Stock Market Forecast For Next 3 Months: Projecting the Future Trends

Updated March 19, 2024

Before embarking on the endeavour to forecast the stock market’s trajectory over the next 3 to 6 months or even making year-long predictions, it is imperative to solidify a foundational understanding of investing and trend analysis. Discerning genuine expertise from mere speculation is a crucial skill. As the saying goes, even a broken clock is right twice daily. Keeping in mind that knowledge is power, fortune favours the well-informed.

A wise investor once said, “Investing is the intersection of economics and psychology.” One must balance analytical prowess and emotional discipline to navigate the complex world of investments. It is essential to approach the markets with a level head, a solid grasp of fundamental principles, and a keen eye for emerging trends.

Let’s begin by debunking the notion of focusing on stock market forecasts for next three months. It’s essential to understand that investing is a long-term endeavour rather than a short-term gamble. Here’s a concise overview of critical aspects deserving your focus.

1. Mass Psychology: Understand the collective sentiment that drives market behaviour. Tap into the power of understanding how the majority thinks to gain an edge.

2. Contrarian Investing: Embrace a different perspective and seek opportunities where others fear to tread. Learn how to identify undervalued assets poised for potential growth.

3. Spotting Emerging Trends: Anticipate market shifts by identifying sectors poised for breakthroughs. Stay ahead by recognizing emerging trends before they become mainstream.

4. Identifying Strong Stocks: Building upon the previous point, after identifying new emerging trends, utilize complimentary tools such as finviz, bar chart, and other free services to pinpoint the most robust sectors. Subsequently, focus on identifying the most promising investment opportunities within those sectors.

5. The Basics of Technical Analysis (TA): Master the fundamentals of TA, a powerful tool for fine-tuning your entry and exit points. Enhance your decision-making process with technical indicators.

Silliness begets more silliness; it is astonishing to see how the masses still place so much faith in these silly forecasts when it has been proven, time and again, that most experts know next to nothing. Monkeys with darts fare better than most experts in the stock market; that should give anyone pause for thought

Navigating the Market’s Path: A Balanced View with Pragmatic Optimism

As we embark upon the journey of 2024, the intricacies of the stock market’s direction capture our attention. In a year marked by surprises, a sense of optimism is woven into the fabric of financial prospects, hinting at a potentially robust bull market. The outlook appears promising, with current bullish sentiment on the rise, surpassing historical averages.

However, it’s essential to heed the wisdom of John C. Bogle, who reminds us that the stock market can often distract from the true essence of investing. Forecasts, though educated, remain subject to various unpredictable factors. As we enter the first quarter, signs of impending volatility emerge, suggesting a delicate dance for significant indices.

This anticipated turbulence, akin to the natural rhythm of market cycles, will present opportunities amidst challenges. As Machiavelli might suggest, crises offer a chance for strategic manoeuvring.

Deciphering the Stock Market Outlook: Forecasting the Next 3 Months

Let’s dive into the heart of the matter. Looking at the current state of the markets, one might expect a significant downturn. This conclusion makes sense, given how stretched the markets seem. However, we believe there’s more to consider. First, let’s see what other market analysts say about the situation. Then, we’ll share our insights, suggesting this issue has more complexity than meets the eye.

If you base your analysis mainly on technical factors and, to some extent, fundamental factors, you could argue that a downturn is on the horizon.

From a technical perspective, almost all major indices, except perhaps the Russell 2000, are trading extremely high on both weekly and long-term monthly charts. This could indicate a less-than-ideal scenario, especially since the Advance/Decline (A/D) line hasn’t confirmed the recent highs.

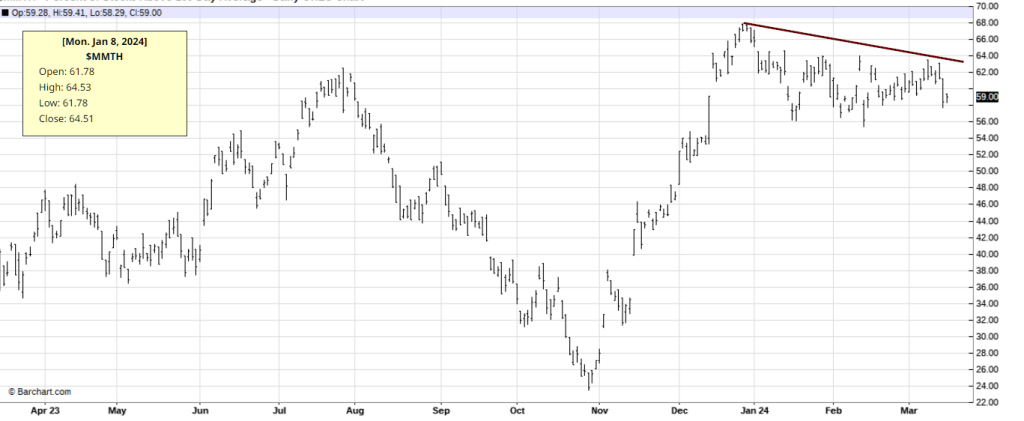

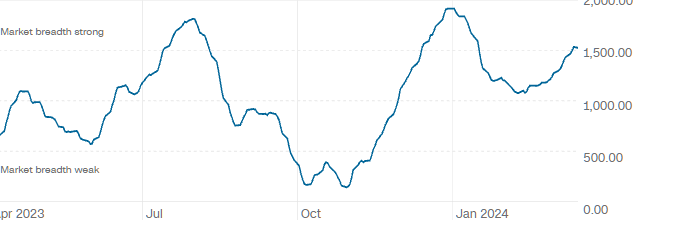

Moreover, the percentage of stocks trading above their 200-day moving average was higher in December 2023 than at any point in 2024 (see first image below). Combined with the fact that the McClellan Summation Index peaked in January 2024 (see second image below), these indicators could support the notion of a sharp pullback/crahs in the near future.

Courtesy of cnn.com

In summary, although the market seems stretched, many technical and fundamental indicators hint at a potential downturn. Yet, as Machiavelli would counsel, a savvy investor must delve deeper. It’s essential to exploit the fears and vulnerabilities of others, seizing opportunities amid market upheaval. Remember, fortune favours the bold and those who adapt swiftly to change.

Market fundamentals paint a nuanced picture. The inverted yield curve, where long-term debt instruments yield less than short-term ones, often foreshadows an economic downturn. This, coupled with concerns about inflation, breeds uncertainty. The mixed bag of inflation data suggests the Federal Reserve may postpone rate cuts, further clouding the outlook.

Investor behaviour also reveals a shift towards defensive sectors like utilities, signalling potential market turbulence as investors seek safer havens during volatility.

The tech-heavy Nasdaq, heavily influenced by a handful of stocks dubbed the ‘Magnificent Seven,’ tied closely to the AI sector, exudes market euphoria akin to speculative bubbles.

Moreover, Bitcoin’s meteoric rise in the past year hints at rampant speculation. Bitcoin’s notorious volatility raises concerns about another impending bubble.

However, while these technical and fundamental factors hold merit, they offer an incomplete view. A critical element is absent from this analysis, which we’ll explore shortly. If you’d like to jump ahead, feel free to scroll down. But first, let’s delve into the factors mentioned above.

The Monthly Chart of the Dow Jones Utility Index

This monthly chart depicts the utilities sector, showing an upward trend that has yet to break past the downtrend line. A monthly close at or above 879 is required for a bullish outlook. However, the belief that a market crash would follow if utilities rise lacks evidence. According to the Tactical Investor-modified Dow theory, a breakout by the DJU signals bullishness, albeit with a delay. Thus, while markets may see pullbacks, a crash is improbable until the missing element emerges.

Concerning worries about higher rates and an inverted yield curve, this narrative lacks substantiation thus far. In brief, it’s not yet confirmed. Regarding euphoria, there’s no widespread exuberance among the masses, although sectors like AI and Bitcoin may show some enthusiasm. Nevertheless, this doesn’t justify a market crash. In the worst-case scenario, these sectors might face a larger pullback, with other sectors stepping in to fill the gap, as observed throughout history.

What’s the elusive piece of the puzzle?

Looking back, it’s clear that investor confidence was subdued for the better part of 2022 and into 2023. The recent surge in enthusiasm is notable, but we’ve seldom seen the bullish sentiment firmly hold at or surpass 55 for two straight weeks. It peeked at this mark in December 2023 but hasn’t returned since. Just last week, it grazed 54, only to dip back under 50 this week, standing now at 49.

If it isn’t already apparent, we’re missing a critical insight from Mass Psychology. It tells us that without the collective joy of the crowd—that sense of market euphoria—the likelihood of a market crash remains low despite other contributing factors. To reach a state of collective jubilation, we’d need to see bullish sentiment consistently stay at or above 56, with a couple of spikes reaching 60 or more. To solidify this view, we’ll also look to our anxiety index, trend indicator, and other analytical tools for confirmation. Until such conditions materialize, any market dips should be viewed with an optimistic perspective, no matter how steep.

Warren Buffett’s wisdom rings true here: “Be fearful when others are greedy, and greedy when others are fearful.” The current market sentiment suggests that greed hasn’t fully taken hold, indicating continued potential for growth. And to echo Peter Lynch, “The key to making money in stocks is not to get scared out of them.” So, in the face of corrections, maintaining a bullish stance could be the shrewd move for those playing the long game in the market.

General Investing Insights: Stock Market Forecast for Next 3 Months

While some may argue that there is no magical formula to ensure success, they are mistaken. There is no magic but a straightforward and commonsense procedure combining mass psychology with elementary technical analysis. Essentially, this formula suggests that one should buy when the crowd is in a state of panic and sell when they are ecstatic. Now, combine this with simple technical analysis involving long-term charts.

Models and theories seeking to explain investor behaviour have similarly focused on factors like sentiment, risk appetite, and credit availability. Behavioural economists have developed various frameworks to capture the herding dynamics and emotional heuristics that drive bubbles and busts in financial markets. However, accurately predicting swings in collective market psychology remains challenging due to the contingent nature of human emotion.

When the group is anxious and the markets are trading in a highly oversold range on long-term monthly charts, it’s time to establish long-term positions in excellent companies. Over the long term, there is not a single bear, whether alive or deceased, who can claim that shorting the markets is the recipe for long-term success. Adopting a formula based on buying when others are fearful facilitates buying low and selling high, allowing you to embrace the trends driving wealth creation for patient investors.

Revealing Market Trends: A Journey from Novice to Expertise

One of the biggest mistakes made by novice investors, and even those who have spent considerable time in the markets, is failing to learn and educate themselves truly. Merely absorbing useless news or blindly following other people’s trading ideas does not lead to growth. It’s crucial to remember that what works for someone else may not work for you. Your risk profile, mindset, and discipline (or lack thereof) are unique; thus, you must develop your customized strategy.

Incorporating ideas from successful traders into your trading style can be beneficial, but blindly following their every move will eventually lead to losses. Instead, please keep it simple and focus on the Trend, technicals and mass sentiment. Novice traders should start by identifying the trend. Investors better understand the market’s performance and direction by analysing long-term trends and patterns. This enables them to make informed decisions rather than relying on guesswork or hearsay.

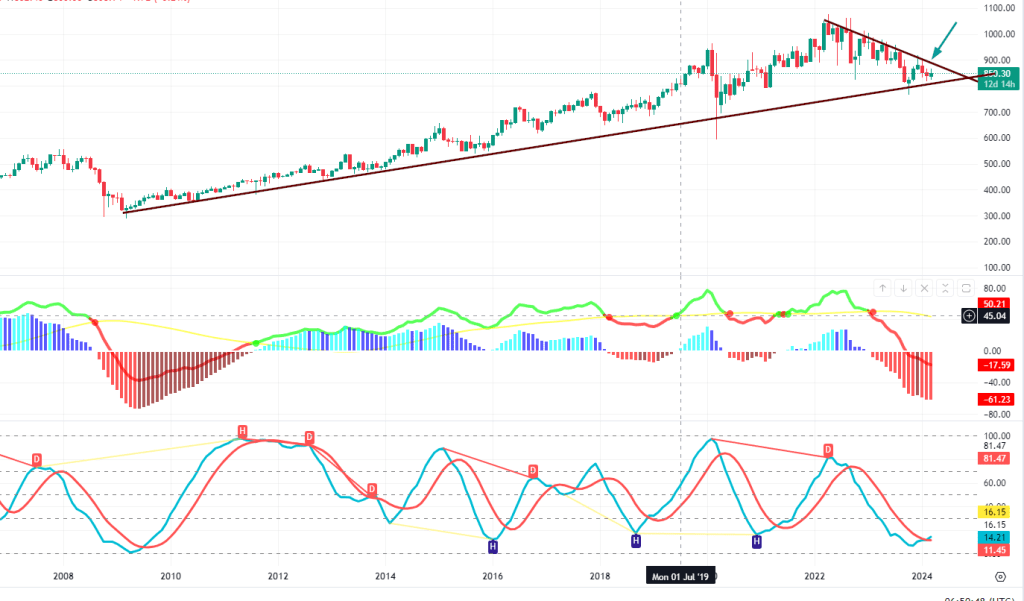

When analyzing trends, pay close attention to the V readings (market Volatility) displayed in the accompanying image. These readings offer valuable insights into market volatility, aiding investors in anticipating potential shifts. While the current market may be at an all-time high, monitoring the trend and watching for signs of stability or decline remains crucial.

Remember, the key to success lies in developing your personalized strategy. Invest time learning, adapting, and growing, and you’ll be on your way to achieving your financial goals in the markets. Remember, the trend is your friend; everything else is rubbish or noise.

As we delve deeper, we’ll anchor our analysis in historical context, heeding the age-old wisdom that ignorance of the past may lead to future missteps. In step with Plato’s belief in learning as a safeguard against error, we strive to embody the lessons of yesteryear, ensuring our actions reflect the knowledge we’ve gained.

Navigating Market Trends: Insights into Future Developments

In today’s market, well-capitalized institutional investors and large players can significantly influence short-term trends due to their substantial financial resources. However, their power is generally limited in altering long-term trends. Therefore, it is prudent for investors to focus on the long term when making investment decisions.

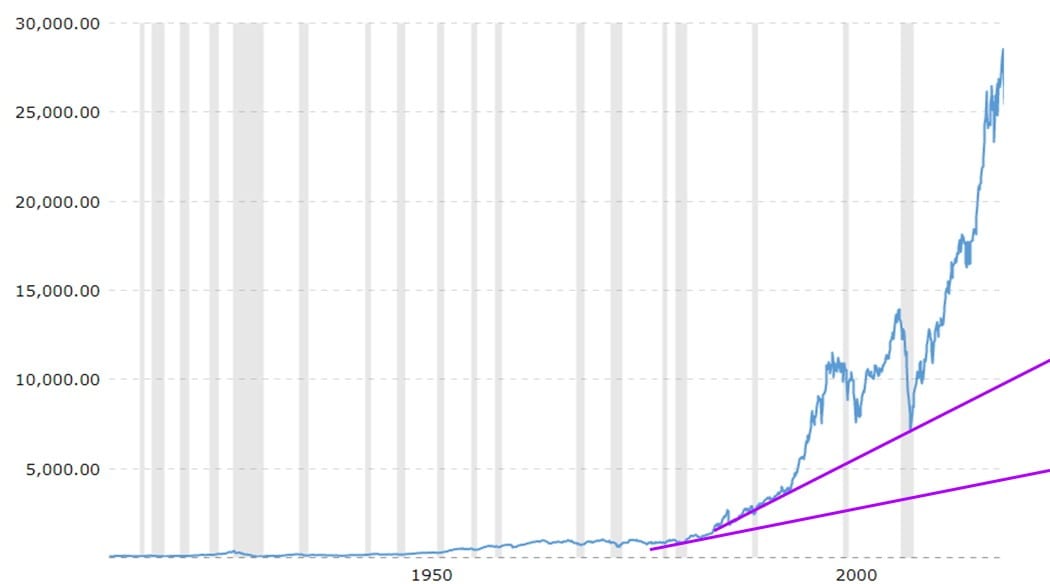

Viewing substantial pullbacks through a bullish lens can be a valid approach, as pullbacks in the market can present buying opportunities. However, developing the ability to discern between ordinary and robust pullbacks is essential. This can be done by analyzing long-term charts and drawing trend lines.

Drawing a trend line can help identify significant support levels when analysing a long-term chart. If the market tests or dips slightly below the trend line, it can be considered a potential buying opportunity, especially when accompanied by bearish sentiment readings trading above 55. It’s worth noting that such occurrences are infrequent on charts with extensive data, so it is crucial to act swiftly when they happen.

For longer-term charts spanning 15-20 years, the long-term trend line may be tested more frequently. This means there may be more opportunities to consider buying when the market dips below the trend line.

However, it is crucial to remember that no strategy or approach can guarantee success in the stock market. Many factors influence market behaviour, and inherent risks are involved in investing. It is wise to conduct thorough research, consider various indicators and aspects, and diversify investments to manage risk effectively.

While well-capitalized institutional investors can influence short-term trends, focusing on the long-term is often prudent. Differentiating between ordinary and strong pullbacks can be done by analyzing long-term charts and trend lines. When the market tests or dips below a long-term trend line, accompanied by bearish sentiment readings, it may present a potential buying opportunity. However, it is essential to remember that investing carries risks, and no strategy can guarantee success. Conducting thorough research and diversifying investments are imperative elements of a well-rounded investment approach.

Profit from Panic: Buying Amid Market Uncertainty

The best time to invest is when the masses are scared and the markets act erratically. While this may sound counterintuitive, a contrarian perspective reveals that the period of stress and chaos that many investors fear can often be the perfect opportunity to make a move.

We have encountered various market phases throughout history, each with distinct characteristics. It all began with the dot-com boom and subsequent bust cycle, followed by the housing crisis. Shortly after, we experienced a brief yet highly volatile period when Donald Trump won the elections. The most recent rollercoaster ride was the COVID-19 crash of 2020.

Our steadfast approach to adopting a bullish perspective has consistently yielded positive results throughout these episodes. Many of our subscribers witnessed their portfolios more than doubling in value as a direct outcome of our bullish stance during the COVID-19 crash. We explicitly advised them to rejoice and celebrate because this crash presented an extraordinary, once-in-a-lifetime buying opportunity. But for those who were disciplined and patient, it was a time of opportunity.

Regarding the markets, discipline and patience are paramount to success, and right now, patience is called for. While the active players may be driving a bullish trend, a contrarian perspective demands caution and a more measured approach. Investors can confidently navigate the current market and make more informed decisions by waiting for opportunities to arise and avoiding impulsive decisions. By remaining disciplined and patient, investors can take advantage of market fluctuations and make sound investment decisions. So, rather than following the masses, take a contrarian approach and wait for the right opportunity to come your way.

Patience: The Key to Accumulating Wealth as an Investor

The impatient investor or trader that overtrades would be better served by investing their money in an index fund and spending leisure time guzzling beer or mowing the lawn. Fortune does not favour the foolish, so despite receiving numerous emails urging us to adopt a more aggressive stance, we must disagree. We did not follow the playbook of the masses, and were we to do so? We would not be here, still standing, after more than 18 years. That said, we will continue to issue entry points on stocks we deem excellent long-term prospects.

The same people now asking us to take a more aggressive stance were those who panicked when we advised them to buy during the COVID-19 crash. Once again, we ask: why do you want to purchase when caution is advisable, and why do you panic when it is time to buy? The truth shall set you free, but it will cause you considerable anguish before it does. And do keep in mind that if you append an “O” to “Hell,” you get “Hello.” Only the patient investor makes money; the impatient investor or the one that overtrades would be better served if they put their money in an index fund and allocated their free time to drinking beer or mowing the lawn. Tactical Investor

Click the link below for a historical view of our 2023 stock market forecast for the next 3 months. Explore insights and past predictions.

Stock Market Forecast for next three months: Historical outlook

Feed Your Intellect: Interesting Reads

Quantitative Easing: Igniting the Corruption of Corporate America

Uranium Market Outlook: Prospects for a Luminous Growth Trajectory

Stock Investing for Kids: Surefire Path to Success!

An Individual Who Removes the Risk of Losing Money in the Stock Market: A Strategic Approach

Palladium Forecast: Unveiling the Stealth Bull Market

I Keep Losing Money In The Stock Market: Confronting the Stupidity Within

Is Value Investing Dead? Shifting Perspectives for Profit

Analyzing Trends: Stock Market Forecast for the Next 6 Months

Example of Groupthink: Mass Panic Selling at Market Bottom

Contrarian Thinking: The Power of Challenging the Status Quo

Mastering Technical Analysis Of The Financial Markets

Unraveling the Enigma: The Dark Allure of Mob Mentality

Contrarian Outlook: A Pathway to Breakthrough or Breakdown

Financial Freedom Book: A Pinch of Salt, a Splash of Whiskey

Unleashing the Power of Small Dogs Of the Dow

References

The Crowd: A Study of the Popular Mind: Gustave Le Bon

Five warning signs of market euphoria: Investopedia

Why people lose money in the markets: The Balance

What is mass hysteria: Medical News Today