Trump vs Obama Stock Market

One of the first things that indicate an economy is on the mend is that people start to feel better and depend less on the government for handouts. However, in this area, this economic recovery is a total illusion. The number of people on food stamps has surged every year of this so-called economic recovery. How can the bureau of Labour Statistics (BLS) blatantly state that the situation is improving when more and more individuals cannot even put food on their table without government aid? If you think something stinks, you are not alone. Anyone with a small amount of common sense can smell the rat. Let us look at some statistics.

Let’s start with the 2013 figures and then move to the 2015 figures to see if there is any improvement.

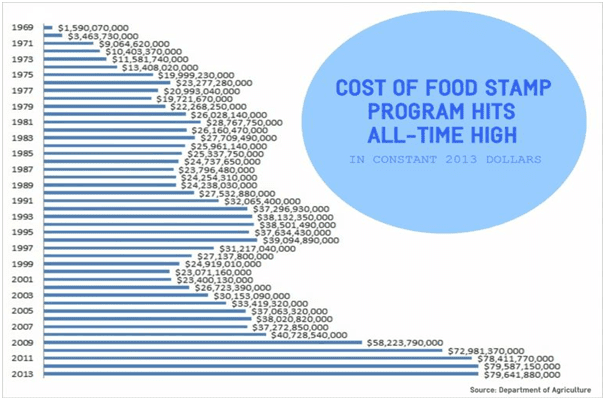

In 2013, a record 20% of households were receiving food stamps, and the chart below illustrates how the cost of the food stamp program has been soaring over the years. This is not what an economic recovery looks like; this is what deception looks like.

Source: Department of Agriculture

Trump vs Obama Stock Market: 46 Million on Food Stamps

In 2014, 14.0% of households required food assistance. In other words, 17.5 million households were food insecure. In 2014, over 46 million individuals needed help from the government to put food on their table. Based on the data listed below, it appears that this trend is not going to end shortly.

In 2015, over 46 million individuals were still on food stamps and the figure has stayed above the 46 million level for 38 months in a row. Does this spell economic recovery to you? To us, it sounds more like a bad dream that is about to enter the nightmare phase. If the outlook is so dismal after we have thrown so much money at this economy, what will happen when the money supply is cut.

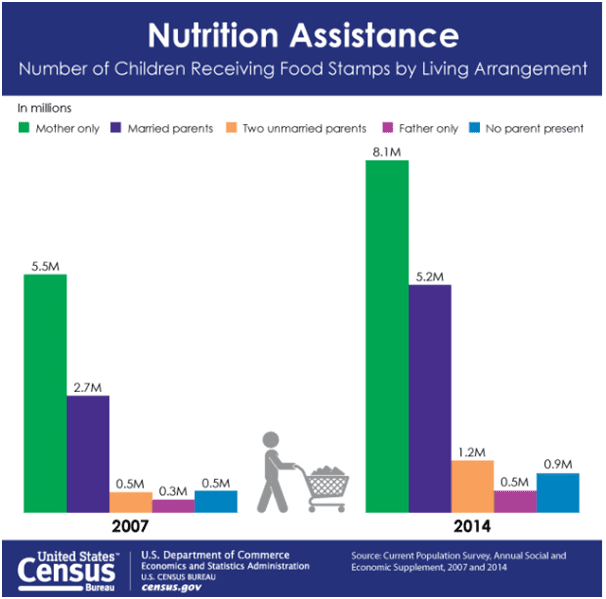

One in five children in the U.S. receives food stamps according to the latest US census bureau report

Trump vs Obama Stock Market: Economic Situation Under Obama was far from Bright

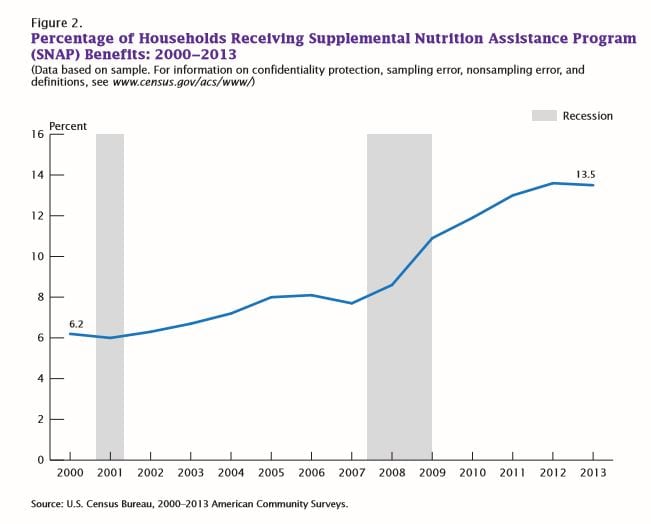

This chart illustrates how the situation has been getting progressively worse over the years and it’s not only restricted to the recession of 2008-2009. One can see that the situation did not improve after the recession of 2001, indicating that the government was looking to boost the economy by flooding the markets with hot money. The effects were not as strong in 2001 as the recession was rather mild and the Fed did not have to create that much new money. However, the 2007-2008 financial crisis required the infusion of massive amounts of money and the Fed forcefully contained interest rates for an inordinate amount of time. When you flood the markets with money, only the very wealthy benefit as it creates an environment that punishes savers and rewards speculators. This article titled “Oops we did it again: the Fed is setting up the masses” explains this in more detail.

We do not have an economic recovery, at best the government is creating an alternate reality whereby they are trying to give the impression of an economic recovery; at worst it’s an outright lie as the middle class has been decimated, and the poor are even poorer. Only the ultra-rich and large corporations have benefited from this so-called debt-induced economic recovery.

Conclusion

The U.S has the tendency to speak from a pulpit proclaiming it is the land of the free, the land of opportunity, progress and all things great. If one examines the facts closely, one finds that the emperor is not only naked but also, he is bald, fat and strikingly ugly.

The U.S claims to have its people’s best interests at heart, but a close examination of the facts reveals that the government has been bought and paid for by the corporate world. Heads of governments are nothing but concubines of the corporate world, for the right price, they will do whatever their masters bid them to do.

What else can explain our needless desire to engage in wars and regime changes in faraway lands and spend trillions of dollars when this money could have been spent on making America stronger? We have the infrastructure of third world country; we do not rank in the top 10 when it comes to education, regarding happiness we no longer make it to the top 20 and regarding health care, we rank at the bottom in comparison to other industrialised nations. All the money spent on wars since 2001 could have been deployed to retrain individuals, improve our education system, improve our infrastructure, thereby creating millions of jobs which in turn would lead to even more jobs. When people have money, they spend, and this paves the way for a new business which creates, even more, jobs. However, this was abandoned for war as several key corporations stood to make billions and in the end, the corporate world is more important to the US government than its citizens.

First World country we no longer are; we are closer to a developing world than a first world. From education to infrastructure the US ranks far below many developing nations. The only spot that we seem to outgun everyone is the insane amount of money we spend on our military.

Beyond Basics: Engaging Stories Await

Cognitive Bias and Its Impact on Logical Positivism Meaning

The Herd Mentality and Its Role in Trading Mistakes

Cognitive Bias: John Bogle Quotes for Investors

Herd Mentality: A Sheep vs Wolf Mentality Analysis

Contrarian Investing: The Emotional Discipline Meaning

Change Valley of Despair: Breaking Free from Expert Dependence

Unpacking the Geopolitical Risk Definition for Savvy Investors

Bearish Divergence: A Critical Indicator for Market Savvy Investors

Exploring the Dynamics of Crypto Market Cycles

What is geopolitical risk?

Weak form efficient market hypothesis

Unraveling the Enigma: How Do Savings Bonds Work and Mature?

Does Dividend Harvesting Work? The Key to Unlocking Wealth in Stock Markets

6 Brilliant Ways to Build Wealth After 40: It’s Never Too Late to Start

What can aspiring investors do to overcome the fear of investing?

Sweet Ambiguity: Decoding the Mysteries of Glucose Syrup