A Guide to Choosing the Top Stocks to Buy Now

Updated March 2023

To achieve long-term gains in the stock market, it’s essential to focus on the condition of the market and determine the underlying trend before identifying the top stocks to buy. Many investors make the mistake of buying outstanding stocks at the wrong time, leading to significant losses. Timing is critical, but it’s not about market timing. Instead, it’s about understanding the market’s direction and waiting for the right time to make a move.

While it’s easy to make a list of the best stocks to buy based on high relative strength ratings, buying these stocks at the wrong time can be detrimental. To avoid this, focusing on the best time to buy stocks is crucial, not just the best stocks to believe in. By doing so, investors can increase their chances of achieving long-term success in the market.

Timing is Key: Mastering the Best Time to Buy Top Stocks

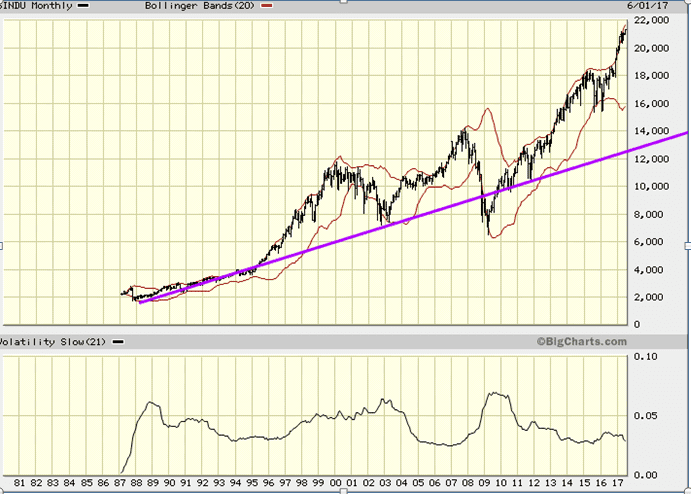

It’s important to note that when using standard deviation bands to gauge the deviation factor of the market, the greater the deviation, the better the buying opportunity. This is best seen with a setting of 3 standard deviations from the norm, which many software programs on the market can automatically fill in.

When the market touches these ranges, and the trend is up, it’s a great opportunity to buy. On the other hand, when the market touches the -3SD bands and the trend is up, it’s time to start going long with a list of the best stocks to buy.

To find these stocks, you can use any screener, such as Finviz or Yahoo stock screener. Focus on companies with high relative strength and strong sales to increase the chances of long-term gains. Timing is critical, and understanding the market’s underlying trend is key to successful investing.

While Big Charts may have limitations with regards to standard deviation settings, it’s still possible to identify buying opportunities by looking at historical market trends. For example, the market crashes of 2003 and 2009 provided excellent buying opportunities for investors who had a long-term perspective and were willing to take on some risk.

These opportunities proved the validity of the principle that the greater the deviation, the better the buying opportunity. If the trend is up, it’s almost a green light to back the truck and load up on strong stocks that have high relative strength and strong sales.

Timing Matters: Best Time to Buy is After a Market Crash

But how do you get out of the market at the right time? First, forget about trying to time the exact top; instead, focus on the emotion. When the crowd turns euphoric, it is time to take money off the table and tighten your stops.

The current bull market is mature and has continued to trend higher despite the nervousness of the crowd. Many individuals believe that this market cannot and should not trend higher, which is precisely why it is likely to continue to trend higher. For the past two years, it has been predicted that this bull market would trend higher than even the most ardent of bull expectations, and it seems that this prediction has come to fruition.

V Readings still at dangerous levels

The V readings are a proprietary sentiment indicator that tracks the degree of bullishness or bearishness in the market. The fact that they remain unchanged for an entire month is unprecedented and may suggest a possible correction in the near future.

However, until the V readings start to move, we can expect market volatility to continue, driven by various factors such as weather and human behavior. Furthermore, the current environment of heightened politics and sensationalized news may add fuel to the fire, creating even more market turbulence. It’s important to remain vigilant and keep an eye on market indicators to make informed investment decisions

History never changes; the markets will experience one very strong correction before this bull keels over. The problem is that the masses have been waiting for a strong correction since roughly 2013. The ironic part is that the markets will pull back firmly, but most likely, they will be trading at a higher level than they were in 2013. In 2013 the Dow was trading in the 12,800-13,000 range. Market Update June 18, 2017

The future intensity of any correction can only be guessed until the trend turns negative. However, if V readings exceed 4200, markets may overcorrect as they have done in the past. Fiat currency remains dominant, and any new financial disaster will likely receive more monetary injections, ultimately leading to new all-time highs.

The Fed’s primary agenda is to create boom and bust cycles, evident throughout history. As the money supply continues to increase, the intensity of these cycles may also increase.

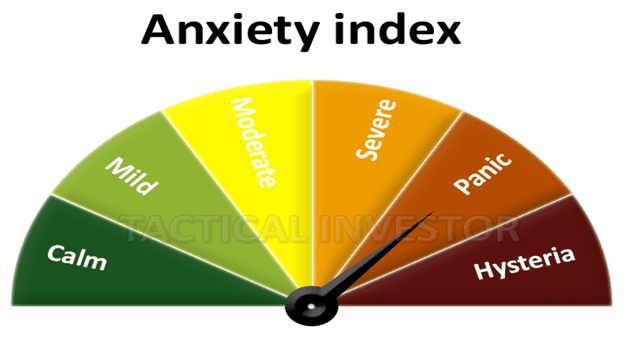

Stock market Investment Hysteria on Display

New Thoughts Jan

A lot of noise was made over the strong correction in the last quarter of 2018. Permabears were proclaiming the dawn of a new era and that investors should prepare for a stock market crash. As usual, their advice was akin to rubbish, and their already bruised egos were the only thing that crashed.

Months and years from now, many will look back with frustration and despair as to why they fled for the hills instead of embracing the pullback. These sorrowful pleas are always the same and sound something like this: “We wish we bought stocks when they were trading at such a discount, and we promise never to make the same mistake again if given a chance.”

However, the power of the herd mentality is too much for the masses to resist; they give in to their will, and do the very thing they promised never to repeat again, and hence begins the cycle of destruction and creation.

To break the cycle of fear, it’s essential to understand that it’s a useless and weak emotion. Recognizing this, you can formulate an immunization plan to overcome it. Despite the solid counter rally in the markets, bullish sentiment readings have not risen further and remain at historical averages, with neutral readings trending upward. When neutral readings are in the 48-52 range, the market has never failed to rally. While unnecessary due to other bullish developments, continuing this trend could reinforce the argument for Dow 30K. It’s crucial to view anxiety and mass hysteria through a bullish lens when the trend is up.

To break the cycle of fear, it’s essential to understand that it’s a useless and weak emotion. Recognizing this, you can formulate an immunization plan to overcome it. Despite the solid counter rally in the markets, bullish sentiment readings have not risen further and remain at historical averages, with neutral readings trending upward. When neutral readings are in the 48-52 range, the market has never failed to rally. While unnecessary due to other bullish developments, continuing this trend could reinforce the argument for Dow 30K. It’s crucial to view anxiety and mass hysteria through a bullish lens when the trend is up.

Article Overview and Summary

Before diving into buying stocks, it’s crucial to understand the best time to buy. The market condition plays a significant role in determining long-term gains or losses. Don’t just focus on the best stocks to buy but the best time to buy them.

Timing is Key

Identifying the underlying trend is important and not focusing solely on market timing. When the market touches the -3SD bands and the trend is up, it’s an excellent opportunity to buy. Use screeners to find companies with high relative strength and strong sales.

Timing Matters

It’s best to buy after a market crash when the deviation is the greatest. Pay attention to the trend and sentiment indicators to get out at the right time. Avoid trying to time the exact top and instead focus on the emotions of the market. Take money off the table and tighten your stops when the crowd turns euphoric.

Don’t give in to herd mentality and fear. Fear is a weak and destructive emotion. Neutral readings trending upward signal a market rally, and anxiety should be viewed through a bullish lens when the trend is up.

In summary, don’t solely focus on the best stocks to buy but on the best time to buy them. The market condition plays a significant role in determining long-term gains or losses. Use screeners to find companies with high relative strength and strong sales, and buy after a market crash when the deviation is the greatest. Mastering the best time to buy is crucial to achieving long-term success in the stock market.

Stock Market Blues? The easy trade is over

Semiconductor Industry News: Key Technical Developments

Unveiling the 1929 Crash Chart: Decoding Market Turbulence

The Dynamics of Bull & Bear Markets: Mastering Trend Analysis

Negative Thinking: How It Influences The Masses

The Limits of Herd Behavior in Markets

Lagging Economic Indicator: Understanding Its Significance

Semiconductor Outlook: Trends & Future Expectations

Trading Journal: The invaluable tool for traders

Stock market experts know Nothing

Best Investment Ideas; Focus on the strategy first

Fed Chair Jerome Powell: The Eccentric

Dow 2008 Crash: Explosive pattern or Impending doom

Technological Progress

Intelligent Investing: Harnessing the Power of Data

ily