Optimize gains with Efficient Allocation of Resources in the stock market

Updated Dec 12, 2023

In the republic of mediocrity, genius is dangerous.

Robert Green Ingersoll

In finance, the stock market is often seen as a battlefield where only the fittest survive. Morgan Stanley, a leading global financial services firm, recently made headlines by stating that making money in the equity markets would no longer be easy. This statement, while surprising to some, is a stark reminder of the inherent volatility and unpredictability of the stock market. However, it’s important to remember that if making money in the stock market were easy, everyone would be wealthy. The reality is far from it, with many investors experiencing losses instead of gains.

The key to achieving above-average gains in the stock market lies in understanding its intricacies and developing a robust investment strategy. This involves thorough research, careful planning, and disciplined execution. Staying updated with market trends and economic indicators is crucial, as these can significantly impact stock prices.

For instance, consider the financial crisis of 2008. It was a period of extreme volatility and uncertainty in the global markets. Many investors suffered significant losses during this time. However, those who deeply understand the market dynamics and diversify their portfolios could minimize their losses and even make profits in some cases.

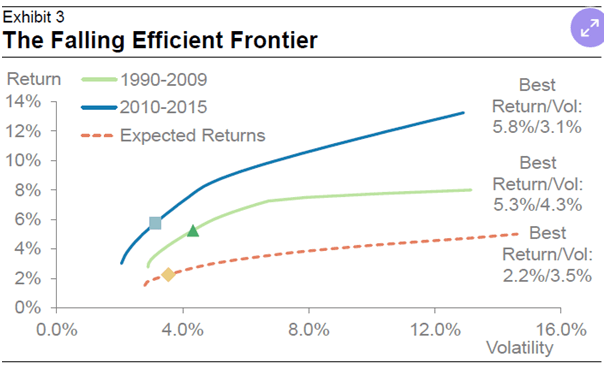

Another critical aspect of achieving above-average gains in the stock market is the efficient allocation of resources. This is where the Efficient Frontier model comes into play. This model, widely used in portfolio management, helps investors identify the optimal portfolio that offers the highest expected return for a given level of risk. However, Morgan Stanley suggests that this model is about to collapse, indicating a potential shift in the investment landscape.

In the face of such challenges, investors must adapt their strategies and look for new opportunities. One such opportunity lies in the realm of generative AI. According to a report by McKinsey, generative AI could add trillions of dollars in value to the global economy, potentially creating lucrative investment opportunities in sectors like banking, high-tech, and life sciences.

However, it’s important to remember that investing in the stock market is not just about identifying opportunities but also about managing risks. This is where the concept of diversification comes into play. Investing in various assets can spread risk and increase their chances of achieving above-average gains.

For example, during the financial crisis, many investors who had diversified their portfolios by investing in different asset classes, such as stocks, bonds, and commodities, could weather the storm better than those who had put all their eggs in one basket. This highlights the importance of diversification in achieving above-average gains in the stock market.

Achieving above-average gains in the stock market is not an easy task. It requires a deep understanding of the market dynamics, a robust investment strategy, and the ability to adapt to changing market conditions. However, with careful planning, disciplined execution, and a willingness to learn, it’s possible to navigate the complexities of the stock market and achieve above-average gains.

Source Bloomberg.com

Efficient Allocation of Resources: Maverick’s Market Opportunities Guide

Amid market chatter, one word caught our attention: “collapse.” To us, that signals not a crisis but an opportunity. The rest of the analysis might be dismissed as hogwash because making money in the markets has never been easy. The majority falters, but it’s not as challenging as some portray it. Success demands effort, debunking the notion that it’s all play and no work.

Trends ebb and flow; identifying new trends early on is key to consistent profits. Listening to conventional wisdom won’t cut it. The claim that profit now hinges on choosing risk overgrowth is absurd. Is there such a thing as a risk-free investment, especially in a market shaped by the Fed’s prolonged ultra-low rates?

Life itself involves risk—commuting to work, for instance. The argument against risk in investments is, in essence, rubbish. Morgan Stanley asserts that a traditional stock and bond portfolio yields mediocre returns. The flaw lies in their 50:50 model, emphasizing bonds and conventional stocks. The real issue is the model, not the market. The solution? Instead of fixating on a single strategy, seek new trends. Identify companies outpacing the competition, even in challenging markets. Don’t be bound by traditional models; focus on the right mix of assets.

Unlocking Extraordinary Gains: A Model for Market Success

The chart below speaks volumes, revealing that settling for mediocrity is a choice, not a necessity. A simple shift in the model can yield remarkable results. The presented data relies solely on ETFs; incorporating individual stocks would have amplified the stunning outcomes. Even with intentionally suboptimal ETF selections, including the Gold ETF, known for underperformance, the long-term results are far from shabby. However, following trends would have prompted an exit from this sector long ago.

Now, envision the potential gains by concentrating on the fastest-growing sectors and investing in top-performing stocks within those sectors. The crux of the matter is this: stock gains will perpetually be mediocre if the model itself is mediocre. Change the model, and the entire outcome transforms. Don’t settle for the average when extraordinary gains are within reach by adopting the right approach.

In high-priced investment firms, the narrative often revolves around proclaiming a paradigm shift, yet the outcomes frequently amount to nothing more than mediocre returns. This prompts the question: why entrust your investments to entities that struggle to adapt to evolving market conditions, consistently delivering subpar results? Perhaps the fundamental paradigm shift needed is in reevaluating the necessity of such firms when all they seem to provide is mediocrity.

Mastery in the Markets: Unleashing Your Financial Game Plan

Take command of your financial destiny and break free from the shackles of conventional advice. Whether you’re a seasoned investor or just starting, now is the time to defy the so-called experts and seize control of your money.

If you’re young and willing to embrace risk, allocate funds to ventures that may be speculative but promise substantial gains. Ditch outdated investment models and shift your focus to the fastest-growing sectors, high-potential stocks, and companies with ascending profits. This strategy positions you for success beyond the average investor.

Explore advanced techniques like writing covered calls or selling naked puts to boost your income without shouldering additional risk. Surprisingly, these options strategies often carry equal or lower risk than conventional stock buying.

In an era that rejects mediocrity, challenge the lacklustre advice peddled by supposed top firms. Today’s financial landscape demands innovation and a departure from the ordinary.

Remember, true investment prowess lies in recognizing opportunities when they’re scorned and exiting when the crowd is exuberant. Embrace this game-changing mentality and embark on a journey to financial mastery. It’s time to redefine your investment approach and claim the success you deserve.

t is for genius to observe.

Benjamin Disraeli

Engaging Articles to Enrich Your Mind

Dark Pools Stock Market: Unveiling Manipulation and Thievery