The Nexus of Goldman Sachs Commodity Index & Inflation Dynamics

Feb 7, 2024

Introduction

In the complex world of finance, understanding the intricate relationships between various market indices and economic indicators can be a key to successful investing. One such relationship is between the Goldman Sachs Commodity Index (GSCI), now known as the S&P GSCI, and inflation dynamics.

The S&P GSCI is a composite index of commodities that measures the performance of the commodities market. It is designed to be investable, including the most liquid commodity futures, and provides diversification with low correlations to other asset classes. This index serves as a benchmark for investment in the commodity markets and a measure of commodity performance over time.

Inflation, on the other hand, is a measure of the rate at which the general level of prices for goods and services is rising and, subsequently, purchasing power is falling. It’s a critical economic indicator that influences financial markets and investment decisions.

The relationship between the S&P GSCI and inflation is significant because commodities often serve as a hedge against inflation. When inflation rises, the value of money falls, and the price of goods and services, including commodities, tends to increase. Therefore, investing in commodities or commodity indices like the S&P GSCI can protect against inflation.

Moreover, the performance of the S&P GSCI can provide insights into inflation trends. If commodity prices are rising, it could be an early indicator of potential inflation. Conversely, falling commodity prices may suggest deflation or a decrease in inflation.

Understanding this relationship can help investors make informed decisions about where to invest. For instance, during periods of high inflation, investments in commodities, gold, and stocks that are positively correlated with inflation may be beneficial.

However, it’s important to remember that while the S&P GSCI can provide valuable insights, it’s just one of many tools investors can use to navigate the financial markets. Comprehensive research, careful strategizing, and consideration of individual financial goals and risk tolerance are crucial for successful investing.

The Interplay of Goldman Sachs Commodity Index and Inflation Dynamics

While the prevailing focus is on inflation easing due to the rally in bonds, there are additional factors in play that could reshape the outlook. History, though not a carbon copy, often echoes familiar themes. Therefore, let’s examine the current situation in the context of historical precedents.

In mid-2006, around August, interest rates peaked at 5.25%, concluding an almost three-year upward trend. Recall the significant events in late 2008-2009 that followed. This aligned with a peak in the real estate market. While real estate prices were exceptionally high then, a comparison to today might suggest that in 2009, it was practically being given away.

Fast forward exactly 17 years to the third quarter of 2023, specifically August. Once again, the Federal Funds target rate has peaked, slightly surpassing 5.25% after approximately three years of ascent. And lo and behold, real estate prices today are exceedingly high. The question arises: will we witness a comparable pattern? Before addressing that, let’s examine the GSCI index.

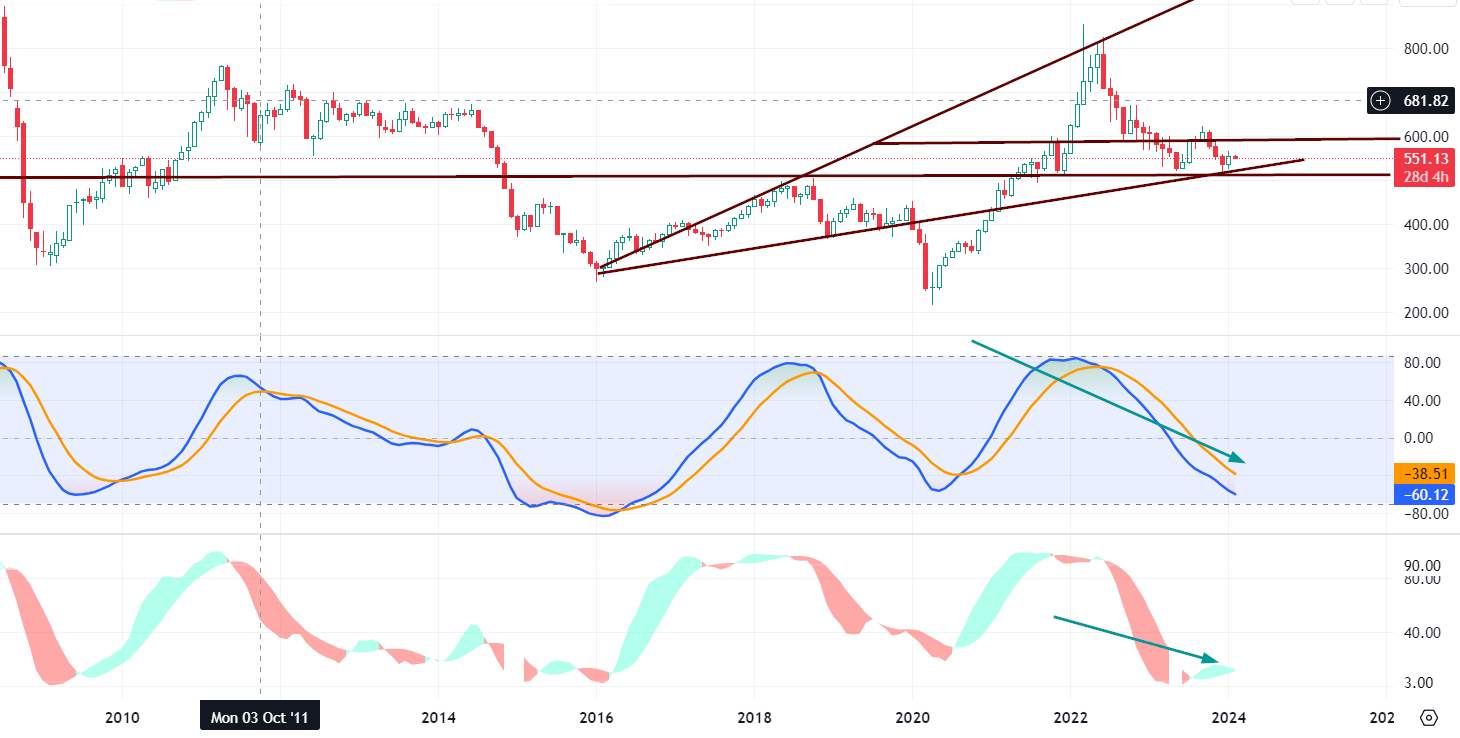

GSCI index: bottom at hand or

Look at the GSCI Index; it is close to putting in a bottom. Once a bottom is in place, commodity prices will start to rise. Additionally, it’s very close to triggering a sizeable positive divergence signal on the monthly charts. If this positive divergence is triggered, we can expect the GSCI Index to perform very strongly. Rising commodity prices typically indicate a non-deflationary environment.

Now, things get interesting when it comes to the Federal Reserve. Even If the Fed doesn’t raise interest rates, it might find itself in a situation where it can’t quickly lower them either. This contrasts with what many people expect. The outcome could be a scenario known as stagflation, where economic growth is slow, and unemployment and inflation are rising—a bit of a tricky situation.

Conclusion

The current situation is reminiscent of 2006, about 17 years ago. We then witnessed a peak in interest rates, steep real estate prices, and overly optimistic market sentiment. Interestingly, we are now also observing a mini-bubble in the AI sector. Considering these factors, there’s a reasonable chance that a scenario similar to what happened in 2006 might unfold.

Furthermore, the GSCI Index shows signs of bottoming and reversing course. The Fed might face challenges in managing interest rates in such an environment, potentially leading to stagflation.

It’s quite striking that hardly any experts, including those who pride themselves on being contrarians, are not delving into this possibility. Instead, they consistently assert that real estate will continue rising, and AI stocks are bound to target the sun. It seems they’re making a possibly mistaken assumption that the recent upturn in bonds and the Federal Reserve’s commitment to keeping rates low leave us with only one path—towards a lower rate environment and, by default, a low inflation environment.

Mass psychology suggests that when a specific factor is ignored or overlooked, there’s a higher likelihood of it materialising. Therefore, we must entertain the idea that a scenario resembling stagflation might unfold—possibly starting gradually and gaining momentum over time.

For now, this serves as food for thought, albeit severe. We will diligently keep a close eye on crucial markets, indices, and indicators. They will serve as our warning system, signalling whether this hypothesis will become a reality.

Must-Read Articles Unveiled

How Inflation Erodes Debt and Strategies for Smart Investing

Demystifying StochRSI Strategy: Easy Strategies for Winning

From Rags to Riches: Stock Market Investing Success Stories

Winning the loser’s game: timeless strategies for successful investing

Stock Market Crash Recession Is A Done Deal: Wishful Thinking

Best Gold ETFs: A Shrewd Investment Choice

Personal Portfolio Management: Essential for Success

Free Stock Trading Resources: Accelerate Your Knowledge Journey

Does Technical Analysis Work? Unveiling The Truth

Stock Market Sentiment Analysis: Flee Euphoria, Embrace Fear

Portfolio Diversification Eliminates Guesswork: A Strategic Approach to Investing

IBMs Stock Price and Dividend: A Winning Duo

The women’s guide to successful investing: achieving financial security and realizing your goals

Market Timing Strategies That Worked: Let’s Rock ‘n Roll!