The Steadfast Strategist: Unveiling the Realm of the Patient Investor

Oct 25, 2023

In the ever-changing stock market, patience and discipline hold immense value for investors. These qualities serve as the cornerstones of successful investing, providing a firm foundation in the tumultuous world of finance. With patience and discipline, investors can navigate the market’s unpredictable nature and seize opportunities when they present themselves.

One of the key advantages of being a patient investor is the ability to utilize mass psychology to its maximum capacity. By understanding the ebb and flow of popular sentiment, patient investors can act in a contrarian manner. They can go long when the masses are euphoric, recognizing potential overvaluation, and short when panic sets in, identifying opportunities for undervalued assets. This level of patience and discipline allows investors to remain steadfast in their strategy, unaffected by the whims of the crowd.

Moreover, patience and discipline enable investors to avoid impulsive decisions driven by short-term market fluctuations. Instead, they focus on long-term goals and stay committed to their investment strategies. This approach helps them weather market volatility and avoid knee-jerk reactions that can lead to significant losses.

Furthermore, patient investors understand the importance of thorough research and analysis. They take the time to study companies, industries, and market trends, making informed decisions based on solid information. This disciplined approach helps them identify quality investments and avoid hasty, ill-informed choices.

In addition, patience and discipline allow investors to ride out market downturns without fear or panic. They understand that market fluctuations are a natural part of investing and that staying the course is often the best strategy. Patient investors can capitalize on market recoveries and potentially achieve higher returns by maintaining a long-term perspective.

Mastering the Art of Disciplined Trading: Capitalizing on Opportunities

In the fast-paced world of trading, mastering the art of disciplined trading is a skill that sets the patient investor apart from the average trader. With the ability to remain calm and collected in the face of market volatility, these investors are better equipped to make well-informed decisions and avoid the pitfalls of emotional investing. By doing so, they can capitalize on opportunities that others may overlook, securing long-term success.

One of the key advantages of being a patient investor is the ability to leverage mass psychology to their advantage. Understanding that market sentiment often swings between fear and overconfidence, disciplined traders can identify optimal entry points. While others may succumb to the fear of missing out (FOMO) or panic, patient investors maintain a cool-headed approach, making strategic moves based on logic and foresight.

Disciplined traders recognize that emotions can cloud judgment and lead to impulsive decisions. By exercising patience, they can avoid making rash moves driven by short-term market fluctuations. Instead, they focus on their trading plan and adhere to their predetermined strategies. This disciplined approach helps them stay on track and avoid costly mistakes.

Furthermore, patient investors understand the importance of risk management. They set precise stop-loss levels and adhere to them, protecting their capital from excessive losses. Maintaining discipline in their trading practices can mitigate risks and preserve their investment portfolios over the long term.

In addition, disciplined traders prioritize continuous learning and self-improvement. They dedicate time to study market trends, technical analysis, and fundamental factors that drive asset prices. This commitment to education allows them to make informed decisions based on solid research and analysis.

Moreover, patient investors recognize that trading is a marathon, not a sprint. They understand consistent profitability is achieved over time rather than through sporadic gains. By maintaining a long-term perspective, they can avoid chasing short-term profits and focus on sustainable growth.

The Rewards of Contrarian Thinking

In investing, the rewards of contrarian thinking are abundant for the patient investor. By embracing a contrarian mindset and understanding mass psychology, these investors can exploit opportunities others may overlook. With unwavering patience and discipline, they gracefully navigate the unpredictable stock market, making strategic moves that align with their long-term goals.

Contrarian thinking allows investors to break free from the herd mentality that often leads to impulsive decision-making. While others may be swayed by market euphoria or panic, the patient investor remains steadfast, guided by their analysis and convictions. This ability to think independently positions them for tremendous success, as they can identify undervalued assets during market pessimism or recognize overvalued holdings during periods of excessive optimism.

Moreover, the patient investor understands that human emotions and sentiments drive the market. By studying mass psychology, they gain insights into the crowd’s behaviour and can capitalize on market inefficiencies. When others are driven by fear or greed, the contrarian investor remains rational and composed, making calculated moves that align with their investment strategy.

The rewards of contrarian thinking extend beyond short-term gains. By going against the grain, patient investors can position themselves for long-term financial success. They can accumulate assets at favourable prices when the market sentiment is negative, and sell when the market sentiment becomes overly optimistic. This contrarian approach allows them to buy low and sell high, maximizing their returns.

Furthermore, the patient investor’s contrarian mindset fosters resilience and adaptability. They are not swayed by short-term market fluctuations or influenced by the crowd’s noise. Instead, they focus on their research, analysis, and long-term goals. This disciplined approach enables them to stay the course during market downturns and capitalize on opportunities that arise from market inefficiencies.

The Importance of Contrarian Thinking in a Rangebound Market

In a rangebound market, where prices fluctuate within a certain range without a clear trend, contrarian thinking becomes even more crucial. The ability to identify shifts in sentiment and act against the prevailing view can lead to profitable opportunities for the patient investor.

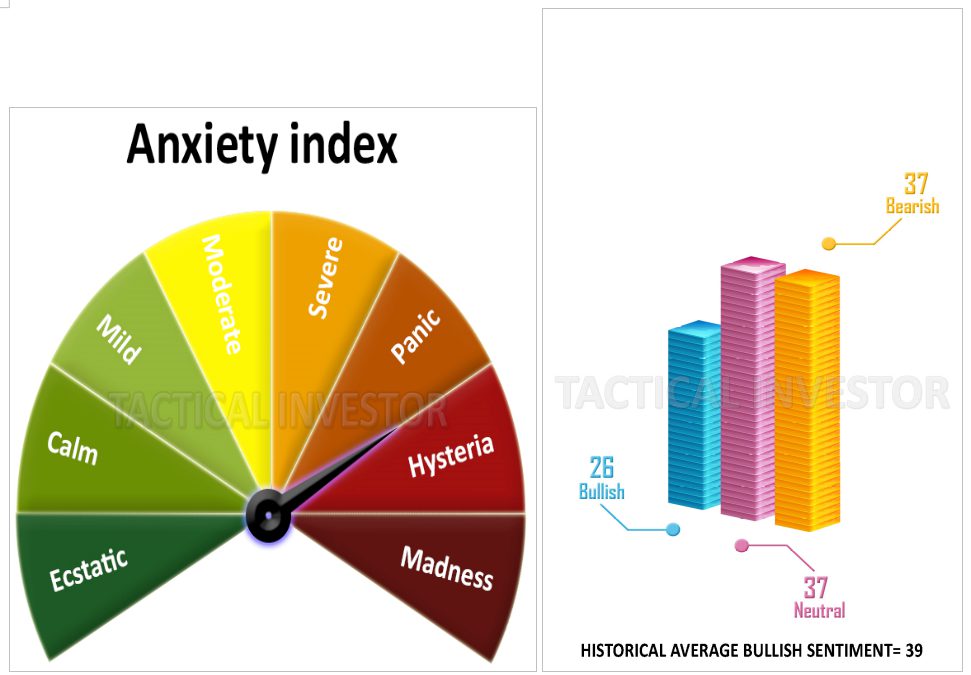

The “hysteria zone” concept highlights the significance of sentiment measures in contrarian thinking. When one of the sentiment measures experiences a significant change, such as a drop in bullish readings or a surge in neutral readings, it can trigger a shift in market sentiment. This shift indicates a potential turning point as an uncommon view gains traction among investors.

The assumption behind contrarian thinking is that once an uncommon view becomes widely held, the market will naturally trend upward. However, this approach only works when the majority does not embrace the view. If the masses continue to hold onto the belief, it can hinder the effectiveness of contrarian strategies.

When a viewpoint becomes popular, it loses its contrarian nature and effectiveness as a trading signal. Therefore, contrarian investors need to stay ahead of the crowd and identify shifts in sentiment before they become widely accepted. This requires continuous monitoring of sentiment indicators and a deep understanding of mass psychology.

Technical analysis combined with mass psychology can be particularly effective in a rangebound market, where prices move within a defined range. Understanding market sentiment can complement the patterns and trends observed in price charts. This combination allows investors to make informed decisions based on technical and psychological factors.

It is important to note that a rangebound market should not be viewed negatively. Instead, it presents an opportunity for patient investors who can capitalize on the predictable price movements within the range. By combining technical analysis with contrarian thinking, investors can identify potential entry and exit points, maximizing their returns in this market environment.

The Rewards of Contrarian Thinking

Once a viewpoint becomes popular, it loses its contrarian nature and ceases effectiveness. Therefore, the rewards of contrarian thinking lie in identifying shifts in sentiment before they become widely accepted.

Contrarian investors can capitalize on market inefficiencies and potentially achieve higher returns. When others are driven by fear or greed, contrarian thinkers remain rational and composed, making calculated moves based on their own analysis and convictions. Going against the grain, they can identify undervalued assets during market pessimism or recognize overvalued assets during periods of excessive optimism.

Moreover, contrarian thinking allows investors to avoid the pitfalls of herd mentality and emotional decision-making. By staying true to their own research and analysis, they can make independent and well-informed decisions. This disciplined approach helps them avoid impulsive moves driven by short-term market fluctuations and focus on long-term goals.

Contrarian thinking also fosters resilience and adaptability. Investors who embrace this mindset are not swayed by short-term market trends or influenced by the crowd’s noise. Instead, they rely on their own analysis and maintain a long-term perspective. This allows them to weather market downturns and capitalize on opportunities that arise from market inefficiencies.

In conclusion, the rewards of contrarian thinking are significant for investors who embrace the virtues of patience and discipline. Contrarian thinkers can uncover opportunities others may overlook by going against the herd and making well-informed decisions based on their analysis. This approach allows them to potentially achieve higher returns and confidently navigate the stock market. However, it is essential to recognize that contrarian thinking is most effective when the majority does not embrace the view, and it requires continuous monitoring of market sentiment and a deep understanding of mass psychology.

The Power of Mass Psychology

The power of mass psychology in the financial markets is undeniable. Understanding how the collective sentiment of investors influences market behaviour can provide valuable insights for making informed investment decisions. However, it is crucial to recognize that the effectiveness of contrarian strategies diminishes once a viewpoint becomes widely accepted.

When a viewpoint becomes widespread, it loses its contrarian nature as the majority embraces it. As a result, the potential for profiting from going against the crowd diminishes. In such cases, the broad rangebound market action hypothesis may come into play, where the market moves within a defined range without a clear trend. This scenario can occur when the majority holds onto a particular belief or sentiment.

While some may view a rangebound market as undesirable, it presents unique opportunities for investors who combine technical analysis with an understanding of mass psychology. In this environment, technical analysis, which focuses on studying price patterns and trends, can be particularly effective. Investors can make well-informed decisions based on market dynamics by analyzing historical price data and identifying support and resistance levels.

Additionally, combining technical analysis with an understanding of mass psychology allows investors to gauge market sentiment and make informed decisions. By monitoring sentiment indicators, such as investor surveys or sentiment indices, investors can gain insights into the prevailing mood of the market. This information can help them identify potential turning points or market inefficiencies.

It is important to note that a rangebound market does not necessarily imply negative market conditions. Instead, it provides an opportunity for patient investors who can capitalize on the predictable price movements within the range. By employing technical analysis and leveraging their understanding of mass psychology, investors can identify potential entry and exit points, maximizing their returns in this market environment.

Achieving Long-term Financial Success

In pursuing long-term financial success, investors can greatly benefit from utilizing mass psychology and mastering the art of disciplined trading. These strategies enable investors to make well-informed decisions based on logic and foresight, positioning themselves for success in the dynamic world of finance.

The power of mass psychology becomes evident when investors understand the ebb and flow of popular sentiment. By recognizing the prevailing mood of the market, investors can act contrarily, going against the crowd when others are driven by fear or overconfidence. This contrarian approach allows investors to identify opportunities others may overlook, potentially leading to greater returns.

However, it is essential to note that the effectiveness of contrarian thinking relies on the majority not embracing the contrarian view. Once a viewpoint becomes widely accepted, it loses its contrarian nature and may no longer provide the same advantages. Therefore, investors must stay ahead of the crowd and identify shifts in sentiment before they become mainstream.

Embracing the virtues of patience and discipline is crucial for long-term success. Patience allows investors to avoid impulsive decisions driven by short-term market fluctuations and stay focused on long-term goals. Discipline ensures investors adhere to their investment strategies, manage risks effectively, and avoid emotional decision-making.

Investors can gracefully navigate the unpredictable stock market by combining these virtues with contrarian thinking. They can make strategic moves based on their analysis and convictions rather than being swayed by the emotions and actions of others. This approach positions investors for long-term success by allowing them to identify undervalued assets, capitalize on market inefficiencies, and make well-informed decisions.

In conclusion, achieving long-term financial success requires utilizing mass psychology, mastering disciplined trading, and embracing the virtues of patience, discipline, and contrarian thinking. By understanding market sentiment, acting contrarian, and staying focused on long-term goals, investors can confidently navigate the stock market and increase their chances of securing long-term success.

Conclusion: Embracing the Virtues of Patience and Discipline

In addition to patience and discipline, embracing the virtues of patience and discipline also brings several other benefits to investors. Firstly, patience allows investors to avoid impulsive decisions driven by short-term market fluctuations. It enables them to take a step back, assess the situation, and make rational decisions based on thorough analysis and research. Patient investors can avoid costly mistakes and make more informed choices by resisting the urge to react immediately to market movements.

Furthermore, discipline plays a crucial role in risk management. It helps investors set clear investment goals, establish risk tolerance levels, and stick to their predetermined strategies. By maintaining discipline, investors can avoid chasing after quick gains or succumbing to fear during market downturns. Instead, they stay focused on their long-term objectives and make calculated decisions that align with their investment plans.

Moreover, embracing patience and discipline fosters a mindset of continuous learning and improvement. Patient investors understand that the market is constantly evolving, and staying updated with the latest trends and developments is essential. They dedicate time to educating themselves, studying market patterns, and refining their investment strategies. This commitment to ongoing learning allows them to adapt to changing market conditions and make more informed decisions.

Lastly, embracing patience and discipline helps investors overcome the emotional roller coaster that often accompanies investing. The stock market can be volatile, and it is easy to get caught up in the excitement or panic of market movements. However, patient investors remain level-headed and make decisions based on logic and analysis rather than emotions. This emotional resilience allows them to stay focused on their long-term goals and avoid making impulsive decisions that could negatively impact their investment portfolios.

Discover More: Stimulating Articles That Will Captivate You

Murphy’s Law and the Stock Market Fear Index: A Cautionary Tale

October 1987 Stock Market Crash: Victory for the Wise, Pain for the Fools

Unleashing Market Fear: The Price of Folly in Investing

AMD Stock Forecast 2024: How MACDs & RSI Signal a Bottom

When is the Best Time to Buy Stocks? During a Market Crash

Investment Pyramid: A Strategic Blueprint or High-Stakes Gamble?

Lessons from Financial Crisis History: Turning Chaos into Opportunity

Disposition Effect: Why Investors Sell Winners and Cling to Losers

Mob Mentality Psychology: Outsmart the Masses and Win Big

Normalcy Bias Example: The Perils of Buying at the Peak

Outsmart Your Brain: Defeat Behavioural Biases in Investing

The Lemming Effect Enigma: Unraveling the Hive Mind

May 6 2010 Flash Crash: How the Uninformed Lost Money

Examples of Newton’s Third Law of Motion: Stock Market Frenzy

Master the Investment Game with Cognitive Dissonance Psychology