Is the Stock Market Crashing or Just a Blip?

Updated Aug 2023

Examining Such Topics Through a Historical Lens

There are two compelling reasons to delve into such subjects within a historical context. Firstly, those who draw lessons from history are less likely to repeat past mistakes. Secondly, it allows us to showcase the precise stance we adopted. Therefore, we will provide an overview of these events within the timeline of 2019 and 2020, offering insight into our actions during those periods.

Stock market crashes, often perceived as financial disasters, can paradoxically represent significant buying opportunities when viewed through the lenses of mass psychology and contrarian investing. Mass psychology highlights the concept that when the majority of investors succumb to panic during a crash, they tend to irrationally sell off their assets at depressed prices. This collective fear-driven selling can lead to market values plummeting below their intrinsic worth. For contrarian investors, this is where the opportunity arises.

Contrarians deliberately swim against the prevailing current of market sentiment. Instead of joining the panic-driven selling frenzy, they seize the chance to purchase undervalued assets when others are fleeing. This counterintuitive approach aligns with Warren Buffett’s famous adage: “Be fearful when others are greedy and greedy when others are fearful.” By buying low during market crashes, contrarians position themselves to reap substantial rewards when markets eventually rebound.

In essence, these strategies hinge on exploiting the emotional extremes of market participants. While stock market crashes evoke fear and uncertainty, those who understand mass psychology and employ contrarian tactics, can represent a pathway to substantial long-term gains as the market eventually corrects itself.

Is the Stock Market Crashing: Fact or Fiction? May 2019 Update

In the most recent update, the neutral readings registered at 42, representing a modest increase from the previous reading of 37 and even higher than the reading of 41 before that. This trend dates back to January of the current year when the neutral readings hit a low point at 18 (as of the January 1, 2019 update). Since then, there has been a steady climb in these readings.

However, it’s intriguing that during the same January 1, 2019 update, the bearish readings were at 53. Subsequently, it seems individuals from both the bullish and bearish camps have migrated towards the neutral position.

What adds an unexpected twist to this narrative is that such a shift has occurred in a rising market. In the first week of January, the Dow was trading in the 23,000 range, having previously dipped below 21,500 at the end of December 2018. It’s worth noting that those anticipating a “crash-like scenario” might find themselves disappointed, as market crashes often materialize when least expected. The sharp pullback in December 2018 caught many off guard, occurring after the market had already retraced from October to November 2018. Now, with widespread expectations of a strong market move, there’s a possibility that the outcome may be a more minor pullback.

June 2019: An Update on the Stock Market’s Performance

The current scenario may lead to disappointment for those anticipating a significant market correction. When examining the monthly charts, it becomes evident that the Dow is trading in extremely oversold territory, potentially limiting downside movements. Often, individuals who casually toss around terms like “significant” or “sharp” correction may not fully grasp the concept of Mass Psychology, leading to constantly shifting targets.

Consider this: before a correction begins, they might be content with the Dow shedding 1500-2000 points. However, once panic grips the masses, these same individuals tend to jump on the panic bandwagon, revising their targets downward. History serves as a stark reminder that they will continue lowering these targets until the markets unexpectedly change course, leaving them surprised once more. It’s a valuable lesson that the crowd rarely emerges victorious, and it’s a fundamental principle investors should keep in mind when navigating the world of investments.

The favoured downside target would fall in the 25,400-25,550 ranges. As V readings are extremely high, there is always the potential for an overshoot as shown in the above chart. Unless the trend reverses (and there is no sign of this) all pullbacks should be embraced; the stronger the deviation from the norm the better the opportunity. Market Update April 23, 2019

Ideally, the markets release a healthy dose of steam, but if they don’t, that’s perfectly acceptable. We’d also consider it a positive outcome if the markets experience minimal steam release, yet negative sentiment surges, causing our indicators to retreat from overbought levels. Our primary focus lies on sentiment analysis, and once we’ve identified the prevailing emotions driving the markets, we turn to technical analysis to refine our entry points.

As we’ve emphasized on numerous occasions, we view pullbacks as opportunities to be welcomed. In fact, the more pronounced the deviation from the norm, the more attractive the opportunity becomes.

September 2020: Navigating the Stock Market Terrain

The recent market pullback has presented us with a unique opportunity to initiate positions in stocks that just a week ago, seemed unattainable. While it’s typical for the market to undergo at least one substantial correction annually, given the current elevated V readings, we anticipate witnessing not just one but possibly two corrections in the near future, ranging from mild to significant. If fortune favours us, we might eventually see the market experience up to three corrections per year. However, we don’t anticipate this development until the Nasdaq surpasses 14,500 or the Dow reaches 33,000.

We’re excited to announce that we’re providing free access to a portfolio analyzer software that was previously exclusive to a select group of AI trend trader subscribers. This offer is extended to everyone for approximately three months, and detailed instructions for accessing the program are included in the second PDF file.

In this environment of abundant hot money and persistent volatility, it’s essential to maintain a focus on long-term strategies and ignore the noise. Some pullbacks will be mild, while others may be wild, but success in this market hinges on adhering to the long game.

We’ve also celebrated the closure of two triple-digit winners: CAT Jan 2021 135 calls, with half the position realizing gains exceeding 130%, and DIA Jan 2022 300 calls, where half the position achieved a gain of 140%.

Notably, John’s plays from the “Plunder from Down Under” (a free bonus to market update subscribers) have seen remarkable gains with DEG.AX now showing profits exceeding 2000%. It might be prudent to secure some of those gains, considering the last trade was at 1.31, and the position was initially established at 0.049.

Please be aware that we send out more frequent updates in times of market turbulence. During normal phases, we typically provide three updates per month. The markets are rapidly progressing toward the “disorder phase” mentioned in our recent updates. After extensive analysis, one conclusion is clear: this market is poised to defy all expectations.

August’s Recent Winning Stocks Picks

We achieved notable successes in July:

– AMOT was closed out with nearly 59% in gains.

– XNTK resulted in a 56% gain upon closure.

– RETL yielded 52% in gains when closed out.

It’s worth noting that former experts may find their projections falling short. This market is poised to surprise the bullish and bearish participants and those who remain on the sidelines (the neutrals). Therefore, be prepared for the unexpected. However, it’s crucial not to let these surprises blindside you.

Despite this market’s anticipated volatility and erratic movements, the overall trend remains positive. As long as the trend persists, we should welcome pullbacks, and the more pronounced the deviation from the norm, the more promising the opportunities become.

July’s Notable Winning Stocks

We’ve been making impressive gains:

– The remaining half of the HALO position resulted in nearly a 90% gain.

– Half of the HIMX Jan 2021 5 Calls yielded a 200% gain.

– We closed half of the UCC position with a 30% gain.

Our FCX calls continue to surge, delivering open gains of almost 230%. Similarly, the ABMD calls have appreciated by 110% from our entry price. Importantly, most of our plays are in the black, reflecting your resilience in the face of the Coronavirus-induced market hysteria.

We’re excited to introduce the AI Trend Trader Service, which is available exclusively by invitation to market update subscribers. Please refer to the attachment for details on this new service. For those interested in taking advantage of the early signup promotion, the link is provided in the June 27th update.

New subscribers can sign up at a reduced promotional rate for the AI Trend Trader Service, launched in July. Please note that this service is exclusively available to Market Update subscribers and is offered at a substantial discount. More information is in the PDF file labelled “AI Trend Trader Service.”

Exploring Random Thoughts on Unlocking Investment Success

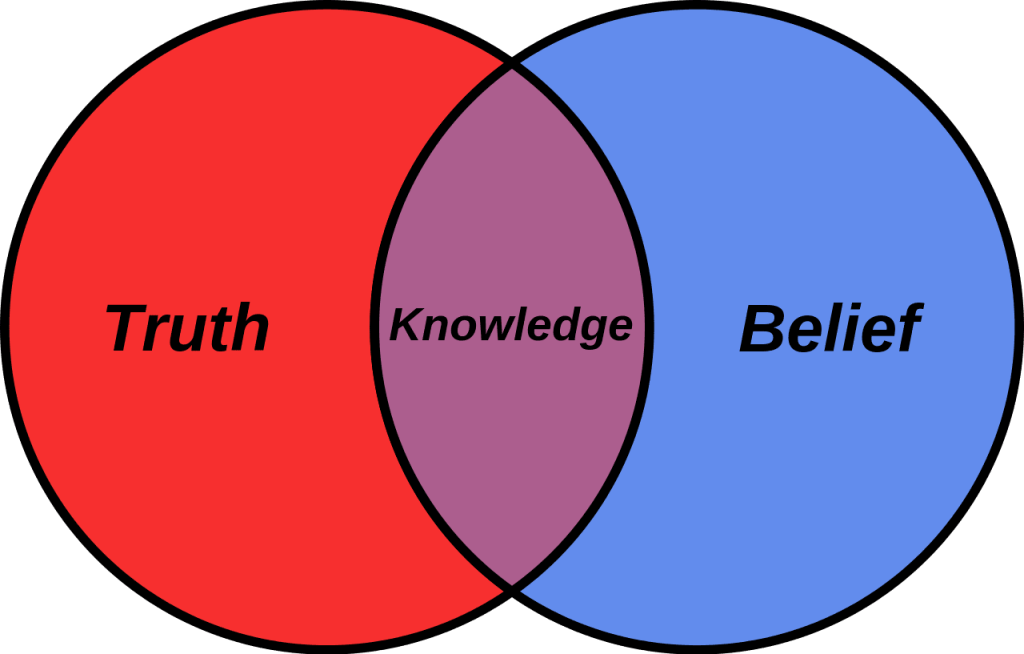

“Delving into random thoughts about achieving investment success: Grasping Mass Psychology and Contrarian Principles for Long-Term Profits. Understanding mass psychology and adopting contrarian investment strategies prove essential for lasting financial gains. Mass psychology highlights the importance of avoiding herd mentality and recognizing market extremes, while contrarian principles help maintain rationality amidst market volatility.

In retrospect, placing trust in self-proclaimed experts and following popular opinion often resulted in financial turmoil. The word “expert” sometimes transforms into “EX Spurt,” a relic of the past. True wisdom lies in adapting to the ever-changing market, employing strategies grounded in comprehension, discipline, and forward thinking.

Rather than fixating on today’s top-performing stocks, the focus should shift towards companies with robust fundamentals, acquired at the opportune moment. Successful investors maintain a long-term outlook, capitalizing on opportunities presented during corrections or bearish phases.

To summarize, the most promising long-term stocks may not always bask in the limelight. They often possess sustained growth potential, occasionally overlooked due to market dynamics. The comprehension of mass psychology, the integration of contrarian investment techniques, and the emphasis on a stock’s long-term viability lead to informed decisions, ultimately yielding rewards in the future. The stock market, after all, builds wealth over time, rather than delivering quick gains.”

Other Intriguing Stories Worth Exploring