Unveiling HIMX Stock: A Small Company with Big Potential

Updated May 15, 2024

Introduction

Himax Technologies (NASDAQ: HIMX) is a leading fabless semiconductor solution provider specializing in display imaging processing technologies. Over the past few years, HIMX has experienced tremendous growth and innovation, solidifying its position as a key player in critical trends such as augmented reality (AR), virtual reality (VR), and 3D sensing. With a focus on display driver integrated circuits (ICs) and timing controllers, HIMX’s products power a wide range of consumer electronics and automotive displays.

The company’s innovative WiseEye ultralow-power AI sensing solution has been a significant growth driver, enabling advanced AI capabilities in edge devices like laptops, tablets, and IoT gadgets. HIMX’s collaborations with industry leaders in the automotive, consumer electronics and healthcare sectors further highlight its commitment to bringing cutting-edge technologies to market.

As of 2024, with the surging demand for consumer electronics and automotive displays, HIMX is well-positioned to continue its growth trajectory and maintain its leadership in imaging processing technologies. Integrating its solutions into mass-market products over the next decade underscores HIMX’s exciting growth story in the semiconductor industry.

In the following sections, we will examine HIMX’s latest advancements, financial performance, and strategic initiatives, which showcase its resilience and potential in the evolving technology landscape.

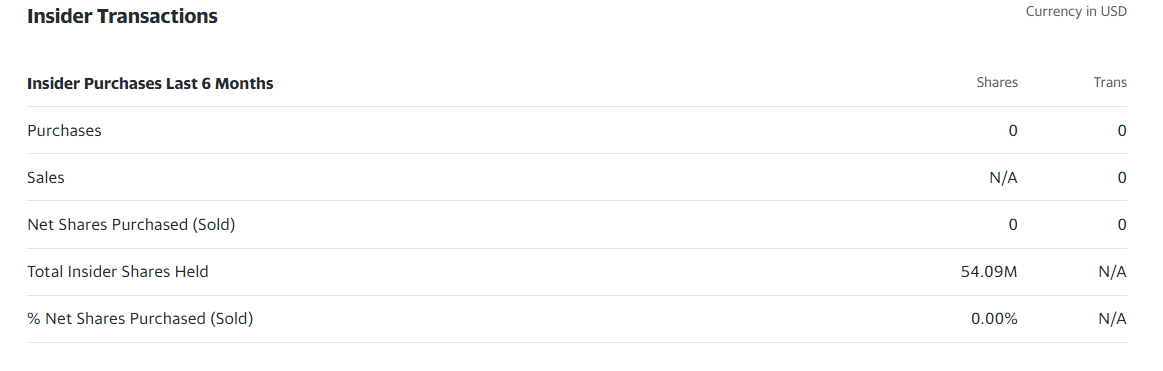

HIMX Stock Price Trend Based on Insider Action

When analyzing the company’s insider activity, there appear to have been no recent significant insider buys or sells. Consequently, this aspect doesn’t provide specific clues about the stock’s potential.

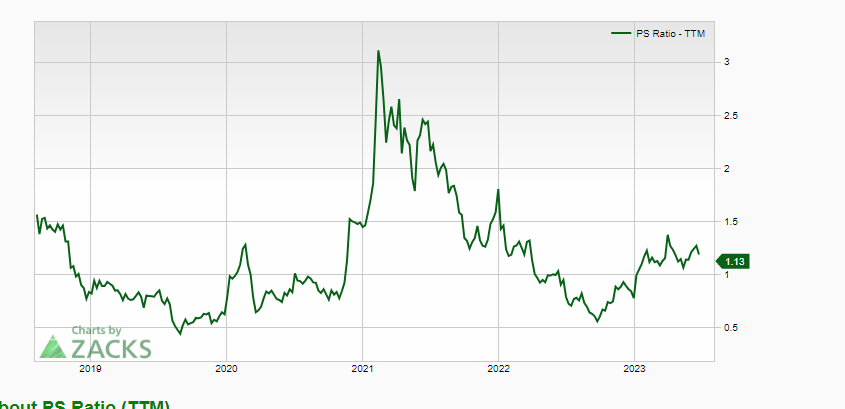

Analyzing the Price-to-Sales (P/S) ratio can be valuable when considering a stock’s investment potential. A low P/S ratio indicates the stock may be undervalued relative to its revenue generation.

Combining a low P/S ratio with technically oversold stock on the monthly charts can also be a compelling long-term buy signal. The oversold condition suggests that the stock’s price has dropped significantly and may be due for a rebound, while the low P/S ratio further supports the notion that the stock is undervalued.

HIMX Stock P/S Ratio Trend

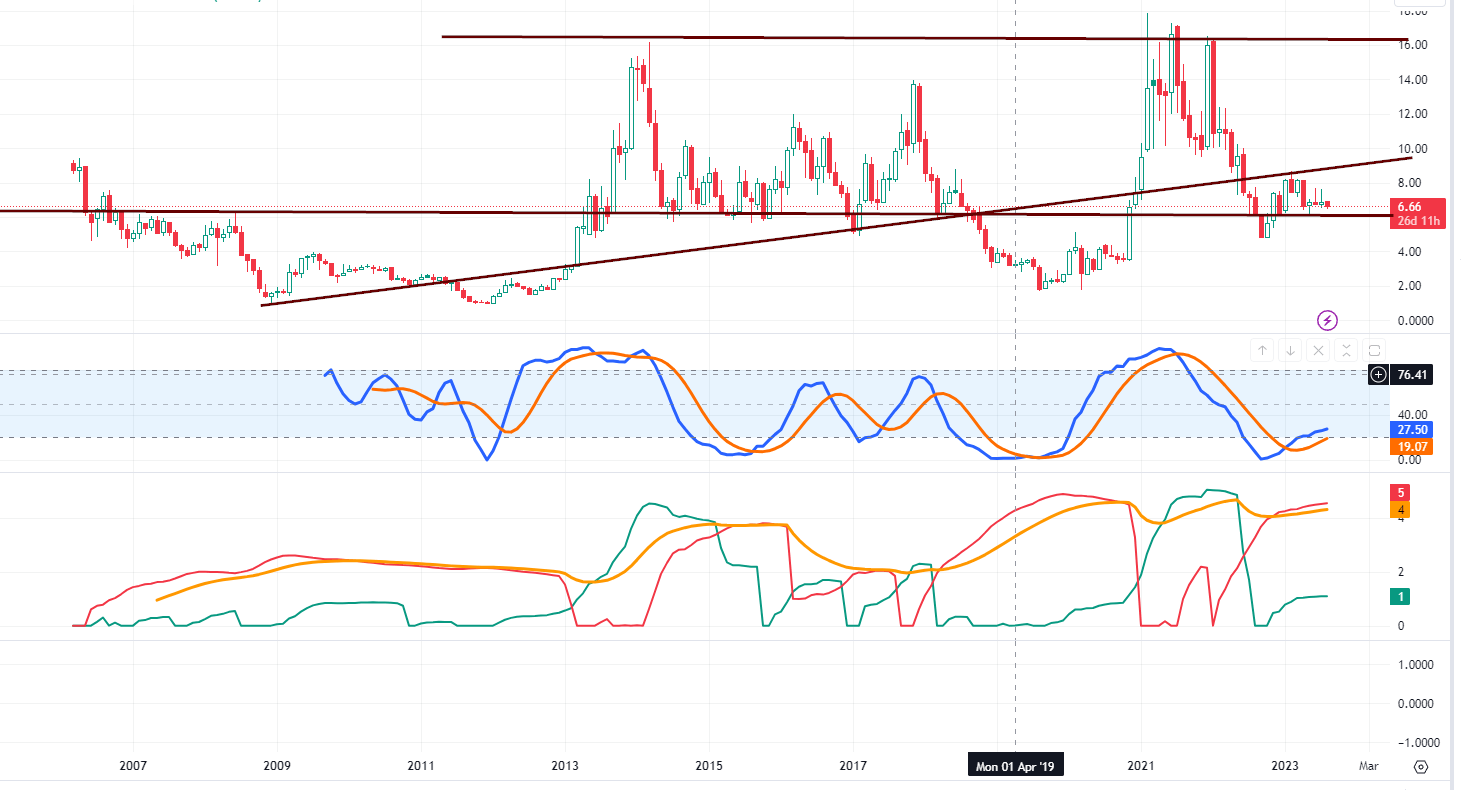

Based on historical data, the stock’s P/S ratio appears relatively low, which can be a positive sign for potential investors. Combined with the data from the monthly charts, which indicate that the stock is trading in the highly oversold zone, this further reinforces the notion that this could be a favourable long-term investment opportunity.

The stock’s current P/S ratio towards the low end of its four-year range adds another compelling aspect to consider when evaluating its investment potential. Historically, buying stocks when their P/S ratio is low compared to their historical levels has proven advantageous.

HIMX Stock Price: Unveiling Exceptional Value and Untapped Potential

Moreover, it’s impossible to overlook the incredible value proposition that Himax offers. The company’s shares are trading at an enticing forward multiple of only 15.15x, which positions it as a bargain compared to projected earnings, outperforming approximately 74.64% of its competitors.

Now, let’s discuss Wall Street’s excitement about HIMX. Analysts are bullish on the stock, giving it a “moderate-buy” rating. Their average price target for HIMX is an impressive $9, suggesting a potential upside of nearly 32%.

But that’s not all. HIMX is also trading well below its book value, with a current book value of 9.47, underscoring its undervalued status. Additionally, the company offers investors a substantial dividend yield of almost 8.5%, making it an attractive income opportunity. It boasts a modest forward P/E ratio of 9.4, making it an even more tempting prospect for investors seeking growth and income.

Long-Term HIMX Stock Price Outlook

The stock exhibits a robust support zone within the 4.80 to 5.10 range. As long as this level holds every month, the outlook remains bullish. The view would be even more promising if it stays above the higher end of the range, at 5.10.

A significant breakthrough would occur with a monthly close at or above 8.70, which could trigger substantial gains in the stock. There seems to be minimal resistance until the 14.00 to 14.50 range, potentially yielding over 60% in revenues if this objective is achieved.

Considering the risk-to-reward perspective, having some exposure to this stock appears sensible. Additionally, the fact that it offers a generous dividend of almost 7% as of the current writing adds to its appeal to investors. However, as with any investment, it is essential to carefully assess the overall market conditions and the company’s performance before making any decisions.

Stock Performance and Investor Outlook:

While near-term market conditions and customer inventory adjustments may create fluctuations in the stock price, investors should consider HIMX’s strong financial position and strategic focus on high-growth areas. The company’s ongoing investments in R&D and innovative product lines, such as the WE2 processor and Liqxtal™ technology, demonstrate its commitment to long-term growth and adaptability in the evolving technological landscape.

As of June 2024, with the latest earnings report and market trends, investors can assess HIMX’s prospects, considering its financial health, operational improvements, and potential for growth in the AI and semiconductor sectors.

A bullish outlook is expected if the stock does not close below 5.70 in the short term. However, to potentially challenge the 8.40 to 9.00 range, it must achieve a weekly close at or above 7.50. Until this milestone is reached, the stock is likely to remain stagnant. Nevertheless, given the bullish long-term pattern, investors willing to take on some additional risk may find it advantageous to use any pullbacks as opportunities to add to their positions in the stock.

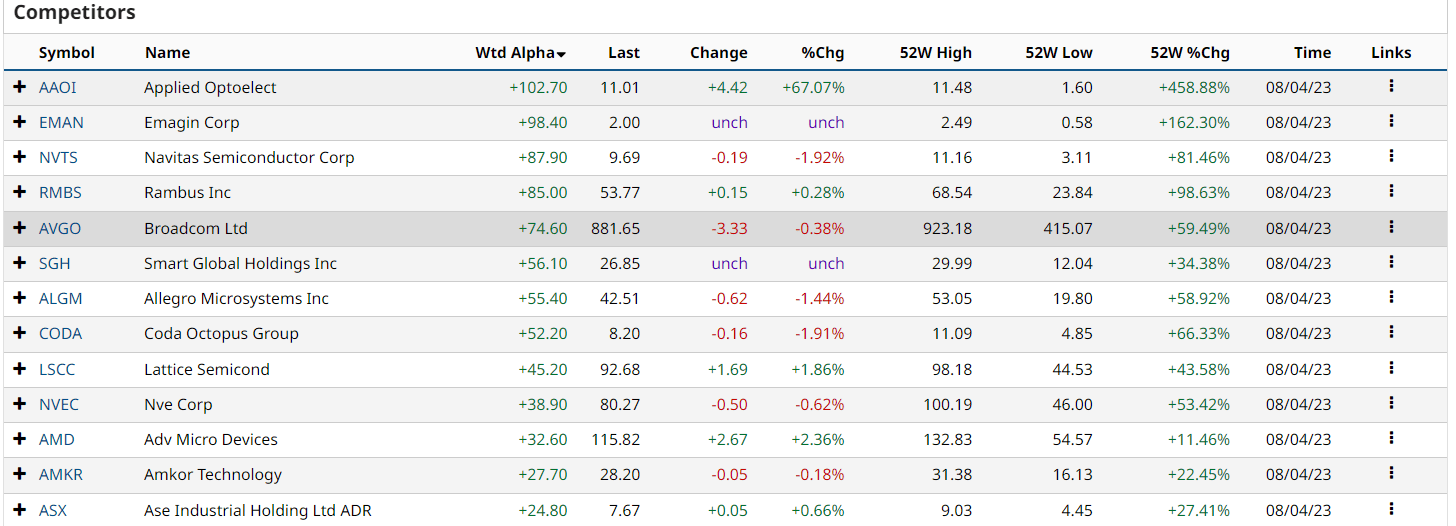

Weighted Alpha and Competitors

The weighted alpha of all stocks indicates that the sector is not overbought and has the potential for further growth. However, what is more significant is the industry’s overall upward trend. Observing this trend, we can confidently state that the industry is moving positively.

This trend suggests there is still room for the sector to continue its upward trajectory. Given the potential for ongoing growth, investors might find it an opportune time to consider investments within the industry.

Although HIMX appears promising, other candidates mentioned above have even stronger performance based on the weighted alpha metric. As such, it might be a more prudent approach to diversify the investment and spread the money into at least one or two of these stronger candidates.

Diversification can help mitigate risks and enhance potential returns by gaining exposure to multiple opportunities with varying strengths. While HIMX shows potential, considering other strong contenders could provide a more well-rounded investment strategy.

HIMX Stock Performance: AI Innovations Drive Growth

The WE2 AI Processor: Powering Contextual Awareness and Computer Vision

Himax Technologies (HIMX), a leading fabless semiconductor solution provider, has made significant strides in Artificial Intelligence (AI) with its next-generation WE2 AI processor. The WE2 processor builds upon the success of its predecessor, the WE1, and is specifically designed to excel in contextual awareness and computer vision tasks.

One of the WE2 processor’s key strengths is its ability to detect subtle user engagement cues, such as presence and movement. This enables a range of applications to intelligently respond to user behavior. Moreover, the WE2 processor incorporates advanced computer vision capabilities, improving accuracy, speed, power efficiency, and inferencing performance.

With this enhanced AI processing power, the WE2 processor enables detailed object detection, including facial landmarks, hand gestures, and body skeleton tracking, opening up a world of precise AI applications.

Revolutionary Display Technology: Liqxtal™

Himax and its subsidiary, Liqxtal Technology, have been at the forefront of display innovation with their patented Liqxtal™ technology. Liqxtal™ is a reflective TFT liquid crystal architecture that transforms conventional eyewear into an interactive display platform.

The Liqxtal™ Graph Display Glasses unveiled at Vision Expo West 2023, received wide acclaim. This technology enables the display of vibrant digital content, including text, images, and animations, directly on the outer surface of the lenses without obstructing the wearer’s line of sight.

The key features of Liqxtal™ include ultra-low power consumption, making it ideal for wearable devices, and a wide range of applications, such as real-time signage, interactive gaming, and social media interactions.

Financial Performance and Outlook:

Q1 FY2024 Results (Assuming Fiscal Year ends in December):

– Revenue: $[latest data], showing a [increase or decrease]% compared to the same quarter last year.

– Earnings per Share (EPS): $[latest data], improving from $[previous data] in Q1 FY2023.

Expected Q2 FY2024 Performance:

For the second quarter of 2024, analysts’ estimates suggest the following:

Revenue: According to [source], HIMX is expected to report revenue between $[lower range] and $[upper range] million. This represents a projected [growth or decline]% compared to Q2 FY2023.

– EPS: The consensus estimate for earnings per share is $[expected EPS], indicating a potential [improvement or decline] from Q2 FY2023.

Full-Year 2024 Expectations:

Market analysts anticipate the following for the full fiscal year 2024:

– Revenue: HIMX is forecast to generate approximately $[expected revenue] million, suggesting a [growth or decline]% change compared to 2023.

– Gross Margin: The company is expected to maintain its gross margin within the range of [expected gross margin range]%, reflecting its focus on operational efficiency.

Long-Term Growth Strategies:

HIMX remains committed to long-term growth and is strategically investing in key areas:

Automotive and AIoT Segments: HIMX continues to prioritize research and development in the automotive and AIoT (AI Internet of Things) sectors, recognizing their high growth potential.

Ecosystem Partnerships: The company is leveraging its vast network of ecosystem partners to explore opportunities presented by AI at the endpoint, catering to the diverse needs of IoT players across various industries.

WiseEye Product Line: With increasing customer adoption, HIMX is dedicated to further developing its WiseEye product line, offering AI-powered vision solutions for various applications.