Apr 3, 2024

Introduction

Real estate investing has long been a popular way for individuals to build wealth and secure their financial future. However, investing in real estate can seem daunting for many people, especially if they have no prior experience. This article will provide a beginner’s guide to real estate investing, covering what you need to know to get started.

Why Invest in Real Estate? Before we dive into the specifics of how to invest in real estate, let’s take a moment to consider why you might want to do so. There are several compelling reasons to consider real estate as an investment opportunity:

Potential for high returns: Real estate can generate high returns through rental income and appreciation in property value over time. According to the National Council of Real Estate Investment Fiduciaries (NCREIF), the average annual return for private commercial real estate over the past 20 years has been 9.4%.

Tangible asset: Unlike stocks or bonds, real estate is a tangible asset you can see and touch. This can provide a sense of security and stability for many investors.

Diversification: Real estate can be an excellent way to diversify your investment portfolio, reducing your overall risk.

Tax benefits: Real estate investing offers several tax benefits, including deductions for mortgage interest, property taxes, and depreciation.

Types of Real Estate Investments

There are several different ways to invest in real estate, each with advantages and disadvantages. Here are some of the most common types of real estate investments:

Rental properties: One of the most popular ways to invest in real estate is to purchase a property and rent it out to tenants. This can provide a steady stream of rental income and the potential for appreciation in property value over time.

House flipping: Another popular strategy is purchasing, renovating, and selling a property for a profit. This can be a more hands-on approach to real estate investing, requiring significant time and effort.

Real Estate Investment Trusts (REITs): REITs own and operate income-generating properties. By investing in a REIT, you can gain exposure to the real estate market without purchasing and managing properties yourself.

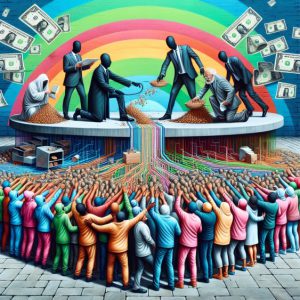

Crowdfunding: In recent years, crowdfunding platforms have emerged as a way for individuals to invest in real estate projects with relatively small amounts of money. These platforms allow you to pool your money with other investors to fund larger projects.

Getting Started with Real Estate Investing

If you’re interested in getting started with real estate investing, here are some steps you can take:

Educate yourself: Before investing in real estate, you must educate yourself about the market and the types of investments available. Read books, attend seminars, and talk to experienced investors to gain knowledge and insight.

Determine your goals: What are you hoping to achieve through real estate investing? Are you looking for a steady stream of rental income, or are you more interested in short-term profits through house flipping? Having clear goals will help guide your investment decisions.

Assess your finances: Real estate investing requires capital, so it’s important to assess your financial situation before getting started. Determine how much money you have available to invest and consider whether you need to secure financing.

Build a team: Real estate investing can be complex, so building a team of professionals is essential to help you navigate the process. This might include a real estate agent, a property manager, a contractor, and a financial advisor.

Start small: If you’re new to real estate investing, it’s often best to start small and gradually build your portfolio over time. Consider starting with a single rental property or investing in a REIT before taking on larger projects.

Risks and Challenges

While real estate investing can be lucrative, it’s essential to know the risks and challenges involved. Here are some of the most common risks and challenges faced by real estate investors:

Market fluctuations: The real estate market can be unpredictable, and property values can fluctuate based on various factors, such as economic conditions, interest rates, and local supply and demand.

Vacancies: If you own rental properties, there may be times when you cannot find tenants, resulting in a loss of rental income.

Maintenance and repairs: As a property owner, you will be responsible for maintaining and repairing your properties, which can be costly and time-consuming.

Financing: Securing financing for real estate investments can be challenging, especially for newer investors with limited experience.

Legal and regulatory issues: Real estate investing is subject to various legal and regulatory requirements, which can be complex and vary by location.

Conclusion

Real estate investing can be a powerful way to build wealth and secure your financial future. However, it’s essential to approach it cautiously and educate yourself about the risks and challenges involved. By understanding the different types of real estate investments available, assessing your financial situation, and building a team of professionals to support you, you can increase your chances of success as a real estate investor. Whether you choose to invest in rental properties, REITs, or other real estate investments, the key is to start small, stay informed, and remain committed to your long-term goals.

It’s worth noting that while real estate investing can be a lucrative opportunity, it’s not a get-rich-quick scheme. Real estate investing requires patience, persistence, and a willingness to learn from mistakes. It’s essential to have realistic expectations and to be prepared for the ups and downs of the market.

One of the most significant advantages of real estate investing is the potential for passive income. Investing in rental properties or REITs allows you to generate a steady income stream without having to manage the properties yourself actively. This can be especially appealing for those looking to supplement their income or build long-term wealth.

Another advantage of real estate investing is the potential for tax benefits. Real estate investors can often deduct expenses such as mortgage interest, property taxes, and depreciation, which can help to reduce their overall tax liability. However, it’s essential to consult with a tax professional to ensure you take advantage of all available deductions and credits.

Ultimately, the decision to invest in real estate is a personal one that should be based on your individual financial goals, risk tolerance, and investment strategy. While real estate investing can be a powerful tool for building wealth, it’s essential to approach it cautiously and do your due diligence before making any investment decisions.

By educating yourself about the risks and rewards of real estate investing, assessing your financial situation, and building a solid team of professionals to support you, you can increase your chances of success and achieve your long-term financial goals. With patience, persistence, and a commitment to learning and growth, real estate investing can be a rewarding and fulfilling way to build wealth and secure your financial future.

Diverse Views: Compelling Insights

The Art of Portfolio Agility: Mastering the Tactical Asset Allocation Strategy

Stock Market Forecast for Tomorrow: Ignore Noise, Focus on the Trend

Defying the Crowd: Exploring the Stock Market Fear Index

Crowd Behavior Psychology: Deciphering, Mastery, and Success

Inflation vs Deflation vs Stagflation: Strategies for Triumph

What Is The Best Way For One To Recover After a Financial Disaster?

The Psychology of Investing: Shifting Focus from the Crowd to the Trend

What Development In The Late 1890s May Well Have Prevented Another Financial Disaster?

Mass Psychology of Stocks: Ride the Wave to Win

How Inflation Erodes Debt and Strategies for Smart Investing

Demystifying StochRSI Strategy: Easy Strategies for Winning

From Rags to Riches: Stock Market Investing Success Stories

Winning the loser’s game: timeless strategies for successful investing

Stock Market Crash Recession Is A Done Deal: Wishful Thinking