Negative Real Interest Rates: The Fallout

Updated March 2023

The quote below suggests that Yellen is preparing the Crowd for a surprise. However, it won’t really be a surprise because it was planned all along, and we warned our readers about this for months on end.

Separately, former Fed Vice Chair Alan Blinder asked Yellen yesterday why U.S. productivity growth – which ultimately drives growth and living standards – has been a slim 0.5% for the past five years – far below historical averages. “It’s a source of huge concern,” she said. “We really don’t know.” That’s an honest answer. Full Story

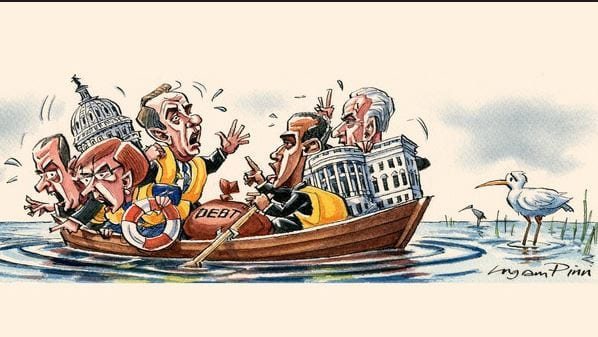

What she is saying is that, well, we knew all along that this economic recovery was nothing but a hoax. Still, we had to make it look like things were just fine and dandy before coming out and stating that the outlook is actually a lot worse than expected. Why would they do this? Well, you need to give the masses a reason to feel it’s okay to rob them again. More hot money is set to flood the markets.

A good headline would be negative rates coming to a town next to you. Negative rates will provide rocket fuel for this market; the corporate world will go ballistic with their share buyback programs. All those top players will walk away with millions, just as all the bankers responsible for the financial crisis of 2008 walked away with boatloads of money.

They don’t care if the market crashes; why would they? Would you care if you had several million dollars stashed away? In some cases, this amounts to hundreds of millions of dollars. Some expect no remorse from these individuals; they will do everything and anything to squeeze the last buck out of this market before they let it collapse.

Consequences of negative interest rates: Savers will be punished

Yellen states that negative rates are part of the Fed’s Tool Box. Yellen recently stated that conditions had not yet deteriorated to a point “sufficient to cause the next move to be cut”. “It’s not what I think is the most likely scenario,” she said in response to a question in the Senate Banking Committee.

Translation; be ready for her to lower rates and embrace negative rates with gusto.

Negative rate outlook update Oct 2019

Negative interest rates turn that concept on its head. For example, when interest rates are below 0% a year, a depositor would receive less cash back at the end of the year than they put into their account. Try reading a series on the topic I wrote here a few years ago for a more comprehensive discussion.

New research shows that when central banks push rates below zero, it can harm the economy.

” We showed that a negative policy rate was at best irrelevant, but could potentially be contractionary due to a negative effect on bank profits,” states the paper titled: “Negative Nominal Interest Rates and the Bank Lending Channel,” by researchers at Harvard University, Brown University, and Norges Bank. The authors include Lawrence Summers, former U.S. Secretary of the Treasury and one-time president of Harvard.

In simple terms, when a central bank decides to pursue a policy of making interest rates lower than zero (a.k.a. negative), the effects could shrink the economy rather than grow it. That’s because negative interest rates destroy banks’ profitability, especially those that rely on customer deposits to make loans. Forbes

The Higher Rate Dilemma? 2023 Update

We no longer need to discuss the Downside of Negative Real Interest Rates, 2023.

The recent collapse of Silicon Valley Bank and several other US banks in March, followed by Credit Suisse, has raised concerns about the stability of the banking system. President Biden’s assurance to do “whatever is needed” to prevent further bank runs may give some comfort, but it begs the question of what exactly will be done to stop the haemorrhaging.

The truth is, central banks have a history of creating boom and bust cycles through the manipulation of interest rates, and what we’re seeing today is no different. Powell’s earlier comments about welcoming a little inflation have only exacerbated the problem, further compounded by the helicopter money strategy implemented during the COVID-19 pandemic.

Unfortunately, the situation is expected to worsen as the USD is predicted to reach a multi-year high in 2023, leading to real inflation that will hit the average person hard. It’s an excellent time to start considering investments in precious metals and stocks in the iron and copper sectors to hedge against the potential fallout.

Certain politicians have cautioned against a rescue of banks that may have acted recklessly. It is, therefore, imperative, according to Adam Guren, Associate Professor of Economics at Boston University’s College of Arts & Sciences, that a thorough analysis of the situation takes place after the crisis is contained.

“At present, we are tackling the blaze itself. Our primary objective is to quell the flames,” remarks Guren. “Once this objective is achieved, we need to undertake a postmortem investigation to determine what led to the catastrophe and to establish revised protocols for future crises.”

BU Today had the opportunity to seek the expert opinions of Guren, Mark Williams – a seasoned lecturer in finance at BU’s Questrom School of Business, and Cornelius Hurley – an adjunct professor at the School of Law, regarding the events that took place, as well as what the future hold. bu.edu

Other articles of interest

Why market crashes are buying opportunities

A clear Illustration of the Mass Mindset In Action

the Level Of Investments In A Markets Indicates

How to win the stock market game

Next stock market crash predictions