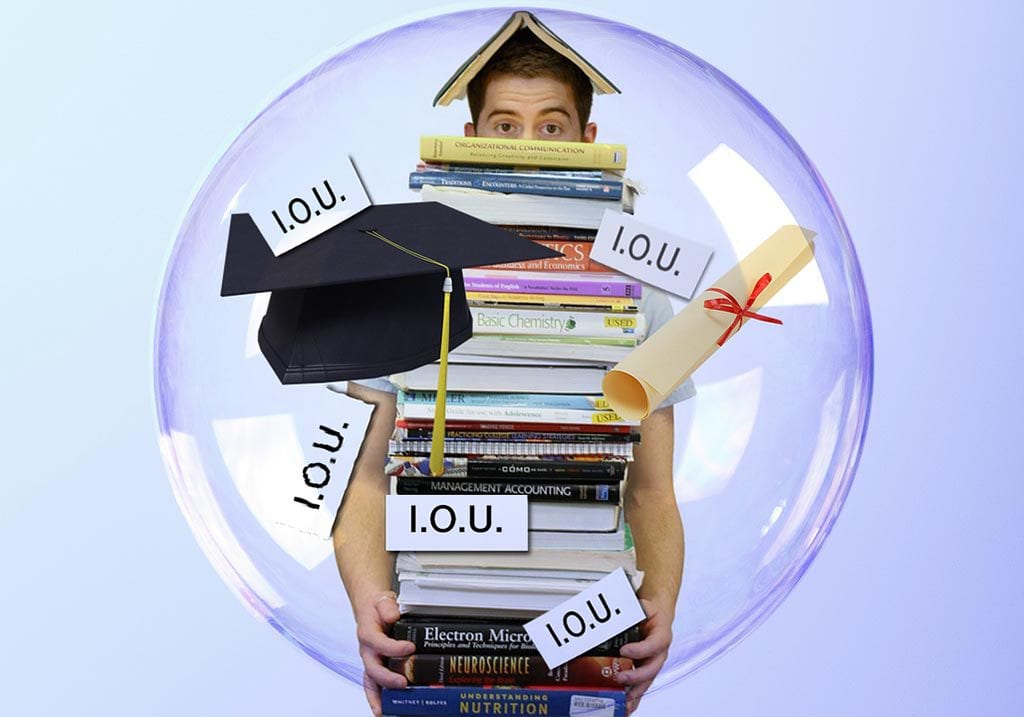

Student Debt News: Levels Soar Uncontrollably

Updated Dec 03, 2023

The student debt crisis in the United States is a ticking time bomb that could explode anytime. As of 2023, the total student debt has surpassed $1.7 trillion, growing at over $2,800 per second. This staggering figure is a testament to the magnitude of the crisis, with millions of Americans grappling with the financial burden of student loans.

The rate at which student debt is growing has slowed down slightly, but it still poses a significant financial burden for many Americans. This burden is not just a personal issue for those saddled with debt but also has broader economic implications. High levels of student debt can limit consumer spending, hinder home ownership, and even influence career choices, with graduates often forced to take higher-paying jobs to service their debt rather than pursue careers in fields they are passionate about.

While the number of individuals with student debt late on their payments has decreased slightly, it remains a concern for the economy. Late payments can lead to many problems, including lower credit scores, increased interest rates, and even wage garnishment. This can further exacerbate the financial strain on individuals, making it even harder for them to pay off their debt.

The unemployment rate has fluctuated since 2015, and as of the latest data, it currently stands at 4.2%. The labour force participation rate has also changed at 61.8%. These figures indicate that there are still ongoing challenges related to student debt and employment in the United States. High levels of student debt can deter individuals from pursuing further education or training, potentially limiting their job prospects and earning potential.

The student debt crisis is not just a problem for individuals but also poses a significant risk to the broader economy. High levels of student debt can limit consumer spending, which is a crucial driver of economic growth. Furthermore, the burden of student debt can also deter entrepreneurship, as individuals with high debt levels are less likely to start their businesses.

The student debt crisis in the United States is a pressing issue that requires urgent attention. With total student debt surpassing $1.7 trillion and growing at over $2,800 per second, it’s clear that this problem cannot be ignored. As the crisis continues to unfold, it’s crucial for policymakers to take action to address this issue and alleviate the financial burden on millions of Americans.

The Nature and Extent of Student Debt

Indeed, the nature and extent of student debt in the United States have become significant concerns. Here are some key aspects to consider:

1. Increasing Debt Levels: Student debt in the United States has risen over the past few decades. Higher education costs have outpaced inflation, leading more students to rely on loans to finance their education. As a result, the total outstanding student loan debt has reached unprecedented levels, surpassing $1.7 trillion.

2. Impact on Borrowers: Student debt can profoundly impact borrowers’ lives. Many individuals face substantial monthly loan payments that can stretch their budgets and limit their ability to achieve other financial goals, such as buying a home, starting a business, or saving for retirement. High debt burdens can also contribute to financial stress and mental health issues.

3. Economic Consequences: The consequences of student debt extend beyond individual borrowers. The high levels of debt can impact the broader economy. Graduates burdened with student loans may delay or forgo major purchases, reducing consumer spending. The debt can also deter entrepreneurship and innovation, as individuals may hesitate to take risks due to financial obligations.

4. Inequality and Social Mobility: Student debt exacerbates wealth and income disparities. Students from low-income backgrounds often have limited access to financial resources and must rely more heavily on loans to finance their education. As a result, they may face higher debt burdens and have a more challenging time building wealth and achieving upward mobility than their wealthier counterparts.

5. Policy Debates and Solutions: The issue of student debt has sparked policy debates and discussions. Various proposals have been proposed to address the problem, including expanding federal financial aid programs, increasing investment in public higher education, implementing loan forgiveness or income-driven repayment plans, and exploring tuition-free or debt-free college options.

6. Financial Literacy and Education: Promoting financial literacy and education is crucial in addressing the student debt crisis. Providing students and borrowers with the knowledge and tools to make informed decisions about loans, repayment options, and financial planning can help mitigate the negative impacts of student debt.

It is crucial to understand that the impact and severity of student debt can differ significantly among individuals based on factors such as loan conditions, career paths, and income levels. To manage their debt effectively, borrowers must seek personalized financial advice and explore available resources, including loan repayment programs and assistance.

The Impact on the Individual and Economy

The impact of student debt extends to both individuals and the broader economy. Here’s a closer look at the effects:

Individual Impact:

Student debt can have far-reaching consequences that can affect individuals’ lives in various ways. Firstly, high levels of student debt can postpone significant life milestones, such as buying a home, starting a family, or pursuing advanced degrees. Debt obligations can limit financial flexibility, making it harder to save for these milestones.

Secondly, student debt can influence career choices, as graduates burdened with significant debt may feel pressured to prioritize higher-paying jobs over their passions. This may also lead to a lack of motivation and dissatisfaction at work, which can further affect their mental health.

Lastly, the stress and anxiety associated with student debt can have adverse effects on individuals’ mental health. The constant worry about debt repayment and financial stability can contribute to pressure, tension, and depression.

Economic Impact:

Student loan payments can take up a significant portion of a borrower’s monthly income, which limits their ability to spend on other goods and services. This, in turn, can hurt the economy as it reduces consumer spending. Additionally, high levels of student debt may discourage individuals from investing in areas such as homeownership, starting businesses, or pursuing entrepreneurial ventures, thus hindering economic growth and innovation.

Furthermore, student debt can exacerbate existing wealth inequalities by putting those with limited financial resources at a disadvantage in wealth accumulation compared to individuals from wealthier backgrounds who can afford to pay for education directly. This can lead to social mobility issues as the burden of debt disproportionately affects individuals from low-income backgrounds, impeding their ability to climb the economic ladder and access opportunities for upward mobility.

Addressing the impact of student debt requires a comprehensive approach that involves multiple strategies. One of these strategies is implementing policies ensuring higher education is more affordable. Expanding access to grants and scholarships, exploring loan forgiveness programs, and promoting financial literacy education are essential. By easing the burden of student debt, individuals can have more financial freedom, increasing consumer spending and investment, and enhancing social mobility. Ultimately, this will benefit the economy as a whole.

Government Efforts and Policy Proposals

Here is an overview of crucial government efforts and policy proposals aimed at addressing the student debt crisis, as well as associated debates:

1. Income-Driven Repayment Plans: Income-driven repayment plans help borrowers manage their student loan payments based on their income and family size. These plans typically cap monthly payments at a percentage of the borrower’s discretionary income and provide loan forgiveness after a specific repayment period. Supporters argue that these plans relieve borrowers by making payments more affordable. However, critics say that the complexity of these plans and potential tax implications can create confusion and may not address the root causes of the student debt problem.

2. Public Service Loan Forgiveness (PSLF) Program: The PSLF program aims to encourage individuals to pursue careers in public service by forgiving their remaining student loan balance after making 120 qualifying loan payments while working for a qualifying employer. Supporters view this program as a valuable incentive for individuals to enter public service sectors such as education, healthcare, or government. However, the program has faced challenges, with many applicants being denied forgiveness due to program requirements and administrative issues.

3. Tuition-Free or Debt-Free College Proposals: Some policymakers and advocates have proposed making higher education tuition-free or debt-free. These proposals aim to reduce or eliminate the need for student loans by shifting the burden of funding higher education to the government or other sources. Supporters argue that this would make education more accessible and reduce the reliance on loans. Critics raise concerns about the cost and sustainability of such programs, potential implications for quality and competition in higher education, and the potential for increased tax burdens.

4. Financial Literacy and College Affordability Initiatives: Another area of focus is improving financial literacy among students and families to help them make informed decisions about college costs, student loans, and other financial matters. Additionally, efforts to address college affordability aim to reduce the need for excessive borrowing by increasing grants, scholarships, and other forms of financial aid.

The initiatives to address the student debt crisis have raised debates around their cost, effectiveness, and potential unintended consequences. Stakeholders have different perspectives on balancing personal responsibility and government intervention in addressing this crisis.

To effectively address the student debt crisis, it is essential to adopt a comprehensive and balanced approach. This approach should combine efforts to make higher education more affordable, improve financial literacy, provide targeted relief to needy borrowers, and address the systemic issues contributing to rising education costs.

The Future of Student Debt

Various factors will influence the outlook for student debt. Here are some important considerations:

1. Policy Decisions: Government policies and regulations significantly shape the student debt landscape. Changes in loan repayment programs, loan forgiveness initiatives, and funding for higher education can substantially impact student debt levels. Ongoing policy debates will continue to influence the future trajectory of student debt.

2. Economic Trends: Economic factors, such as job market conditions, wage growth, and overall economic stability, can affect the ability of borrowers to repay their student loans. Economic changes can impact borrowers’ financial circumstances and their capacity to manage their debt obligations.

3. Higher Education Landscape: Shifts in the higher education landscape, including changes in tuition costs, enrollment trends, and the availability of financial aid, can influence the amount of student debt individuals incur. Efforts to make higher education more affordable and accessible can potentially mitigate future increases in student debt.

4. Public Perception and Advocacy: Public awareness and advocacy around the student debt crisis can influence policy discussions and potential reforms. The dialogue surrounding student debt, including conversations around student loan forgiveness and systemic changes, has gained momentum in recent years. This increased attention may shape future policies and initiatives.

5. Unforeseen Events and External Factors: Unexpected events, such as the COVID-19 pandemic, can significantly impact student debt dynamics. Pandemic-related relief measures, like temporary payment suspensions and interest waivers, have provided temporary relief for borrowers. However, the long-term effects and potential lasting changes resulting from the pandemic remain uncertain.

It’s crucial to acknowledge that accurately predicting the future trajectory of student debt is challenging. Multiple factors influence the dynamics related to education financing and debt and can evolve unpredictably. However, continuous conversations, policy efforts, and public awareness present opportunities to address the student debt crisis and potentially reduce its impact on the future.t.

Horizons of Knowledge: Exceptional Perspectives

Mastering the Art of Retirement: How to Start Saving for Retirement at 45 with Grace and Style

Investor Sentiment in the Stock Market: Maximizing Its Use

What is the Average Student Loan Debt in the US? Understanding the Crisis

Student Debt Crisis Solutions: Halting the Madness is Essential

Financial Freedom Reverse Mortgage: A Sophisticated Strategy for a Comfortable Retirement

Early Retirement Extreme: A Philosophical and Practical Guide to Financial Independence

Student Loan Refinance: A Smart Move Towards Financial Freedom – Poise in Debt Reduction

How to Lose Money: The Dangers of Ignoring Market Trends and Psychology in Stock Investing

How much has the stock market gone up in 2023? -A Refined Analysis

Maximizing Gains: Mastering Market Sentiment Indicators

How to Achieve Financial Goals: The Midas Touch for Your Financial Dreams

Sophisticated Strategies for US Dollar Index Investing: Elevate Your Forex Game

How much has the stock market dropped in 2023?

Visionary Views: How to Achieve Financial Freedom Before 40

A Major Problem with ESOPs is That Employees Can Lose Big

Dividend Investing Strategy: Your Path to Lasting Wealth