A man, when he wishes, is the master of his fate.

Jose Ferrer

While oil continues to drop, there is one sector connected to the oil market that is doing rather well. It is the oil tanker sector, and while oil is trading at 11-year lows, many stocks in this sector are already posting double digits gains over the past 12 months.

This sector looks appealing both from the Contrarian and Mass psychology perspective for the following reasons

- The masses are ignoring it; in fact, one could state that most of them dislike this sector. The best time to get into a sector is when the masses despise or are blatantly ignoring a sector.

- The average Joe assumes that if oil drops, the tanker sector will also suffer. While this was true during the first part of the oil market collapse, the two markets have parted ways.

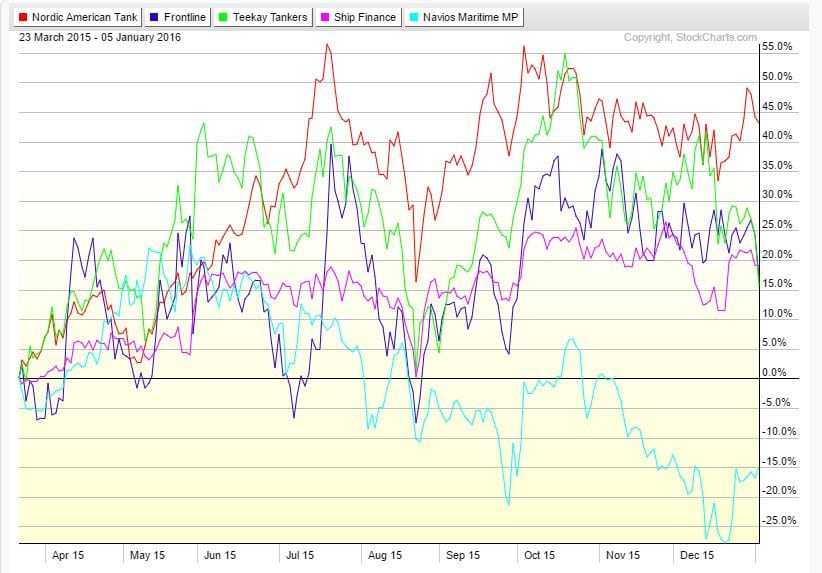

Take a look at the following chart and it shows that most of the stocks in this sector have performed rather well over the past few months. We purposely included one laggard to illustrate the point that not all stocks are created equal. One should focus on the leaders during the first part of the breakout stage. When the rally is mature, one can divert attention to the laggards as they will eventually catch up the pack.

Factors that bode well for this sector

- Time Charter Rates for very large crude carriers (VLCC) have soared over the past 12 months, in fact from a low of roughly 34,000 per day; they have surged to almost $50,000 per day.

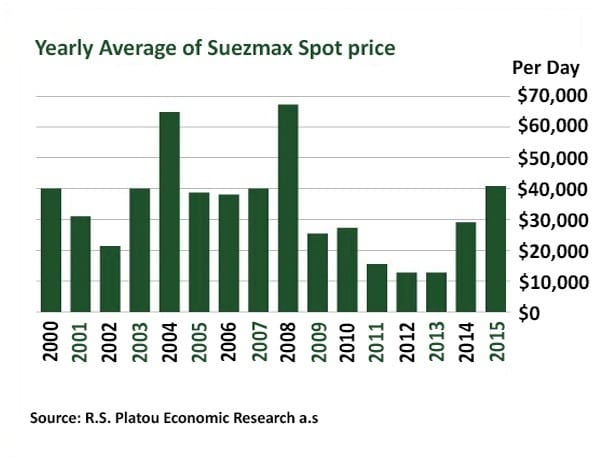

- Oil producers all over the world continue to pump oil at record rates. In fact, Russia set a new record last year despite ultra-low oil prices. It pumped 081 million metric tonnes in 2015, 40% more than it did in 2014. Iran’s oil will soon hit the markets, and this could put even more pressure on the already weak market. However, this is good business for oil tanker stocks, as a lot of this oil will have to be put in storage. The fact that rates have surged by almost 45% from a year ago indicate that the industry now has some pricing power, and it looks like this trend could continue going forward. Rates are still below their 2008 peak, but they are a long way of their 2012-2013 lows.

- A group of stocks in this sector have broken out, indicating that this is not an isolated event. Out of the five stocks, we listed, 4 are showing healthy gains and the strongest stock in the sector as of today is Nordic American Tankers (NAT). Two other strong players in the sector are Frontline (FRO) and Ship Finance International (SFL).

Game Plan

The sector is not being followed actively, in fact, the crowd is ignoring it, and this is usually the best time for the astute investor to plan an entry. Mass psychology states that you should be happy when the crowd is nervous, and wary when they are happy. Investing in the energy sector has been an exercise in futility in 2015 for the most part, but there appears to be a bright spot. We would wait for the oil tanker sector to pullback before committing any new money to this sector. The current market pullback should provide investors with lovely entry points in some of the top performing stocks in this sector.

Let us act on what we have, since we have not what we wish.

Cardinal J. Newman