Market Fear: Unmasking the Costs of Panic & Misjudgment in Investment

Updated Oct 30, 2023

Learning from history is crucial for true understanding. It helps us avoid past mistakes and take tangible actions. Fear can often lead to hasty and erroneous decisions, especially in investing. Strategic patience is essential to overcome the mass psychology of fear.

Prepare for a turbulent ride as volatility looms, with potential 1500-point swings—brace for the Dow breaching 33,000, triggering rapid 3000-point movements. When the bears growl about a 3000-point weekly dip, remember, if the upward trend persists, their pride and accounts may be the only things nearing an end.

This market promises wealth to a select few, but quick riches often appear elusive due to fear’s grip on many. It’s time to shift perspective, recognizing fear for what it is—an illusion that obscures opportunities. This market journey may not be swift, but with strategic resilience, lasting wealth awaits.

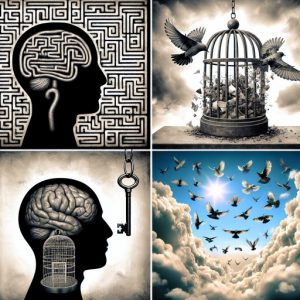

Fear is an illusion that gains power if one feeds it; the outcome is rarely positive, and if it is, it’s usually a fluke. Here is a simple exercise when fear starts to set in. Ask yourself this simple question? Will I die one day? The answer is obviously yes unless one is mentally deranged; in that case, nothing matters. If the answer is yes, follow up with this question. Do I obsess over this event day and night? The solution for most will be no. Hence, if you don’t obsess over your death, which is the single most destructive event that anyone could experience, why, for crying out loud, do people obsess over a trivial market correction? Why not look at the market correction/crash through a bullish lens?

Escaping the Fear Trap: Mastering Market Moves for Success

Can you point to one market crash or so-called end-of-the-world financial event that lead to the demise of the world or the financial markets? Nobody can, even those loud-mouthed slick snake oil salesmen can’t . Sol Palha

Fear is one of the greatest enemies of success in the markets. When fear takes over, it causes investors to make irrational decisions that go against their long-term interests. Fear feeds on itself and grows larger the longer it is embraced. However, with an understanding of how fear works and some simple techniques, investors can avoid falling into the fear trap and instead seize opportunities during volatile periods.

One of the primary causes of fear in the markets is loss aversion. Research has shown that losses psychologically impact people around 2-2.5 times more than equivalent gains. When prices start dropping, the pain of potential losses looms much larger in our minds than the prospect of profits. This makes it incredibly difficult for humans to hold on during downturns. However, we must recognize that portions of the portfolio will often experience short-term losses and that attempting to sell at the absolute bottom is nearly impossible. It is better to have preset standards for when to cut losses rather than letting fear dictate the timing.

Another driver of fear is the negativity bias in our minds. Our brains are hardwired to give more weight to negative information as an evolutionary adaptation. However, this bias tends to distort our perceptions of risk during declines. We become hyper-focused on worst-case scenarios rather than assessing likelihood and historical context. One way to counter this is to seek out opposing viewpoints and facts that provide a more balanced perspective. Force yourself to consider alternative positive narratives rather than just dwelling on threats. Looking at past periods of volatility can also help reduce the sense of doom during present downturns.

Social and media influences are another factor that intensifies fear. During significant selloffs, the airwaves and social media tend to light up with panic-stricken commentary predicting an imminent crash. Negative headlines grab more attention, the resharing of frightening opinions goes viral, and the atmosphere becomes hysteria. This social proof of fear has a real psychological impact and causes ‘herding’ behaviour as investors rush to sell low with everyone else. The remedy is to limit exposure to chicken little commentary and focus on analysis from experienced investors who have lived through prior downturns. Reduce time spent on emotionally charged discussions andtune out alarmist personalities.

Lack of preparation is also a problem. Investors who experience sharp downturns without a plan tend to freeze up emotionally and make hasty decisions to take action. However, proactively preparing with a strategy going into volatility reduces that panic reaction and gives a foundation to make choices anchored in longer-term goals rather than ephemeral fear. Considerations like portfolio allocation, buy/hold targets, mental stop losses, rebalancing policies, and cash reserves should be established in advance so you are not starting from scratch when turmoil hits. Coming ready to handle turbulence dampens the fear impulse.

Fear also stems from illusions about control. In times of wild market gyrations, there is a very human desire to feel in command of outcomes. This inspires behaviours like frantic selling, switching strategies frequently chasing short-term moves, day trading, and over-reliance on forecasts to divine short-term direction. However, attempting to perfectly time short swings is usually a losing game, driven more by emotion than skill. Investors need to accept volatility as uncontrollable and instead focus on managing only the variables within their power, like cost-basis, asset allocation, and investment horizon. This mental shift from prediction to preparation reduces anxiety.

Incorporating routine meditation, exercise, relaxation techniques, and mindfulness can also help quiet fear responses during stressful periods. Taking some deep breaths, focusing on the present moment rather than projecting into an uncertain future, enlists the pre-frontal cortex to take command from the brain’s emotional regions. Short daily periods training the mind to observe thoughts non-judgmentally without reaction weakens fear’s grip. Similarly, ensuring sufficient sleep and maintaining supportive social connections are essential to remain mentally resilient amid volatility. A healthy lifestyle provides inner resources to ride out financial storms without panicking.

Simply becoming aware of how fear operates psychologically is half the battle. With discipline and practice, investors can overcome fear-based reactions, view volatility as an opportunity rather than a threat, and survive and potentially thrive during turbulent times through calm, transparent decision-making. Fear is often the very thing that causes investors to lose in a down market. But with the right strategies, it need not dictate outcomes or prevent seizing prospects that fear and panic create amid the falls. Staying invested for the long term without panicked exits near bottoms is how to pierce fear’s veil and consistently benefit from market cycles.

Mastering Markets: Triumphing Through the Tempest of Fear

In the dynamic realm of finance, fear often looms large, dominating headlines with ominous prophecies of market crashes and apocalyptic scenarios. Yet, history repeatedly reveals the exaggeration of such predictions, as no single event has led to the demise of the financial markets or the world itself.

Astute investors reject fear-mongering, recognizing market fluctuations as an inherent part of the cycle—a cycle that unveils unique opportunities amidst downturns. With trend indicators, mass psychology insights, and sentiment data, informed decisions are the cornerstone of strategic success.

Crucially, successful market navigation involves resisting the herd mentality. Blindly following the crowd can result in missed opportunities and poor choices. Instead, investors thrive by staying disciplined and focusing on the regenerative aspect of the market cycle, overcoming fear to capitalize on emerging prospects.

Selective information consumption is another pivotal strategy to evade the fear trap. Commercial media often thrives on sensationalism, sowing confusion and fear. Investors make decisions grounded in sound analysis by discerning reliable sources and avoiding the allure of unfounded suspicions.

Escape the fear trap in financial markets by embracing a disciplined, focused approach. Recognize market fluctuations as part of the natural cycle, and armed with informed decision-making, discipline, and a discerning mindset, position yourself to weather uncertainties and triumph in the dynamic world of finance.

Script Flip: Transforming Market Fear into Portfolio Growth Opportunities

If we had to make what is sometimes referred to as an educated guess, it is all but certain that the Nasdaq will trade to and past 15K. Market Update Sept 30, 2020

In the ever-changing landscape of the financial markets, it is crucial to approach market fear with a different perspective. Rather than succumbing to panic and uncertainty, astute investors understand that market downturns can present unique growth opportunities. By flipping the script and viewing fear as a chance to capitalize on discounted assets, investors can position themselves for success.

While it is impossible to predict the exact movements of the market, educated guesses and trend analysis can provide valuable insights. For instance, in September 2020, it was suggested that the Nasdaq could trade past 15,000. Although the timeline for this achievement was not specified, it serves as a reminder that markets have the potential to trend higher over time.

However, it is essential to acknowledge that market trends are not linear. Along the way, bouts of volatility and mini-crashes will be designed to trigger panic among the masses. A few often use this orchestrated chaos to exploit the many. Recognizing this reality is crucial to avoid being swayed by manipulative tactics.

To navigate these challenges successfully, it is essential to cut the cord and detach from the influence of mass media. By doing so, investors can break free from the filters that falsely direct their choices and regain control over their decision-making process. This awareness allows for a more objective evaluation of investment opportunities.

When the market experiences a pullback, it is essential to replace panic with opportunity. While the masses panic, astute investors calmly search for the best plays at discounted prices. By focusing on the growth potential rather than succumbing to fear, investors can position themselves to take advantage of undervalued assets.

Flipping the script on market fear is a powerful strategy for growing one’s portfolio. By recognizing that fear presents an opportunity for discounted investments, investors can approach market downturns calmly and purposefully. Cutting the cord from mass media and staying focused on long-term trends allows for a more objective evaluation of investment opportunities. Ultimately, wise investors understand that concentrating on chance rather than fear is the key to success in the financial markets.

Revealing the Road to Stock Market Triumph: Unleashing the Winning Strategy

To achieve success in the stock market, it is essential to understand and leverage the power of mass psychology. The collective sentiment of market participants plays a significant role in influencing market behaviour. Investors can gain a competitive advantage by gaining insights into the majority’s thinking.

One effective strategy is to embrace contrarian investing. Contrarian investors adopt a unique perspective and actively seek out opportunities that others may avoid. By going against the crowd, they can identify undervalued assets with significant growth potential. Contrarian investing requires a deep understanding of market dynamics and recognition when market sentiment has pushed prices to extremes.

Another critical aspect of unlocking the winning strategy is anticipating emerging trends. Successful investors stay ahead of the curve by spotting sectors on the verge of breakthroughs. By recognizing emerging trends before they become mainstream, investors can position themselves to capitalize on the growth potential of these sectors. This requires thorough research, staying informed about technological advancements, and understanding consumers’ evolving needs and preferences.

Once promising sectors are identified, the next step is pinpointing the most promising stocks. This involves developing a methodology for evaluating stocks based on specific criteria that set winners apart. Factors such as financial health, competitive advantage, management quality, and growth prospects all play a role in determining the strength of a stock.

Mastering the fundamentals of technical analysis (TA) is crucial to enhance the decision-making process further. Technical analysis involves analyzing historical price and volume data to identify patterns and trends. By using technical indicators, investors can refine their entry and exit points, improving the timing of their trades. However, it is essential to note that technical analysis should be used in conjunction with other forms of research and not relied upon as the sole basis for investment decisions.

Unlocking the winning strategy in the stock market requires a multifaceted approach. By grasping the power of mass psychology, embracing contrarian investing, anticipating emerging trends, pinpointing promising stocks, and mastering the fundamentals of technical analysis, investors can position themselves for success. It is essential to continuously educate oneself, stay informed, and adapt strategies as market conditions evolve. With a disciplined and well-informed approach, investors can confidently navigate the stock market and unlock their path to success.

Diving into Market Psychology: Navigating Contrarian Investing for Triumph

1. Recognizing Behavioral Biases: Contrarian investing involves identifying and capitalizing on market misjudgments driven by behavioural biases. Understanding these biases, such as herd mentality, confirmation bias, and loss aversion, can help investors uncover opportunities where the market’s perception deviates from the underlying fundamentals of an asset or market.

2. Market Sentiment Analysis: Embracing market psychology requires analyzing market sentiment to gauge the prevailing investor mood and sentiment. By monitoring sentiment indicators like investor surveys, news sentiment analysis, and social media sentiment, contrarian investors can identify potential turning points or extreme market conditions that may present contrarian opportunities.

3. Contrarian Timing: Timing plays a crucial role in contrarian investing. Contrarian investors aim to buy when sentiment is excessively negative and sell when sentiment becomes overly optimistic. Understanding market psychology can help investors develop a sense of timing by evaluating indicators like market breadth, sentiment extremes, and emotional exhaustion, which can signal potential reversals in market trends.

4. Emotional Discipline and Patience: Contrarian investing requires emotional discipline and patience. Going against the crowd can be emotionally challenging, as it often involves enduring short-term losses or recognizing a market shift early. By understanding market psychology, investors can better manage their emotions, avoid impulsive decisions driven by fear or greed, and maintain a long-term perspective in their investment strategies.

5. Analyzing Contrarian Indicators: Successful contrarian investors use a range of indicators to identify opportunities. These indicators may include market valuation measures, such as price-to-earnings ratios or price-to-book ratios, to identify undervalued or overvalued assets. Additionally, contrarian investors may analyze technical indicators, such as oversold or overbought conditions, to determine potential turning points in market trends.

6. Studying Market History: Examining historical market patterns and cycles can provide valuable insights into market psychology. Contrarian investors analyze past market events and investor behaviour during market downturns or euphoria to understand better how market psychology influences asset prices. This historical perspective helps investors navigate market conditions and identify contrarian opportunities.

7. Contrarian Investing and Fundamental Analysis: Contrarian investing is not solely based on market sentiment and psychology. It also involves fundamental analysis to assess the intrinsic value of an asset. By combining an understanding of market psychology with rigorous fundamental research, contrarian investors can identify undervalued or overvalued assets relative to their underlying fundamentals, increasing the probability of successful investment outcomes.

8. Risk Management: Contrarian investing entails risks, as going against prevailing market sentiment can result in short-term losses. Understanding market psychology allows investors to assess and manage these risks effectively. By diversifying their portfolios, setting stop-loss orders, and employing appropriate position-sizing strategies, contrarian investors can mitigate risks and protect their capital while pursuing contrarian opportunities.

9. Learning from Successful Contrarian Investors: Studying the strategies and experiences of successful contrarian investors can provide valuable insights into market psychology. Analyzing their past investments, decision-making processes, and how they navigated through contrarian opportunities can help investors refine their own contrarian investing approach and develop a deeper understanding of market psychology.

10. Adapting to Changing Market Conditions: Market psychology is not static, and investor sentiment can fluctuate based on changing economic conditions, geopolitical events, or market cycles. Contrarian investors need to adapt and evolve their strategies to stay ahead of market psychology. Regularly monitoring market trends, staying informed about relevant news and events, and continuously updating their knowledge base can help contrarian investors navigate changing market conditions successfully.

By delving into these deeper layers of market psychology, contrarian investors can enhance their ability to identify and capitalize on investment opportunities that arise from market misjudgments, ultimately increasing their chances of success in the financial markets.

Harmonizing Amidst Market Dissonance: The Art of Fundamental Analysis

Fundamental analysis is a key component of contrarian investing, as it allows investors to uncover opportunities where market sentiment diverges from the intrinsic value of an asset or market. By immersing themselves in fundamental analysis, investors can gain a deeper understanding of the financial intricacies of a company or market, evaluate industry standings, and critically assess management quality. Here’s how fundamental analysis enhances the contrarian investing approach:

1. Financial Statement Analysis: Fundamental analysis involves a thorough examination of a company’s financial statements, including the balance sheet, income statement, and cash flow statement. By scrutinizing these financial records, contrarian investors can assess the company’s financial health, profitability, and cash flow generation, helping them determine its intrinsic value and identify potential discrepancies with market sentiment.

2. Valuation Techniques: Fundamental analysis enables investors to employ various valuation techniques to estimate the intrinsic value of an asset. These techniques may include discounted cash flow (DCF) analysis, price-to-earnings (P/E) ratio analysis, price-to-sales (P/S) ratio analysis, or other industry-specific valuation metrics. By comparing the estimated intrinsic value with the prevailing market price, contrarian investors can identify assets that are potentially undervalued or overvalued.

3. Industry Analysis: Contrarian investors also conduct comprehensive industry analysis to understand the dynamics and competitive landscape of the market in which a company operates. This analysis evaluates industry trends, growth prospects, regulatory factors, and competitive forces. Contrarian investors can uncover investment opportunities by gaining insights into the industry’s long-term potential and identifying discrepancies between market sentiment and industry fundamentals.

4. Management Assessment: Fundamental analysis includes a critical assessment of the quality and competence of a company’s management team. Contrarian investors evaluate the management’s track record, strategic decision-making, corporate governance practices, and aligning interests with shareholders. Assessing management quality helps investors gauge the company’s ability to navigate challenges, adapt to changing market conditions, and unlock long-term value.

5. Competitive Advantage Analysis: Contrarian investors analyze a company’s competitive advantages or moats, determining its ability to generate sustainable profits and maintain a differentiated position in the market. By assessing factors such as intellectual property, brand strength, economies of scale, and switching costs, investors can determine the durability of a company’s competitive advantage and its potential for long-term success.

6. Risk Assessment: Fundamental analysis aids contrarian investors in evaluating and managing risks associated with an investment. Investors can make informed decisions about a contrarian opportunity’s potential risks and rewards by assessing financial leverage, liquidity, regulatory risks, and industry-specific risks. This risk assessment helps investors develop risk mitigation strategies and determine appropriate position sizing.

7. Long-Term Investment Perspective: Contrarian investors utilizing fundamental analysis often adopt a long-term investment perspective. By focusing on the intrinsic value of an asset and identifying market dissonance, investors can have the conviction to hold investments over the long term, even during periods of short-term market volatility or negative sentiment. This long-term perspective allows contrarian investors to capture the potential value realized as market sentiment aligns with intrinsic value.

8. Continuous Monitoring and Updating: Fundamental analysis is an ongoing process that requires continuous monitoring and updating of investment theses. Contrarian investors regularly review financial statements, industry trends, and company-specific developments to ensure their investment thesis remains valid. By staying informed and adapting their analysis to new information, investors can make informed decisions and adjust their contrarian positions as necessary.

Contrarian investors can find harmony amidst market dissonance by immersing themselves in fundamental analysis. This approach allows them to identify opportunities where market sentiment deviates from intrinsic value, enabling them to make contrarian investment decisions with the potential for long-term success.

Risk Management: Navigating Contrarian Challenges

Risk management is a crucial aspect of contrarian investing, as going against the prevailing market sentiment can expose investors to unique challenges and potential losses. By implementing effective risk management techniques, contrarian investors can safeguard their portfolios and navigate the turbulent currents of contrarian investing. Here are some key risk management strategies to consider:

1. Diversification: Diversification is a fundamental risk management technique that spreads investments across different asset classes, sectors, industries, and geographic regions. By diversifying their portfolio, contrarian investors can reduce the impact of specific investment risks and avoid excessive exposure to any single investment. Diversification helps mitigate the potential losses that may arise from contrarian positions that do not perform as expected.

2. Prudent Position Sizing: Controlling the size of each investment position is essential for managing risk in contrarian investing. Prudent position sizing involves allocating an appropriate portfolio portion to each contrarian investment. By carefully considering factors such as the risk-reward profile of the asset, the investor’s risk tolerance, and the overall portfolio diversification, contrarian investors can ensure that no single position has an outsized impact on the portfolio’s performance.

3. Stop-loss Orders: Stop-loss orders are a risk management tool that allows investors to set predetermined price levels at which they will sell a security to limit potential losses. Contrarian investors can use stop-loss orders to protect their downside risk if a contrarian position moves against them. By setting stop-loss orders at strategic levels, investors can exit a situation before losses become excessive, preserving capital and managing risk.

4. Continuous Monitoring and Evaluation: Contrarian investors should regularly monitor and evaluate the performance and progress of their contrarian investments. By staying informed about market conditions, industry trends, and company-specific developments, investors can make timely adjustments to their positions if new information suggests a change in the investment thesis or increased risk. Continuous monitoring helps contrarian investors proactively manage risks and make informed decisions.

5. Risk-Reward Assessment: Before entering a contrarian investment, it is crucial to assess the risk-reward profile of the opportunity. Contrarian investors should carefully evaluate the potential upside versus the potential downside of the investment. By thoroughly analysing the investment’s intrinsic value, industry dynamics, and market sentiment, investors can make informed judgments about the risk-reward tradeoff and allocate capital accordingly.

6. Emotion Management: Contrarian investing can be emotionally challenging, as it often involves going against the crowd and enduring short-term losses or unfavourable market sentiment. Effective risk management requires contrarian investors to manage their emotions and avoid making impulsive decisions driven by fear or greed. Developing emotional discipline, maintaining a long-term perspective, and adhering to a well-defined investment strategy can help contrarian investors stay focused and make rational decisions.

7. Scenario Analysis: Contrarian investors can conduct scenario analysis to assess the potential outcomes and associated risks of their contrarian investments under different market conditions. Investors can identify potential risks and devise contingency plans by considering various scenarios, including both favourable and adverse effects. Scenario analysis helps contrarian investors anticipate and prepare for different market scenarios, enhancing their risk management capabilities.

8. Regular Portfolio Review: Regularly reviewing the portfolio’s performance and risk exposure is essential for effective risk management. Contrarian investors should assess the performance of their contrarian investments, examine the impact of market sentiment on portfolio holdings, and evaluate the overall risk level of the portfolio. This review process allows investors to identify any excessive risks, rebalance the portfolio if necessary, and adjust their risk management strategies.

The Patience of a Wise Contrarian

Indeed, patience is a virtue for contrarian investors. The success of contrarian investing often relies on the ability to withstand short-term market fluctuations and maintain a long-term perspective. Here are some key reasons why patience is essential for wise contrarians:

1. Allowing Time for Market Sentiment to Adjust: Contrarian investors aim to identify opportunities where market sentiment deviates from intrinsic value. However, it takes time for market participants to recognize and adjust their views. By patiently holding contrarian positions, investors give the market time to correct mispricings and align with the underlying fundamentals. This patience allows contrarians to potentially profit as sentiment evolves in their favour.

2. Overcoming Short-Term Volatility: Contrarian investments may experience short-term volatility and periods of underperformance. This is because going against the prevailing market sentiment can initially be met with scepticism or even resistance. However, by maintaining a long-term outlook, contrarian investors can ride out these fluctuations and allow the investment thesis to unfold over time. Patience helps investors avoid making impulsive decisions based on short-term market noise.

3. Capitalizing on Long-Term Potential: Contrarian investors often seek opportunities with the potential for significant long-term gains. These opportunities may arise from assets or sectors temporarily out of favour or undervalued due to market sentiment. Contrarian investors can benefit from realising their long-term potential by exercising patience and holding onto these investments. Patience allows investors to capture the value that may be unlocked as the market recognizes the underlying strengths of the asset.

4. Avoiding Emotional Decision-Making: Impulsive decisions driven by fear or greed can hinder investment success. Patience helps contrarian investors maintain emotional discipline and resist the temptation to make hasty decisions based on short-term market movements. Investors can make rational and informed decisions by focusing on the long-term potential and sticking to a well-defined investment thesis, not swayed by temporary market fluctuations.

5. Taking Advantage of Market Inefficiencies: Market inefficiencies can persist for extended periods when market sentiment is misaligned with fundamental value. Contrarian investors who exercise patience have the opportunity to capitalize on these inefficiencies. Investors can potentially generate significant returns by maintaining a contrarian position and waiting for the market to recognize the actual value.

6. Allowing for Fundamental Factors to Materialize: Fundamental changes in a company or industry often take time to materialize and impact the market. By exercising patience, contrarian investors allow these fundamental factors to unfold and create value. This can include management changes, industry disruptions, regulatory shifts, or technological advancements. Patience will enable investors to be in a position to benefit from these long-term developments.

Uncovering Value Through Thorough Investigation

Thorough research and due diligence are crucial for contrarian investors to uncover value and make informed investment decisions. By delving deep into the foundations of prevailing market sentiment and conducting comprehensive investigations, contrarian investors can identify sound fundamental rationales that support their contrarian viewpoint. Here are some key steps to undertake during the research process:

1. Understand the Market Sentiment: Contrarian investing involves going against prevailing market sentiment. To do so effectively, it is essential to understand the prevailing sentiment and the reasons behind it clearly. This can be achieved through monitoring news, market analysis, and investor sentiment indicators. By comprehending the market sentiment, contrarian investors can identify potential areas of mispricing and opportunities for contrarian positions.

2. Conduct Fundamental Analysis: Fundamental analysis is the cornerstone of contrarian investing. It involves a detailed examination of a company or market’s financials, industry dynamics, competitive landscape, and qualitative factors. By analyzing financial statements, evaluating industry trends, and assessing management quality, contrarian investors can gain insights into the intrinsic value of an investment opportunity. Thorough fundamental analysis helps uncover potential discrepancies between market sentiment and underlying fundamentals.

3. Evaluate Contrarian Indicators: Contrarian investors often look for contrarian indicators that suggest a potential turning point in market sentiment. These indicators could include extreme levels of pessimism or optimism, divergences between price and underlying fundamentals, or shifts in investor positioning. By carefully evaluating these contrarian indicators, investors can identify potential entry or exit points for contrarian positions.

4. Assess Risk-Reward Ratio: Contrarian investing involves taking calculated risks. As part of the research process, contrarian investors should assess the risk-reward ratio of potential investments. This involves evaluating an asset’s potential upside and downside and determining whether the potential rewards justify the associated risks. By conducting a thorough risk-reward analysis, investors can make more informed decisions and manage their risk exposure effectively.

5. Seek Contrarian Catalysts: Contrarian investments often rely on identifying catalysts that can change market sentiment. These catalysts could be events such as a new product launch, management changes, regulatory shifts, or industry disruptions. By identifying potential contrarian catalysts, investors can assess the likelihood and impact of these events unfolding and driving a shift in sentiment.

6. Monitor Investor Behavior: Contrarian investing involves understanding and capitalizing on behavioural biases in the market. By monitoring investor behaviour and sentiment, contrarian investors can identify instances where emotions or herd mentality may drive market sentiment, leading to potential mispricings. Understanding and exploiting these biases can provide contrarian investors with opportunities for value creation.

7. Stay Informed and Continuously Learn: The investment landscape is constantly evolving, and staying informed is crucial for contrarian investors. This involves keeping up with market news, industry developments, and ongoing research. Contrarian investors can adapt their investment theses and make informed decisions based on the latest insights by continuously learning and staying abreast of new information.

Adaptability in the Contrarian Landscape

Indeed, adaptability is a crucial trait for contrarian investors. The dynamic nature of the market requires contrarians to remain flexible and adjust their strategies as new information emerges. Here are key reasons why adaptability is essential in the contrarian landscape:

1. Changing Market Conditions: Market conditions are constantly evolving, and what may be a contrarian opportunity today may not be the same tomorrow. Adapting to changing market conditions allows contrarian investors to seize new opportunities and avoid being caught on the wrong side of a shifting trend. Investors can adjust their strategies by remaining vigilant and responsive to market dynamics.

2. New Information and Insights: The investment landscape is inundated with new information and insights that can impact market sentiment and investment theses. Contrarian investors must stay informed, continuously evaluate new data, and be open to revisiting their assumptions. By incorporating further information into their analysis, contrarian investors can make more informed decisions and adjust their strategies if necessary.

3. Managing Risk: Adaptability is crucial for managing risk in contrarian investing. As new information emerges, it may reveal potential risks or highlight changes in the risk-reward profile of an investment. By being adaptable, contrarian investors can proactively address these risks, adjust their position sizes, or even exit a position if warranted. Adapting to changing risk dynamics helps investors protect their capital and navigate the contrarian landscape more effectively.

4. Capitalizing on New Opportunities: The contrarian landscape presents many opportunities, and adaptability allows investors to capitalize on emerging trends or overlooked areas. Contrarian investors can identify new investment themes, sectors, or asset classes that offer attractive risk-adjusted returns by remaining open to altering strategies. Adapting to new opportunities expands the potential for value creation and enhances the overall performance of a contrarian portfolio.

5. Avoiding Confirmation Bias: Confirmation bias can significantly challenge contrarian investors. It is the tendency to seek out information confirming pre-existing beliefs and ignore evidence contradicting them. By cultivating adaptability, contrarian investors can challenge their biases, actively seek diverse perspectives, and remain open to alternative viewpoints. This helps mitigate the risk of falling victim to confirmation bias and allows for a more objective and comprehensive investment approach.

6. Flexibility in Execution: Adapting to the contrarian landscape requires flexibility in execution. This includes adjusting position sizes, implementing different investment strategies, or employing alternative investment vehicles. By being adaptable in execution, contrarian investors can tailor their approach to suit the specific opportunities and challenges presented by the market.

7. Continuous Learning and Improvement: Adaptability goes hand in hand with continuous learning and improvement. Contrarian investors should consistently evaluate the performance of their investments, analyze their decision-making processes, and seek feedback from their experiences. By embracing a growth mindset and being open to learning, contrarian investors can successfully refine their strategies and enhance their ability to navigate the contrarian landscape.

In the contrarian landscape, adaptability is crucial for seizing opportunities, managing risks, and maintaining an accurate compass. By remaining flexible, open-minded, and responsive to changing market conditions and new information, contrarian investors can position themselves to thrive in the face of market disruptions.

Mistakes as Stepping Stones

Mistakes are an integral part of the journey for contrarian investors, and they serve as valuable learning opportunities. Here’s why mistakes can be stepping stones for contrarians:

1. Acknowledging Mistakes: Recognizing and acknowledging mistakes is the first step towards growth and improvement. Contrarians understand that they are not infallible and that errors are inevitable. By acknowledging mistakes, contrarians can maintain humility, avoid overconfidence, and remain open to learning from their experiences.

2. Analyzing Mistakes: After acknowledging a mistake, contrarians delve into a thorough analysis of what went wrong. They examine the underlying factors that led to the mistake, including their own biases, flawed assumptions, or misinterpretation of market signals. Through a diligent post-mortem analysis, contrarians gain insights into their decision-making processes and identify areas for improvement.

3. Learning and Adaptation: Mistakes provide valuable lessons that shape a contrarian’s expertise. By reflecting on errors, contrarians can refine their investment approach, adjust their strategies, and enhance their decision-making frameworks. Learning from mistakes fosters continuous improvement and helps contrarians adapt to changing market dynamics.

4. Risk Management: Mistakes often highlight the importance of effective risk management. Contrarians understand that risk is inherent in their investment approach, and errors can be reminders to reassess risk exposure and implement risk mitigation strategies. Contrarians can enhance their risk management practices and protect their portfolios by incorporating the lessons learned from mistakes.

5. Emotional Resilience: Mistakes can test the emotional resilience of contrarian investors. Market downturns, unexpected events, or contrarian positions that temporarily go against prevailing sentiment can create emotional stress. However, by acknowledging and analyzing mistakes, contrarians develop the emotional fortitude to navigate through challenging periods and maintain confidence in their contrarian convictions.

6. Building Experience and Expertise: Each mistake adds to the contrarian’s experience and expertise. Over time, the lessons learned from missteps contribute to developing a seasoned contrarian investor. The ability to handle adversity, learn from mistakes, and adapt strategies becomes a distinguishing characteristic that sets experienced contrarians apart.

7. Cultivating a Growth Mindset: Mistakes are integral to personal and professional growth. Contrarians embrace a growth mindset, viewing mistakes as opportunities for learning and improvement rather than as failures. By adopting this mindset, contrarians are better equipped to bounce back from setbacks, remain resilient, and continue their journey towards becoming seasoned contrarian leaders.

In the contrarian landscape, mistakes are stepping stones that refine expertise and shape contrarian investors into resilient and experienced leaders. By acknowledging and analyzing errors, embracing a growth mindset, and applying the lessons learned, contrarians can continuously improve their decision-making processes, risk management strategies, and overall performance.

Market Fear Unveiled: Decoding the Enigmatic Wisdom of Contrarians

You’ve beautifully captured the essence of contrarian investing and the unique wisdom it entails. Contrarians indeed go beyond traditional analysis by incorporating an understanding of market sentiment and the emotional drivers behind it. Here are some additional points that highlight the distinct qualities and rewards of contrarian investing:

1. Contrarian Analysis: Investors blend various analytical approaches to understand investment opportunities comprehensively. They combine fundamental analysis, which assesses the intrinsic value of an asset, with technical analysis, which examines price patterns and market trends. By integrating these different perspectives, contrarians can make more informed decisions considering the underlying fundamentals and the market sentiment.

2. Embracing Market Psychology: Contrarian investing recognizes that human emotions, such as fear, greed, and herd mentality, influence the market. Contrarians study market psychology to identify situations where emotions drive sentiment to extreme levels, creating potential opportunities for contrarian positions. By understanding and leveraging market psychology, contrarians can capitalize on mispricings and market inefficiencies caused by emotional biases.

3. Patience and Discipline: Contrarian investing requires patience, discipline, and the ability to withstand short-term market fluctuations. Contrarians understand that market sentiment takes time to change and that their investment theses may take months or even years to materialize. By maintaining discipline and staying true to their contrarian convictions, investors can navigate market volatility and potentially reap the rewards when sentiment aligns with their positions.

4. Learning from Successful Contrarians: Contrarian investing is a specialized skill; learning from successful contrarian investors can be invaluable. Studying renowned contrarians’ strategies, experiences, and philosophies can provide insights and guidance for navigating the contrarian landscape. Investors can enhance their contrarian mindset and decision-making by seeking mentorship and looking at the approaches of those who have successfully practised contrarian investing.

5. Unique Rewards: Contrarian investing offers the potential for unique rewards. By going against the crowd and taking positions that deviate from prevailing sentiment, contrarians can uncover undervalued assets or identify turning points before they become widely recognized. This contrarian approach can lead to significant outperformance and the ability to capitalize on market dislocations that other investors may overlook.

6. Intellectual Challenge and Personal Growth: Contrarian investing is intellectually challenging and requires continuous learning and self-improvement. It encourages investors to question conventional wisdom, challenge their biases, and develop a deep understanding of market dynamics and human behaviour. Engaging in contrarian investing can foster personal growth, expand one’s analytical capabilities, and create a unique perspective on the financial markets.

Contrarian investing is like orchestrating a symphony, blending psychology, analysis, and discipline to find harmony in the market’s turbulence. While it carries risks, those who master the contrarian mindset and embrace the challenges it presents can potentially achieve exceptional results. By understanding market psychology, blending different analytical approaches, and studying the wisdom of successful contrarians, investors can earn their well-deserved ovation in the grand investing arena.

Conclusion: Overcoming Market Fear

In the ever-changing landscape of the financial markets, it is crucial to approach fear with a rational mindset. While market volatility can trigger anxiety and uncertainty, it is essential to remember that corrections and downturns are a natural part of the market cycle. Rather than succumbing to fear and obsessing over the potential for a crash, investors can position themselves for success by viewing these market corrections as opportunities to grow their wealth.

To overcome fear, it is essential to utilize tools such as trend indicators, mass psychology, and sentiment data. These tools provide valuable insights into market trends and help investors make informed decisions. By understanding the collective sentiment influencing market behaviour, investors can gain an advantage and avoid the most devastating events.

Another crucial aspect of overcoming fear is to focus on banking profits on profitable positions. It is essential to recognise when an investment has reached its potential and take profits accordingly. This not only helps to secure gains but also provides a sense of confidence and control over one’s portfolio.

Additionally, reducing exposure to commercial media can significantly reduce fear and confusion. Retail media outlets often thrive on sensationalism and fear-mongering, leading to irrational decision-making. By being selective about the information consumed and seeking out reliable sources, investors can avoid being swayed by unfounded fears and make decisions based on sound analysis.

Ultimately, the key to overcoming fear in the financial markets is to view it as an illusion that gains power if one feeds it. Investors can confidently navigate the markets by embracing market corrections as opportunities to grow wealth and staying focused on long-term goals. It is important to remember that fear is a natural reaction, but it should not dictate investment decisions. With a disciplined and rational approach, investors can overcome fear and position themselves for success in the financial markets.

Originally published on February 24, 2021, this continually updated piece culminates in its latest revision in June 2023

More Good Reads

Projected Silver Prices: Setting Sail for Precious Metal Ascension

Stock Bubble: Act Quickly or Lag Behind

Perception Manipulation: Mastering the Market with Strategic Insight

Contrarian Outlook: A Pathway to Breakthrough or Breakdown

Market Uncertainty: A Challenge for Investors

Stock market basics for beginners: Adapt or Die

The Unfortunate Truth: Why Covered Calls are a Bad Strategy

DJU Index: To Buy or Flee? Unraveling the Market Mystery

Stock Market Psychology 101: Learn, Thrive, and Profit

In 1929 the Stock Market Crashed Because of Greed

Palladium Forecast: Unveiling the Stealth Bull Market

Unshackling Minds: The Journey to Remove Brainwashing

Mastering the Trading Range: Unlocking the Potential for Explosive Gains

Unveiling the VIX Fear Indicator: A Case Study in Market Volatility

Mind Games: Unmasking Brainwashing Techniques in Institutions & Media

Revamping the 60 40 Rule: Unleashing New Strategies for Success