Russell 2000: The Ultimate Gamble—Buy, Sprint, or Sink

April 7, 2025

The market doesn’t whisper. It roars—only most are too distracted to hear it.

Every major turning point in history has followed the same script: panic, paralysis, and then… a ferocious rebound that leaves the herd in disbelief. 1987. 2009. 2020. In each case, the crowd stared at the wreckage while the market quietly pivoted. Why? Because mass psychology lags price action. Always has. Always will.

Right now, we’re at that same inflexion point—but this time, it’s the Russell 2000 that’s playing the underdog with teeth. The charts aren’t broken—they’re baiting you.

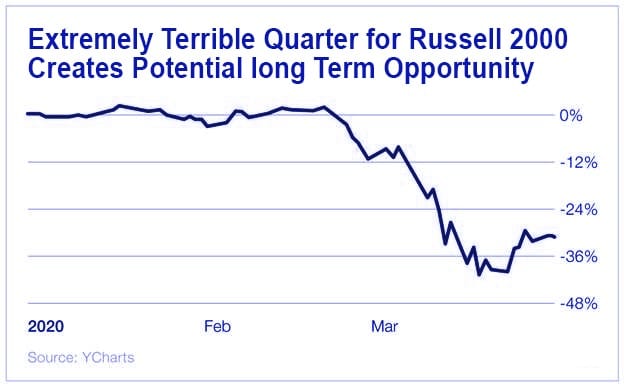

Most investors glance at the current Russell chart below and scream collapse. But that’s the noise. Look again. Look with intent.

The Russell is trading nearly three standard deviations from its mean—a setup that statistically screams mean reversion. Not maybe. Not someday. Historically, this is when asymmetrical bets get placed before the crowd catches on.

Think in phases. The first leg of the recovery always goes to the big boys—mid and large caps with fortress balance sheets and wide moats. That’s predictable. That’s safe. That’s Phase One.

But Phase Two? That’s where the velocity lives. That’s when small caps explode off the floor, fueled by re-rating, short covering, and raw optimism returning to the system. That’s where the Russell becomes the spearhead, not the laggard.

Most won’t touch it. That’s the tell. Because the greatest trades always look reckless when they’re ripe.

Bottom line: If you’re waiting for comfort, you’ll miss the turn. The Russell isn’t sinking—it’s coiling. And when it unwinds, it won’t ask permission.

Retail’s Dying—But the Russell’s Roaring

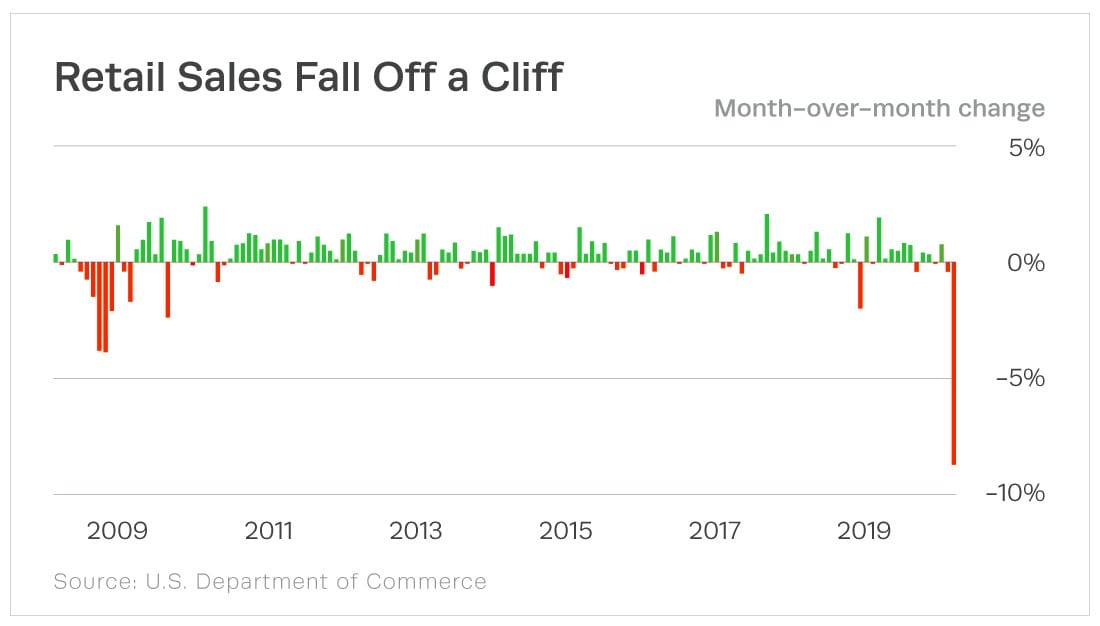

Retail sales look like roadkill—but the Russell 2000 is flashing strength.

This isn’t just an ugly snapshot—it’s the slow death of legacy retail. Brick-and-mortar is bleeding out, and the crowd still hasn’t processed it. Meanwhile, Amazon just clocked a new intraday high. Translation? The shift is permanent. The mall rats are finished. Clicks are eating bricks.

Zoom out and the AI sector’s already front-running the next move. Many names have clawed back big losses—they’ll be printing new 52-week highs before the Dow even sniffs 29,000. The herd’s still staring at lagging economic data while the leaders are already airborne.

Look at the charts. Strip away the noise. This market is climbing a wall of worry, and that’s bullish. Fear has been priced in. Despair has been digested.

The Russell doesn’t care about retail—it cares about reality.

The smart money knows: bad headlines are often a buy signal, not a red flag.

Conclusion: From 2020 Panic to 2025 Precision

The Dow is likely to test the 24,000 to 24,500 range with a possible overshoot to 25,000. Market Update April 7, 2020

Back in April 2020, when the world was spiralling and the Dow clung to the 24K handle, we said loud and clear: “Fear fuels the next leg up.” While the crowd screamed ‘collapse,’ we outlined 23,100–23,600 as the first trigger zone and 24,000–24,500 as the battleground for bulls. The Dow poked past 24K, then faked a pullback, just enough to throw off the amateurs and reload the spring.

The masses were drugged on doom. Meanwhile, the Fed backed up the liquidity trucks and began rewriting the rules of monetary gravity. $1,200 checks? That was the warm-up. We said the psychological conditioning had begun—trillions were no longer terrifying, they were expected. And just as we forecasted, the tidal wave of stimulus that followed triggered a V-shaped recovery, most dismissed as impossible.

They weren’t ready. We were.

Fast-forward to 2025, and the game’s still psychological, still driven by instinct wrapped in headlines. But the battlefield looks different.

2025 Tactical Outlook: Russell and SPX Playbook

Right now, Russell 2000 (IWM as proxy) is flashing an early opportunity—but not the full green light just yet. The prime zone to deploy capital was in the 180–190 range, a window that rewarded the patient. If you missed that bracket, there’s still room to step in, but keep your powder dry. Stagger entries. This isn’t the moment to go all in. A rally toward the 239–243 zone could be a profit-taking trigger, even though a shot at new highs remains on the table. Why? Because after that, the odds favour a sharp pullback. And that correction? It’s not something to fear—it’s the kind of setup that fuels generational trades.

For the broader market, the S&P 500 (SPX) roadmap follows a tiered strategy:

- First deployment zone: 5400–5500

- Second tier: 5000–5100

- Final load-up: 4800 or lower, should fear reignite

But remember this: true opportunity doesn’t arrive when things look “reasonable.” It emerges when the emotional pendulum swings from complacency to chaos, but before total despair. That sweet spot, when fear is present but not yet peaking like it did in April 2020, is the zone where legends are made.

The V-shaped recovery we’re seeing now? Rare. Unnatural. And likely unsustainable without a reset. So prepare for that reset—not with panic, but with precision.

Final Word

This isn’t about charts. It’s about crowd reflexes, fear cycles, and controlled aggression. The masses always show up late—after the pain, after the rebound, after the easy money is gone. You? You show up during the discomfort. You scale in when the headlines drip fear, but the market starts sniffing strength.

The next great buying opportunity won’t come when you feel ready. It’ll come when you feel wrong. Be ready anyway.