DSX Stock Outlook: Breakout or Breakdown

Sept 27, 2023

Before we delve into the exciting outlook for DSX stock, let’s take a moment to explore the captivating world of Diana Shipping Inc. (DSX) and its dynamic business model.

Imagine a fleet of mighty vessels traversing the vast oceans, carrying the lifeblood of global trade. That’s precisely what Diana Shipping, a leading international shipping company, specializes in. With a fleet comprising 41 impressive vessels, including the powerful Capesize, versatile Panamax, agile Kamsarmax, and efficient Ultramax vessels, Diana Shipping dominates the seas, a vital link in the global supply chain.

DSX operates shipping routes that span the corners of the Earth, facilitating the transportation of essential dry bulk cargoes. From iron ore powering industrial growth to coal fueling energy production, from grain-sustaining agricultural systems to various materials driving infrastructure development, DSX ensures the smooth flow of these commodities worldwide.

But what drives DSX’s success? It’s the art of providing impeccable transportation services to esteemed clients. In an intricate dance of logistics, DSX connects companies and organizations with their cargo, delivering it efficiently and safely to its destination. And it’s not just about moving goods; it’s about delivering value. DSX charges fees for its transportation services, contributing to its robust revenue stream while supporting global trade and economic growth.

Picture a fleet of vessels strategically deployed across the globe, like chess pieces on a board, seizing market opportunities and meeting the demands of clients. DSX’s fleet, meticulously maintained and armed with advanced technology, ensures reliable and cost-effective transportation solutions. The company’s extensive experience and global network enable it to navigate the complex shipping industry with finesse, adapting to the ever-changing tides of supply and demand.

It’s no wonder that DSX has earned its place as a trusted and reputable player in the dry bulk shipping market. Operational excellence is the cornerstone of DSX’s success, with a strong emphasis on safety and customer satisfaction. By prioritizing these principles, DSX has forged enduring relationships with clients, fostering trust and securing a formidable position in the market.

Now, let’s set our sights on the technical outlook for DSX stock. Will it break out to new heights, defying expectations? Or will it face a potential breakdown, creating opportunities for astute investors? Let’s explore the possibilities and uncover the exciting potential that lies ahead.

DSX Stock: Technical outlook

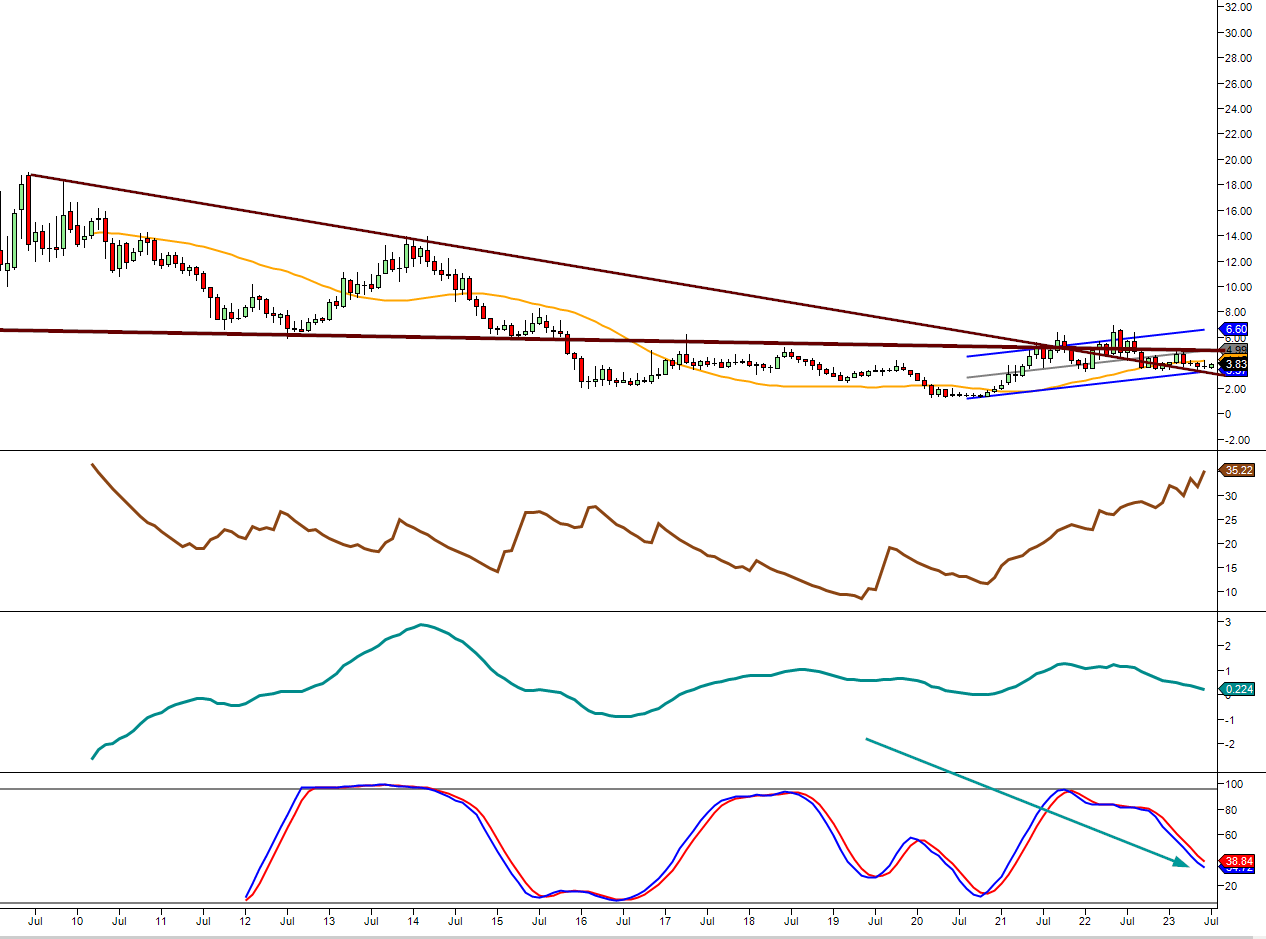

From a technical perspective, this stock is trading in the highly oversold range, creating a higher risk but potentially higher reward opportunity. Any pullback from these oversold levels will make for a good buy if one understands the elevated risk. However, the risk drops when a stock trades in oversold territory, as is the case here.

Notice the tight channel formation, though it appears narrower due to the time frame (17 years’ worth of data). Once a breakout above this channel occurs, things could accelerate quickly. A monthly close at or above $5.60 o should lead to fireworks. On the other hand, if it trades in the $5.60 range from current levels, coupled with the high dividend, it would represent a sizable gain.

One other thing to keep in mind: if it closes below $2.90 on a monthly basis, the current bottom of the channel will flip from support to resistance. Still, even a drop to $2.40 would be acceptable as long as it does not close below $2.90.

As long as one understands this play falls under the “higher risk category”, the risk-reward has shifted in the speculator’s favour. To be safe, I would divide my funds into at least three parts if entering this position.

Sailing Ahead: DSX’s Fleet Modernization Powers Global Shipping Success

Certainly! DSX’s fleet modernization is key to its competitive advantage in the global shipping industry. By continuously upgrading and optimizing its fleet, DSX gains several benefits that enhance its operational efficiency, cost-effectiveness, and customer satisfaction.

1. Enhanced Performance: Fleet modernization allows DSX to incorporate the latest technological advancements in vessel design and engineering. Newer vessels often have advanced propulsion systems, fuel-efficient engines, and improved cargo handling capabilities. These enhancements result in increased vessel performance, faster transit times, and improved fuel efficiency, reducing operational costs and providing a competitive edge.

2. Increased Capacity and Flexibility: DSX often increases its cargo-carrying capacity as it replaces older vessels with newer ones. Modern ships are designed to maximize cargo space, allowing for larger shipments and economies of scale. The flexibility of DSX’s modern fleet enables it to adapt to changing market demands and meet the evolving needs of its clients more effectively.

3. Improved Safety and Environmental Compliance: Fleet modernization enables DSX to meet and exceed stringent safety and environmental regulations. Newer vessels incorporate advanced safety features, such as state-of-the-art navigation systems, advanced fire suppression systems, and improved crew accommodations. Regarding environmental compliance, modern vessels often have lower emissions, reduced fuel consumption, and improved waste management systems, aligning with sustainability goals and regulatory requirements.

4. Reduced Maintenance and Operating Costs: Older vessels require more frequent maintenance, leading to higher repair costs and increased downtime. DSX can reduce maintenance expenses and improve operational efficiency by modernising its fleet. Newer vessels often have lower maintenance requirements, advanced monitoring systems that detect potential issues early on, and improved reliability, reducing operational disruptions and cost savings.

5. Competitive Differentiation: A modern fleet enhances DSX’s market positioning and competitive differentiation. Clients often prefer shipping companies with newer vessels that offer improved efficiency, reliability, and adherence to international standards. DSX’s commitment to fleet modernization demonstrates its dedication to providing high-quality services and staying ahead of competitors in terms of operational excellence and customer satisfaction.

DSX strategically evaluates its vessel portfolio to support fleet modernisation, considering factors such as vessel age, market conditions, and technological advancements. The company may acquire new vessels and dispose of older ones through sales or scrapping, ensuring a constant cycle of fleet optimization and modernization.

By leveraging the benefits of fleet modernization, DSX can offer its clients more efficient and cost-effective transportation solutions, maintain a strong market position, and continue building long-term customer relationships. The continuous improvement of its fleet is a testament to DSX’s commitment to operational excellence, safety, and meeting the evolving needs of the shipping industry.

What Drives DSX’s Strategic Fleet Modernization Decisions?

DSX employs a strategic approach when deciding which vessels to acquire and dispose of during fleet modernization. Several factors come into play during this evaluation process. Here are some key considerations that DSX typically takes into account:

1. Market Conditions and Demand: DSX closely monitors the market conditions and demand for various vessels and dry bulk commodities. They assess global trade patterns, industry forecasts, and freight rates. By understanding market dynamics, DSX can identify growth opportunities and determine which types of vessels are in high demand. This analysis helps inform their acquisition decisions, ensuring they invest in vessels that align with market needs and maximize revenue potential.

2. Vessel Age and Condition: DSX assesses the age and condition of its existing vessels as part of its fleet modernization strategy. Older ships may require more maintenance and have higher operating costs than newer, more technologically advanced ones. DSX evaluates the cost-effectiveness of upgrading and retrofitting older vessels versus the benefits of acquiring new ships with improved efficiency and performance. This analysis helps determine which plates are suitable for replacement or disposal.

3. Technological Advancements: DSX considers the latest technological advancements in vessel design, propulsion systems, fuel efficiency, and cargo handling capabilities. They evaluate how incorporating these advancements can improve operational efficiency, reduce fuel consumption, and enhance overall performance. Vessels with advanced technologies offer a competitive advantage by providing better customer service, cost savings, and compliance with environmental regulations.

4. Portfolio Optimization: DSX maintains a diverse portfolio of vessel types, including Capesize, Panamax, Kamsarmax, and Ultramax vessels. During fleet modernization, they evaluate the performance and profitability of each vessel type based on market demand, operational costs, and revenue generation. This analysis helps identify potential imbalances in the fleet composition and guides decisions on acquiring or disposing of specific vessel types to optimize the overall portfolio.

5. Financial Considerations: DSX carefully assesses the financial implications of vessel acquisition and disposal. They analyze the return on investment (ROI) for potential vessel acquisitions, considering vessel prices, financing options, charter rates, and potential revenue streams. Similarly, DSX considers sales prices, likely scrap values, and associated costs when disposing of vessels. Financial modelling and analysis play a crucial role in evaluating the economic viability of fleet modernization decisions.

6. Regulatory Compliance: DSX considers evolving environmental regulations and industry standards when making fleet modernization decisions. They assess how vessels align with or exceed environmental requirements, such as emissions standards and ballast water management regulations. DSX aims to maintain a fleet that meets regulatory obligations and demonstrates its commitment to sustainability and responsible shipping practices.

DSX can make informed decisions regarding vessel acquisitions and disposals during fleet modernization by carefully evaluating these factors. The goal is to optimize the fleet’s performance, enhance operational efficiency, and ensure alignment with market demand and regulatory compliance. The dynamic and iterative decision-making process allows DSX to adapt to changing market conditions and technological advancements while maintaining a competitive edge in the global shipping industry.

How Does DSX Optimize Vessel Acquisitions and Disposals?

When assessing the financial implications of acquiring and disposing of vessels, DSX considers various factors to ensure a thorough evaluation. Here are some key considerations in their financial analysis:

1. Vessel Acquisition Costs: DSX evaluates the costs of acquiring new vessels. This includes the purchase price, financing costs, and potential expenses for outfitting the vessel with necessary equipment or modifications. They consider the market value of vessels, negotiation leverage, and potential cost savings through bulk purchases or long-term contracts with shipyards.

2. Operating Costs and Revenue Generation: DSX analyzes new vessels’ projected operating costs and revenue generation potential. They estimate fuel consumption, crew expenses, maintenance and repair costs, insurance, and port charges. By comparing these costs against estimated revenue streams, including charter rates and market demand, DSX can assess the profitability and return on investment of acquiring new vessels.

3. Financing Options: DSX evaluates different financing options for vessel acquisitions. They consider interest rates, repayment terms, and potential loan covenants. DSX may work with financial institutions or explore alternative financing options, such as sale-leaseback arrangements, to optimize their capital structure and minimize the impact on cash flows and financial performance.

4. Charter Rates and Market Conditions: DSX assesses the market’s prevailing Dry bulk charter rates for different vessel types. They consider the projected demand for dry bulk shipping and the potential revenue that can be generated through charter agreements. By analyzing charter rates and market conditions, DSX can estimate the cash flows and profitability associated with the acquisition of new vessels.

5. Vessel Disposal Considerations: DSX evaluates potential sales prices or scrap values when disposing of vessels. They consider vessel age, condition, market demand for second-hand ships, and any associated costs with vessel decommissioning or scrapping. DSX aims to maximize the proceeds from vessel sales while minimizing any expenses related to the disposal process.

6. Financial Modeling and Sensitivity Analysis: DSX employs financial modelling techniques to assess the potential impact of vessel acquisitions and disposals on their financial statements. They consider cash flow projections, income statements, balance sheets, and key financial ratios. Sensitivity analysis allows DSX to evaluate the impact of different scenarios, such as changes in charter rates, fuel prices, or vessel operating expenses, to understand the potential risks and uncertainties associated with their financial decisions.

7. Return on Investment (ROI) Analysis: DSX calculates the expected return on investment for vessel acquisitions. They compare the projected cash inflows and outflows over the vessel’s lifespan, considering factors such as the vessel’s useful life, residual value, and estimated cash flows from charter agreements. DSX can determine the profitability and financial viability of acquiring new vessels by assessing the ROI.

By conducting a comprehensive financial analysis incorporating these factors, DSX can make informed decisions regarding the acquisition and disposal of vessels. Their goal is to optimize their fleet composition, enhance financial performance, and align their strategic choices with the long-term sustainability and profitability of the company.

How Is DSX Boosting Profitability and Efficiency?

DSX is implementing various strategic measures to enhance profitability and efficiency in the future. These steps aim to optimise their operations, enhance revenue generation, and manage costs effectively. Here are some key initiatives undertaken by DSX:

Fuel Efficiency and Emissions Reduction: DSX is committed to environmental sustainability and reducing its carbon footprint. They prioritize fuel efficiency initiatives by adopting slow steaming, hull cleaning, and optimizing vessel designs. DSX also explores alternative fuels, including liquefied natural gas (LNG) and biofuels, to reduce greenhouse gas emissions. These efforts align with regulatory requirements and contribute to cost savings through reduced fuel consumption.

Operational Excellence: DSX focuses on improving efficiency and customer satisfaction. They implement rigorous operating procedures, safety protocols, and quality management systems to ensure smooth and reliable operations. DSX invests in crew training and development to maintain high performance, safety, and compliance standards. By continuously improving operational processes, DSX aims to enhance customer service, minimize disruptions, and optimize resource utilization.

Cost Management and Optimization: DSX actively manages costs across its operations. They identify cost-saving opportunities through procurement strategies, supply chain optimization, and vendor management. DSX explores economies of scale by leveraging its size and negotiating advantageous terms with suppliers. They also evaluate potential fuel consumption, maintenance, and vessel performance efficiencies to reduce operating costs and enhance profitability.

Market Intelligence and Risk Management: DSX closely monitors market trends, freight rates, and global trade patterns. They leverage market intelligence and data analytics to make informed decisions regarding vessel deployments, charter agreements, and portfolio optimization. DSX employs risk management strategies to mitigate market volatility, currency fluctuations, and other industry-specific risks that may impact profitability.

Customer Focus and Service Offerings: DSX strongly emphasises customer satisfaction and building long-term relationships. They tailor their service offerings to meet customer needs, providing customized solutions and value-added services. DSX actively engages with clients to understand their requirements, adapt to market dynamics, and provide reliable and efficient transportation solutions. This customer-centric approach enhances customer loyalty, attracts new business, and contributes to long-term profitability.

DSX aims to drive profitability, improve operational efficiency, and maintain a competitive edge in the shipping industry by implementing these strategic measures. Continuous innovation, cost management, and customer-centricity are at the core of DSX’s strategy to achieve sustainable growth and success.

DSX Stock Outlook FAQ

Q: What is DSX stock and the company behind it?

A: DSX stock represents shares of Diana Shipping Inc., a global shipping company specializing in transporting dry bulk cargoes. They operate a fleet of 41 vessels, transporting commodities like iron ore, coal, and grain.

Q: How does Diana Shipping generate revenue?

A: Diana Shipping generates revenue by providing transportation services for clients who need to move large quantities of dry bulk cargo. They charge fees for their transportation services.

Q: What is the technical outlook for DSX stock?

A: The stock currently trades in the extremely oversold range, with the potential for higher rewards and risks. A breakout above a tight channel formation could lead to quick acceleration.

Q: What price levels are significant for DSX stock?

A: A monthly close at or above $5.60 could lead to significant movements. It may represent a sizable gain if it trades in the $5.60 range from current levels, coupled with the high dividend.

Q: What happens if DSX stock closes below certain price levels?

A: If it closes below $2.90 on a monthly basis, the current bottom of the channel will flip from support to resistance. However, even a drop to $2.40 could be acceptable if it does not close below $2.90.

Q: Is DSX stock a higher-risk investment?

A: The play falls under the “higher risk category.” Understanding the risks is crucial, and investors may consider dividing their funds into multiple parts if entering this position.

Q: What factors have contributed to Diana Shipping’s strong market position?

A: Diana Shipping’s strategic fleet deployment, operational excellence, safety standards, and customer satisfaction have helped establish the company as a reputable player in the dry bulk shipping market.