Editor: Vladimir Bajic | Tactical Investor

Markets surge on a wall of worry

Let’s look at what this means

While a “wall of worry” may sometimes consist of a single economic, political or geopolitical issue significant enough to affect consumer and investor sentiment, it more commonly comprises concerns on numerous fronts. The markets’ ability to climb a wall of worry reflects investor confidence that these issues will be resolved at some point. However, market direction once the wall of worry has been surmounted is impossible to ascertain and depends on the stage of the economic cycle at which it occurs.

Wall of worry and the coronavirus

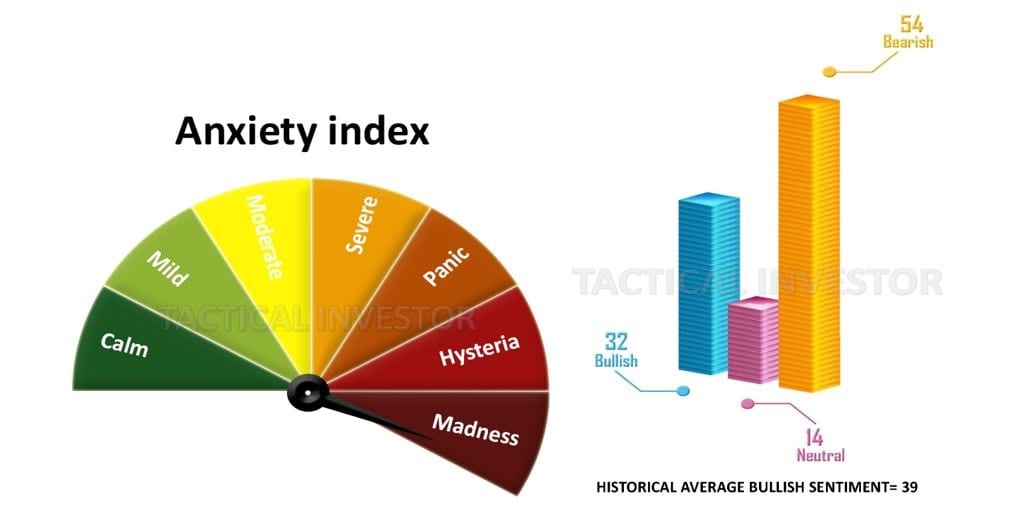

The crowd is still in a state of disarray, and this is probably what the Anxiety index is measuring. Look how they flock to money market funds, that pay next to nothing, but oh yeah, they offer safety. Well, thank goodness for the mass mindset for as they seek safety, we will do the opposite and keep buying. These brilliant minds are holding 4.5 trillion in cash, what a feeding frenzy this will create when these enlightened (us being sarcastic) individuals finally realise it’s time to jump in.

Investors in China poured more than $141 billion into domestic money-market mutual funds in the first quarter, bringing the sector’s total assets under management near a record high. https://yhoo.it/3bTuu0y

The same phenomenon is occurring in China, indicating that distance is not a limiting factor when dealing with the mass mindset. The more the crowd derides this market, the happier you should be.

In the age of coronavirus, cash is indeed king. That’s the view, at least, of many major investors, who are selling everything from stocks to bonds to gold in order to raise cash.

Bank of America Merrill Lynch in its March Fund Managers’ Survey indicated that month over month, cash among funds has seen the 4th largest monthly jump in the survey’s history, from 4 per cent to 5.1 per cent. Like buy-side fund managers, sell-side advisors also feel the need to be conservative, waiting on the side-lines for the market selloff to settle. https://cnb.cx/3bQmbCz

The saying should be changed to: in the age of ignorance; cash appears to be king but will soon face the same outcome the naked emperor did. It took a kid to point out the obvious, that the dude was fat, naked and sorely in need of some shock therapy.

To understand the concept of Markets surge on a wall of worry

Consider studying the following:

The study of market sentiment is incredibly useful in determining market tops and bottoms in advance of the event.

All it takes is some patience and the desire and drive to understand the fundamental forces that are useful to our survival are extremely detrimental when it comes to investing in the markets.

Articles that can help you in your quest to be a better trader

Mob Mentality: How to overcome & Win Investing Game

Mob Mentality: Understand, Overcome & Win StockMarket Game

Clear illustration of the mass mindset

Comic Strip Illustrating Mass Mindset