Longest Bull Market In History:

Updated Dec 2022

Verily, the notion of hope is folly for those with ample time on their hands and an insatiable appetite for torment, at least as far as investing in the markets is concerned. We do not mean to be unkind, but the stock market is akin to a jungle, where only those that can adapt shall thrive, while the rest become cannon fodder. The foremost thing to comprehend is that investing does not merely rely on fundamental analysis, technical analysis, divining the future through tea leaves, or heeding the whims of the puppet masters on CNBC. Instead, it boils down to the regulation of one’s emotions.

In theory, this is a straightforward task, but in practice, it is an entirely different beast, and hence the axiom, “practice makes perfect.” We do not advocate becoming a machine devoid of emotions but rather the capacity to recognize the emotion without succumbing to it.

Even the most prosperous investor experiences apprehension when purchasing stocks after a sharp market pullback. When the masses are in panic mode, and trepidation also grips you, it is the perfect opportunity to make long-term investments. The focal point should not be on the ephemeral gains but on long-term growth. More emphasis should be laid on comprehending the emotions of fear and hope since these are the two most vital emotions that consistently lead to losses in the stock market.

Almost a decade later, this detested Stock Market Bull is still soaring higher and higher, leaving many to wonder why it refuses to relent. Two solutions elucidate this phenomenon:

Longest Bull Market In History: Fuelled By Hot Money

In recent years, the US Federal Reserve and other central banks have employed quantitative easing and ultra-low interest rates to support the economy. However, despite these efforts, the economy has not significantly improved. As a result, corporations have turned to massive share buybacks as a means to boost earnings per share. This trend has only intensified since 2010, with current levels of share buybacks standing at $1 trillion, which is more than the GDP of many nations.

By buying back their own shares, corporations create the impression that their earnings are improving, which can lead to higher stock prices. This, in turn, allows them to borrow even more money based on the increased value of their stock, creating a cycle that can only end in default. It’s also unclear if the Federal Reserve is directly intervening and supporting the market, as their books are not audited, which could lead to them creating even more money to prop up the markets.

Given the lack of oversight and potential for manipulation, some predict that the amount of hot money hitting the market will continue to soar, leading to a super bubble that will eventually collapse. Despite this, the Hated Stock Market Bull is expected to trend even higher before it ultimately drops dead from exhaustion.

Emotions will Drive the hated Bull Market Higher

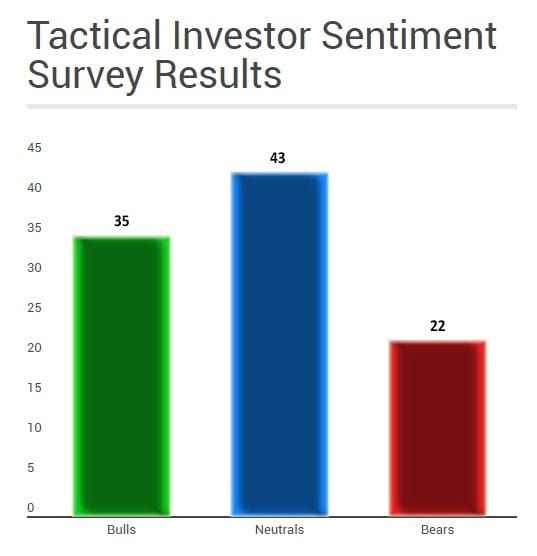

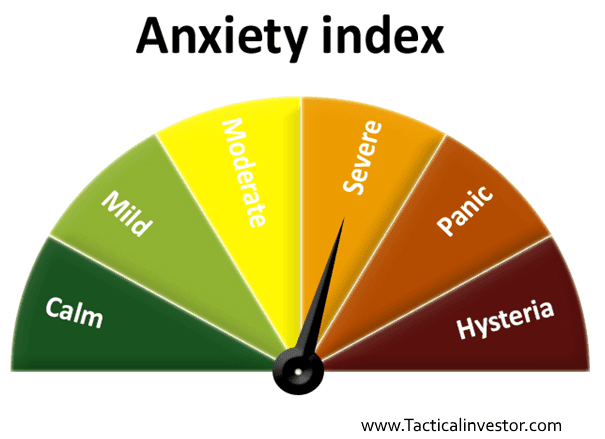

The two graphs provided demonstrate that the majority of people have not yet entered the market. This means that the longer they stay on the sidelines, the higher the market is expected to rise. This is a common trend in history, where a market peak is near when the public is euphoric, and a market bottom is near when the public is pessimistic. Therefore, investors should focus on the overall trend and not be swayed by short-term market noise, as it is often the loudest but least significant.

Both charts are slightly delayed in order to protect our paying subscribers; as you can see the crowd is still nervous, and so all strong pullbacks have to be viewed as buying opportunities.

https://youtu.be/RL4GTzV-TYw

Bull Market History: Tactical Investor Aug 2019 Update

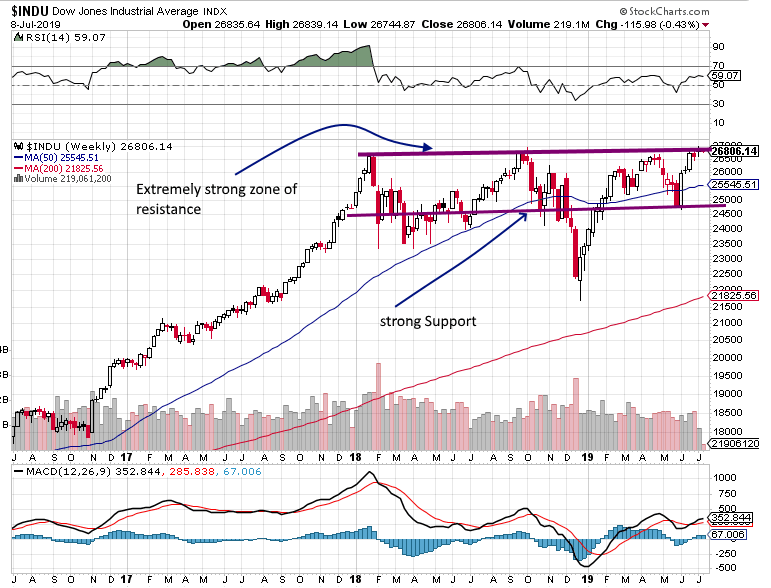

Or, the Dow falls back and could drop to 23,000 before it finds strong support. This is a critical juncture, and the markets are in a state of flux. Traders need to watch the Dow and its behaviour around the 27,000 level to determine the next move.

If it breaks out above 27,000, it could signal a new bullish trend. However, if it falls below 23,000, it could indicate a bearish trend. It is important to keep an eye on the support and resistance zones to determine the Dow’s future direction.

Forget the Stock Market Crash: Focus on the Trend Instead

Should the Dow fail to hold above the 27K mark after trading above it, a pullback ranging from medium to strong could be expected. A medium pullback would likely end in the 25,500-25,800 ranges, while a stronger one could potentially take the Dow down to 24,5K (plus or minus 200 points). However, the long-term outlook remains bullish, and such pullbacks only serve as an opportunity for investors who view strong deviations through a very positive lens.

It is easy to buy when the market is calm, but most panic and run during volatile times instead of embracing the opportunity. It is interesting to note how individuals who were once willing to pay more for a stock when the market was soaring are now afraid to pay less for the same stock. If such a scenario were to unfold, it would be a good time for investors to test their resolve and take advantage of the opportunity presented.

The strong the deviation, the better the opportunity factor. It’s amazing how when a market is soaring everyone wants to get in and pay more and more, but the same individuals that were willing to pay more are now afraid to pay less for the same stock. Market Update, July 11, 2019

Longest Bull Market In History: Article Overview

Central bankers led by the Fed have attempted to improve the economy through quantitative easing and maintaining an ultra-low rate environment. However, as businesses remain stagnant, corporations have increased share buybacks as an easy way to grow earnings per share. This has led to soaring levels of share buybacks, which currently stand at $1 trillion in the US.

Despite this, the masses have not fully embraced the stock market, leading to the possibility of even higher levels of hot money entering the market. This could drive the market to super bubble territory before eventually collapsing. However, contrarian investors believe that the trend is still up and that strong deviations from the norm offer an excellent opportunity factor. A Contrarian Perspective on the Current State of the Stock Market

A Contrarian Perspective on the Current State of the Stock Market

The Dow is currently at an inflexion point, with extreme resistance and support zones at the 26,800-27,000 range. If it breaks above this range, former resistance could become strong support. Alternatively, a pullback could range from medium to vigorous if it fails to hold above 27K after trading above it. In short to intermediate terms, a pullback to the 25,500-25,800 range or even down to 24.5K is possible. However, the long-term outlook remains bullish.

It is interesting to note that when a market is soaring, individuals are willing to pay more and more to get in. However, when the market experiences a sharp or medium pullback, the same individuals are often afraid to pay less for the same stock. This creates an opportunity factor for contrarian investors willing to embrace the market volatility and take advantage of strong deviations.

In summary, the US stock market is currently in a state of flux, with both bullish and bearish indicators present. However, contrarian investors believe that strong deviations from the norm offer excellent opportunities for profit. While a pullback is possible in short to intermediate term, the long-term outlook remains positive.

Research

- “The Benefits of Being a Contrarian Investor” by Investopedia – This article explains how being a contrarian investor can lead to higher returns and lower risks in the long run by going against the crowd. It also provides examples of famous contrarian investors like Warren Buffet and Benjamin Graham. Link: https://www.investopedia.com/articles/01/071801.asp

- “Why It Pays To Be A Contrarian Investor” by Forbes – This article emphasizes how contrarian investing can be a profitable strategy by taking advantage of market overreactions and undervalued assets. It also provides tips on how to be a successful contrarian investor. Link: https://www.forbes.com/sites/investor/2020/07/17/why-it-pays-to-be-a-contrarian-investor/?sh=2db08c836fb2

- “The Advantages of Contrarian Investing” by The Balance – This article explores how being a contrarian investor can help to minimize losses and increase returns by taking positions that oppose prevailing market sentiment. It also provides examples of successful contrarian investment strategies. Link: https://www.thebalance.com/the-advantages-of-contrarian-investing-4173129

- “The Power of Contrarian Thinking” by Harvard Business Review discusses how contrarian thinking can lead to innovation and success in business by challenging conventional wisdom and finding new solutions. It also provides examples of companies that succeeded by going against the crowd. Link: https://hbr.org/2019/09/the-power-of-contrarian-thinking

- “Going Against the Crowd: Investment Strategies of Elite Investors” by Kiplinger analyzes the investment strategies of successful contrarian investors like Seth Klarman and David Einhorn, who have achieved superior returns by making unpopular investment decisions. It also provides insights on how to identify undervalued assets and opportunities in the market. Link: https://www.kiplinger.com/investing/601466/going-against-the-crowd-investment-strategies-of-elite-investors

Other Articles of Interest

Are Doppelgangers Real: Enter the Age of AI Identity Replication

What happens when the stock market crashes? Opportunity!

The Trap: Why Is Investing in Single Stocks a Bad Idea?

How Can Stress Kill You? Unraveling the Fatal Impact

Investment Pyramid: A Paradigm of Value or Risky Hail Mary?

Contrarian Investing: The Art of Defying the Masses

Quantitative Easing: Igniting the Corruption of Corporate America

Uranium Market Outlook: Prospects for a Luminous Growth Trajectory

Stock Investing for Kids: Surefire Path to Success!

An Individual Who Removes the Risk of Losing Money in the Stock Market: A Strategic Approach

Palladium Forecast: Unveiling the Stealth Bull Market

I Keep Losing Money In The Stock Market: Confronting the Stupidity Within

Is Value Investing Dead? Shifting Perspectives for Profit

Analyzing Trends: Stock Market Forecast for the Next 6 Months

Example of Groupthink: Mass Panic Selling at Market Bottom