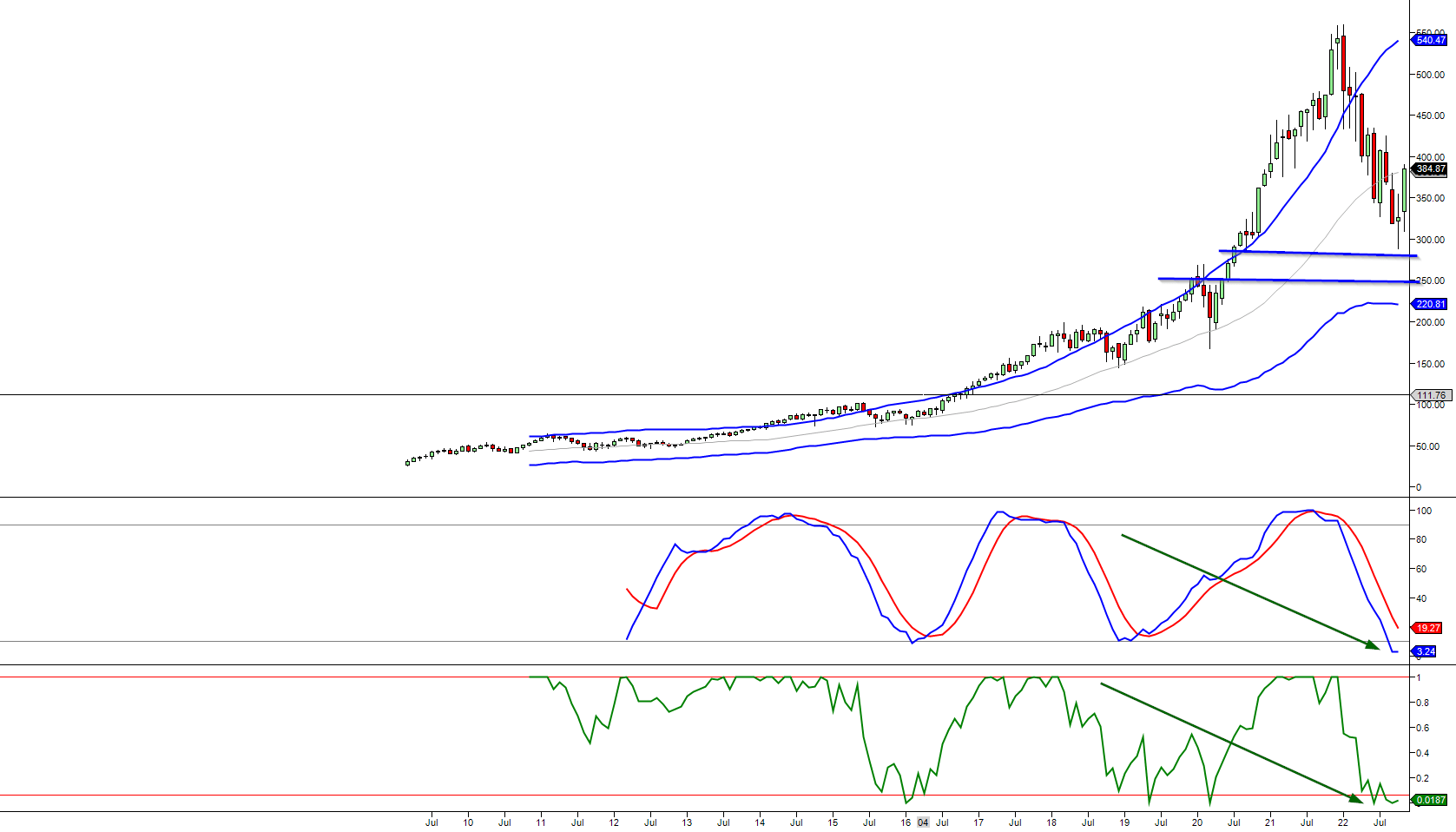

From a long-term perspective, each time SOX has traded within these ranges, it has proven to be an exceptional investment opportunity. A turnaround appears imminent as the second indicator (MACD 2) drops below three on the lower panel. Although, in one instance depicted on this chart, the indicator bottomed out and never completed its entire cycle, it presented an even better opportunity. When a time-tested indicator fails to complete an entire cycle, the subsequent move in the same direction is typically twice as strong.

The Monthly Chart of SOXX

Currently, the first indicator (MACD1) has dropped from a highly overbought state to an almost insanely oversold condition. The lowest reading was -4.93 in October 2002; the current reading is a negative 3.5. It is plausible that it could trade to -6, generating a “screaming buy” opportunity.

Long-Term Prospects for the Semiconductor Industry Look Promising

The highly overbought reading observed in January 2022 is bullish from a long-term perspective, indicating that the MACD1 values will likely surge to new highs, resulting in new highs for the SOX. We anticipate that the SOX will triple before the next bull cycle concludes.

Without semiconductors, the A.I. industry would not exist. Therefore, every sector related to this market will trend higher, including the designers, manufacturers, companies that supply the raw materials to power this sector, and more. For instance, without Neon Gas, this sector would be kaput.

Big profits are generated by following the super-trend and avoiding monitoring your portfolio on a daily basis. The upward phase in a super-trend cycle lasts much longer than the downward phase. While most investors focus 90% of their attention on the downward phase, we have realized significant profits in the companies we invested in before the recent correction. These were not paper profits but actual profits we deposited in the bank. The markets are presently undergoing a cleansing phase, and when it concludes, the stage of massive profits will begin anew.