Fake News: Data Manipulation Is The New Plague

Aug 29, 2023

Introduction

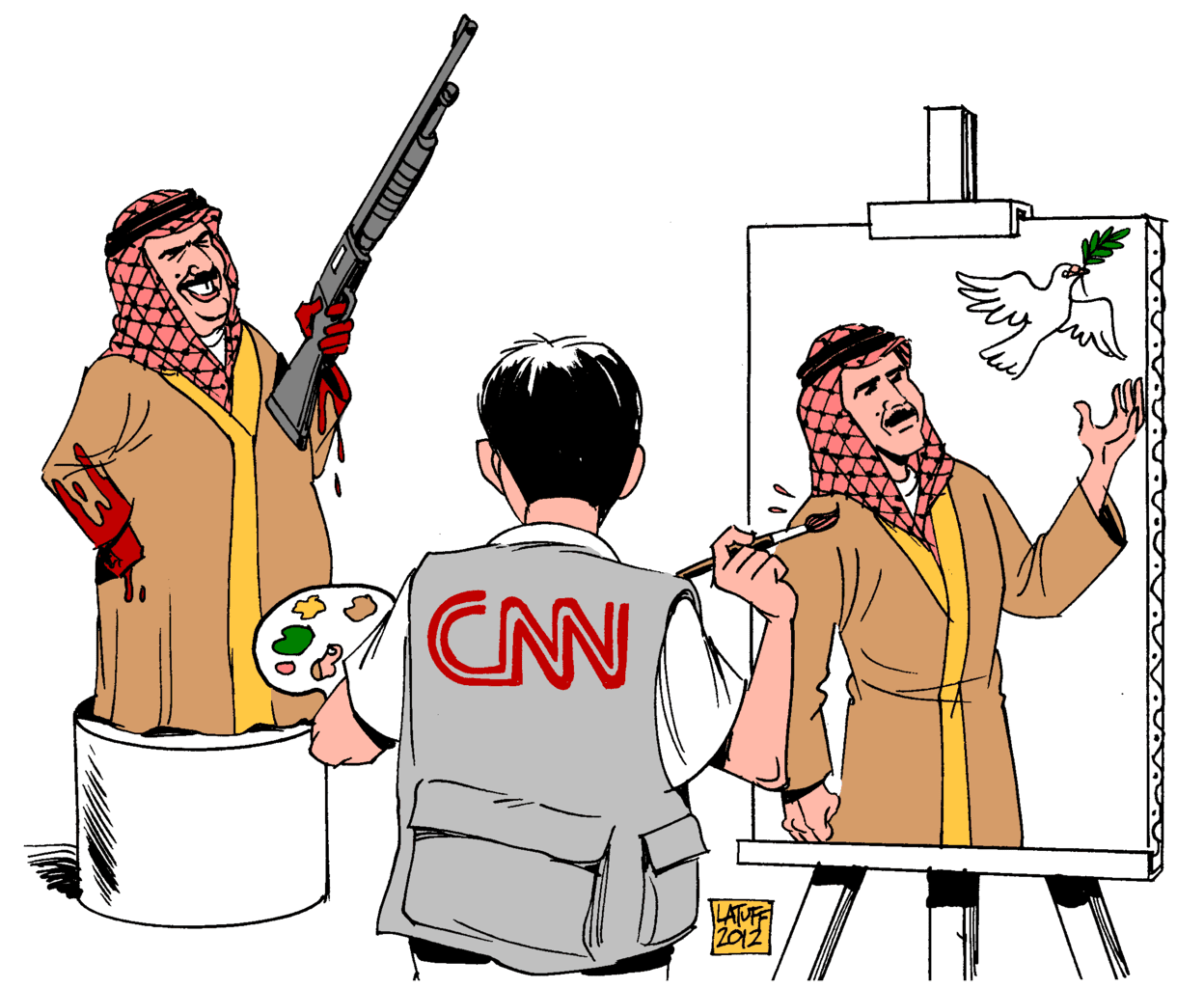

In the digital age, the proliferation of information has become both a blessing and a curse. While it has democratized access to knowledge, it has also given rise to a new form of plague: fake news through data manipulation. This phenomenon has become a significant concern, affecting various aspects of society, from politics to health, and everything in between.

Understanding Fake News and Data Manipulation

Fake news refers to misinformation or disinformation presented as true news. It often has the intention of misleading the audience, influencing political views, or causing confusion. Data manipulation, on the other hand, involves changing data to make it present a different picture than what it should naturally show. When these two elements combine, the result is a potent tool that can sway public opinion, incite fear, or even cause harm.

To understand the impact of fake news and data manipulation, it is essential to recognize their underlying mechanisms. Fake news often relies on sensationalism, clickbait headlines, and emotional appeals to capture the attention of readers. It exploits people’s cognitive biases and preconceived notions, making it easier for false information to spread rapidly.

Data manipulation, on the other hand, can take various forms. One common technique is cherry-picking data, where only specific data points that support a particular narrative are highlighted, while contradictory information is ignored. For example, in a study on the effects of a new drug, data manipulation may involve selectively presenting positive outcomes while disregarding negative side effects.

Another method of data manipulation is the use of misleading graphs or visual representations. Graphs can be manipulated by altering the scale, omitting relevant data points, or using inconsistent units. This can distort the true nature of the data and lead to false conclusions. For instance, a graph showing a slight increase in crime rates over time can be manipulated to appear as a significant surge, creating a sense of fear and urgency.

The Mechanics of Data Manipulation in Fake News

Data manipulation in the context of fake news is a pervasive issue that undermines the integrity of information and distorts public perception. Understanding the mechanics behind data manipulation is crucial in combating the spread of misinformation.

One common technique used in data manipulation is the creation of misleading graphs. Graphs can be visually manipulated to exaggerate differences or similarities between data points, leading to a distorted representation of the information. For example, the scaling of the axes can be altered to make differences appear more significant than they actually are. This manipulation aims to sway the audience’s interpretation of the data and reinforce a particular narrative.

Another method of data manipulation in fake news involves cherry-picking data. This entails selectively choosing data points that support a predetermined conclusion while ignoring contradictory evidence. By presenting a biased selection of data, manipulators can create a false impression of the overall picture. This tactic is particularly effective in shaping public opinion and reinforcing preconceived beliefs.

Perhaps the most egregious form of data manipulation in fake news is outright falsification. In some cases, data may be entirely fabricated to deceive the audience and promote a specific agenda. This can involve inventing statistics, altering survey results, or even creating entirely fictional sources. Such falsification not only misleads the public but also erodes trust in legitimate sources of information.

To combat data manipulation in fake news, it is essential to promote media literacy and critical thinking skills. Educating individuals on how to identify misleading graphs, recognize cherry-picked data, and verify the authenticity of sources can empower them to make informed judgments. Additionally, fact-checking organizations play a crucial role in debunking false information and holding manipulators accountable.

Examples of Fake News and Data Manipulation

One notable example of fake news and data manipulation is the infamous “Pizzagate” conspiracy theory. In 2016, false allegations emerged claiming that a Washington, D.C. pizzeria was involved in a child sex trafficking ring linked to prominent political figures. This baseless conspiracy theory spread rapidly through social media platforms, fueled by manipulated data and misleading information. The consequences were severe, as an individual later entered the pizzeria with a firearm, believing the conspiracy to be true.

Another example is the manipulation of climate change data. Sceptics of climate change have been known to cherry-pick data or misrepresent scientific studies to cast doubt on the existence or severity of global warming. By selectively presenting data that supports their claims while ignoring the overwhelming consensus among scientists, they create confusion and hinder efforts to address this critical issue.

In the realm of politics, data manipulation has been used to influence elections. During the 2016 U.S. Presidential Election, fake news articles with manipulated data were widely shared on social media platforms. These articles targeted swing states, spreading false information about candidates and their policies. The intention was to sway public opinion and influence voter behavior, ultimately impacting the election outcome.

Another example is the spread of fake news during the COVID-19 pandemic. Misleading data and false information about the virus’s origin, spread, and treatment were rampant, causing panic and confusion among the public.

The Impact of Data Manipulation on Fake News

The impact of data manipulation in fake news cannot be underestimated. It has profound consequences that extend beyond the realm of information dissemination. Understanding these impacts is crucial in recognizing the urgency of addressing this issue.

One significant impact of data manipulation in fake news is the erosion of public trust in institutions. When people are exposed to manipulated data presented as factual information, it undermines their confidence in the sources of that information. This erosion of trust can have far-reaching implications, as it weakens the foundation of a well-informed society and hampers the ability to make informed decisions.

Another consequence of data manipulation in fake news is its potential to influence election outcomes. By manipulating data and disseminating false information, malicious actors can sway public opinion and manipulate the democratic process. This can lead to the election of candidates or the adoption of policies that do not align with the true will of the people, undermining the principles of democracy.

Furthermore, data manipulation in fake news can have severe implications for public health. Misinformation about health-related topics, such as vaccines or treatments, can lead to harmful behaviours or the rejection of scientifically proven interventions. This can result in the spread of diseases, increased mortality rates, and unnecessary suffering.

Additionally, data manipulation in fake news contributes to the polarization of society. When individuals are exposed to manipulated data that aligns with their existing beliefs, it reinforces their biases and creates echo chambers. This polarization can lead to a fragmented society, where people are divided based on the misinformation they believe, making it increasingly challenging to find common ground and engage in constructive dialogue.

To mitigate the impact of data manipulation in fake news, a multi-faceted approach is necessary. This includes promoting media literacy and critical thinking skills to empower individuals to discern reliable information from manipulated data. Fact-checking organizations and platforms can play a crucial role in identifying and debunking fake news. Additionally, fostering transparency and accountability in the dissemination of information can help rebuild public trust in institutions.

Combating Data Manipulation in Fake News

Combating data manipulation in fake news is a complex task that requires concerted efforts from various stakeholders. It involves not only the promotion of media literacy and critical thinking but also the active participation of tech companies, governments, and individuals.

Promoting media literacy is a fundamental step in combating data manipulation. Media literacy involves understanding how media messages are created, disseminated, and consumed. It equips individuals with the skills to critically evaluate the information they encounter and discern between reliable and manipulated data. Schools, universities, and community organizations can play a crucial role in fostering media literacy through education and awareness campaigns.

Encouraging critical thinking is another essential strategy in combating data manipulation. Critical thinking enables individuals to analyze information objectively, question its validity, and make informed judgments. By fostering a healthy scepticism towards information sources, individuals can become more discerning consumers of news and less susceptible to manipulated data.

Tech companies also have a significant role to play in combating data manipulation in fake news. They can develop and implement algorithms to detect and flag manipulated data and false information. They can also promote transparency in their content moderation policies and collaborate with fact-checking organizations to verify the authenticity of information.

Governments, too, have a part to play in this fight. They can enact legislation to penalize the deliberate dissemination of manipulated data and fake news. They can also support research into data manipulation techniques and fund initiatives to promote media literacy and critical thinking.

Individuals, as consumers of news, also have a responsibility to verify the information they consume and share. This can involve cross-checking information with multiple sources, fact-checking dubious claims, and being cautious about sharing unverified information.

Conclusion

In conclusion, the proliferation of fake news through data manipulation poses a significant threat to our society. This modern plague has far-reaching implications, affecting trust in institutions, influencing election outcomes, impacting public health, and contributing to societal polarization. To address this issue effectively, a multi-pronged approach is necessary.

First and foremost, promoting media literacy and critical thinking skills among individuals is essential. Education and awareness campaigns should equip people with the tools to discern between genuine information and manipulated data. This empowers individuals to make informed decisions and reduces their vulnerability to fake news.

Tech companies play a pivotal role in this battle by developing algorithms to detect and flag manipulated data and false information. They must also be transparent in their content moderation policies and collaborate with fact-checking organizations to verify information authenticity.

Governments should enact legislation to deter the deliberate dissemination of manipulated data and fake news. They can also support research into data manipulation techniques and fund initiatives that promote media literacy and critical thinking.

Ultimately, individuals must take responsibility for verifying the information they consume and share. Fact-checking, cross-referencing sources, and being cautious about spreading unverified information are essential steps individuals can take to combat the spread of fake news through data manipulation.

In the digital age, where information is readily available and easily manipulated, safeguarding the truth and the integrity of data is paramount. By collectively addressing this issue, we can strive for a society where misinformation and data manipulation hold no power and the pursuit of knowledge and truth prevails.

Random notes on Navigating Market volatility

Historically, markets have not crashed until the masses have fully embraced them, and we do not believe this bull market will be an exception to that pattern. As the markets experience a pullback, we are triggered to consider certain investment opportunities. It is crucial to maintain a balanced perception and not let market volatility alter our viewpoint.

The masses often complain about wanting better prices, but when their wishes are granted, they panic and hastily sell, which they mistakenly perceive as investing. Their emotional state oscillates between misery and euphoria, leading to a short-lived investment lifespan.

We find contentment in the current market action as it allows for a release of pressure, and we encourage you to do the same. This action helps eliminate weak-handed investors and provides the market with renewed energy.

Articles That Nourish the Intellect

Investor Sentiment in the Stock Market: Riding the Right Wave

When is the Best Time to Visit Colombia? Uncover the Ideal Season

What Is Price to Sales Ratio in Stocks?: A Gem-Spotting Metric

What is Behavioral Psychology?: Secrets of Human Behavior

What’s a Contrarian?: Out-of-the-Box Thinkers and Action Takers

Mass Hysteria Examples in America: Let the Tales Unfold

What is Oleic Acid Good For: Unveiling Its Health Benefits

The Ultimate Guide to Finding the Best Time to Visit Colombia

Stock Market Crash History: Learn from the Past or Be Doomed

How to Invest When the Stock Market Crashes: Embrace the Fear, Buy the Opportunity

Third Wave Feminism is Toxic: Its Impact on America

A Crisis of Beliefs: Investor Psychology and Financial Fragility

Copper ETF 3X: Rock On or Get Rolled Over

Which of the Following Is True of Portfolio Diversification?

What is the Average Student Loan Debt in the US? Understanding the Crisis