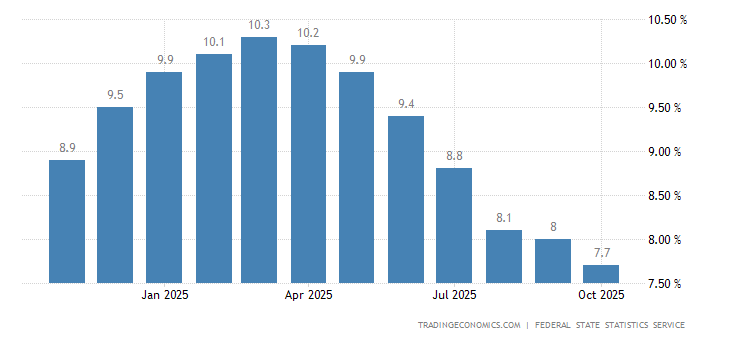

Russian Inflation

For a long time, we have been stating that the Sell-off in both the Ruble and the Russian stock market provided the astute investors with a great long-term buying opportunity. The Chart below is clear proof that the outlook is improving and that the Sanctions that the West imposed on Russia at the behest of America was a stupid idea, but more importantly, it has made Russia even stronger. The chart below is proof of this, inflation is down over 50% year over year. Translation things must be getting better.

An Updated Chart Illustrating Russian Inflation Is Trending Downwards

The annual inflation rate in Russia decreased to 4.6 per cent in July of 2019 from 4.7 per cent in the previous month and in line with market expectations. It was the lowest inflation rate since December of 2018, mainly due to lower services prices. Full Story

However, economic growth is still not as robust as originally projected

A summary of the World Banks Report Indicates things are improving albeit slowly

The real GDP growth in Russia surpassed expectations in 2018, reaching 2.3 per cent, mostly due to one-off effects of energy construction. Forecasted growth of 1.2 per cent in 2019 and 1.8 per cent in 2020 and 2021 reflects a more modest outlook.

Russia’s macro-fiscal buffers remain strong, with fiscal surpluses across all tiers of government and low public-debt levels. When compared to advanced economies, Russia spends less on health and education. Rebalancing in favour of these categories could improve the overall efficiency of public spending. Short-term inflationary risks have abated, with the Bank of Russia signalling a return to a neutral policy rate.

Lending activity is recovering, but the banking sector remains afflicted with high concentration and state dominance. Having eased slightly, the poverty rate remains in double digits with many households close to the poverty line and lacking formal employment. Informal employment is rising in the face of close-to-zero net job creation by medium-sized and large formal enterprises.

Key risks to medium-term growth include the expansion of economic sanctions, renewed financial turmoil in EMDEs, a dramatic drop in oil prices, and souring of the global trade environment. The recent double-digit expansion in household credit may also pose a risk to financial stability in the case of a deterioration in the macroeconomic environment. Full Story

How To Benefit From Lower Russian Inflation

There is a saying that one should buy when blood is freely flowing in the streets and that appears to be the case now. Thus, prudent investors would do well to compile a list of stocks that they would like to open positions and slowly start committing funds to some of these plays. One great way to play the Russian market is via ETF’s such as RUSL, RSX, ERUS, etc

Let’s take a closer look at RSX

The investment seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Market Vectors® Russia Index. The Russia Index is comprised of securities of Russian companies. A company is generally considered to be a Russian company if it is incorporated in Russia or is incorporated outside of Russia but generates at least 50% of its revenues (or, in certain circumstances, has at least 50% of its assets) in Russia. It is non-diversified

This is what we said back in March of 2016

It will face resistance in the 16.00-16.50 ranges, so it would make sense to wait for a pullback to the 13.50-14.00 ranges before committing new funds

It pulled back and then surged upwards. It is now trading in the 24 ranges. A monthly close above 25.50 will set the path for a test of the 31 ranges and a possible overshot as high as 36.00. Use pullbacks to open long positions. The trend is your friend everything else is your foe.

Other stories of Interest:

Perfect Scam; Central Banks Print Money & buy bullion with it (March 10)

Achieve Financial Independence & retire Young by not being a Lemming (March 9)

Fed Will Shock Markets; Expect Monstrous rally in 2016 (March 6)

How to Profit from Misery & Stupidity (March 4)

Religious wars set to Rip Europe Apart (March 4)

Oil prices: bottomed out or oil prices heading lower (Feb 28)

China targets corruption: strikes zombie companies hard (Feb 27)