A moment’s insight is sometimes worth a life’s experience.

Oliver Wendell Holmes

Stock Market Trends 2023: Emphasizing Trends Over Noise

Updated June 2023

Approaching the subject of trends is most effectively achieved through a historical lens, for the trajectory of stock market trends in 2023 bears resemblance to that of stock market trends in 2022 and even harkens back to stock market trends in 1987. The essence of trend investing remains consistent—change is elusive. The overarching long-term trend remains upward, a reality substantiated by a singular irrefutable truth: no bearish endeavour can endure when attempting to short the markets over extended durations.

This bull market initially emerged as the most detested in history, and it is presently transforming into the most remarkable bull market of all time. By all indications, this market requires a release of pressure, given its trading within the profoundly overbought range. Traditionally, the majority tends to hold a bullish stance at this juncture, but that doesn’t seem to be the scenario now. What’s striking is that despite the markets trading near their peak, the masses remain as anxious as ever.

When you look at the sentiment data, one thing becomes apparent: the masses are uncertain. They do not know whether they should embrace the bullish or bearish camp. Most of the actions seem to be limited to the Neutral camp; in other words, individuals keep moving from the bullish or bearish camps into the Neutral camp. Market Update March 26, 2017

The masses are filled with uncertainty, which is merely a less intense manifestation of fear. They are unfamiliar with what to anticipate thus they continue to gravitate towards the neutral stance. Examining the most recent five data points, spanning from the 17th of March, reveals that the percentage of individuals aligning with the bullish perspective has never surpassed the 48% threshold. This is hardly in line with what one would anticipate at this juncture.

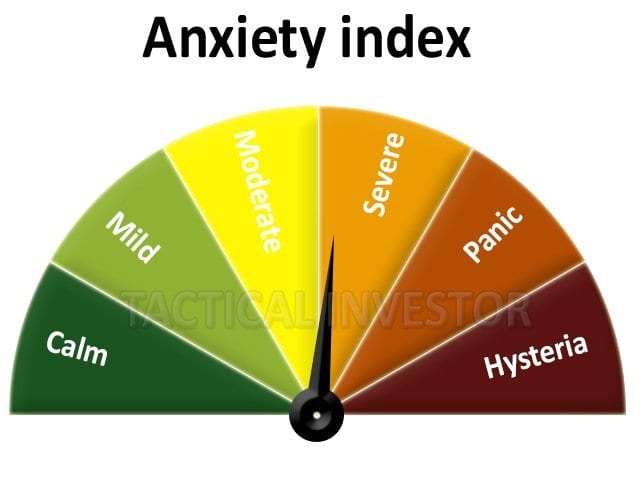

Market Sentiment data indicate that the Masses are still nervous

On the 17th of March, the combined total of individuals adopting a neutral or bearish stance amounted to 74%.

Moving forward to the 24th of March, the total of those leaning neutral or bearish decreased to 67%.

Once again, revisiting the 17th of March, the combined total of neutral and bearish individuals remained at 74%.

Progressing to the 28th of March, the cumulative score of those in the neutral and bearish camps declined to 64%.

Finally, by the 2nd of April, the collective score of individuals in the neutral and bearish categories had risen to 70%.

Emerging Stock Market Trends in 2023: Are They in Play?

Emotions are exerting such a profound influence on this market that traders would greatly benefit from closely monitoring the psychological condition of the masses rather than relying solely on technical indicators. Our focus remains on the technical aspect, implying that a significant correction (an outcome we would readily welcome) might not transpire due to the already escalating fear factor.

After dedicating numerous years to observing the markets, it’s impossible for us not to recognize the emergence of an exceedingly unconventional scenario. The markets are yearning for a cause to undergo a correction, yet the very catalyst they seek is conspicuously absent. Before a correction, the masses typically display optimism and a bullish sentiment, but this pattern does not hold true here. What was once the most disliked market is now transitioning into an extraordinarily exuberant bull market, defying one standard Bull Market rule after another.

During periods when markets are achieving record highs, the crowd tends to exhibit varying degrees of bullishness and complacency. Your objective is essentially to gauge the extent of this bullishness or complacency. However, as previously noted, this market is deviating from this norm. It will be intriguing to witness the trajectory the markets follow—will there be a sharp market pullback even in the presence of an already apprehensive crowd?

Stock Market Trends in 2023: Are Masses Panicking Unnecessarily?

Fear, as far as we’re concerned, serves as a futile emotion that is consistently exploited by nearly every media outlet—both financial and non-financial. Our philosophy centres on staying informed about ongoing developments so that we’re equipped to respond composed and collectedly. We lean towards the prospect of a sharp market correction, although we acknowledge that our viewpoint holds limited significance. Markets derive a peculiar pleasure from penalizing those who possess steadfast opinions. In all our years, we’ve never observed a call undergo a substantial pullback, no matter how overbought it becomes, when the fear factor is elevated.

Nevertheless, there exists the potential for a first-time occurrence or the emergence of a different scenario. This underscores the necessity of maintaining a perpetual state of readiness and adaptability. Should the market experience a robust pullback while the crowd remains apprehensive, it signifies a shift into an uncharted realm. In response, we’ll make the necessary adjustments. There’s no deliberation or resistance on our part; in the event of a change in trend, there’s just one choice: embrace and acclimate to the new trajectory or stand firm and face the consequences.

Interestingly, the crowd’s anxiety has intensified further this week, a fact evidenced by our proprietary “Anxiety Index.”

Even we, after dedicating so many years to scrutinizing the markets, find ourselves compelled to shake our heads in astonishment at the substantial dichotomy unfolding within the needs at present. If someone had informed us of this situation a few years ago, we might have endeavoured to counter their assertion, as the notion would have appeared nearly unbelievable. However, today, we must stand prepared and open to addressing every conceivable possibility.

Conclusion

At this juncture, exercising patience and keen observation takes precedence. The markets currently operate within highly overbought ranges, warranting a cautious approach. Our strategy involves awaiting the retreat of our indicators into the oversold zones. Meanwhile, we opt to initiate positions solely in stocks situated within the exceedingly oversold ranges, thus minimizing potential downside exposure.

For those adopting a conservative trading stance, the recommended course of action would involve either remaining on the sidelines or reducing exposure to long positions, accompanied by tightening stop-loss levels. Engaging in calculated risk is acceptable if you possess a more risk-tolerant approach. However, the emphasis should be on selecting high-quality stocks that have either experienced a pullback or are trading in extremely oversold zones while maintaining well-defined stop-loss measures.

Crafting Your Path to Market Proficiency: Formulating a Personalized Strategy for Success

One of the most significant errors made by inexperienced investors, and even those who have dedicated substantial time to market participation, is their failure to educate themselves genuinely. Mere absorption of inconsequential news or blindly following others’ trading concepts does not foster advancement. It’s vital to recognize that what proves effective for someone else might not yield the same results for you. Your individual risk tolerance, mindset, and self-discipline (or the lack thereof) are distinct, necessitating the creation of a tailor-made strategy.

While integrating successful traders’ concepts into your trading methodology can offer benefits, mindlessly emulating their every move will inevitably result in losses. Instead, prioritize simplicity and concentrate on foundational principles. Novice traders should commence by identifying prevailing trends. Through the analysis of long-term trends and patterns, investors attain a deeper comprehension of market performance and trajectory. This empowers them to make enlightened decisions rather than relying on conjecture or unverified information.

Remember that the path to triumph hinges on formulating your strategy. Dedicate time to learning, adapting, and progressing, and you’ll set yourself on the way to realizing your financial objectives within the markets.

Originally established on April 4, 2017, this creation has been subject to continuous updates over the years, with the most recent revision completed in June 2023.