Fool’s Gold: Decoding Why People Lose Money in the Market

Feb 29, 2024

The stock market is often viewed as a way for individual investors to grow their wealth over time. However, the reality is that the crowd usually loses in the stock market because they are influenced by emotions, misinformation, and groupthink, which lead them to make poor investment decisions. This is why people lose money in the market.

One reason people lose money in the market is that emotions influence them. The stock market is inherently volatile, which can cause fear and panic when the market drops, causing investors to sell their holdings and lock in their losses. On the other hand, greed takes over when the market rises, leading investors to pour money into the market, often buying at the top, which is why people lose money.

Misinformation in the Stock Market: Why Investors Lose Money

Another reason people lose money in the market is misinformation. A wealth of information is available, but not all is accurate or trustworthy, leading to widespread confusion and misunderstandings among investors. Additionally, many investors rely on financial advisors who may not have their best interests at heart, which can result in poor investment decisions.

The herd mentality can also contribute to why people lose money in the market. When everyone is investing in a particular stock or market trend, it can be tempting to follow suit, even if it is not in your best interest. This often results in buying high and selling low, as investors follow the crowd instead of their instincts and analysis. This is particularly problematic regarding “hot” stocks or market sectors. It can quickly become overcrowded and lead to a market correction, so people lose money.

The Contrarian Approach to Investing: Why Some Investors Don’t Lose Money in the Market

In contrast, contrarian investors take a different approach to the stock market. They are willing to go against the crowd and invest in stocks that are out of favour or undervalued. They understand that the stock market is inherently volatile and are not swayed by emotions or groupthink. Instead, they base their investment decisions on a thorough analysis of a company’s financials and growth prospects, which is why contrarian investors do not lose money in the market as often.

Furthermore, contrarian investors are patient and willing to hold onto their investments for the long term. They understand that short-term market volatility is expected and are not concerned about short-term losses. This long-term focus allows them to ride out market corrections and reap the benefits of a well-diversified portfolio over time, which is why contrarian investors do not lose money in the market as often.

In conclusion, people often lose money in the market due to being influenced by emotions, misinformation, and groupthink, leading to poor investment decisions and missed growth opportunities. In contrast, contrarian investors take a different approach, relying on informed analysis and a long-term focus, which is why they do not lose money in the market as often. The key to success in the stock market is to have a well-diversified portfolio and to be patient, disciplined and informed in your investment decisions, which will help reduce the chances of losing money in the market.

Common Reasons for Financial Loss in the Market

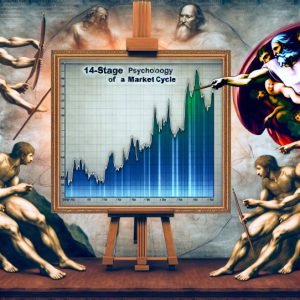

Mark Twain might have quipped with his timeless wit, “October is one of the perilous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August, and February.” This humorous observation encapsulates the stock market’s unpredictability and the folly of trying to time it.

In the financial arena, several critical missteps lead to monetary losses. Inadequate risk management exposes investments, while the elusive quest of market timing often results in costly errors. Overconfidence can obscure the clarity of judgment, leading investors to downplay potential dangers—excessive trading, with its associated costs, chips away at profits. And as Twain might agree, irrational decisions, a form of financial stupidity, can devastate a portfolio.

Lack of Proper Risk Management:

Effective risk management is essential in investing. Sir John Templeton, a pioneer of global investment, demonstrated this through his contrarian approach. He famously bought 100 shares of each company trading for less than $1 per share during the Great Depression, a move that paid off handsomely as markets recovered. His strategy was not without risk, but it was calculated and underscored by a deep understanding of market fundamentals.

H.L. Mencken, known for his sharp wit, might have pointed out the folly of ignoring risk, suggesting that for every complex problem, there is a clear, simple, and wrong answer. In investing, the clear and simple answer is to follow the herd, which is usually harmful. Mencken would likely advocate for a more nuanced approach to risk, one that acknowledges the complexity of the market.

The ancient Athenian statesman Solon instituted laws that mitigated economic disparity and prevented excessive risk accumulation by any one class. Investors can learn from Solon’s wisdom by diversifying their portfolios, spreading risk, and avoiding the concentration that can lead to ruin.

In practice, investors should:

-Use stop-loss orders judiciously to cap potential losses.

– Diversify across asset classes, sectors, and geographies.

– Assess risks thoroughly before investing, considering both the micro-level details of the company and the macroeconomic environment.

By managing risk with a clear strategy, investors can protect their portfolios from significant downturns, much like the prudent generals of history who knew that the best victories are those where the risks are calculated and minimized.

Market Timing and Speculation:

Market timing and speculation, while alluring, often lead to financial missteps. Jesse Livermore, a renowned trader, experienced both colossal gains and losses by attempting to predict market fluctuations. His ultimate success, however, came from recognizing broader market trends and capitalizing on them rather than short-term speculation. For instance, his fortune was made during the 1929 market crash, where his understanding of the market’s overvaluation led him to short-sell, amassing wealth that would be worth billions today.

Though not an investor, Machiavelli offered insights that resonated with the principles of strategic investment. He understood the importance of timing and patience, advising leaders to act only when the time was ripe. This philosophy can be applied to investing, where impulsive decisions often lead to regret, while calculated patience can yield significant rewards.

Solon, the Athenian lawmaker, also provides a lesson in the perils of short-sightedness. His reforms in ancient Athens laid the groundwork for long-term prosperity, emphasizing the importance of foundational strength over immediate gain.

Investors should heed these lessons, focusing on solid fundamentals and long-term potential rather than the siren song of quick profits. By doing so, they align themselves with the wisdom of history’s strategic thinkers and the successful practices of the world’s most renowned investors.

Overconfidence and Confirmation Bias

Overconfidence and confirmation bias are psychological traps that can ensnare even the most astute investors. Benjamin Graham, the father of value investing, often warned against the dangers of investor irrationality. He knew that overconfidence could lead to a false sense of security, causing investors to take on more risk than they could handle or to hold concentrated positions without proper analysis.

Confirmation bias, as psychologist Daniel Kahneman describes, can cause investors to seek out information that supports their preconceived notions, leading to a narrow view of the broader market picture. This tunnel vision can result in missed warning signs and underestimates potential risks.

George Soros, a financier known for his reflexivity theory, has demonstrated the perils of overconfidence through his own experiences. His theory suggests that market participants’ biased beliefs can influence market events and vice versa, creating a feedback loop that can lead to extreme market fluctuations. Soros’s ability to recognize his own biases has been a critical factor in his success, allowing him to avoid the pitfalls of overconfidence.

Confirmation bias is another cognitive bias that can impact investment decisions. To mitigate the impact of overconfidence and confirmation bias, investors should cultivate self-awareness and adopt a disciplined, evidence-based approach to investing. This includes:

1. Embrace humility, recognizing the limits of their knowledge and the unpredictability of markets.

2. Conduct thorough research, seeking information from various sources to challenge their assumptions.

3. Diversify their investments to mitigate the risks of any single asset’s underperformance.

4. Regularly reassess their investment thesis regarding new data and market developments.

By acknowledging and adjusting for these psychological biases, investors can make more informed decisions and improve their chances of success in the complex investing world.

Failure to Adapt and Learn from Mistakes:

Many individuals face losses in the stock market due to a lack of adaptability and learning from errors. Successful investing demands openness to learning, adjusting strategies, and responding to shifts in market dynamics. A prevalent pitfall is neglecting to glean insights from past investment choices. Although making mistakes is inevitable for investors, it’s vital to introspect and understand what went awry. Recognizing factors like flawed decision-making, insufficient research, or subpar investment selections aids in steering clear of repeating missteps. Regrettably, some investors brush off their errors, viewing losses as anomalies or anticipating an eventual recovery. This reluctance to acknowledge and adjust can hinder their investment prospects over time. Failing to learn from mistakes often results in recurring poor decisions and subsequent financial setbacks.

In investing, George Orwell’s sagacity is unexpectedly pertinent: “To see what is in front of one’s nose needs a constant struggle.” Much like the political landscapes Orwell depicted, the market does not suffer fools gladly. It demands a clear-eyed view of reality, where the investor who acknowledges their missteps rather than cloaking them in excuses thrives.

George Santayana, a philosopher with a keen understanding of history’s patterns, famously said, “Those who cannot remember the past are condemned to repeat it.” This is acutely true in investing, where historical amnesia can be costly. The investor who studies the past, not to predict the future but to understand the nature of human folly and wisdom, is better equipped to navigate the capricious seas of the market.

John Templeton, an investor whose name became synonymous with value investing, once observed, “It is impossible to produce superior performance unless you do something different from the majority.” To succeed where others fail, one must learn from the herd’s missteps and chart a course informed by experience but not bound by it.

Kirk Kerkorian, a business magnate who understood the casino of capitalism and any, lived by the philosophy, “The biggest risk is not taking any risk.” In a rapidly changing world, not taking risks is the only strategy guaranteed to fail. For the investor, this means embracing the uncertainty of every decision and recognizing that even a loss is a step toward future gains, provided the lesson is learned.

In essence, successful investing is less about the mechanics of finance and more about the psychology of decision-making. It is a continuous process of learning, adapting, and evolving, where the most significant tool an investor has is the wisdom to recognize their limitations and the humility to learn from their mistakes. It is the interplay of courage and caution, the balance of risk and reward, and the wisdom to know when to hold fast and when to let go.

Excessive Trading and Transaction Costs:

In the tapestry of financial wisdom, the echoes of the past resonate with timeless advice. The Stoic philosopher Epictetus, who lived nearly two millennia ago, taught that we should concern ourselves only with what is within our power. This principle is acutely relevant to investors who engage in excessive trading. The illusion of control can be costly, as each transaction carries a price, not just in commissions and taxes but also in the opportunity cost of gains foregone.

Benjamin Graham, the father of value investing, espoused the virtue of an investor’s temperament, warning against the restless churn of buying and selling. He knew that the investor’s chief problem—and even his worst enemy—was likely to be himself. Excessive trading, often spurred by emotional responses to market volatility, can lead to a cycle of overreaction and regret.

Warren Buffett, a disciple of Graham’s principles, has long advocated for a long-term investment approach. He famously said, “If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.” This sage advice underscores the pitfalls of excessive trading—where the frictional costs of transactions can erode the very gains investors seek.

The legendary investor Peter Lynch also warned against the folly of trying to time the market, noting that “far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in the corrections themselves.” The quest to capture the perfect market moment often leads to portfolio churning, which, as Lynch implies, can be more damaging than market downturns.

To navigate the market’s vicissitudes, consider these strategies:

– Embrace a long-term perspective: Align your investment horizon with the enduring upward trajectory of the markets, allowing compounding to work in your favour.

– Cultivate emotional discipline: Resist the siren call of market noise and the temptation to react to every twist and turn.

– Minimize transaction costs: Be mindful of the impact of fees and taxes on your portfolio’s performance.

– Adopt a strategic approach: Develop a clear, well-reasoned investment plan and stick to it, adjusting only when fundamentals, not emotions, dictate.

– Educate yourself: Knowledge is the antidote to fear and impulsivity. The more you understand the market and your investments, the less likely you are to fall prey to the costly cycle of excessive trading.

Ultimately, the investor who learns from the past, practices patience, and invests with discipline stands the best chance of reaping the market’s rewards.

Lack of Patience and Long-Term Perspective:

Impatience and short-term focus can undermine investment success. The Stoic philosopher Seneca advised, “It is not that we have a short time to live, but that we waste a lot of it.” This wisdom applies to investing, where the short-term pursuit often leads to missed opportunities for long-term growth.

Warren Buffett, known for his long-term investment philosophy, exemplifies the benefits of patience. His investment in Coca-Cola, initiated in 1988, demonstrates the power of a long-term perspective. Despite market fluctuations, Buffett’s holding in Coca-Cola has grown significantly over the decades, showcasing the compounding effect of returns.

Similarly, Charlie Munger, Buffett’s long-time business partner, emphasizes the importance of a long-term approach. His investment in Costco is a testament to this strategy. Munger recognized Costco’s potential early on and understood its business model was built for sustainable growth. He benefited from the company’s steady expansion by holding onto his investment.

To emulate such investors, one should:

1. Set long-term goals: Define what you want to achieve over an extended period.

2. Build a diversified portfolio: Spread investments to mitigate risk and capitalize on growth across sectors.

3. Focus on Mass Psychology: Invest when there is widespread fear and panic in the market, leading investors to overlook fundamentally strong companies. Be prepared with a curated list of robust businesses, ready to seize the opportunity.

By adopting a patient, long-term view, investors can navigate market volatility and achieve substantial returns, avoiding the pitfalls of short-termism.

Other Articles of Interest

Stock Market Psychology Pdf: Mastering the Facts, Not the PDF

What Causes Mob Mentality: Unraveling the Psychology

Cracking Market Cycle Psychology: Navigating the Ups and Downs

Best Silver ETFs: Shining Bright in Your Investment Portfolio

Harnessing the Psychology of a Market Cycle: Thrive in Bull and Bear Markets

ETF Definition: A beginner’s guide to exchange-traded funds

What is a Bull Market Simple Definition: Understanding the Basics of a Thriving Market

Home Mortgage Interest Rates Forecast: Timing is Key

Why is investing in a mutual fund less risky than investing in a particular company’s stock?

Breaking Free: Embracing Early Extreme Retirement

What is a Bull Market? Unleashing its Power

Elliot Wave Theory: Navigating the Pitfalls

AI Takeover Theory: Humanity’s Crossroads with AI’s Future Impact

Financial Freedom vs Financial Independence: Your Wake-Up Call to Take Control

Embracing Contrarian Wisdom: How to Start Investing for Your Child

Financial Mastery: Time in the Market Trumps Timing