Apollo Commercial Real Estate Inc: A Good Play

This company operates as a real estate investment trust that primarily originates, acquires, invests in and manages commercial first mortgage loans, subordinate financings, commercial mortgage-backed securities, and other commercial real estate-related debt investments in the United States. The current yield stands at lofty 10.4%

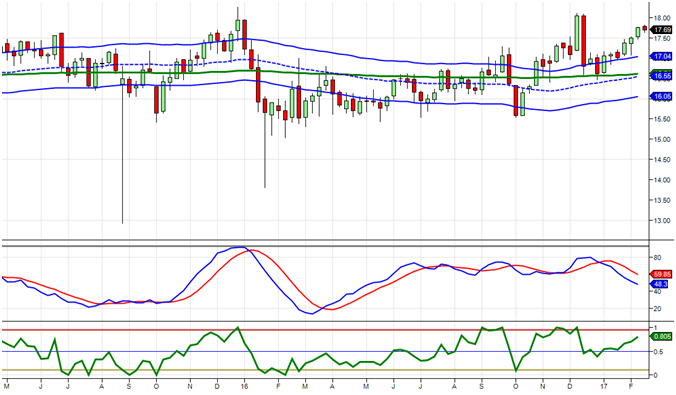

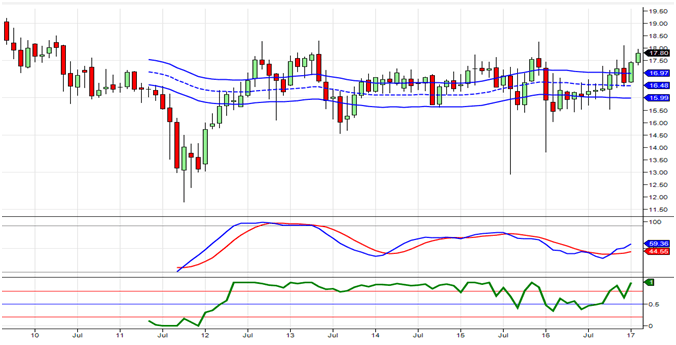

Like SNH, the stock looks attractive on the weekly charts, and a bullish crossover on the MACDs should push it to a series of new 52-week highs.

The monthly chart shows that the MACD, surprisingly, are trading in what we would label as the “minimum oversold ranges”.

Suggested strategy

Purchase one lot in the 16.50-16.80 ranges

Deploy one more lot in the 15.70-15.90 ranges

If it happens to drop to or below 15, use the last 1/3rd of your funds to purchase an additional position.

Other stories of interest

Decoding the Mystery: Where have bonds been when the stock market crashes?

The Ebb and Flow of Investor Sentiment: Bull, Bear and Stock Market Crashes

What are the three investments one can make to beat inflation?

US Stock Market Crash Date: Experts Discuss, But Where’s The Action?

Unlocking the Benefits of Investing in Precious Metal Stocks

Mastering Emotional Control for Successful Stock Market Investing

Preferred Stock Market Valuation Is Based Primarily Upon

Mastering Options Trading: Unveiling the Real Secrets

Which of the Following Is an Example of Collective Behavior?

4X ETF: Deadly Risks and Realities

SPY 200-Day Moving Average Strategy: Learn, Earn, and Prosper

Best Tech Stocks To Buy Now: Spotting the Trend

CPNG Share Price: Buy, Sell, or Hold?

Rolling Over Options: The Ultimate Guide to Mastery