Swedish Currency Outlook

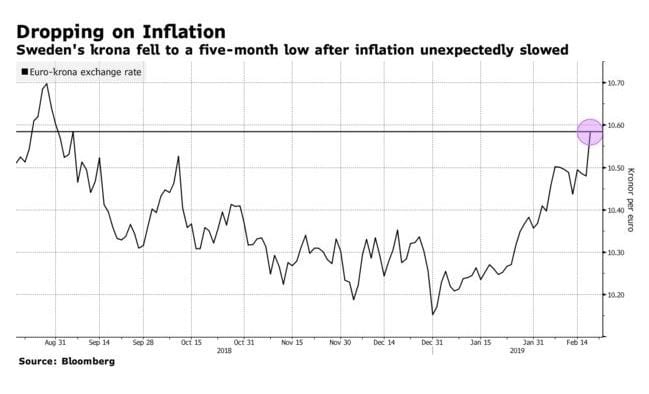

According to Bloomberg, the Swedish currency is one of the worst-performing major currencies. Let’s stop here for a minute as mass psychology states that when the masses despise something, some sort of turnaround is not too far in the making. The Krona has slumped to an 8-month low and the primary reason for this is supposedly inflation. Interest rates are negative; what this means is that if you get a mortgage the banks pays you interest for borrowing the money.

The latest numbers add to investor scepticism on the outlook for the krona, which is ironically forecast to return the most among the Group-of-10 exchange rates this year. The currency had its worst January since 1993 after retail sales and consumer confidence slumped in Scandinavia’s biggest economy.

“The last couple of months has shown that investors are somewhat reluctant to buy SEK, and this figure doesn’t change the negative sentiment,” said Kiran Sakaria, a strategist at Handelsbanken AB in Stockholm. “We expect inflation will pick up somewhat during the first half of 2019, and if we’re right that will lead to the markets pricing a higher probability of a rate hike this autumn and we will probably see a gradual strengthening of the krona.”

Danske Bank

- The inflation data was disastrous and it’s hard to find an argument for the Swedish currency to rebound versus the euro right now, other than it looks oversold versus the short-term models, said analyst Stefan Mellin.

- “We still not see a hike this year, but realize that there should still be a certain hike premium.”

- The next key data point is 4Q GDP next week, which could be another blow to the Riksbank; Danske Bank’s preliminary estimate is for growth of 1.2% y/y vs the Riksbank’s 1.7%. Bloomberg

Views from ING

“The outlook has clearly taken a turn for the worse,” said Jonas Goltermann of ING. The krona’s depreciation, which he said is in contrast to expectations from the Riksbank of a gradual appreciation, “is even more remarkable given the bounceback in risky asset prices globally during January, which would typically be associated with a stronger krona”, he said.

“The slowdown in residential construction that has been predicted since the end of 2017 is now underway and will lower growth by 0.5 percentage points this year,” stated Mr Holmgreen from SEB. He also cited weak household spending as an area of concern, and if that trend continues it could have an impact on consumer confidence. This, in turn, would provide the central bank with even less room to consider a rate hike. At the Tactical Investor, our focus is on the trend. The trend is currently neutral and once it turns bullish it would make sense to go long the Krona until then the best play is to sit on the sidelines.

Daily FX viewpoint on the Swedish Currency

Recent inflation data has been trending below the policy target rate of two per cent, lending credence to the notion that a hike may not be the outcome of this particular meeting. This is compounded by recent unemployment data that showed the number of those without a job jumped from 6.6 per cent to 7.7 per cent. The Swedish Krona plunged alongside local bond yields, hinting that the downbeat report inspired a dovish shift in policy.

The central bank has stated that it intends on raising rates in Autumn – more specifically in September. However, one needn’t look further than the benchmark OMX’s performance contrasted with Sweden’s economic activity to see that investors are not pricing in a hike any time soon. The almost-20 per cent rise in the index – ignoring the economic circumstances – suggests traders are expecting a continuation of the loose credit paradigm. daily fx

Tactical Investor Outlook on the Krona

Before we get to the technical outlook, here’s an excerpt we posted on an article title: Currency War and Negative rates

Don’t listen to the crap the Fed has been mouthing for months that all is well; we can already see the all is good slogan breaking down to “it’s not as good as we thought” slogan. This will eventually change to “oh my God it’s darn right ugly out there” and we need to lower rates to prevent a catastrophe slogan. The same strategy has been used again and again; it works marvellously so why stop now.

The masses like Pavlov’s dogs have been trained very well, so there is absolutely no need to change the game plan. Keep the lie simple, repeat it over and over again and the masses will swallow it hook line and sinker. Crowd psychology clearly illustrates that the mass mindset is self-destructive; individuals with this mindset claim they are looking for something better but their actions speak otherwise. We will cover this issue in more detail in a separate article.

The first experiment was to maintain a low rate environment; the second one was to Flood the system with money; this was achieved via QE. The third phase was to get the corporate world in on the act of flooding the markets with money. This was achieved through massive share buyback programs. The next stage is to introduce negative rates to the world to fuel the mother of all bubbles; this program is currently underway.

The Technical Outlook

We have a serious layer of interest that comes into play in the 9.60 ranges. A close above this level on a monthly basis means that the exchange rate will move from 9.50 to one USD to potentially as high as 11 to 1. Failure to close above this level on a monthly basis will result in a test of the main uptrend line or a pullback to the 7.60 to 8.10 ranges. Overall the trend for the dollar is still strong and it indicates that any rallies in the Krona, for now, will be brief in nature.

Other stories of Interest

Nickel Has Put In A long Term Bottom; What’s Next? (July 31)

AMD vs Intel: Who Will Dominate the Landscape going forward (June 28)

Fiat Currency: Instruments of Mass Destruction (June 18)

The Retirement Lie The Masses Have Been Conned Into Accepting (June 15)

Stock Market Bull 2019 & Forever QE (June 13)

Forever QE; the Program that never stops giving (May 31)

Trending Now News Equates To Garbage; It’s All Talk & No Action (April 24)

Americans Are Scared Of Investing And The Answer Might Surprise You (March 9)

Experts Finance Predictions for 2019

Stock Market Crash Stories Experts Push Equate to Nonsense (March 4)

Popular Media Lies To You: Don’t Listen To Experts As They Know Nothing (March 3)

Fiat Money; The main driver behind boom & Bust Cycles (March 1)

Permabear; It Takes A Special Kind Of Stupid To Be One (Feb 21)