Chinese Millennials Homeownership Boom

Updated Nov 8, 2023

The most valuable lessons, especially in live and market investment, are derived from history. Learning from the past enables us to avoid repeating mistakes and seize opportunities as they arise. By delving into historical insights, we can extract the wisdom necessary for success.

In life and market investments, the wisdom gleaned from history is invaluable. Understanding past events empowers us to circumvent recurring errors and seize emerging opportunities. By delving into historical narratives, we unlock the knowledge essential for triumph.

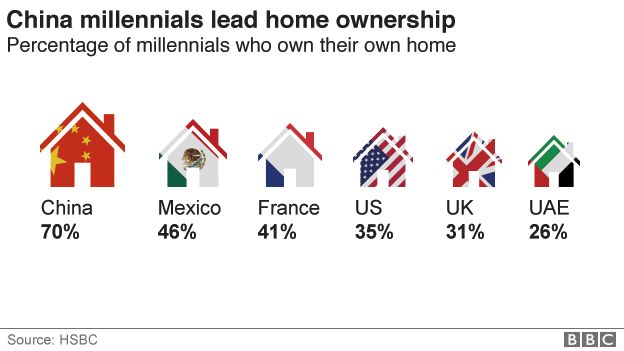

If you fall within the age group of 19 to 36 and find yourself without a home, chances are you’re not currently residing in China. While young individuals worldwide grapple with homeownership challenges, a revealing study conducted by HSBC sheds light on a remarkable statistic: an astonishing 70% of Chinese millennials have already reached this significant milestone.

Furthermore, this study uncovers another compelling insight: 91% of Chinese millennials harbour intentions to purchase a home within the next five years, as reported in the survey. The survey, conducted by the mortgage lender HSBC, involved approximately 9,000 participants hailing from nine different countries.

Remarkably, China leads the way with the highest percentage of millennials who have successfully ventured into homeownership. Following closely behind, Mexico boasts 46% of millennials who proudly own property, while France stands at 41%, securing the third position in this global comparison.

In a world where homeownership often appears to be an impossible challenge for millennials, China’s dominance is intriguing. It may be perceived as a contrarian perspective compared to the struggles young people face in many other countries.

One possible explanation for this phenomenon is China’s unique real estate market dynamics. The Chinese government has actively encouraged property ownership as a means of wealth accumulation. In many Chinese cities, real estate has been a primary avenue for investment, driving a strong desire for homeownership among the younger generation.

Moreover, Chinese millennials have shown a remarkable willingness to live with their parents longer, saving diligently for a down payment on a home. This contrasts with the trend in some Western countries where young adults increasingly opt for rental living due to high property prices and economic challenges.

It’s also essential to consider cultural factors and societal expectations, which are significant in the Chinese approach to homeownership. These diverse elements contribute to China’s unique position, making it a fascinating case study in the global landscape of millennials and homeownership.

Unlocking the Secrets of Homeownership for Chinese Millennials

Chinese millennials have defied the odds, achieving homeownership in a real estate market notorious for its high prices. In a nation where Forbes identifies seven of the world’s top 10 most expensive cities for residential property, the path to property ownership is nothing short of fascinating.

Shanghai, one of China’s prominent cities, even witnessed couples resorting to fake divorces to exploit a legal loophole for homeownership. A notable revelation from HSBC’s survey shows that a significant 85% of respondents in China reside in urban areas, with 14% in the suburbs and a mere 1% in rural regions.

So, what is the secret behind the remarkable homeownership rate among Chinese millennials?

For many, the answer lies in the “Bank of Mum and Dad.” Additionally, this trend is underpinned by China’s unique marriage market dynamics. The One Child Policy has created a gender imbalance, with projections suggesting that by 2020, there will be 30 million more men than women seeking partners in China. This demographic shift adds an intriguing layer to the homeownership equation.

The Chinese approach to homeownership unveils a broader perspective on the role of family support and the marriage market in facilitating property acquisition. It serves as a compelling indicator of long-term economic growth and the resilience of the Chinese real estate market. Full Story

This is another confirmation that China is set to lead the way from now on. Homeownership is a very revealing long-term indicator of solid growth.

Chinese Millennials Defy Global Trends with High Homeownership Rates

In a surprising turn, Chinese millennials emerge as frontrunners in the global homeownership race, leaving their American counterparts in the dust.

A recent HSBC survey, encompassing over 9,000 individuals born between 1981 and 1998 across nine countries, unveiled a remarkable statistic: a staggering 70% of young adults in China have already achieved the milestone of homeownership. This figure is nearly double the global average, setting China apart as a unique success story.

Mexico, with 46% of its millennials owning property, claimed the second spot, showcasing a significant difference. Meanwhile, the United States lags, with only 35% of American millennials enjoying the status of property owners.

What makes the Chinese case even more intriguing is that it’s not only the high rate of homeownership but also the aspiration for homeownership that sets them apart. In China, more renters aspire to transition into homeowners, further emphasizing the robust real estate aspirations that are driving the country’s millennial population.

The Driving Force Behind China’s Millennial Homeownership Surge

China’s millennial population is charting an unprecedented path to homeownership, and the driving force behind this phenomenon is a remarkable blend of demographics and parental support.

A striking revelation from recent studies shows that over 90% of Chinese millennials who do not own a home plan to leap into homeownership within the next five years. This statistic outpaces their American counterparts by a notable 11 percentage points, emphasizing the enthusiastic drive of Chinese millennials to secure their piece of real estate.

A crucial factor at play in China’s unique homeownership landscape is the looming gender imbalance. By the end of the decade, more than 30 million additional adult men will be competing in the dating market compared to women, creating intense competition for potential female partners. This gender math necessitates a distinct approach to improving marriage prospects.

In this context, Chinese parents are pivotal players. The country’s former one-child policy has left numerous families with a sole heir, prompting parents and grandparents to collaborate by pooling their resources to invest in real estate on their child’s behalf. This support not only secures a brighter future for the younger generation but also aligns with a cultural emphasis on family and prosperity. Full Story

Compelling Articles from Various Angles

The Mob Psychology: Why You Have to Be In It to Win It

What Is Collective Behavior: Unveiling the Investment Enigma

What is the Rebound Effect? Unlock Hidden Profits Now

Dividend Collar Strategy: Double Digit Gains, Minimal Risk, Maximum Reward

Dividend Capture Strategy: A Devilishly Delightful Way to Boost Returns

BMY Stock Dividend Delight: Reaping a Rich Yield from a Blue-Chip Gem

Define Indoctrination: The Art of Subtle Brainwashing and Conditioning

What Is the Velocity of Money Formula?

What is Gambler’s Fallacy in Investing? Stupidity Meets Greed

Poor Man’s Covered Call: With King’s Ransom Potential

How to Start Saving for Retirement at 35: Don’t Snooze, Start Now

The Great Cholesterol Scam: Profiting at the Expense of Lives

USD to Japanese Yen: Buy Now or Face the Consequences?

How is Inflation Bad for the Economy: Let’s Start This Torrid Tale

Copper Stocks: Buy, Flee, or Wait?

1987 stock market crash anniversary discussions- nothing but rubbish

Buy When the Blood in the Streets is Flowing Freely