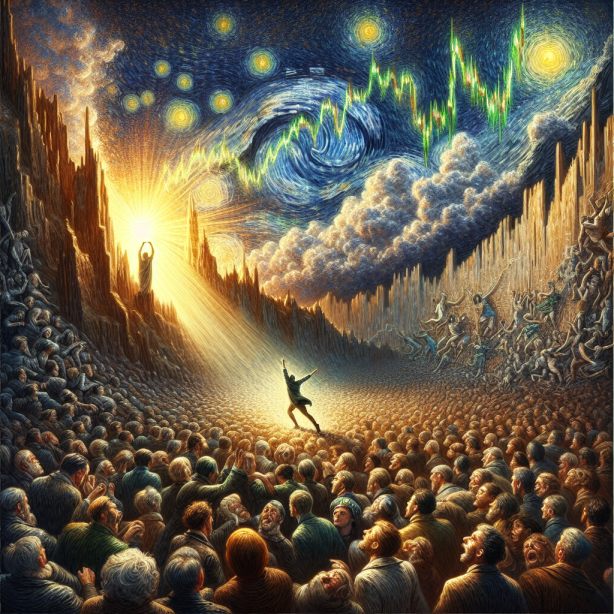

When is the Best Time to Buy Stocks: Amidst Widespread Fear

June 22, 2024

From the ancient markets of Mesopotamia to the bustling trading floors of Wall Street, the art of timing stock purchases has captivated investors for millennia. This essay delves into the timeless wisdom of when to buy stocks, drawing on insights from traders and behavioural observers spanning over 4,000 years of human history.

Central to this exploration is the role of mass psychology in shaping market dynamics. The ebb and flow of collective sentiment often create opportunities for the astute investor. As the 18th-century banker Baron Rothschild famously advised, “Buy when there’s blood in the streets.” This contrarian approach highlights a fundamental truth: the best time to buy is often when others are fearful.

Mass psychology dictates that markets are driven by emotions as much as by fundamentals. Periods of extreme pessimism or euphoria can lead to significant mispricing of assets. Understanding these psychological undercurrents allows investors to identify moments when fear has overtaken rational analysis, creating potential buying opportunities.

By examining historical market events, behavioural patterns, and the wisdom of renowned investors, we will uncover strategies for navigating the complex interplay between mass sentiment and stock valuations. This journey through time and human nature will equip you with the insights needed to seize opportunities when they arise, turning market chaos into potential profit.

The Wisdom of Antiquity

As far back as 2000 BC, Babylonian merchants understood the cyclical nature of markets. Clay tablets from the era reveal sayings such as, “Buy when the streets run with blood,” an ancient precursor to Baron Rothschild’s famous advice to “buy when there’s blood in the streets.” This contrarian approach highlights a fundamental truth: the best time to buy is often when others are fearful.

Fast-forward to ancient Greece, where the philosopher Aristotle observed, “The whole is greater than the sum of its parts.” This holistic view reminds us that when evaluating stocks, we must consider not just individual companies but the broader economic landscape and market sentiment.

The Renaissance of Market Insight

During the Renaissance, Italian mathematician Fibonacci introduced his famous sequence, which traders still use today to identify potential market turning points. His work reminds us that patterns exist in markets, and recognizing them can help time our entries.

In the 17th century, Dutch trader Joseph de la Vega wrote “Confusion de Confusiones,” one of the earliest books on stock trading. He noted, “The expectation of an event creates a much deeper impression upon the exchange than the event itself.” This observation on the power of anticipation in markets remains relevant today, highlighting the importance of monitoring mass sentiment.

Modern Market Mavens

Fast forward to the 20th century, and we find a wealth of wisdom from legendary investors. Benjamin Graham, the father of value investing, advised, “Buy not on optimism, but on arithmetic.” His approach of seeking undervalued companies with solid fundamentals during market downturns has proven successful for decades.

Warren Buffett, Graham’s most famous disciple, famously quipped, “Be fearful when others are greedy and greedy when others are fearful.” This encapsulates the contrarian approach to buying stocks during market corrections or crashes.

Identifying Market Corrections and Crashes

Historical examples of significant market corrections include the 1929 crash, Black Monday in 1987, the dot-com bubble burst in 2000, and the 2008 financial crisis. These moments of panic they created extraordinary buying opportunities for those with the courage to act.

However, timing is crucial. As legendary trader Jesse Livermore cautioned, “Don’t be too eager to anticipate the market’s action.” It’s essential to wait for the pullback to gain momentum and not rush in too early. Look for signs of stabilization, such as:

1. Declining volatility

2. Reduced trading volume

3. Rebounds from key support levels

4. Improving investor sentiment

5. Fundamental improvements in economic conditions

Monitoring Mass Sentiment and Psychology

Behavioral finance expert Richard Thaler reminds us, “The purely rational man is a mythical hero.” Understanding market psychology is crucial for timing stock purchases. When bearish sentiment reaches extreme levels (55 or higher on sentiment surveys), it often signals a potential buying opportunity.

At these points, fear and panic override rational thinking, causing stock prices to become detached from fundamentals. As contrarian investor David Dreman noted, “Psychological factors are responsible for wide, capricious swings in the market.”

Focusing on High-Quality Companies

During market downturns, concentrate on purchasing shares of high-quality companies with:

1. Strong balance sheets

2. Proven business models

3. Loyal customer bases

4. Competitive advantages (or “economic moats” as Buffett calls them)

5. Attractive valuations

Peter Lynch, the legendary Fidelity fund manager, advised, “Know what you own, and know why you own it.” This approach helps investors weather market storms with confidence.

Disciplined Investment Plan

Developing a watch list of promising stocks and a plan for deploying cash before volatility arises is crucial. As systematic investor Ray Dalio emphasizes, “He who lives by the crystal ball will eat shattered glass.” Rather than trying to time the market perfectly, consider dollar-cost averaging – investing fixed amounts at regular intervals.

Trader and author Alexander Elder suggests, “The goal of a successful trader is to make the best trades. Money is secondary.” This mindset helps maintain discipline and avoid emotional decision-making during market turmoil.

Historical Market Events and Lessons

Examining past market events offers valuable lessons:

1. The Great Depression (1929-1939): Highlighted the importance of diversification and not using excessive leverage.

2. Black Monday (1987): Demonstrated how quickly markets can recover from sharp, panic-driven selloffs.

3. The dot-com Bubble (2000) Reminded investors of the dangers of irrational exuberance and the importance of valuing companies based on fundamentals.

4. Global Financial Crisis (2008): Underscored the interconnectedness of global markets and the value of holding high-quality assets during times of stress.

5. COVID-19 Crash (2020): Showed how quickly sentiment can shift and the importance of staying invested for long-term goals.

Contrarian Investing Approaches

Legendary value investor Sir John Templeton said, “Bull markets are born on pessimism, grow on scepticism, mature on optimism, and die on euphoria.” This encapsulates the contrarian approach to market cycles.

Implementing a contrarian strategy requires the following:

1. Patience to wait for extreme sentiment readings

2. Courage to act when others are fearful

3. Discipline to stick to your investment plan

4. A long-term perspective that looks beyond short-term market noise

As Howard Marks of Oaktree Capital notes, “The most profitable investment actions are by definition contrarian: you’re buying when everyone else is selling (and the price is thus low) or you’re selling when everyone else is buying (and the price is high).”

Embracing Volatility as Opportunity

Volatility, often feared by novice investors, can be a powerful ally for those prepared to capitalize on it. As options trader Nassim Nicholas Taleb observes, “Wind extinguishes a candle and energizes fire.” Similarly, market turbulence can destroy the unprepared while creating opportunities for the well-positioned investor.

Legendary trader Paul Tudor Jones advises, “The secret to being successful from a trading perspective is to have an indefatigable and undying and unquenchable thirst for information and knowledge.” This curiosity and constant learning help investors identify opportunities in various market conditions.

The Role of Patience and Emotional Control

Perhaps the most challenging aspect of timing stock purchases is maintaining emotional control. As investment guru Charlie Munger states, “The big money is not in the buying and selling, but in the waiting.” Patience allows investors to wait for desirable opportunities rather than chasing every market movement.

Psychologist Daniel Kahneman’s work on prospect theory reminds us that humans feel losses more acutely than equivalent gains. This natural tendency can lead to poor decision-making during market downturns. Awareness of these biases is the first step in overcoming them.

Conclusion: The Eternal Dance of Markets

As we’ve seen, the question of when to buy stocks has occupied the minds of traders and investors throughout history. While no single strategy guarantees success, the collective wisdom of centuries points to several fundamental principles:

1. Embrace contrarian thinking

2. Focus on high-quality companies

3. Maintain a disciplined investment plan

4. Learn from historical market events

5. Monitor mass sentiment and psychology

6. Remain patient and emotionally controlled

By internalizing these lessons and combining them with thorough analysis and a long-term perspective, investors can position themselves to capitalize on the opportunities that market corrections and crashes inevitably create.

Remember the words of market sage Bernard Baruch: “Don’t try to buy at the bottom and sell at the top. It can’t be done except by liars.” Instead, focus on identifying value, managing risk, and staying true to your investment principles. In doing so, you’ll be well-equipped to navigate the eternal dance of the markets, seizing opportunities where others see only chaos and despair.