Stock market experts focus on fiction, not facts

Updated March 2023

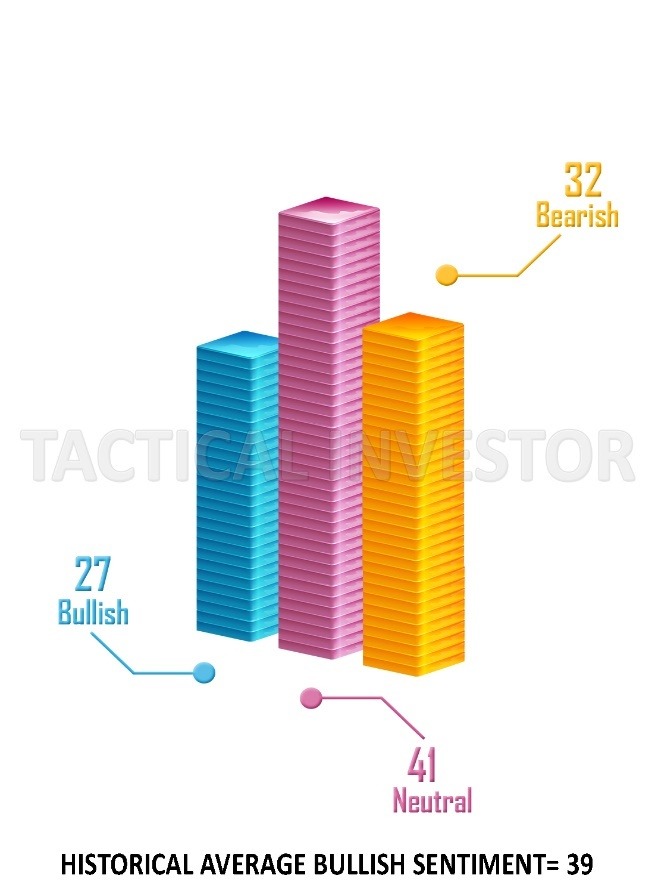

Last week’s bullish readings dropped to 22, and this week’s readings stand at 26. Neutral readings continue to trend upwards, indicating uncertainty is the predominant force. Fear is like gas for the markets, but uncertainty is the equivalent of rocket fuel. Euphoria is just as deadly, but its effects are felt opposite. In other words, it can kill any bull.

Overall, the number of bulls is declining, and the number of investors in the neutral camp is rising. The primary force dominating the markets is uncertainty. The Stock Market will likely end the party with a big bang.

Unlike the Dow, the MACDs in the weekly chart of the NDX (Nasdaq100) did not experience a bullish crossover in November. It appears the NDX was indicating/suggesting that Santa might come to town late. Even though the dude arrived late, he still went to the party. The MACDs are now trading in the oversold ranges, and they could soon move to the extremely oversold ranges. The markets don’t have to pull back firmly. Market Update Dec 27, 2021.

Zigzag action would be enough to push the MACDs into the highly oversold ranges. If the MACDs move into the highly oversold ranges, the correction will likely be delayed until February 2022 or early March of 2022. A weekly close but preferably a monthly close at or above 16,410 should set the wheels in motion for the Nasdaq to surge to new highs.

We usually don’t post daily charts, but the MACDs in the daily chart have just experienced a bullish crossover. This, in turn, is likely to lead to a bullish MACD crossover on the weekly charts, and when that occurs, we are in store for a monstrous move.

The weekly chart of the Dow

A weekly close at or above 36,090 will turn the short-term trend to bullish, and the odds of the Dow testing the 37K plus ranges will rise to 75%. Market Update, Dec 11th, 2021

The MACDs experienced a bearish crossover, and the Dow shed more than just 900 points. However, this pullback occurred in the face of uncertainty, so as expected, the markets mounted a strong comeback. Fear is running high, individuals are pulling money out of funds like ARK, and we suspect many ETF or managed funds will close their doors within the next 60 months. Market Update Dec 27, 2021

This market has moved to a stage that will drive experts insane as they fail to think outside of the box. Experts are in denial; they use outdated models and trading systems that fail to account for the massive war chests the big players have built. More importantly, experts are not considering the changing landscape (the new stock player, crowd patterns and Mass Psychology).

Today’s participants are flakes.

They have no stamina or staying power. Any investor expecting to book massive gains constantly over a short period is a dreamer. Such dreamers will get their heads handed to them in dirty filthy, rusted platters as Tin and other commodities are no longer that cheap. This group of investors could account for over 55% of today’s market participants. They have been spoiled with the massive moves they have witnessed in technology, meme, crypto stocks, and cryptocurrencies. A period of unusually explosive and irrational price movement is almost always followed by a brutal bloodletting period. Does this mean everyone will lose? Astute investors will have the chance to get into many quality companies that will, in some cases, tack on gains in the 360 to 560 per cent ranges.

The big players have so much money now that the average person would have great difficulty envisioning it. Even some of the big players are probably stunned by the size of their war chests. This means that they can employ new tactics when manipulating the markets. Never before have individuals been as obsessed with money as they are today. 90% of individuals will sell their grandma for a chance to make a million bucks. Market Update, Dec 11th, 2021

There is going to be no fixed formula that will work going forward.

Why? The big players have so much money now that they take delight in creating new narratives and generating new outcomes.

What is the secret, then? Mass psychology, coupled with patience and discipline. Watch in amazement and as expert after expert is laid to waste in the months to come.

And just like that, neutral readings rose. If they trend above 41 for several weeks (it does not have to be in a row), it will be a preliminary warning of what to expect next year. The current neutral score is the highest in over six months. Market Update, Dec 11th, 2021

One could argue that neutral readings have been at 41 or higher for the past three weeks. If you take the average of the last three readings (even though one week, the readings came in at 40), the average is 41. We have a nascent trend in motion. This means that while the overall indices will surge higher, many individuals will now sell some of their best holdings for fear of what tomorrow holds.

Dont procrastinate

Remember, tomorrow never comes. Today is the tomorrow you promised you would change yesterday. Instead, it is yesterday’s tomorrow that you promised the day before yesterday you would make better. Translation: those that focus on tomorrow give up today and end up missing the only point of control they have; the present. Focusing/fixating on tomorrow while ignoring today is a recipe for loss in terms of stocks. Hence, we see immense, and we mean tremendous opportunity in the months and years to come as both small and big investors will fail to adjust to the changing times. In the end, only the big sharks and the smart sardines or dolphins will survive.

There is a 24% to 27% chance that BTC could soar to new highs, and if this comes to pass, the pullback will be even more substantial. If GBTC closes below 33 for three days in a row, 24 is likely to be tested. With a possible overshoot to 18.00. Long-term support resides in the 13.50 to 16.50 range. Market Update, Dec 11th, 2021

In reality, the above outcome is the more favourable outcome. As it will lead to a total massacre. Here is the fun part, even though 90% will lose in the coming crypto collapse, there is so much money out there. The entire crypto market could vanish, and it would not have any long-term effect on this market.

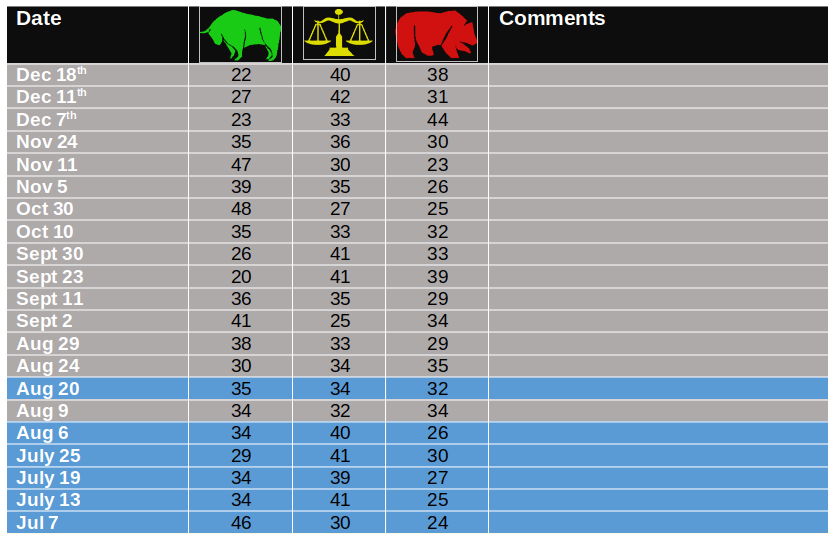

Historical Sentiment values

Concluding thoughts on Stock market experts

Next year will be the year of the hyper-killing fields game. Volatility will be high, and thin-skinned investors will be slaughtered mercilessly. Neutral investors will provide an early warning signal. When neutral readings trade consistently above 41, it will indicate that uncertainty will be the predominant force at play. Uncertainty is the best option for long-term traders to take advantage of, for it neuters both the bulls and the bears. While markets climb a wall of worry, they soar above a wall of uncertainty. Market Update, Dec 11th, 2021

The average neutral reading for the past 3 weeks stands at 41, so uncertainty is gaining traction.

While the situation looks rough to grim, from a long-term perspective, we see the first signs of another long-term opportunity in the makings. The old way of trading/analysing the markets is history. Market Update, Dec 11th, 2021

And just like old Santa popped out from nowhere, maybe he was just too obese for the reindeer to make it into town on time. Time for the dude to shed some dead weight. Nevertheless, he showed up and unleashed his thunder.

2022 promises to be an excellent year for the Tactical Investor

A Tactical Investor understands and incorporates the concepts of Patience and Discipline. It will be a miserable year for the undisciplined investor. Many of these follow the crowd; investors will be decimated. But wait, do you think that will be the end of them? No, their greed/stupidity runs so deep that they will find a way to borrow, beg, or even steal to get back into the markets. The final bang will coincide with a top in the A.I. Super Trend. At that point (it is still a long way in the making), the markets will shed a minimum of 65%; the maximum well could be above 81%.

Finally, remember what we stated in the last update

Whatever rubbish the naysayers state next year, remember the above statement. The Fed will drop everyone on the board before allowing the markets to really crash. A real crash is when the indices shed over 60% and remain at this level for at least 6 months. Market Update, Dec 11th, 2021

Stock market experts talk the talk but never walk the walk. Hiring a monkey with darts will provide for a better outcome with 1/10th the stress.

Other Articles of Interest

Best Time To Buy Stocks: Embrace Panic & Seize Opportunity

Common Sense Investing Book: Ironically, It Isn’t So Common

Stock Market Long Term Trends Success equates To Discipline

Analyzing Trends: Stock Market Forecast for the Next 6 Months

The Perils of Following the Flock: Understanding Sheep Mentality

October 1987 Stock Market Crash: The Astute Get Rich, While the Rest Suffer

Market Opportunity: Embrace Crashes Like a Lost Love

Contrarian King: Investing Beyond Fad Trends

Investor Mindset: Without Discipline and Patience, Chaos Reigns

Which Of The Following Is A Cause Of The Stock Market Crash Of 1929

Deep Value Investing: Forget That, Focus on Smart Moves

Smart Money vs Dumb Money: Why Smart Prevails

Mastering Finance: Beware the Pitfalls of Fear Selling

Navigating Fear & Opportunity in the October Stock Market Crash