Unlocking the Definition and Formula for Velocity of Money

Updated Feb 27, 2024

The velocity of money measures how fast money circulates in an economy, indicating economic vibrancy and development. It’s calculated by dividing the GDP by the money supply. A higher velocity suggests a more active economy where transactions occur frequently.

Velocity fluctuates with the business cycle. In economic upturns, confidence leads to increased spending and higher velocity. In downturns, spending slows, and velocity decreases. Velocity correlates with GDP and inflation; it typically rises with them during growth and falls during contractions or low inflation.

This metric helps analyze economic health and the impact of monetary policy. It’s affected by various factors, including consumer behaviour, technological changes, and global economic events. Understanding money velocity is essential for grasping economic dynamics and informing policy decisions.

The best way to demonstrate the above is via an example

if real output is $9,000 and the price level is 2 and the velocity of money is 3 then the money supply is?

To determine the money supply, we can use the equation of exchange:

MV = PY

Where:

M = Money supply

V = Velocity of money

P = Price level

Y = Real output

Given:

– Real output (Y) is $9,000

– Price level (P) is 2

– Velocity of money (V) is 3

Let’s plug these values into the equation and solve for M:

MV = PY

M * 3 = 2 * $9,000

M * 3 = $18,000

Now, divide both sides by 3 to isolate M:

M = $18,000 / 3

M = $6,000

Therefore, if the real output is $9,000, the price level is 2, and the velocity of money is 3, then the money supply is $6,000.

The Federal Reserve’s Stance on the Velocity of Money Formula

Let’s start with the velocity of money formula

In this equation

In this equation:

M stands for money.

V represents the velocity of money (or the rate at which people spend money).

P stands for the general price level.

Q stands for the quantity of goods and services produced.

According to the equation for the velocity of money, assuming a constant velocity, when the money supply (M) grows at a faster rate than actual economic output (Q), the price level (P) is expected to increase to compensate for this difference. In line with this perspective, it was projected that inflation in the U.S. would be approximately 31 per cent per year between 2008 and 2013. During this period, the money supply grew at an average pace of 33 per cent per year, while output experienced an average growth rate of just below 2 per cent. However, contrary to these projections, inflation remained persistently low, below 2 per cent.

Factors Contributing to Persistently Low Inflation

Low inflation has been a persistent phenomenon in many economies, and understanding its causes requires a multifaceted approach. Here are the factors contributing to this economic trend:

1. Velocity of Money: The velocity of money has been unpredictable and has often deviated from theoretical expectations. For instance, despite a significant increase in the money supply, the U.S. experienced an annual inflation rate below 2% between 2008 and 2013, contrary to the projected 31% based on the quantity theory of money. This discrepancy was due to a decline in money velocity, as consumers and businesses increased savings and reduced spending.

2. Economic Conditions and Confidence: The global financial crisis of 2008 led to a period of economic uncertainty, diminishing consumer and business confidence. This lack of confidence translated into reduced spending and investment, which slowed the transmission of money supply growth into inflation.

3. Central Bank Actions: Central banks, such as the Federal Reserve, have employed various monetary policy tools to manage inflation. Adjustments in interest rates and quantitative easing are among the measures that have influenced the money supply and its impact on inflation.

4. Labor Market Conditions: The labour market plays a crucial role in inflation dynamics. High unemployment or underemployment can lead to wage stagnation, suppressing consumer spending and keeping inflation low.

5. Productivity and Technology: Advances in technology and productivity can lead to cost savings for businesses, which may be passed on to consumers through lower prices, thereby curbing inflation.

6. Global Trade Dynamics: International trade affects domestic inflation through competition and the availability of cheaper imports, which can keep domestic prices down.

7. Government Policies: Fiscal policies, including taxation and government spending, can influence economic activity and inflation. For example, austerity measures can reduce demand and downward pressure prices.

8. Consumer Behavior: Shifts in consumer preferences towards saving over spending can reduce the velocity of money and dampen inflationary pressures.

9. Global Economic Events: Events such as financial crises or trade disruptions can have spillover effects on global capital flows and inflation.

Real-world examples of these dynamics include Japan’s “Lost Decade,” where deflationary pressures persisted despite monetary policy efforts, and the post-2008 era in the U.S., where inflation remained low despite quantitative easing and low interest rates.

In conclusion, low inflation results from a complex interplay of various economic, social, and policy factors. Policymakers must consider this intricate web when designing strategies to manage inflation and stimulate economic growth.

Declining Velocity of Money: A Subtle Warning of Trouble Brewing

The calculation of velocity as transactions per unit of cash gives vital clues about an economy’s pulse. However, this heartbeat is ever-changing – as unpredictable as the tides of human nature itself. A dip may seem innocuous, but further decrease can portend darkening skies if left unaddressed.

During periods when central authorities flood markets with stimulus, any slackening in velocity belies people’s hesitance to spend and circulate that liquidity freely. Goods move slower through supply chains as uncertainty grips business owners and consumers alike. A substantially retreating velocity, even despite money supply boosts, can bewilderingly yield dropping prices instead of the desired inflation.

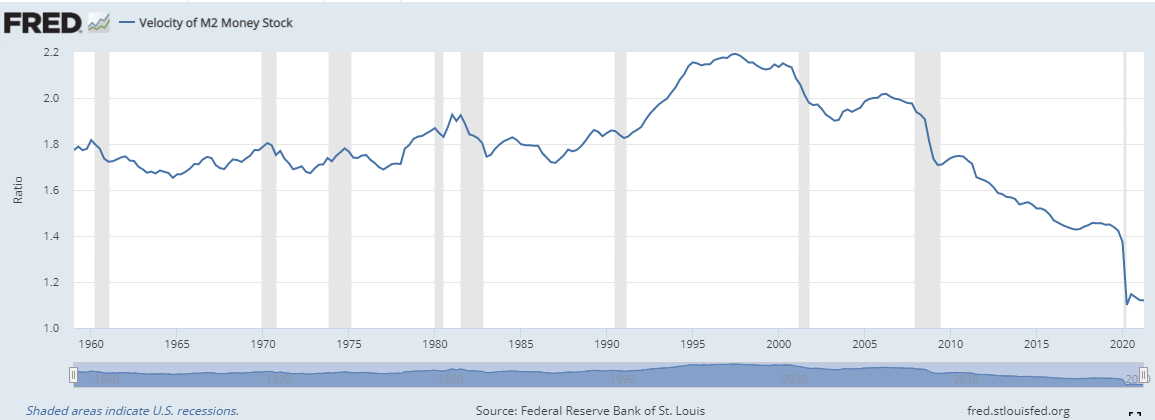

With GDP representing all value created, declining velocity indicates less output derived from each dollar. Transactions that formerly churned the wheels of the industry now slow as doubt and fear replace optimism. If uncontained, this fall in churning risk snowballing as empty pockets foster ever less spending and more warehousing of cash. Dark days may loom if the roots of receding velocity in shrinking demand and confidence go unpruned before taking deeper hold. For the economy’s vital signs, no measurement bears watching with sharper eyes than its rate of money’s circulation. Stlouisfed.org

The Velocity of Money: A Concerning Decline and AI Disruption

The observed trend in the velocity of money raises concerns about the authenticity of the economic recovery from its inception. If we examine the velocity of money, it appears to have experienced a significant decline, reaching new lows before stabilizing. This begs the question: What could be the underlying cause? One plausible explanation could be that the market is already factoring in the disruptive potential of artificial intelligence (AI). The advent of AI threatens established business practices and numerous industries that have been slow to adapt, including large banks, law firms, many mega-corporations, and even governmental institutions, which are considered the most significant contributors to this issue.

Let’s zoom in

The Rise of AI and Robots: A New World Order for the Workforce

Option 2: It could signal that this so-called economic boom will go up in smoke without a very accommodating Fed. As we hinted, Forever Q.E. is here to stay forever or until a new monetary system is launched. Still, A.I. will be in charge when that happens, and there will be a whole new world order. This new world order will not be what the current NWO members expected or envisioned. However, that discussion is beyond the scope of this publication.

One thing is all but sure: the human workforce will be a lot different just 60 months from today. A.I. and Robots will replace a vast swath of the workforce. And this just came out from Tesla.

Tesla CEO Elon Musk said the company expects to build a humanoid robot with artificial intelligence next year to complete simple physical tasks most workers detest. Musk unveiled the “Tesla Bot” concept on Thursday during its “A.I. Day,” which the company streamed on its website. Musk said the bipedal gadget is meant to “navigate through a world built for humans.”

“Tesla is arguably the world’s biggest robotics company because our cars are like semi-sentient robots on wheels,” Musk said. “In the future, physical work will be a choice. If you want to do it, you can. But you won’t need to do it. nbcnews.com/

When business owners can replace the many mediocre workers they are forced to hire, they will gleefully replace them with robots. And Tesla is not the only company attempting to build affordable robots.

Is the Sluggish Money Pulse Slowing Prosperity’s Pace?

As the money supply expands, economic logic dictates faster times should follow. Yet one vital sign spells trouble – velocity, the rate at which each greenback circulates, has plunged to a paltry 4.4 rotations per year.

This puzzles professionals, as the Fed flooded finances to fuel fortunes. Money mushrooms, but where has the momentum moulted? Transactions trickle at one-quarter the tempo of yesteryear when velocity vaporized downturn demons.

Curious citizens cry – what malfunction muffles this monetary motor? With pumping pools of printing, prices should pop up and output overdrive. Instead, GDP inches yearly while dollars sit dormant.

Experts exclaim some force chokes the economic engine, as intensifying inputs induce minimal motion. Confidence perhaps cowers or consumers, conserves content to cache cash outside commerce’s churn.

Until velocity’s abrupt vitiation gets validated, vulnerability lingers. But answers arise by investigating why willing wealth wilts, still in pockets as productivity lags. Solutions seek the switch to restart this risible rotation, reigniting the rapid resource reallocation rewarding recovery.

For now, that faltering figure of finance’s frenzied flows raises questions. Is the sluggish money pulse slowing prosperity’s pace permanently? Only time will tell if tactics can thaw frozen funds’ flow.

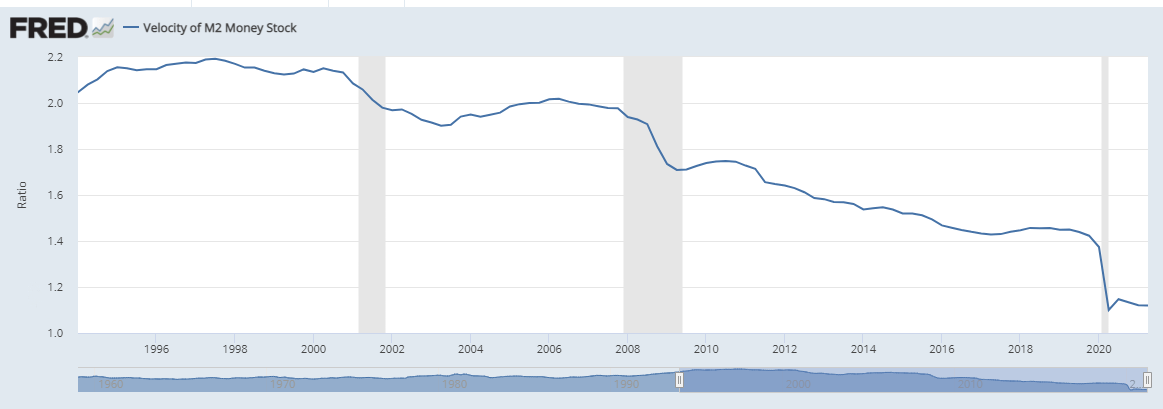

Unprecedented Money Demand: Disrupting Velocity of Money

During the period before the recession, a consistent relationship was observed between the decrease in 10-year Treasury note interest rates and the decline in the velocity of the monetary base. For every 1 percentage point decrease in interest rates, the velocity decreased by an average of 0.17 points based on a linear regression model. Given that 10-year interest rates decreased by around 0.5 percentage points between 2008 and 2013, the expected decrease in the velocity of the monetary base would have been approximately 0.085 points. However, the actual decline in velocity was much larger, amounting to 5.85 points, which is 69 times larger than predicted.

This discrepancy can be attributed to the fact that the nominal interest rate on short-term bonds had essentially reached zero during this period. As a result, money became the preferred risk-free liquid asset over short-term government bonds. Consequently, there was an unprecedented increase in money demand as individuals and the private sector chose to hoard money rather than spend it. This significant surge in money demand has led to a substantial slowdown in the velocity of money, as depicted in the figure below. NBC News

Based on the Fed’s (own) observations. It could be concluded that our economy is sick or possibly even contracting. Given the dramatic rate at which the velocity of money has been plunging since 1996. Great food for thought!!!!! And here is the kicker: the above article was published in 2014. The velocity of money has dropped from 1.53 in 2014 to 1.12.

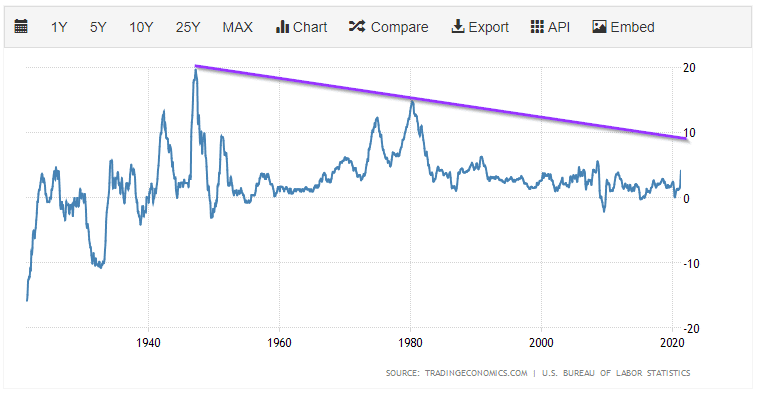

The 107-year chart of the CPI illustrates that it would have to trade past 10 to break its downtrend line, suggesting that inflation might not be something to fret over from a historical perspective.

The key points to focus on are:

The velocity of money continues to fall, which clearly implies that all is not well. In other words, take away the money supply, and this magic cycle of prosperity will go up in smoke. Whatever happens, the Fed will not stop pumping money into this economy. They might hit the brakes on one program, but they will press the pedal to the metal on another. From a much higher vantage point, this development foreshadows the demise of the human workforce.

When talking about inflation, it matters what reference points one is using. Randomly selecting points to match one’s argument amounts to curve fitting. Theoretically, if one does that, one can make rubbish smell like roses.

Declining Velocity of Money: Economic Implications

A decrease in the velocity of money typically signals a slowdown in economic transactions, which can lead to lower GDP growth. This is because money circulation is integral to economic activity; less circulation means fewer transactions and a potential economic deceleration.

Deflationary Risks

With a lower velocity of money, there’s a risk of deflation. Fewer transactions can lead to a drop in price levels, which is the opposite of the inflation that monetary stimulus efforts aim to achieve.

Consumer Spending and Investment

A declining velocity of money often results in reduced consumer spending and investment. Uncertainty in the economy makes individuals and businesses more cautious, decreasing consumption and demand.

Savings and Hoarding

Increased savings and money hoarding can occur when money’s velocity falls. Economic agents may choose to save rather than spend, which further reduces money circulation.

Unemployment

A slower velocity of money can negatively impact job creation due to reduced economic activity, potentially leading to higher unemployment rates.

Debt Burden

Deflation can exacerbate the actual value of debt, making it more burdensome and increasing the risk of debt crises, particularly for heavily indebted sectors.

Recession Potential

A sustained low velocity of money can be a precursor to a recession, indicating a lack of confidence and a potential downturn in the business cycle if not addressed by policy measures.

Monetary Policy Challenges

Central banks manage the economy by using tools like interest rates and money supply. However, when the velocity of money is low, these tools may become less effective. Central banks may need to consider alternative measures to stimulate spending and economic growth.

Income Inequality’s Effect

High-income inequality can contribute to a lower velocity of money, as wealthier individuals and entities are more likely to save than spend. Addressing income inequality can help increase the velocity of money by ensuring more income is circulated within the economy.

Technological Advancements Impacting Money Velocity

Technological progress has significantly influenced the velocity of money by enabling faster and more efficient financial transactions. Digital payment systems, including mobile wallets and cryptocurrencies, facilitate instantaneous fund transfers, reducing the reliance on physical cash and the duration for which money is held between transactions. Financial technology innovations have also expanded financial inclusion, allowing more people, especially in underserved populations, to participate in the economy, potentially increasing the velocity of money.

Globalization’s Influence on Money Velocity

Globalization has enhanced the movement of money across borders, accelerating international transactions and trade. This increased mobility of funds contributes to a higher velocity of money as it circulates more quickly between countries. However, globalization can also introduce market volatility and affect consumer and investor behaviour, which can impact the velocity of money globally. Understanding these dynamics is vital for those shaping economic policy and for businesses operating internationally.

Behavioural Shifts Affecting Money Velocity

Consumer Confidence and Spending Habits

Consumer confidence significantly influences spending habits. High confidence typically leads to increased spending and a faster velocity of money, as currency circulates more rapidly through the economy. In contrast, low consumer confidence often results in decreased spending and a slower velocity of money.

Investment and Business Expenditures

Business investments and expenditures are crucial for the velocity of money. Active investment and business expansion stimulate economic activity and quicken the circulation of money. Conversely, reduced business spending during economic downturns slows the velocity of money.

Saving and Hoarding Behavior

The propensity to save rather than spend affects money velocity. Increased saving behaviour leads to money being held and not circulated, decreasing its velocity. When people choose to spend or invest, the velocity of money increases.

Credit Availability and Borrowing

Credit availability and borrowing habits also impact money velocity. Easy access to credit can lead to more spending and investment, raising money velocity. Conversely, restricted credit access or a reluctance to borrow can lead to reduced spending and a slower velocity of money.

Online and E-commerce Trends

The growth of online shopping and e-commerce has influenced money velocity by enabling quicker transactions and spending, potentially raising the velocity of money. The convenience and increased competition from online shopping can affect consumer spending behaviours and money circulation.

Consumer Expectations and Future Outlook

Expectations about future economic conditions can shape consumer spending and money velocity. Pessimistic outlooks may lead to increased saving and reduced spending, slowing money velocity. Optimistic views can result in more spending and a faster velocity of money.

These behavioural factors, driven by confidence, investment decisions, saving habits, credit access, and technological changes, significantly impact the velocity of money in the economy.

We’re going to delve deep into the subtopics we touched on earlier. The introduction was just the tip of the iceberg; now, we’ll explore the intricacies of money velocity, offering in-depth insights for those hungry for knowledge in this field.

Evolving Demographics and Money Velocity Dynamics

Demographic shifts have a significant impact on the velocity of money. As populations age and the ratio of retirees to working individuals increases, there tends to be a decline in disposable income and spending, which can slow down the velocity of money.

Younger populations, on the other hand, typically spend a higher proportion of their income, which can increase money velocity. Declining birth rates and shrinking working-age populations may reduce economic activity and spending, while immigration can introduce youthful workers to sustain consumer spending. Longer life expectancies lead to extended retirement periods, potentially increasing savings and reducing money velocity. Additionally, urbanization changes consumption patterns, often resulting in higher money velocity due to dense transactional networks in cities. These demographic factors are crucial for monetary authorities to consider in their policy decisions.

Financialization’s Impact on Money Velocity

The financialization of economies, marked by the growing significance of financial sectors, affects the velocity of money. As economic activities become more central to the economy, investment transactions often rise, which can increase money velocity through more frequent exchanges of money. An influx of funds into asset markets can lead to active trading and asset turnover, potentially raising money velocity. Demographic changes, such as ageing populations accumulating wealth, may shift focus towards financial planning and investment, contributing to financialization and possibly increasing money velocity.

However, the effects of financialization on money velocity are complex and can vary based on economic characteristics, regulations, and market conditions. While financialization can promote liquidity and growth, it also carries risks like market volatility and systemic vulnerabilities. Analyzing these factors comprehensively to understand their full economic implications is essential.

Fintech’s Influence on Monetary Policy and Money Velocity

Financial technology advancements are reshaping traditional payment and lending systems, with significant implications for implementing monetary policy. These innovations have the potential to change the way money is demanded and its velocity in the economy.

Traditionally, monetary policy operates through the banking system, with tools such as interest rates and reserve requirements affecting economic activity. Fintech disrupts this model by enabling direct transactions that circumvent conventional financial institutions, potentially modifying monetary policy transmission.

As fintech applications gain popularity, they may shift the public’s demand from cash and traditional banking to digital alternatives. This evolution in consumer preferences could transform the aggregate demand for money within an economy. Moreover, fintech’s alternative lending platforms, such as peer-to-peer networks and crowdfunding services, may alter money velocity by streamlining the flow of capital, allowing for quicker movement of funds between parties.

Central banks and policymakers are examining how the rise of fintech may influence the efficacy of established monetary policy instruments and the overall stability of the financial system. The effects of fintech vary by location, shaped by the local technological infrastructure, regulatory climate, and consumer adoption rates. Ongoing observation and assessment are necessary to adjust monetary policy to the changing financial landscape.

Fintech’s growth offers opportunities and poses challenges for formulating monetary policy. Recognizing potential changes in money demand and velocity spurred by fintech is essential for policymakers striving to maintain the relevance and effectiveness of economic policy in an increasingly digital financial world.

Wealth Distribution, Income Inequality, and Money Velocity’s Household Impact

How wealth and income are distributed across different population segments profoundly affects household spending behaviours and the velocity of money. Households with lower incomes generally spend a larger share of their income, which means that policies or economic shifts that transfer income to these households can increase overall spending and the velocity of money.

On the other hand, when higher-income households hold a larger share of wealth and income, aggregate spending may decrease. This is because wealthier households typically save more of their income, which can lead to a lower velocity of money.

The complexity of the relationship between wealth distribution, income inequality, and money velocity varies from one economy to another. Social norms, credit access, and government policies are among the factors that can influence these dynamics.

Income inequality can also have broader implications for economic stability and social cohesion. Significant disparities in income can lead to tensions that may affect consumer confidence and spending behaviours, thereby influencing the velocity of money and overall economic activity.

Policymakers must consider the effects of wealth distribution and income inequality when designing economic strategies. Policies aimed at reducing income disparities and promoting a more equitable wealth distribution could stimulate spending and potentially increase the velocity of money. Finding a balance that fosters economic growth while ensuring social harmony and long-term sustainability is essential.

Money Velocity: A Key to Economic Growth and Complexity

Various factors, including comparative economic growth influence money velocity. When a country’s economy grows faster than its peers, it can attract capital inflows, affecting interest rates and money velocity. Strong economic growth can lead to lower interest rates, stimulating investment and borrowing, and increasing money velocity. Conversely, higher interest rates resulting from slower growth or capital outflows can reduce investment and borrowing, slowing down money velocity.

Economic factors alone don’t dictate money velocity; social, technological, and political factors are also influential. Technological advancements can change payment methods and consumer behaviour, affecting money velocity. Political and policy changes can shift business confidence and investment decisions, impacting the speed at which money circulates.

The global economy’s interconnectedness adds complexity, with international events influencing capital flows, interest rates, and money velocity. Understanding these broad economic environments is crucial for grasping money velocity dynamics and its implications for economic growth.

The Velocity Factor: Money Flow and Macroeconomic Progress

Money velocity, the rate at which money changes hands, is closely tied to economic growth. Historically, higher money velocity has been associated with increased economic output. This correlation suggests that when money moves faster through an economy, it can stimulate business and consumer transactions, contributing to a rise in GDP.

However, the causality between money velocity and GDP growth is complex. While a growing economy can boost money, artificial economic stimuli may inflate velocity without sustainable growth. Actual progress relies on matching currency supply with productive investment.

Business Cycles and Money Velocity

Money velocity often declines during economic recoveries, especially after financial crises, as caution prevails over overspending. Yet, in well-developed economic systems, the relationship between money velocity and growth is more pronounced, with technological advancements enhancing the flow of funds.

Money Velocity as a Policy Indicator

Velocity remains a critical indicator for policymakers, reflecting the financial system’s health and the monetary policy’s effectiveness. As such, it is a focus of ongoing research to unlock sustainable economic expansion.

Currency Expectations and Money Velocity Impact

Currency expectations significantly influence money velocity. Anticipation of currency devaluation prompts individuals to spend or convert their holdings, increasing velocity. Conversely, expectations of appreciation can lead to hoarding, reducing velocity.

Competitive devaluations, where nations lower their currency values to boost trade, can also alter spending and saving patterns, affecting money flow. Central bank policies, such as adjusting interest rates or implementing quantitative easing, shape a currency’s future value expectations, influencing money demand and velocity.

The complexity of currency expectations on money demand and velocity arises from economic indicators, geopolitical events, and market sentiment. Policymakers and central banks must consider these factors as they affect currency stability, economic growth, and financial stability.

Influence of Global Conditions on Money Velocity and Investment

Global economic conditions and financial spillovers play a crucial role in shaping business confidence, investment spending, and the velocity of money. The interconnectedness of the world’s economies means that events in one region can have far-reaching effects on others, influencing investment decisions and the pace at which money circulates.

During times of global economic downturn, businesses may reduce investment due to lower confidence, leading to a slowdown in money velocity. Financial crises can trigger a chain reaction, affecting investor sentiment and reducing investment spending across borders, further impacting the velocity of money.

Investment spending is a key driver of money velocity, representing the flow of funds into new capital goods and productive assets. High levels of investment spending can increase money velocity, while low levels can have the opposite effect.

To counteract the negative impacts of global economic shifts, policymakers and central banks closely monitor these conditions. Their goal is to maintain sustainable growth and stability by enhancing economic resilience and strengthening financial systems against the backdrop of global uncertainties.

Money Velocity Through the Ages

Examining the historical changes in money velocity reveals insights into economic activity and the factors driving these shifts. In the United States, data shows a peak in velocity around the early 1980s, followed by a gradual decline, with a more pronounced drop after 2007. This trend reflects various influences, including payment technology advancements, demographic changes, and economic uncertainties.

Factors Influencing Money Velocity

Payment innovations like credit cards and digital wallets have made it easier for people to spend, potentially increasing velocity. The ageing population, particularly the retirement of Baby Boomers, has decreased spending and velocity. Low inflation rates have reduced the need to spend quickly to preserve purchasing power, contributing to lower velocity. Economic uncertainties, such as financial crises and trade tensions, have also made people more cautious about spending.

Policy Implications

Understanding money velocity trends is crucial for effective monetary policy. Policymakers can leverage fintech to encourage spending and consider demographic shifts by supporting younger workers’ employment and spending power.

Velocity in Emerging vs. Developed Economies

Emerging markets often have higher money velocities due to inflation volatility and less developed financial systems, leading people to use money as a store of wealth. In contrast, developed countries typically have lower velocities because of stable inflation, strong currencies, and diverse investment options.

Factors Affecting Global Money Velocity

Industrialization and export growth can increase velocity as wages and investment spending rise. Countries with large informal sectors and cash reliance also tend to have higher velocities. Rapid urbanization can boost velocity through increased electronic payments and financial inclusion. Demographics influence velocity, with younger populations increasing it and older ones decreasing it. High-income inequality can lower velocity as wealthier households save more of their income.

Tech Acceleration and Monetary Mobility

The rapid advancement of financial technology has transformed the movement of money, introducing complexities in assessing its velocity. Digital platforms facilitate quicker transactions, potentially increasing the velocity of money as it moves more freely through the economy. However, the same technology also allows for easier wealth accumulation in investment vehicles, which may reduce the velocity by keeping funds static.

Emerging Financial Trends

Non-traditional lending and the rise of stablecoins are redefining traditional financial models, making it challenging to draw clear conclusions about their impact on money demand. Cryptocurrencies offer the promise of higher velocity, but their effect is uncertain and heavily dependent on widespread adoption and integration into the financial system.

Policy Challenges

Policymakers face the challenge of keeping up with rapid technological advancements that outpace regulatory frameworks. Continuous monitoring is essential to understand the evolving economic landscape and to adapt monetary policies accordingly.

Money Velocity’s Impact on Central Bank Policy

The decline in money velocity presents a challenge to traditional central banking practices. As the relationship between money supply and inflation weakens, central banks are turning to unconventional tools to stimulate the economy. However, these new strategies come with uncertainties and potential long-term consequences.

Unconventional Monetary Tools

Interest rate cuts and quantitative easing are designed to boost economic activity, but their effectiveness is limited if money velocity remains low. Central banks are exploring alternative measures, such as forward guidance and balance sheet adjustments, to encourage spending and investment.

Navigating Economic Uncertainty

Central banks must communicate effectively and adapt to the changing economic environment. They are tasked with maintaining stability while managing the risks associated with new monetary policy tools. Coordinated international efforts are necessary to prevent adverse spillover effects and to recalibrate economic models to reflect the new realities of financial management.

Exploring Money Velocity: Models and Theories

The quest to understand money velocity has led to various models and theories. Early ideas linked velocity to interest rates, suggesting that lower rates encourage spending and increase velocity. However, this relationship is not always straightforward, as credit dynamics and business cycles also play a role. For example, leverage expansions before a crash can mask the buildup of risks.

Other theories consider expected inflation, where the anticipation of price increases might prompt spending. However, managing inflation expectations remains a challenge for policymakers. Demographic changes also affect money velocity, as different age groups have different spending habits.

Recent models attempt to account for multiple factors by examining the unique behaviours of households, firms, financial institutions, and governments. These sectoral approaches help to isolate specific relationships and understand the overall velocity.

However, factors like consumer sentiment, geopolitical events, and technological changes introduce variability. The persistent decline in velocity since 2008 has defied many predictions, highlighting the need for more nuanced analysis.

Future research, leveraging big data and network analysis, may provide deeper insights into money velocity, aiding policymakers in navigating this complex economic variable.

Random Thoughts on the Velocity of Money

The velocity of money is supposed to rise when GPD rises, and economic activity expands. It is also believed to increase when consumers spend more. But it’s not. Perhaps this is why economics has been called the dismal science and why monkeys armed with darts can outperform experts and economists with PhDs.

Einstein viewed quantum entanglement as “spooky action”; perhaps that name should have been reserved for economics. It’s spooky how experts in the field of economics get paid so well when they are almost always wrong.

Articles That Cover a Spectrum of Timeless Topics

Stock Buybacks: Exploring Their Detrimental Effects

US Dollar Rally: Is it Ready to Rumble?

Stock Books For Beginners: Investing Beyond the Pages

Psychological Manipulation Techniques: Directed Perception

When is the Best Time to Buy Stocks: Key Insights

False Information and Its Consequences

Investor Beware: How Primal Fears Could Be Ruining Your Portfolio

Winning with Nasdaq 100 ETF: Riding the Right Side of the Trend

Stock Market Trend Analysis Decoded: Unveiling the Insights

Risk To Reward Ratio & Opportunity Vs Risk

What Is Fiat Money: USD Is Prime Example Of Fiat

Hot Money & Copper: Exploring the Moral Implications of a Dangerous Dance

Japanese Yen to Dollars: An Outlook of Resilience & Potential Rally

DJI History: Profiting from the Past Market Trends