Semiconductor Industry News: Exciting Technical Analysis Developments

April 4, 2023

An Impeccable Long-Term Investment

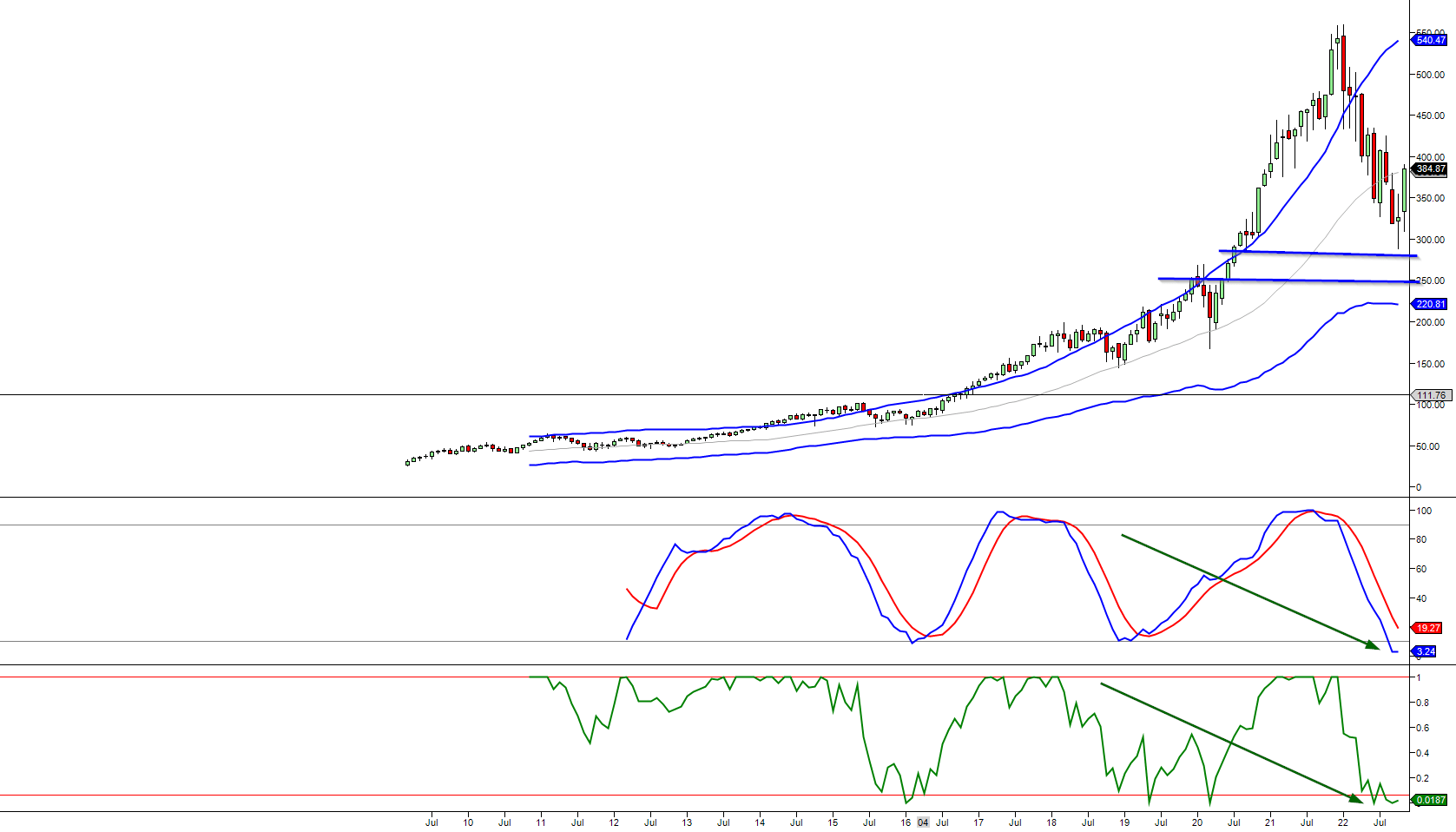

In each case, from an extended point of view, it proved to be a brilliant long-term investment when SOX found itself trading within these boundaries. A proper turnaround is near when our secondary indicator (MACD 2) drops below three on the lower panel. In at least one event (as shown by this very chart), the mentioned indicator hit rock bottom and failed to complete its entire cycle. However, this unexpectedly turned into an even greater opportunity.

Whenever a time-tested indicator struggles to complete its entire cycle (meaning from the lows of oversold to the highs of overbought, and vice versa), the following move in the same direction tends to be twice as strong. Currently, our primary measure (MACD1) has fallen from a highly overbought state to an almost ridiculously oversold condition. The most severe reading was -4.93 in October 2002; our current figure is a negative 3.5. We speculate that it may well reach -6, and should this prediction come true, it would create a “screaming buy” opportunity.

![]()

Bullish Perspectives and SOX Predictions

The highly overbought reading (around January 2022) is totally bullish from a long-term viewpoint, as it suggests that MACD1 values will likely climb to new heights, in turn leading to new peaks for the SOX. We reckon that the SOX will triple before the next bull’s final act.

Without semiconductors, artificial intelligence is nothing but a pipe dream. Every sector connected to this market is destined to trend higher – the designers, manufacturers, and suppliers of the raw materials necessary to fuel this growing sector, and so on. For example, this sector would be rendered useless without Neon Gas.

Semiconductor Industry News: The Real news is the Supertrend

Significant wealth is gained by sticking to the super-trend rather than constantly checking one’s portfolio. The upward phase of a super-trend cycle lasts much longer than its downward counterpart. A whopping 90% focus on the latter phase. We made a tidy sum from the companies we invested in before the recent market correction – and these were not just paper profits but gains we actually banked. The markets are currently going through a cleansing phase. Once this ends, the era of massive profits shall start all over again.

Adjusting the MACDs: A Method to the Madness

The settings on the MACDs here (first indicator) differ from those employed on the initial chart. One might ponder the rationale behind employing disparate values. While we have broached this subject numerous times over the years, allow us to provide a hint: there is more than one way to skin a cat. In this particular chart, the MACDs are trading at a fresh nadir. Although this ETF is not as venerable as the SOX index, it aptly illustrates this sector’s incredible opportunity for the astute.

RSI and Support Zones: Identifying Opportunities

The RSI is also trading in the highly oversold realms. A robust zone of support exists in the 280 to 291 range, with solid support found within the 255 to 267 range. A test of these levels, or lower, would constitute a screaming buy. Should a fortuitous event transpire, with the ETF plummeting to the 222 to 237 range, it would be akin to a “back up the truck” moment.

A Brewing Opportunity in Semiconductors and A.I.

A colossal opportunity is fermenting in the Semiconductor and A.I. sector, potentially overshadowing any other semiconductor industry news. While the news may tantalise the ears, mastering the trend can enrich one’s bank account. Remain vigilant and astute, dear investor, for these burgeoning markets could provide unparalleled rewards for those who seize the opportunities that lie ahead.

FAQ section

Long-Term Investment Strategies:

What is the significance of a proper turnaround in long-term investing?

A proper turnaround is near when the secondary indicator (MACD 2) drops below three on the lower panel. Whenever a time-tested indicator struggles to complete its entire cycle, the following move in the same direction tends to be twice as strong. This creates a “screaming buy” opportunity for investors.

What is the significance of sticking to the super-trend in long-term investing?

Significant wealth is gained by sticking to the super-trend rather than constantly checking one’s portfolio. The upward phase of a super-trend cycle lasts much longer than its downward counterpart. Investors can make massive profits by identifying opportunities and playing the trend.

Semiconductor Industry:

What is the significance of the semiconductor industry in long-term investing?

The semiconductor industry is a colossal opportunity for long-term investors. Without semiconductors, artificial intelligence is nothing but a pipe dream. Every sector connected to this market is destined to trend higher, including the designers, manufacturers, and suppliers of the raw materials necessary to fuel this growing sector.

What is the significance of the MACDs in the semiconductor industry?

The MACDs are a valuable tool for identifying opportunities in the semiconductor industry. The settings on the MACDs may differ depending on the chart, but they can help investors identify when the market is highly oversold or overbought. A fresh nadir in the MACDs can indicate a “screaming buy” opportunity for investors.

What is the significance of the RSI in the semiconductor industry?

The RSI is another valuable tool for identifying opportunities in the semiconductor industry. A robust zone of support exists in the 280 to 291 range, with solid support found within the 255 to 267 range. A test of these levels, or lower, would constitute a “screaming buy” opportunity for investors.

Additional FAQ:

What is the significance of patience in long-term investing?

Patience is crucial in long-term investing. The upward phase of a super-trend cycle lasts much longer than its downward counterpart, and investors must be willing to wait for the right opportunities to arise. Identifying opportunities and playing the trend can lead to significant wealth over time.

What is the significance of being vigilant and astute in investing?

Being vigilant and astute is crucial in investing, especially in the semiconductor and A.I. sectors. The markets are constantly changing, and investors must be able to identify opportunities and adjust their strategies accordingly. Mastery of playing the trend can truly enrich one’s bank account.

What is the significance of safety in investing?

Safety should always be a top priority in investing. While the semiconductor industry and the A.I. sector offer significant opportunities for investors, there is always risk involved. Investors must be willing to take on some level of risk to reap the rewards, but they must also prioritize safety and exercise patience in their investments.

Other Articles of Interest

Master the Investment Game with Cognitive Dissonance Psychology

The Yen ETF: A Screaming Buy for Long-Term Investors

Is Value Investing Dead? Shifting Perspectives for Profit

What Happens If the Market Crashes? Smart Moves vs. Panic Runs

Logical vs. Emotional Thinking: Deciphering the Dominant Force

Financial Mastery: Time in the Market Trumps Timing

What is Hot Money: Unraveling the Significance and Endurance

Stochastic Calculus: Math’s Secret Weapon to Defeating the Stock Market

Bayes’ Theorem: Boost Your Investing Returns

Inflation or Deflation: Who’s Really in Control?

Deep Value Investing: Forget That, Focus on Smart Moves

According To Emergent Norm Theory, Crowds Are Filled With Folly

Volatility Harvesting: The Badass Guide to Rock It

Is Inflation Bad for the Economy? Only if You Don’t Know the Truth