India vs China

Updated June 2023

The comparison between India and China as investment destinations is complex and influenced by many factors.

China’s economic model, characterized by state-led growth and a strong manufacturing sector, has proven successful in achieving rapid development. Its large domestic market, robust infrastructure, and technological advancements make it an attractive destination for investors. However, concerns about transparency, regulatory unpredictability, and intellectual property rights protection persist.

On the other hand, India, with its democratic governance and rule of law, offers a different investment landscape. The country’s young and dynamic workforce, burgeoning middle class, and digital revolution present significant growth opportunities. However, challenges such as bureaucratic red tape, infrastructure deficits, and regulatory complexities can deter investors.

If Modi made the currency convertible, if he made the markets open to outsiders, then I would have to be back in India again. So far, Modi has been doing worthwhile things like addressing some social issues—I am all for that, and that is great for a lot of people—but India needs more.

You have saved your farmers by making it illegal for foreigners to own more than five hectares—how on earth can an Indian farmer compete with an Australian farmer with 50,000 hectares? In history, India has been one of the great agricultural nations of the world—you have the land, the people, whether—God gave you everything. And then, he also gave you Delhi to mess it all up. Jim Rogers

The reforms mentioned by Jim Rogers above, such as making the currency convertible and opening markets to outsiders, could indeed boost India’s attractiveness. However, it’s also crucial to address structural issues like land ownership restrictions for farmers. The comparison to Australian farmers underscores the need for India to modernize its agricultural sector, which employs a significant portion of its population.

Both China and India offer unique investment opportunities and challenges. The choice between the two would depend on an investor’s risk tolerance, sectoral interests, and long-term strategic goals. It’s also worth noting that geopolitical considerations and global economic trends can significantly influence investment decisions in these two emerging giants.

China Vs India: GDP Divergences

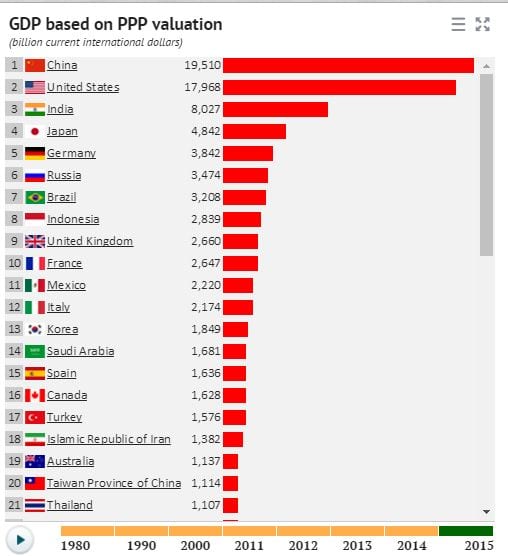

The economic trajectories of China and India, the two most populous nations in the world, have indeed diverged significantly. China’s GDP, when adjusted for purchasing power parity (PPP), has indeed become the largest in the world, surpassing even the United States. This is a testament to China’s rapid industrialization, urbanization, and export-led growth strategy that has lifted hundreds of millions out of poverty over the past few decades.

India, while also experiencing significant economic growth, has not matched China’s pace. As of now, India’s GDP (PPP) ranks third globally, behind China and the United States. Several factors contribute to this divergence. India’s economic liberalization started about a decade later than China’s, and its growth model, focusing more on services rather than manufacturing, has been different.

Moreover, India faces unique challenges such as a large informal economy, lower female labour force participation, and infrastructure deficits. These issues, coupled with the need for further economic reforms, mean that India has untapped potential for growth.

However, it’s important to note that GDP is not the only measure of a country’s progress. Other factors such as income inequality, environmental sustainability, and social development indicators also play a crucial role. Both China and India have their own set of challenges in these areas.

Therefore, while current trends suggest a certain path, the future of these two economic powerhouses remains open to various possibilities.

Source of image: knoema.com

India vs China in Terms of Investments

China makes for a better investment than India for several reasons:

The market is highly oversold; great companies sell for a fraction of their former prices.

The sentiment is negative, the crowd is panicking, and crowd psychology states that you should buy when the masses are fleeing for the exits. Here are some companies in China that could make for great long-term investments: CHH, TCEHY, CQQQ, etc but patience is warranted, and do not bet the house on these stocks and or ETFs the current market conditions might present buying opportunities, investors must conduct thorough due diligence and adopt a diversified approach.

On the other hand, India’s investment landscape is characterized by a vibrant startup ecosystem, a rapidly growing digital economy, and a large consumer market. The country’s focus on infrastructure development and digital transformation presents significant investment opportunities. However, challenges such as regulatory complexities, infrastructure deficits, and occasional economic volatility require careful navigation.

In conclusion, both China and India offer unique investment opportunities. The choice between the two would depend on an investor’s risk tolerance, investment horizon, and strategic objectives. It’s also important to remember the golden rule of investing – diversification is key to managing risk and achieving long-term investment goals.

India vs China: The heat is on

The comparison between the GDPs of India and China indeed highlights the significant size difference between the two economies. As of now, China’s economy is substantially larger than India’s, and even with a lower growth rate, it can add more in absolute terms to its GDP than India can with a higher growth rate. This is a simple function of the base effect – a smaller percentage of a larger number can still be greater than a larger percentage of a smaller number.

However, it’s important to note that economic growth is not just about size, but also about the quality of growth. While China’s economy is currently larger, India’s demographic dividend, characterized by a young and growing workforce, could potentially fuel its economic growth in the coming decades. Moreover, India’s ongoing digital revolution and structural reforms could further enhance its growth potential.

Predicting whether India can overtake China’s economy in the next two to three decades involves a lot of uncertainties. It would depend on a multitude of factors, including the pace and effectiveness of economic reforms, technological advancements, geopolitical developments, and environmental considerations, among others.

In conclusion, while the current economic size and growth rates suggest a certain trajectory, the future economic landscape of these two emerging giants could be influenced by a variety of known and unknown factors. Therefore, it’s crucial to adopt a nuanced and dynamic perspective when comparing these two economies.

Other articles of interest: