Interest Rate Wars: Fed Trapped Between a Hard Place and a Grenade

Updated Aug 25, 2025

The Fed’s Corner: Liquidity or Bust

The Federal Reserve isn’t choosing between good and bad options—it’s choosing between hard and harder. Faced with that kind of menu, you pick the bruise, not the grenade. For more than a year, the case has been consistent: whatever happens with policy rates, the Fed would eventually be pushed back toward balance-sheet expansion. Put bluntly, the runway is short. There’s effectively one lever left to pull—keep money flowing and the system lubricated—or watch the engine seize.

The Next Play: Negative Rates and the Global Race to the Bottom

Central banks abroad have already probed the next frontier of stimulus: negative interest rates. It’s only a question of timing, this argument goes, before the U.S. flirts with the same tool. Washington may hold out longer to preserve the optics of a stronger dollar, but in a global race to the bottom, the strategy is to finish last, not first. Sub‑zero policies function like an implicit tax on saving and a nudge toward speculation, rewarding those who take more risk while eroding the returns of those who park cash.

The Fed is already stalling; this is a clear signal, as any, that they are already planning the next line of attack. And please do not fall for the notion that the Fed is panicking; having no choice is not the same thing as panicking. The Fed and its friends always win. Those who fight the Fed have a short life span. They have had decades to fine-tune this nefarious art of fleecing the masses, and they are experts at it now.

Those at the top have already used a vast portion of their paper wealth to secure valuable hard assets, so if the entire market were to collapse tomorrow, they would not lose anything. They will stand to make even more as they will come in and purchase everything in sight. However, the markets are not going to collapse tomorrow; one day in the future, they might, but that day is not tomorrow.

The war on Interest rates is on, and you cannot fight a trend in motion so that the U.S will have no option but to join the battle.

This economic recovery is nothing but a hallucination, and we will prove it without a shred of doubt with one chart.

In the next update, which we are currently working on, we will provide you with this chart, and the data will be sourced directly from the Federal Reserve.

We have identified several factors that suggest this recovery is a hoax. Still, instead of fighting the trend, we have taken an unconventional view: despite the economic recovery being a hoax, the markets are likely to trend higher. The weapon of choice now is to throw increasingly large sums of money at the problem, and this works because the masses are not ready to fight.

The can will be kicked down the road until the road ends or the can becomes so heavy that kicking the can rips the leg out of its hinges. We are still a long way from that point. The debt is going to increase to a level that will one day be labelled “as insanely unimaginable”. Don’t believe us. Well, then, tell us what you make of the fact that it took over 100 years to reach $1 trillion; now it surges by that amount almost every year.

Conclusion

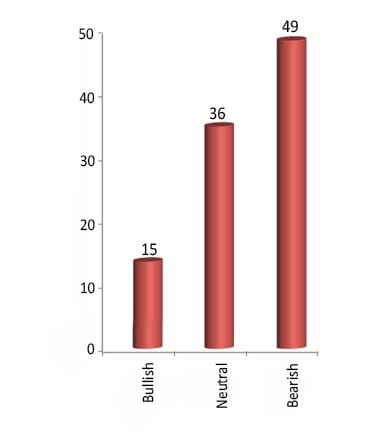

The fear levels continue to rise, and all our gauges are now in the extreme zones. While the markets may trend lower, they are unlikely to crash. Instead of a crash, we are most likely going to end up with a great buying opportunity.

The war on interest rates means that deflation will be here for longer than most expect so while Gold will slowly trend higher, it is not likely to explode upwards as the Gold bugs are sitting and hoping and forlornly waiting.

Behind the Curtain of Conventional Wisdom