Contrarian Investing: The Key to Successful Investing in Changing Markets

Feb 25, 2023

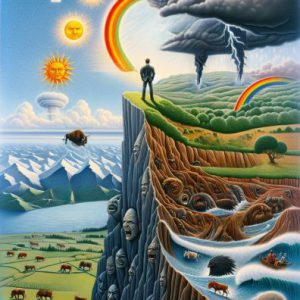

The financial markets are constantly changing and can be incredibly difficult to predict. The key to successful investing is having a well-defined strategy and sticking to it, regardless of market conditions. One such strategy is contrarian investing, which goes against the crowd and seeks to take advantage of market corrections and undervalued opportunities.

Contrarian investing is based on the premise that the crowd is often wrong and that markets often overreact in either direction. Contrarian investors aim to benefit from market corrections and capitalize on undervalued opportunities by taking a position contrary to the masses. The key to successful investing is to have a good understanding of the market and be able to anticipate market movements.

The Art of Successful Investing: Why Contrarian Strategies Pay Off

Contrarian investors also have a long-term perspective and are willing to hold onto their positions for extended periods, even in the face of short-term market volatility. This allows them to ride out market corrections and reap the benefits of a well-diversified portfolio over time.

However, it’s important to note that contrarian investing is not for everyone. Contrarian investors must also be able to make quick decisions in response to market movements, as they often invest in undervalued opportunities that may not last for long.

The Key to Successful Investing: Strategy, Discipline, and a Long-Term Perspective

The key to successful investing is to have a well-defined strategy and stick to it, no matter the market conditions. Whether you prefer mass psychology or contrarian investing, it is essential to have a long-term perspective and be ready to make quick decisions in response to market movements. The key to successful investing is also to be well-informed and understand the financial markets well.

In conclusion, the key to successful investing is to have a well-defined strategy and stick to it, no matter the market conditions. Contrarian investing is a strategy that seeks to exploit market corrections and undervalued opportunities. However, it requires high discipline, patience, and a long-term perspective. The key to successful investing is to be well-informed and understand the financial markets well. Additionally, investors should have a well-diversified portfolio and be patient, disciplined, and informed in their investment decisions.

Overview of the article

The world of financial markets is ever-changing and unpredictable. Successful investing requires a well-defined strategy and a commitment to sticking with it, regardless of market conditions. Contrarian investing is a strategy involving going against the crowd to capitalize on market corrections and undervalued opportunities.

Contrarian investors believe that the crowd is often wrong, and markets tend to overreact in either direction. They seek to take advantage of undervalued opportunities by taking a position opposite to the masses. Contrarian investors also adopt a long-term perspective and are willing to hold onto their positions for extended periods, even in the face of short-term market volatility.

It’s important to note that contrarian investing is not suitable for everyone. Investors must be able to make quick decisions in response to market movements and invest in undervalued opportunities that may not last long.

Regardless of your investment strategy, a well-defined strategy and a long-term perspective are crucial. It’s also essential to be well-informed and understand the financial markets thoroughly. Successful investing requires discipline, patience, and a well-diversified portfolio. Avoid being swayed by emotions, misinformation, and groupthink, and instead, capitalize on market trends and opportunities.

In conclusion, the key to successful investing is having a well-defined strategy and sticking to it, regardless of market conditions. Contrarian investing can be an effective strategy but requires patience, discipline, and a long-term perspective. Irrespective of your chosen approach, being well-informed and understanding the financial markets are essential to achieving investment goals.

Other Articles of Interest

Investor Psychology Cycle: Stand Strong Against the Herd

Wisdom in Reverse: Learning the Hard Way How to Lose Money in Stocks

Clear-Cut Investing: Distinguishing Fundamental Analysis from Technical Analysis

Market Psychology Chart: Tips for Informed Investment Decisions

Selling Covered Calls For Income: Elevate Your Income Strategy

Contrarianism: Capitalizing on Dissent in the Market Maze

Amazon Stock Direct Purchase Plan: A Comprehensive Guide

The Contrarian Personality: Igniting Minds with Unconventional Sparks

Palladium Price Trends: Unveiling the Allure of a Shining Investment

What is a Bullish Market: Debunking the Illusion of Stock Market Crashes

Profit Surge Unleashed: Mastering the Craft of Selling Puts for Income

Best Stock Investing Books that Transcend Expectations

Mastering Stock Market Psychology: Neutralizing Emotions & Biases

The Uptrend Alchemy: Transmuting Market Insights into Wealth