Top Sectors 2016: Key Players in the Market

Updated Oct 2, 2016

In order to assist traders seeking valuable information, we have compiled a comprehensive report on the top sectors and stocks in the market, specifically focusing on the year 2016. This analysis encompasses four key areas: the top 10 sectors based on price action, the top 10 industries based on relative strength, the top 15 stocks in the entire market, and the top 12 stocks among the weakest 180 stocks. Our aim is to equip traders with the necessary insights to make informed investment decisions.

For those looking to adopt a strategy, we suggest considering a simple yet effective approach. It involves patiently waiting for robust price retracements before initiating new stock positions within preferred sectors. By capitalizing on strong pullbacks, traders can potentially seize advantageous entry points.

Effective Strategy: Seizing Opportunities during Volatility

Additionally, we recommend applying 1-3 technical indicators, such as Relative Strength, Stochastics, MACD, and others, to further refine the stock selection. Evaluating whether a stock is trading within oversold ranges can provide valuable insights. Ideally, during market pullbacks, the stock should exhibit oversold conditions. As we anticipate 2016 to be an exceptionally volatile year, it is crucial to leverage strong to very strong pullbacks for opening new positions.

It’s important to note that this strategy only applies during bullish or neutral trends. A neutral trend implies that while it may be bullish in one or two indices, it is not necessarily the case across all three indices. For instance, if the Dow exhibits a bullish trend while the Nasdaq and SPX demonstrate neutral trends, this strategy can still be effective.

By utilizing the information and implementing these guidelines, traders can enhance their decision-making process and potentially capitalize on favourable market opportunities in 2016.

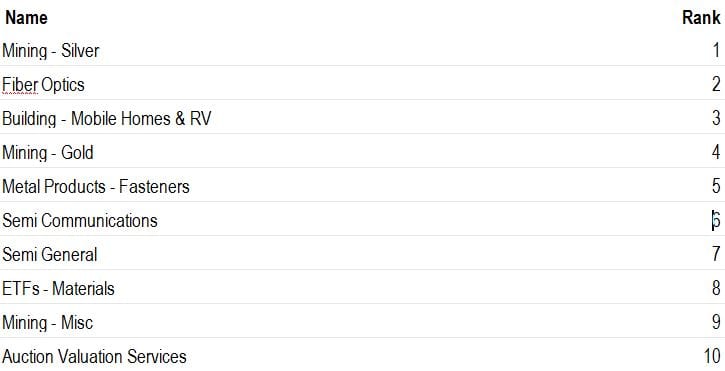

Sector Spotlight 2016: Thriving Industries to Invest In

We consolidated the 90-day price action and relative strength segments into one as this simplifies the task of trying to find the best sector.

Top 15 Stocks in the Whole Market

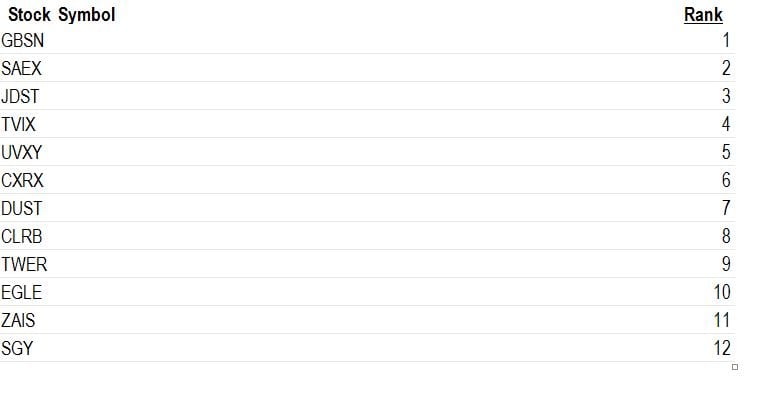

Top 12 Stocks amongst the bottom 180 stocks

Originally published in Jan 2016 and updated in February 202, this article offers enhanced insights and analysis.

Stories to Tickle You

Market Timing Strategies: Debunking Flawless Predictions

How to boost your immune system: Simple Ideas

Buy When There’s Blood in the Streets: Adapt or Die

Financial Insights: Cutting Through the Noise