Banking on Bad Banks

How do you get the majority to embrace a particular narrative? In this instance, we have bulls, bears and neutral. There are three separate groups with three different views. Well, you punish all three of them, and you punish them so severely that there is only one outcome to embrace, but the outcome is so obscene that now and then, they will question it, so you punish them again and again.

The bulls are questioning the rally as they banked some profits, hoping to buy back at a lower level, but the markets never pulled back. So, while they did not short the markets, they are getting punished for their stance and losing money on the long positions they closed.

Bears die young

90% of the bears that shorted the markets during the coronavirus selloff got hammered when the Dow reversed course so fast, and they believed the reversal would fail. They assumed this market would at least release some steam before trending higher. This pullback would allow them to recoup those losses, but it has not come to pass.

The neutrals take the biggest beating; they are sitting in cash. They are getting hammered for being savers as interest rates are almost zero, and they lose on banking any profits as the markets soar.

Sneaky Fed: The Deceptive Path Led by Bad Banks

In effect, the Fed is employing the most dangerous strategy of all; it’s now negatively using high-level Mass Psychology on everyone. Friend and foe are now all targets, so anyone relying on just one tool will be blown out of the water. We will expand on this more, but for now, investors need to steel themselves to view sharp pullbacks that will be triggered for no reason and randomly as opportunities.

It is time to prepare for psychological warfare, and the only way to prepare for this warfare is to understand that the underlying theme is deception. So, what you think is not happening and vice versa. The markets will not crash, but they will appear to be in crash mode for brief periods, and then they will reverse just as fast. If you prepare for this, the attack mode is straightforward; embrace every pullback until the trend turns neutral or negative.

While we lost on the options, our other holdings are performing remarkably well. So, our strategy going forward will be only to look at options with a minimum of 6 months of time premium.

In Summary

Trying to gauge the short-term direction is almost a waste of time because everything is controlled on short timelines. So, the best strategy in such a manipulated environment is to focus on the longer trend. The short-term trend is being manipulated because the Fed wants individuals to embrace the market yesterday and not tomorrow. And don’t bother asking why? It does not matter; you don’t fight the Fed, no matter how strong you think you are.

We are not stating that it’s guaranteed that the Dow will go to 28K before pulling back; we don’t have a crystal ball. We are saying that if the Dow closes above the stated levels, the odds are above average that it could hit those levels. Given the Fed’s new strategy, we are focusing on the underlying trend as we have to change our line of attack. This plan is simple, we will focus on the long side, and when the Markets let out steam while everyone howls, we will smile and pile into top-quality stocks.

Brace yourself Mentally

So, prepare yourself mentally to deal with sharp gyrations from time to time, for the rewards will be huge. We are now in a different market; technical analysis, fundamental analysis, and any time of single study will fail. This is psychological warfare of the highest order. The order is to subtly change the masses’ perception so they will think and believe they have arrived at a conclusion already chosen for them.

Hence, let’s look to exit these June puts at the best possible price you can get. Our other plays are holding up very well. Now Murphy’s law might kick in, but we can’t sit and focus on a tiny event. With our new data, we must focus on the long-term, not the short-term game. Now the other option for those willing to take on more risk is to hold them and take a risk that the market will suddenly revert to the norm, let out some steam quickly and before trending higher.

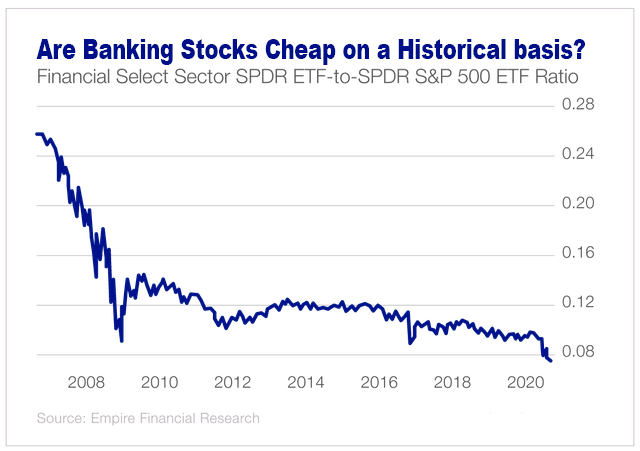

US Banks, Including Bad Banks stocks, are cheap.

Historically, US bank stocks are very cheap, and 12 to 24 months from today, a large percentage of these chaps should be trading at least 50% higher. KEY still makes for a good play, and we are issuing two more plays, one in the Trend portfolio and one in the ETF portfolio.

What is the best time to buy US bank stocks?

According to a study by Tobias Levkovich, Citigroup’s Chief US Equity Strategist, purchasing disliked bank stocks has often proved beneficial. Levkovich observed that when US bank stocks received low ratings and faced negative investor sentiment, they tended to outperform the overall market in the subsequent year. Conversely, when bank stocks received high ratings and positive emotion, they tended to underperform.

Investing.com’s research further supports the notion that the banking sector is a contrarian investment opportunity. The study suggests investors should consider buying bank stocks when out of favour. This advice stems from the sector’s historical volatility, oscillating between extreme optimism and extreme pessimism. When market sentiment toward banks turns pessimistic, their stocks often trade below their book value, which can be an appealing prospect for value investors.

Moreover, a report from JPMorgan highlights that US banks are currently undervalued relative to other sectors. The report argues that the US banking sector possesses robust capitalization, healthy balance sheets, and a favourable position to benefit from the anticipated rise in interest rates.

Other Articles of Interest

US jobless claims No Longer Connected To Stock Market (Sep23)

Easy Money Environment Fosters Price Manipulation (Sep23)

How to Become A Better Trader? (Sep23)

What is deflation? A bigger Problem Than Inflation (Sep23)

Missed opportunity and the Mother of All Buy signals (Sep23)

Market Opportunity: Embrace crashes like a lost love (Sep23)

Market insights: Fight the Fed & End Up Dead (Sept 22)

Investment Pyramid: Valuable Concept Or ? (Sept 2)

Successful Investing; Never Follow the Crowd (Sep2)

Define Fiat Money: The USD Is A Great Example (Aug 13)