In 1929, the Stock Market Crashed Because of unchecked speculation

Feb 20, 2024

Introduction to the 1929 Stock Market Crash

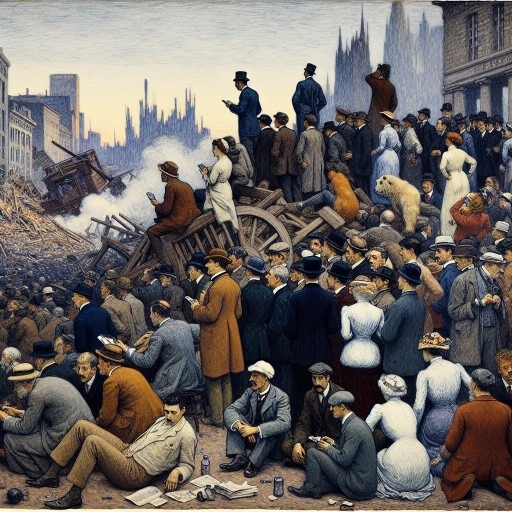

The cataclysmic stock market crash of 1929 is a stark reminder of the consequences of arrogance and ignorance in the financial world. It was not a sudden, isolated event but the result of a complex interplay of factors that culminated in one of history’s most devastating economic collapses. The crash was the tipping point of the Great Depression, a severe financial hardship that affected the globe.

In the lead-up to the crash, the United States experienced significant economic growth and prosperity, known as the Roaring Twenties. However, the seeds of disaster lay beneath the surface of this economic boom. A culture of overconfidence and speculative excess took hold as investors, driven by the allure of quick profits, engaged in reckless stock market speculation. The widespread practice of buying on margin allowed individuals to borrow heavily to invest in stocks, inflating their prices beyond their actual value and creating an unsustainable bubble.

The arrogance of the era was characterized by blind faith in the market’s continued rise. This overconfidence was not just limited to investors; it permeated the financial institutions and regulatory bodies that turned a blind eye to the speculative frenzy. The ignorance of the risks involved and a failure to learn from historical financial panics set the stage for disaster.

As stock prices soared, the underlying economic indicators were ignored. The uneven distribution of wealth meant that the prosperity of the 1920s was not as widespread as it appeared. Many Americans were not participating in the economic gains, and consumer spending could not keep up with production. When the realization set in that stock values were grossly overinflated, the market’s confidence shattered, leading to a frantic sell-off.

The crash began with market declines in late October 1929, culminating in Black Tuesday, when a record number of shares were traded, and billions of dollars were lost in a single day. The aftermath was catastrophic: investors were ruined, banks failed, and the economy plunged into the Great Depression.

The 1929 stock market crash is a cautionary tale of what can happen when arrogance blinds investors to the realities of the market and ignorance prevents them from recognizing the warning signs of an impending crisis. It underscores the need for prudent investment practices, regulatory oversight, and a deep understanding of economic history to prevent future financial disasters.

In 1929, Stock Market Crash: Understanding the Impact of Arrogance and Ignorance

Arrogance: The Illusion of a Never-Ending Boom

The stock market crash of 1929 was partly fueled by an arrogance permeating the Roaring Twenties. A belief in the infallibility of the market and the economy marked this era. Investors, both seasoned and novices, were swept up in a euphoric rush to capitalize on the seemingly endless upward trajectory of stock prices. The notion that stocks would continue to rise indefinitely led to reckless investments and a disregard for the fundamental principles of investing.

The arrogance of the time was not just limited to investors; it extended to the financial institutions and the government. Banks offered loans to investors with little regard for their ability to repay, and regulatory oversight was minimal. The belief that the market was self-regulating and that government intervention was unnecessary contributed to the lack of safeguards that might have prevented the crash.

Ignorance: A Failure to Heed History’s Lessons

Ignorance also played a critical role in the events leading up to the crash. There was a widespread lack of understanding of the market’s complexities and the risks involved in stock trading, particularly on margin. The concept of buying on margin allowed investors to borrow money to buy more stock than they could afford, which magnified the impact of the crash when it came.

Moreover, there was a failure to learn from past economic downturns and financial panics. History lessons were ignored, and the warning signs of an overheated economy were overlooked. The belief that the new era of technological advances and economic growth had rendered the old rules obsolete led to a dangerous complacency.

The Consequences of Arrogance and Ignorance

The combination of arrogance and ignorance had dire consequences. When the market began to falter, the illusion of a never-ending boom was shattered. Investors panicked, and the rush to sell off assets led to a dramatic plunge in stock prices. The crash wiped out individual fortunes and devastated the economy, leading to the Great Depression.

The aftermath of the crash was a sobering reminder of the dangers of hubris and the importance of financial literacy. It led to significant changes in the regulatory framework, including the creation of the Securities and Exchange Commission (SEC) to enforce federal securities laws and regulate the securities industry.

The stock market crash of 1929 serves as a cautionary tale about the perils of arrogance and ignorance in the financial world. It underscores the need for vigilance, respect for the economy’s cyclical nature, and a commitment to understanding the complexities of the financial markets. Only by acknowledging the limitations of our knowledge and the potential for unforeseen events can we hope to prevent a repeat of such a catastrophic economic collapse.

Conclusion: Lessons from the 1929 Stock Market Crash

The stock market crash of 1929 remains a profound cautionary tale in our economic history. It stands as a testament to the potentially devastating consequences of unchecked speculation, rampant greed, and an unfettered belief in the infallibility of markets. The crash and the ensuing Great Depression serve as stark reminders of the importance of maintaining a balance between economic optimism and pragmatic caution.

The arrogance of the era, characterized by overconfidence in the market’s continuous rise, reveals the dangers of complacency in the face of economic bubbles. The ignorance, illustrated by a failure to acknowledge the cyclical nature of economies and heed historical lessons, underlines the critical need for financial literacy and a deep understanding of market complexities.

The fallout from the crash was not confined to the financial markets; it permeated every facet of society, affecting ordinary people’s lives in profound ways. It led to a loss of faith in financial institutions, a significant shift in public policy, and a re-evaluation of the role of regulatory oversight in financial markets.

Today, as we navigate the complexities of our global economy, the lessons from 1929 are more relevant than ever. They remind us of the need for vigilance, transparency, and restraint in our financial practices. They underscore the importance of equitable wealth distribution, robust regulatory frameworks, and sustainable economic policies.

In an era characterized by rapid technological changes, unprecedented connectivity, and evolving financial instruments, we must not fall prey to the same arrogance and ignorance that led to the stock market crash of 1929. Instead, we should strive to learn from our past, embrace the principles of sound financial management, and work towards creating a resilient, inclusive, and sustainable economic environment. This is the true legacy of 1929: a call to action for responsible financial stewardship in the face of ever-present economic uncertainty.

Stimulating Reads for the Inquisitive

Mastering Options Trading: Unveiling the Real Secrets

Which of the Following Is an Example of Collective Behavior?

4X ETF: Deadly Risks and Realities

SPY 200-Day Moving Average Strategy: Learn, Earn, and Prosper

Best Tech Stocks To Buy Now: Spotting the Trend

CPNG Share Price: Buy, Sell, or Hold?

Rolling Over Options: The Ultimate Guide to Mastery

Fearless Finance: Harnessing Stock Market Fear for Contrarian Victories

Market Timing Strategies: Debunking Flawless Predictions

Dow 30 Stocks with Dividends: A Winning Strategy for Income Investors

Collective Behavior Generally Takes Which of the Following Forms?

Harnessing Collective Behavior: Strategies for Investment Success

Unlocking Value in Equal-Weighted Index Funds: Benefits and Strategies

What Caused the 1987 Stock Market Crash: Could It Happen Again?