Is Now a Good Time To Buy Bonds: The Compelling Case for Bonds

Jan 31, 2024

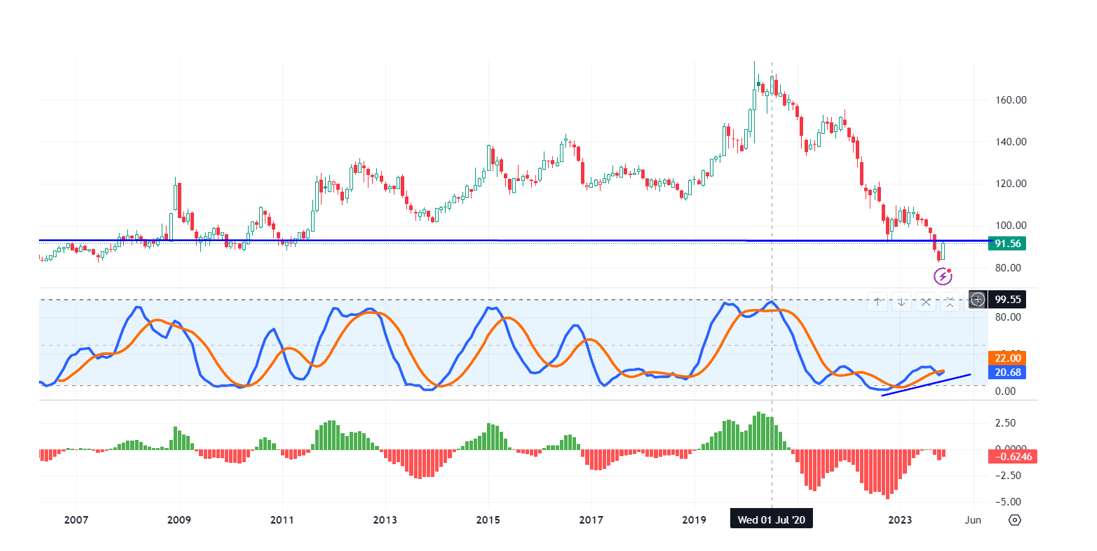

In the ever-evolving investment landscape, market dynamics constantly offer new opportunities. Currently, one such opportunity lies within the bond market. Despite their somewhat tarnished reputation, bonds are shaping to be an attractive investment option for several reasons. From a mass psychology perspective, their current state of being highly oversold and widely disliked makes them an exciting prospect. Furthermore, the imminent completion of a positive divergence signal on the monthly charts suggests it could be an opportune time to buy bonds. Lastly, the Federal Reserve’s recent assurance that interest rates are unlikely to rise adds another compelling dimension to the bond market.

The Psychology of Market Sentiment

Investment decisions are not solely based on numbers and charts but significantly influenced by market sentiment and investor psychology. Currently, bonds are being oversold and generally disliked, which, paradoxically, makes them an attractive investment option. When a particular asset is unpopular and heavily sold off, it often indicates that the market has overreacted, pushing prices lower than their intrinsic value. This creates a unique opportunity for investors to buy at lower prices with the potential for significant upside as the market corrects itself.

Positive Divergence: An Encouraging Signal

In addition to the market sentiment, technical indicators suggest that now may be an opportune time to invest in bonds. The positive divergence signal on the monthly charts is nearing completion. This pattern is not an ordinary occurrence but one of massive proportions. Suppose TLT (iShares 20+ Year Treasury Bond ETF) achieves a monthly close at or above 105. In that case, it will set the stage for a minimum projected movement of 120 to 123, indicating a significant potential upward shift. Based on historical trends, a positive divergence pattern typically completes nine out of ten times, further strengthening the case for buying bonds now.

The Hidden Side of the Federal Reserve

The Federal Reserve, often praised as the guardian of the U.S. economy, conceals a less virtuous aspect beneath its appearance of stability and authority. Critics argue that instead of safeguarding the economy, the Fed acts as a manipulative force that widens the gap between the rich and the poor while preserving its interests and those of the banking sector.

Since its establishment in 1913, the U.S. dollar has lost about 96% of its value. This continuous devaluation, a direct outcome of the Fed’s inflationary monetary policies, has diminished the buying power of everyday Americans. While the wealthy can offset this inflation through investments, the poor and middle class, whose wealth is primarily in cash, feel the impact of this devaluation more significantly.

The Federal Reserve has consistently influenced economic cycles, leading to detrimental boom-and-bust scenarios. The housing bubble of the early 2000s, fueled by artificially low interest rates set by then Fed Chairman, Alan Greenspan, serves as a clear example. This imprudent policy directly contributed to the 2008 financial crisis, devastating the savings of millions while those responsible for the disaster faced no consequences.

Despite presenting itself as a public entity acting in the interest of the U.S. economy, the Federal Reserve is, in reality, a quasi-public institution operating independently with limited accountability. Private banks’ regional Federal Reserve Banks ownership exposes their true loyalties.

The 2008 financial crisis exposed the true nature of the Federal Reserve. While ordinary Americans lost their jobs and homes, the Fed utilized taxpayer funds to bail out the very banks responsible for the crisis. This favouritism towards banks over people revealed the Fed’s skewed priorities.

The consistent bailouts of financial institutions by the Federal Reserve have created a hazardous moral situation. Banks, aware that they will be rescued regardless of their reckless behaviour, continue to engage in risky activities, putting the entire economy at risk.

In summary, the Federal Reserve, operating under the guise of economic guardianship, has perpetuated a system that favours the wealthy, penalizes the less affluent, and encourages financial recklessness. This unsettling reality underscores the need for heightened scrutiny and accountability of this influential institution.

Conclusion

In conclusion, the current market conditions present a compelling case for investing in bonds. The combination of an oversold market, the imminent completion of a positive divergence signal on the monthly charts, and the Federal Reserve’s stance on interest rates create a favourable environment for bond investors. Investing in bonds now could offer significant potential for growth and returns, making it a worthwhile consideration for any investor’s portfolio.

If we had to guess, the odds of the positive divergence pattern not completing are very low, below 18%. If this pattern unfolds, it won’t be an ordinary occurrence but of massive proportions. Therefore, if this pattern is completed and TLT achieves a monthly close at or above 105, it should ensure a minimum move in the range of 120 to 123. Please note that we are focussing on “minimum” targets for now. The maximum targets are much higher, and we will discuss them when TLT is close to breaching the minimum targets.

Articles That Inspire Fresh Thinking

Timeless Fortune: Exploring How Savings Bonds Operate After 30 Years

Decoding the Mystery: Where have bonds been when the stock market crashes?

The Ebb and Flow of Investor Sentiment: Bull, Bear and Stock Market Crashes

What are the three investments one can make to beat inflation?

US Stock Market Crash Date: Experts Discuss, But Where’s The Action?

Unlocking the Benefits of Investing in Precious Metal Stocks

Mastering Emotional Control for Successful Stock Market Investing

Preferred Stock Market Valuation Is Based Primarily Upon

Mastering Options Trading: Unveiling the Real Secrets

Which of the Following Is an Example of Collective Behavior?

4X ETF: Deadly Risks and Realities

SPY 200-Day Moving Average Strategy: Learn, Earn, and Prosper

Best Tech Stocks To Buy Now: Spotting the Trend

CPNG Share Price: Buy, Sell, or Hold?