Evaluating OVV Stock Price: A Comprehensive Analysis

Aug 7, 2023

Formerly known as Encana Corporation, Ovintiv Inc. is a Canadian oil and gas producer headquartered in Denver, Colorado. The company’s operations focus on exploring, developing, and producing oil, natural gas liquids, and natural gas in the Western Canada Sedimentary Basin and the Anadarko Basin in the United States.

OVV boasts key assets in the Montney and Duvernay formations in Alberta and British Columbia, the Eagle Ford trend in Texas, and the Anadarko Basin in Oklahoma and Texas. As of 2021, Ovintiv had estimated proven reserves of 1.4 billion barrels of oil equivalent and a daily production rate of approximately 604 thousand barrels.

The company’s stock is traded on both the New York Stock Exchange and Toronto Stock Exchange under the symbol OVV. Challenges arising from volatile commodity prices and the COVID-19 pandemic have prompted Ovintiv to undertake cost reduction, debt repayment, and efficiency improvement efforts.

(OVV) is a leading North American exploration and production (E&P) company. It is engaged in discovering, developing, producing, and marketing natural gas, oil, and natural gas liquids. The company operates through a diverse portfolio of assets, primarily in the United States and Canada.

Regarding financial performance, Ovintiv has shown significant growth over the past two years. In 2022, the company reported an impressive revenue of $12.46 billion, marking a growth of 43.96% from the previous year. This growth trend continued into 2023, with the company generating revenue of $11.83 billion in the twelve months ending June 30, 2023, reflecting a year-over-year growth rate of 9.21%.

Despite the challenging market conditions, Ovintiv has managed to maintain a solid financial position, demonstrating its resilience and strategic capabilities in the energy sector.

Exploring OVV Stock Price Growth Prospects

Every stock exhibits tendencies that become apparent through analysis of charts across different timeframes. However, these tendencies only come into play under specific circumstances, requiring a patient approach until they manifest.

Ideal Scenarios for OVV Stock Price Movement:

– Avoiding excessive bullish sentiment is crucial.

– Early entry during extremely oversold trading generally results in a reversal and upward trend unless the stock has no potential.

– Oversold conditions in monthly charts are favorable.

Distinct Patterns for OVV Stock Price:

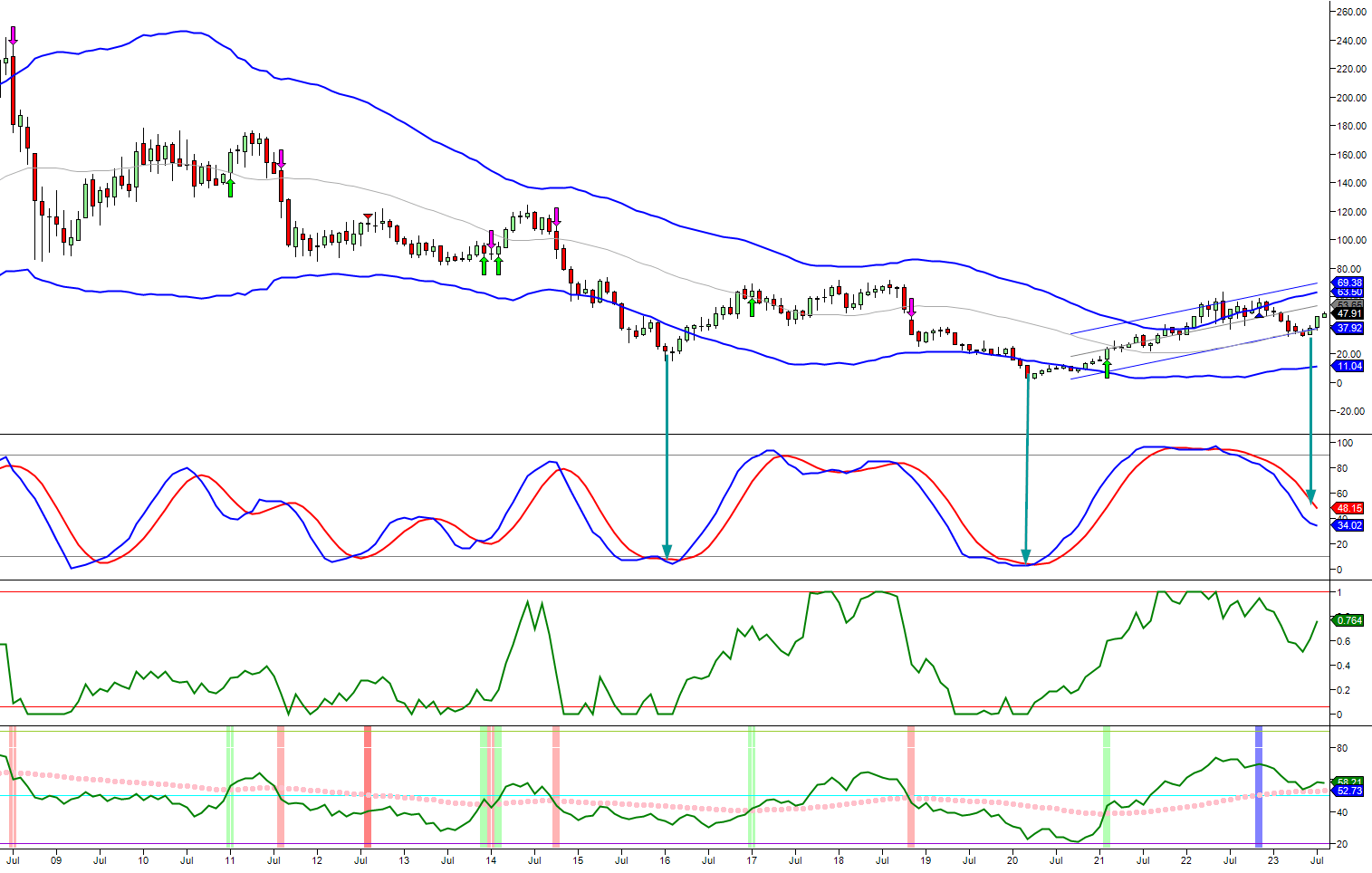

When MACDs on the monthly charts move very low as shown by the green arrows, the stock usually hits a bottom and starts rising. OVV might still go down more since the MACDs aren’t extremely low yet. So, if you’re ready to take a risk, invest only a small amount of money at this point. When the MACDs match the levels of 2015 and 2020, it’ll be smarter to take on more risk for better rewards.

Another good plan is to sell puts once the MACDs are very low. If the shares are added to your account, you buy at a much lower price. If they aren’t added, you essentially get paid for setting a limit order. It’s a strategy where you win either way as long as you want to own the stock. Don’t sell puts on stocks you don’t want to own.

Concluding Thoughts

OVV stock price has consistently exhibited noteworthy gains following instances of extremely oversold MACD readings. While investment outcomes can’t be guaranteed, OVV’s potential for a significant rally becomes evident when specific technical and sentiment conditions align. This process requires patience and discipline, as ideal setups aren’t frequent.

In summary, OVV stock price has significant potential for substantial gains under particular conditions. Notably, extreme oversold MACD readings, such as those observed in December 2015 and March 2020, often lead to increases ranging from 60% to 100%. The stock’s current trend mirrors similar patterns, indicating the possibility of substantial growth. Investors willing to embrace some risk might consider gradual fund allocation to this opportunity. Diversification is crucial, and avoiding excessive investment in any single position remains prudent.

Engrossing Articles That Shed Light on Complex Topics