Wage Deflation: The New Trend?

Updated Feb 2023

The chart below illustrates the coming wage wars very well. AI will easily replace skilled workers, and jobs once considered unskilled could make a comeback. For example, AI can easily replace Fund Managers, Brokers, Accountants, managers at all levels, etc. Still, they cannot replace a gardener, plumber or good cook.

The Job Frontier: Drastic Change Around the Corner

In a recent report, the World Economic Forum predicted that robotic automation would result in the net loss of more than 5m jobs across 15 developed nations by 2020, a conservative estimate. Another study, conducted by the International Labor Organization states that as many as 137m workers across Cambodia, Indonesia, the Philippines, Thailand and Vietnam – approximately 56% of the total workforce of those countries – are at risk of displacement by robots, particularly workers in the garment manufacturing industry.

By 2020, average salaries in the robotics sector will increase by at least 60% – yet more than one-third of the available jobs in robotics will remain vacant due to shortages of skilled workers. For every job created by automation, several more will be eliminated. This disruption will be devastating.

“Automation and robotics will impact lower-skilled people, which is unfortunate,” Zhang told me via phone from his office in Singapore. “I think the only way for them to move up or adapt to this change is not to hope that the government will protect their jobs from technology but look for ways to retrain themselves. No one can expect to do the same thing for life. That’s not the case anymore.” The Guardian

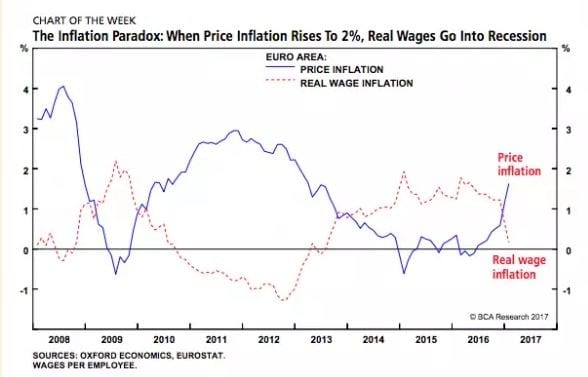

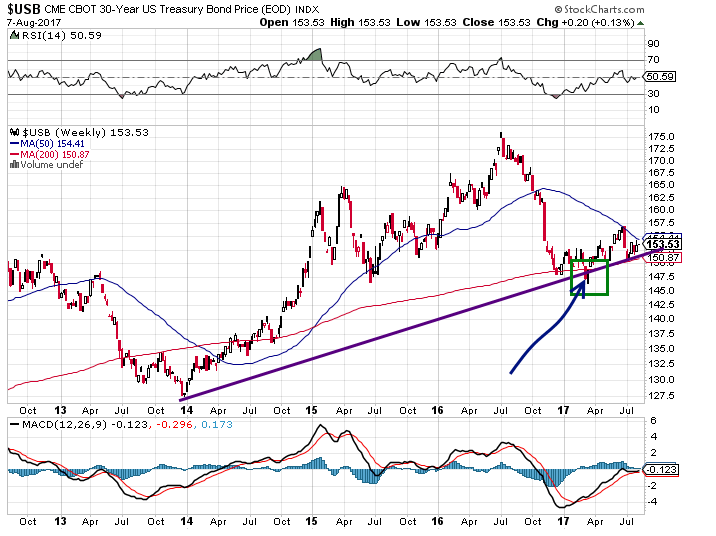

Deflation Economics: Fed is no longer Hawkish.

The Fed has already changed its tune on hiking rates and appears more dovish. The bond market did not trade to new lows after the last rate hike. Bonds put in a higher low and have been trending upwards. It’s acting as if the previous rate hike never took place.

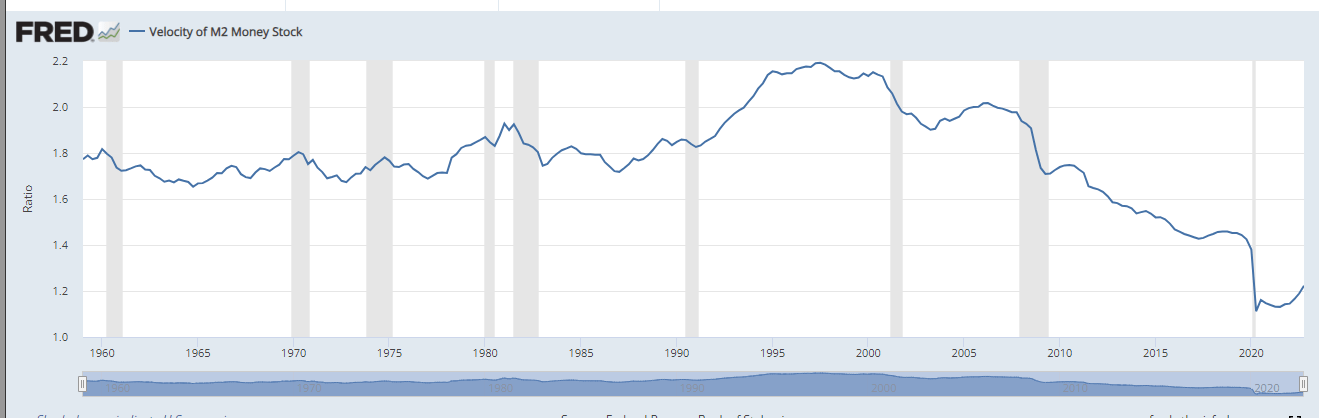

The Velocity of Money and Economic Health: 2023 Update

It (VM) measures how quickly money moves around an economy and is called the velocity of money. The VM (Velocity of Money) refers to how quickly people squander their money. It is determined by counting how often a given amount of money is spent on products and services in a specific time frame.

Money flow velocity is a crucial indicator since it sheds light on the state of an economy. When the velocity of money is high, it implies that cash is moving easily through the economy and that consumers are making purchases, which is a sign of a healthy economy. On the other hand, a low velocity of money indicates that individuals are keeping their money, which may indicate that the economy is weak.

The Current Situation:

The velocity of M2 stock has been declining for some time, and until this trend is reversed, it is unlikely that inflation will become a major issue. This is a sign that all is not well with the economy and that the market relies heavily on hot money to keep it afloat. This is why the market has been performing so poorly since the middle of 2022. While there have been rallies, they have all failed, and most stocks are trading below their 200-day moving averages. This indicates that only a few companies are holding up the market indices.

What Velocity of Money Tells Us:

The velocity of money chart indicates that real inflation is not a major issue at present and that the inflation we are experiencing is likely due to a combination of gross negligence and sanctions against Russia. Before the war with Russia, inflation was not a significant concern. However, the more important takeaway from the velocity of money is that it suggests the economy is unhealthy and cannot withstand a high-interest-rate environment. In other words, it would struggle to function if interest rates were raised to levels that would be considered normal in a healthier economy.

Conclusion

Experts are focussing on the wrong animal. Inflation might not be an issue for many years to come. All the signs indicate that deflation is here to stay, especially regarding wages. Ultra-high wages might soon be a thing of the past. The most expensive component in any business is the “human factor”. If that’s eliminated from the equation, production costs will drop exponentially.

On a different note, the decline in the VM is a worrying sign that the economy is not performing as well as it should be. Until the trend is reversed, it is unlikely that inflation will be a major issue, but it is also a sign that the economy is fragile and cannot withstand higher interest rates.

Overview of Deflation And Wages

Deflation is a persistent decline in the general price level of goods and services in an economy, reducing the purchasing power of money. While deflation has various causes, the rise of artificial intelligence (AI) and robots in the workforce significantly contributes to the deflationary pressure observed in many economies.

As AI and robotics continue to advance, they are increasingly replacing human workers, leading to reduced costs for businesses and increased efficiency in production. The automation of various jobs has led to lower wages, less demand for labour, and reduced consumption, leading to deflationary pressure. The impact of these technologies is expected to increase in the coming years as more industries embrace automation to improve efficiency and cut costs.

Several studies have explored the link between automation, AI, and deflation. A 2020 report by the Bank for International Settlements (BIS) found that technological progress and industrialisation have contributed significantly to the recent downward trend in inflation rates. Another study by the International Monetary Fund (IMF) found that automation and AI could significantly decline wages and employment, exacerbating deflationary pressures in the global economy.

However, some experts argue that AI and automation could also create opportunities for growth and productivity, which could counteract deflationary pressures. For instance, advances in AI could lead to the more efficient allocation of resources and reduced waste, leading to improved economic performance.

Overall, the impact of AI and automation on deflation remains a topic of debate, with arguments for its positive and negative effects. However, it is clear that as technology continues to advance, policymakers must be mindful of its potential impact on inflation and take steps to mitigate any adverse effects.

FAQ on Wage Deflation

Q: What is the World Economic Forum’s prediction regarding robotic automation?

A: The World Economic Forum predicts that robotic automation will result in a net loss of over 5 million jobs across 15 developed nations by 2020.

Q: According to a study by the International Labor Organization, which countries are at risk of robot displacement?

A: Approximately 56% of the total workforce in Cambodia, Indonesia, the Philippines, Thailand, and Vietnam – approximately 137 million workers – are at risk of displacement by robots, particularly workers in the garment manufacturing industry.

Q: What is the impact of automation and robotics on lower-skilled workers?

A: Automation and robotics will impact lower-skilled workers, leading to job displacement and reduced demand for labour, resulting in deflationary pressure in many economies.

Q: What is the Velocity of Money (VM)?

A: The Velocity of Money (VM) refers to how quickly people spend their money. It is determined by counting how often a given amount of money is spent on products and services in a specific time frame.

Q: What does a high velocity of money indicate?

A: A high velocity of money indicates that cash is moving easily through the economy and that consumers are making purchases, a sign of a healthy economy.

Q: What does a low velocity of money indicate?

A: A low velocity of money indicates that individuals are keeping their money, which may indicate a weak economy.

Q: Why is the decline in the velocity of M2 stock concerning?

A: The decline in the velocity of M2 stock suggests that the economy is unhealthy and cannot withstand a high-interest-rate environment.

Q: How is automation and AI contributing to deflationary pressure in many economies?

A: The automation of various jobs has led to lower wages, less demand for labour, and reduced consumption, leading to deflationary pressure.

Q: What is deflation?

A: Deflation is a persistent decline in the general price level of goods and services in an economy, reducing the purchasing power of money.

Q: What are the causes of deflation?

A: Deflation has various causes, including the rise of artificial intelligence (AI) and robots in the workforce, significantly contributing to the deflationary pressure observed in many economies.

Q: What are the potential consequences of automation and AI on the global economy?

A: Automation and AI could significantly decline wages and employment, exacerbating deflationary pressures in the global economy. However, they could also create opportunities for growth and productivity, which could counteract deflation.

Q: How can workers adapt to the changing job market?

A: Workers can adapt to the changing job market by retraining themselves and seeking new opportunities that align with emerging industries and technologies.

Q: What is the impact of robotic automation on wages?

A: Robotic automation is expected to lead to reduced costs for businesses and increased efficiency in production, leading to lower wages and a reduction in the purchasing power of money.

References

- “Technological Progress and Inflation: Why Automation Matters” by the Bank for International Settlements: https://www.bis.org/publ/work867.htm

- “Artificial Intelligence and Economic Growth” by Philippe Aghion et al., National Bureau of Economic Research: https://www.nber.org/papers/w23928

- “The Impact of Robots on Productivity, Employment and Jobs: A Global Perspective” by Georg Graetz and Guy Michaels, Centre for Economic Performance: https://cep.lse.ac.uk/pubs/download/dp1497.pdf

- “Artificial Intelligence and the Economy” by Erik Brynjolfsson and Daniel Rock, National Bureau of Economic Research: https://www.nber.org/papers/w24001

Other Articles of Interest

Why is investing in a mutual fund less risky than investing in a particular company’s stock?

Breaking Free: Embracing Early Extreme Retirement

What is a Bull Market? Unleashing its Power

Elliot Wave Theory: Navigating the Pitfalls

AI Takeover Theory: Humanity’s Crossroads with AI’s Future Impact

Financial Freedom vs Financial Independence: Your Wake-Up Call to Take Control

Embracing Contrarian Wisdom: How to Start Investing for Your Child

The Psychology of a Market Cycle: Navigating Emotional Turbulence

The Power of Investing: Key to Early Retirement and Well-Being

The Audacious Rise: How much has the stock market gone up in 2016

Palladium History: Pursuing Profitable Trends

From Zero to Stock Market Hero: Stock Investing for Dummies PDF

Percentage of Americans That Own Stock: Unlocking the Data

Real Estate Investing for Dummies: The Straightforward Path to Building Wealth

Tantalizing Uranium Stocks Soaring: A Contrarian Perspective