Social Unrest and Fiat are Interlinked

Updated Dec 2022

Look at the chart below and notice how the masses have become increasingly aggressive. What’s the common theme? Fiat. Throughout all this time, the money supply has continued to increase, and the net effect is that we have an utterly polarized world. So today’s social unrest is simply a manifestation of a bigger problem. A problem that seems deeply rooted in inequality, and the charts below clearly indicate that as the money supply has risen, only the very few at the top have benefited.

For deep-down most individuals know that no matter how hard they work, they will not be able to make as much as the elite. For example, the average CEO now makes 361 times more than the average worker.

Last year, CEO pay at an S&P 500 Index firm soared to an average of 361 times more than the average rank-and-file worker, or pay of $13,940,000 a year, according to an AFL-CIO’s Executive Paywatch news release today.

Despite increasing protests from unions and consumer groups, the average CEO pay climbed 6% last year. Meanwhile, the average production worker earned just $38, 613, according to Executive Paywatch.

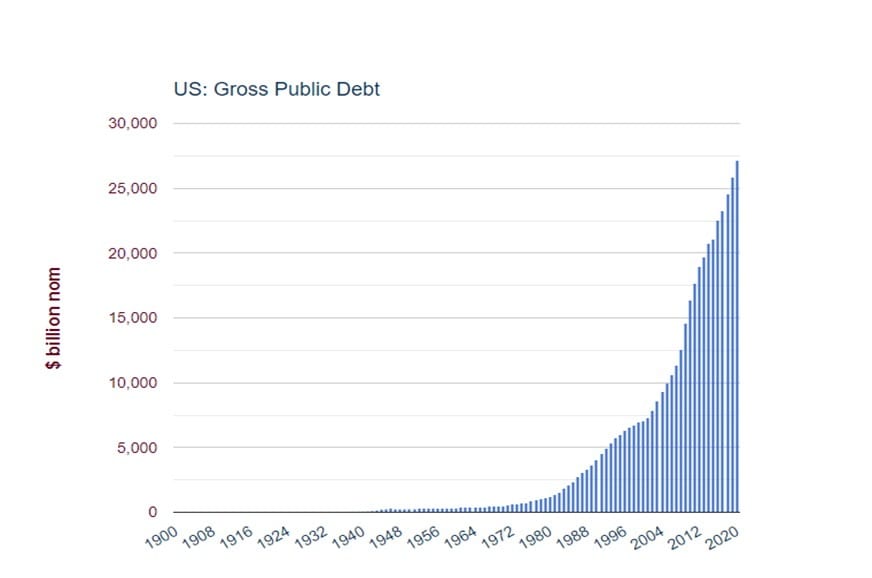

Is that fair yet the public debt keeps rising, and the average worker’s share of this debt rises, but his/her paycheck is not keeping up with inflation? Is it any wonder, then, that there are so many disgruntled individuals?

Source: www.usgovernmentspending.com

CEO compensation has grown 940% since 1978

In 2018, the average CEO pay at the top 350 firms stood at $17.2 million, or a more conservative estimate of $14.0 million when considering stock options. CEO compensation is significantly higher compared to the typical worker, with a ratio of 278-to-1 or 221-to-1. This is a stark contrast to the CEO-to-typical-worker compensation ratio of 20-to-1 in 1965 and 58-to-1 in 1989. CEOs are earning about five times more than the top 0.1% of earners. From 1978 to 2018, CEO compensation witnessed a staggering growth of 1,007.5% (940.3% based on options realized), surpassing the growth of the S&P stock market (706.7%) and the wages of high earners (339.2%). In comparison, the wages of the average worker grew by a mere 11.9%.. EPI.org

Social unrest is due to an unfair economic landscape

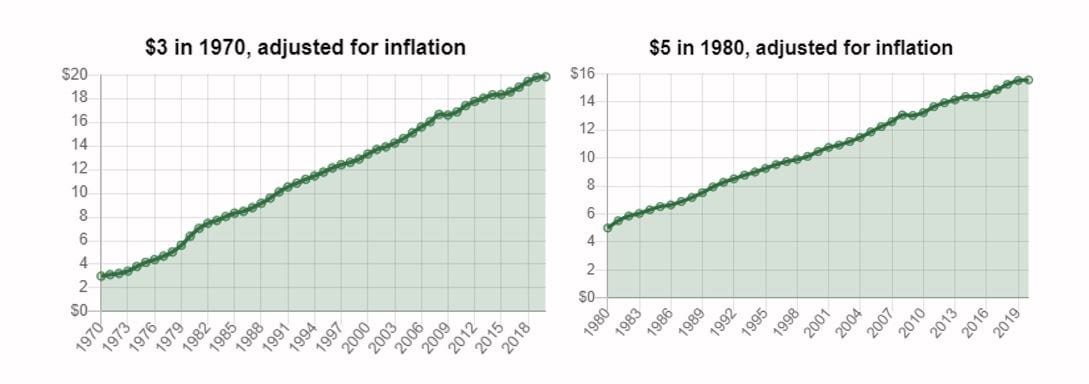

The only way to keep inflation in check is to enslave large portions of the populace. You destroy industries, and you wreak just enough havoc to create the impression that everything is about to fall apart, but the only thing that falls apart is another chunk of the middle to upper-middle class; these guys now join the ranks of the poor. They are now forced to work in sectors that pay less. When you factor in inflation a $15 per hour job still pays a lot less than $3 an hour in the 1970s or a $5 per hour job back in the 1980s.

The Fiat Trap: Unleashing Hot Money, Immoral Behavior, and Civil Disorder

Fiat is the root of all evil, and with this much hot money flooding, the world once can expect a massive surge in immoral behaviour, and civil disorder is going to become the new norm. Hence expect to see things you have never seen before.

So you can see how cunning the guys at the top are. They create the impression that they are paying you more, but when inflation is factored in, you get nothing. This is how the Fed will keep inflation in check, and this is the game the Gold bugs have not figured out yet. They are focussing on the absolute definition of inflation, which is an increase in the money supply, but the Fed is 10X smarter than its given credit for. They were smart enough to provide the patient with sufficient medicine to prevent the symptoms of the disease from manifesting. The symptom of inflation is an increase in prices, and they controlled this by only including a particular basket of goods in their equation.

Why would they do this?

The answer is obvious because they can manipulate those sectors freely. This is why farmers are dumping millions of gallons of milk as they no longer want to lower the price. However, milk in the store still costs quite a bit. Why is this? Because of the middlemen, they make more money than the farmers. AI will change this. Suddenly, these middlemen will be killed, and farmers can sell their products directly to supermarkets or individuals. While everyone will celebrate and call this a fantastic win, guess what? It will be another force of deflation, and this will allow the Feds to increase the money supply even more. The Fed’s are not master chess players but master Go, players.

While we will have bouts of inflation (rising prices), the overall long-term trend for inflation is down, and that’s because machines will keep replacing humans, forcing prices to drop and allowing governments to control a larger swath of the population.

According to the daily beast, things will worsen.

As the demands for racial justice resonate across the nation, lawmakers increasingly recognise the necessity of addressing a significant underlying issue that amplifies the protests: widespread economic inequality that has disproportionately impacted black communities.

This enduring inequality has been further illuminated by the circumstances surrounding George Floyd’s tragic death. The fact that Derek Chauvin, his killer, detained him over an alleged counterfeit $20 bill underscores the deep-rooted disparities. Additionally, the COVID-19 pandemic has exacerbated the situation, with individuals from marginalized communities, predominantly low-wage workers of colour, bearing the brunt of the crisis. These communities have faced severe consequences, including the devastating impact on minority-owned businesses and the surge in unemployment.

What’s The outlook for the dollar

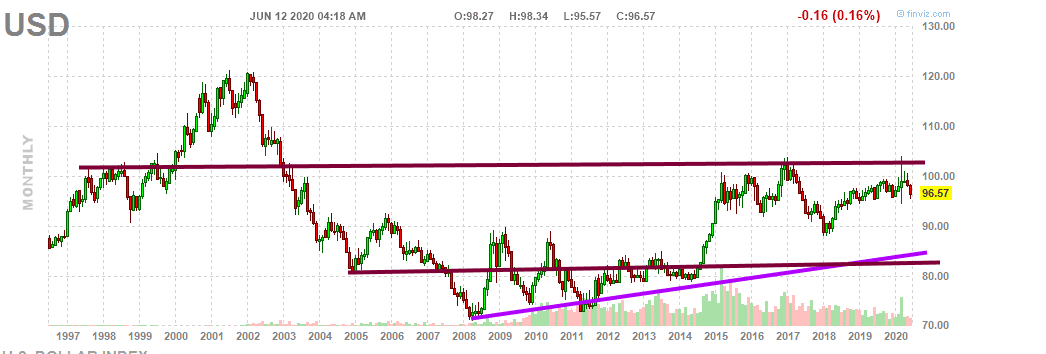

By logical reasoning, the value of the dollar should decline as the Federal Reserve is injecting significant amounts of money into the economy. However, it is important to consider that the Fed’s actions have compelled most other nations to adopt similar strategies. Another argument that could be raised is the high level of US debt. Nevertheless, this argument could have been made many decades ago when the deficit was less than a billion dollars.

In comparison, the total debt around 1901 stood at 4.1 billion dollars, highlighting that today’s debt levels are already staggering. It all boils down to perspective. Presently, we live in an era where the majority of people are oblivious and disengaged, resembling a state of deep slumber. Therefore, as we have mentioned previously, they are unlikely to take notice of anything until the debt reaches the astounding mark of 100 trillion.

The US dollar is trading in a wide channel formation. Notice that when Greenspan increased the money supply, instead of the dollar losing its value, it surged, so there goes the hard money argument. The most illogical analysis would be to suggest that the dollar is building a base to rise to new highs: that would be utterly preposterous. And that is why this outlook is more likely to come to pass than the one that states the dollar is destined to crash.

In the interim Competing currencies are expected to outperform the dollar.

During the intermediate time frames, the dollar is expected to continue consolidating. Currencies such as the Australian dollar (Oz dollar) and the Canadian dollar (Loonie) are likely to perform better than the USD. However, suppose the gains one can achieve from investing in the US markets are one of the main factors. In that case, the profits may not be significant unless equally strong stocks in Canada or Australia are also invested in.

The dollar is anticipated to reach its lowest point and start trending higher once the current consolidation phase is complete. A monthly close above 105.00 will open the way for the dollar to test the range of 116.70 to 118, with a strong possibility of trading at or even surpassing 120.00. Many people overlook the impact that AI and AI-related technologies will have on earnings as we progress, and the United States dominates this sector. Let’s not forget about the medical industry, particularly the biotech sector, where AI will be utilized to develop numerous new life-extension therapies. The narrative that the dollar is doomed, circulated for over five decades, is becoming outdated. Unfortunately, the likelihood of gold enthusiasts witnessing a surge beyond 5K is quite slim.

For them, a “day in the Sun” refers to gold surpassing 5K, but currently, it is challenging to envision gold trading above 2.5K, which is an extreme target. Precious metals, when viewed from a long-term perspective, will likely continue to trend upward. Therefore, allocating a portion of one’s cash to bullion is acceptable. However, staking everything in this sector indicates that one might need a reality check.

Originally published June 16, 2020

Stories To Stimulate The Mind

Stock Buying Opportunity Courtesy Of Coronavirus (May 31)

Market Trends: Focus on Fact And Not Fiction (May 30)

Insider Buying And The Coronavirus Pandemic (April 24)

Market Correction 2020; Long-Term Trend Still Intact (April 15)

Stock Trends & The Corona Virus Factor (March 14)

Misdirection And Upcoming Trends For 2020 And Beyond (March 13)

Trading The Markets & Investor Sentiment (March 3)

Brain Control: Absolute Control Via Pleasure (Jan 20)

Indoctrination: The Good, The Bad and the Ugly (Jan 15)