The Future Of Work

As stated in the last update, the Fed and its friends would do whatever it took to create the impression that shorting the market is a recipe for disaster. The idea as we stated was and is, to force every Tom, Dick and Harry to embrace this bull. One only has to look at Monday’s action to see how far they are willing to go

So, whatever rubbish they pump out in the news, this pullback will resolve itself sooner than later because the Fed and its allies will either come out with new policies to push more money into the markets or directly intervene by supporting the financial system. Market Update June 12, 2020

The Federal Reserve Board on Monday announced updates to the Secondary Market Corporate Credit Facility (SMCCF), which will begin buying a broad and diversified portfolio of corporate bonds to support market liquidity and the availability of credit for large employers.

As detailed in a revised term sheet and updated FAQs, the SMCCF will purchase corporate bonds to create a corporate bond portfolio that is based on a broad, diversified market index of US corporate bonds. This index is made up of all the bonds in the secondary market that have been issued by US companies that satisfy the facility’s minimum rating, maximum maturity, and other criteria. This indexing approach will complement the facility’s current purchases of exchange-traded funds. https://bit.ly/2YFDMrC

The Fed won’t allow the Market To Crash

The markets were pulling back nicely on Monday, and then the Fed comes out and makes that announcement and viola they reverse course. They are not even letting the Dow test the 23K ranges; at the very least by now it should have tested the 21K ranges. The Fed is hellbent, on making it so painful for the bears that the bears will either give up or sit on the sidelines waiting for the so-called perfect opportunity which will never come. In the end, these bears will end up turning into bulls, and that will mark the end of this bullish cycle, which will be followed by a so-called crash, which will then mark the birth of the next baby bull.

Dow futures jump 590 points

US stock-index futures were higher Tuesday morning, aiming to add to the previous day’s rally amid reports that President Donald Trump is backing a $1 trillion infrastructure spending package to add more fiscal stimulus to help the economy recover from the coronavirus pandemic. https://yhoo.it/3d6sgdP

We stated that some infrastructure package would be released because the COVID pandemic has given the Fed and the government the ability to create as much money as they want under the guise of trying to fix a problem that they created. See the ingenuity here. Create a massive problem and then offer to provide a solution while making the innocent pay for the tab. Look how many trillions of dollars they have created over the past 7 weeks and they will create even more if necessary.

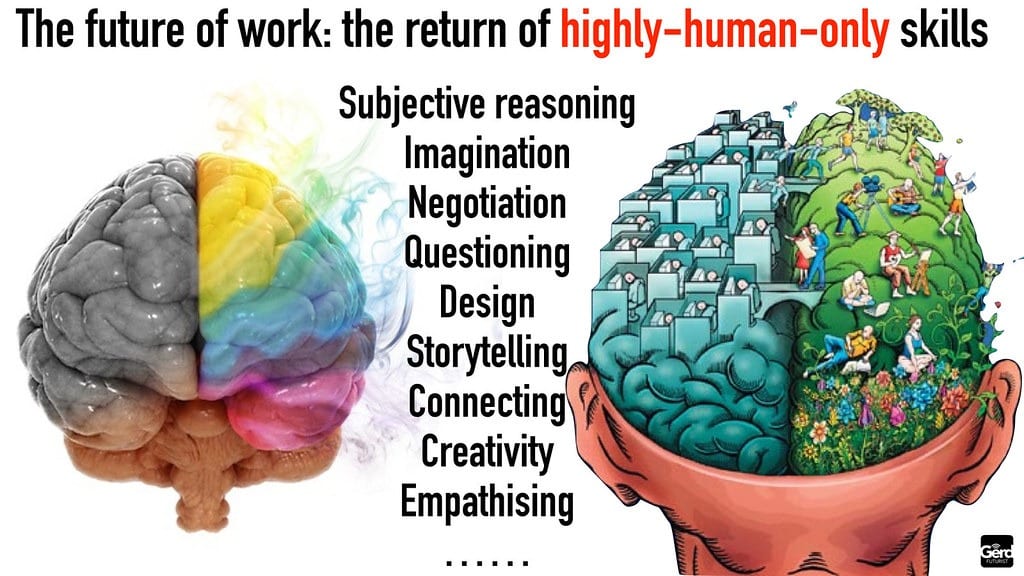

Notice something else; many people are losing their jobs or will never get their jobs back. As we stated recently, the most expensive component in any firm is the human component. So, if you can get rid of high paying jobs, and continue to improve efficiency with better machines. The net effect is deflationary despite the inflation generated from creating so many dollars.

The Future Of Work; It starts with remote working

They are pushing more and more people to work from home. Guess what happens next? If the job is done as well by workers working from home, then why do they need to be at home in the USA. See the next point; then, they will start talking about outsourcing these jobs or inform Americans that they have to work for less or work from another country for less. And this will occur on a global basis. Overall, the net benefactor from this action will be Asia, parts of Eastern Europe and limited portions of South America.

We will expand on this more. So, while America will be a good place to invest and will continue to prosper most workers regardless of the so-called high position they hold, will not fare well. In the Era of AI, it’s only the businessman and or the self-employed that have exceptional skills that will survive and thrive. Now there are always exceptions, and one way to make sure that you are invaluable is to make sure you keep ahead of the learning curve; in other words, you are very good at your job. The second option if you have a good job is to slowly explore the concept of being an independent contractor; sometimes, the benefits can be quite immense if this strategy is implemented well.

Fiat Money is Route to all Evil

As the money supply is going to keep increasing for the foreseeable future, we are reaching the point where it makes almost no sense to focus on stock market crashes. For in reality it is only a stock market crash if you bought in at the top, but if one started opening long positions during the prior crash, it should not be viewed as a crash but as the next buying opportunity. Market Update June 12, 2020

Monday’s action was confirmation that we need to change tactics. We spoke of this in the last two updates, and we are going to transition into this new strategy starting with this update. Monday’s action also seems to confirm that from an opportunity perspective, it is a waste of time to focus on the crash aspect of any cycle. Every stock market crash leads to the birth of a new bull market.

This was the first large scale manufactured crisis and the first time a bull was killed well before its time. And the crash was over before it even gained any traction. This action informs us that ensuing crashes which could be brutal in terms of intensity will not last long and most of the bears will be caught with their pants down as was the case with the coronavirus crash.

Other Articles of Interest

Mass Hysteria Coronavirus (July 3)

The Nyse Composite Index is signalling higher prices (June 18)

Bear Market History: Buy The Bear Sell The Euphoria (June 14)

Shorting The Market: An Endeavor with Poor Risk To Reward Profile (June 1)

Paradoxes: The Scorpion And The Frog (May 14)

Getting Even With China (May 6)

what is the stock market doing today (May 6)

Google Stock Price Projections For 2020 (April 28)

Stock Manipulation: Is It Good, Bad Or Inconsequential? April 28

CHKP Stock Price Target: What To Expect From CHKP in 2020 (April 28)

ABMD Stock Price Forecast for 2020 & Next Few Years (April 27)

Can Stress Kill You: Yes It Can & It Can Cause Chaos In Between (April 26)