Palladium Forecast: Navigating the Silent Bull Market Unfolding

Updated April 1, 2024

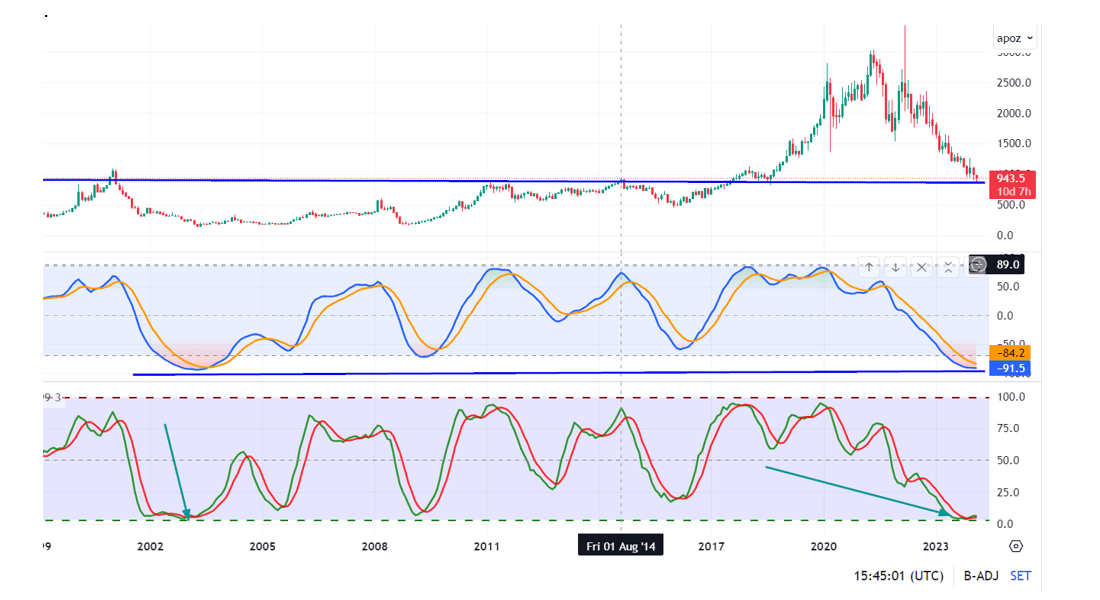

The lustrous white metal Palladium is silently scripting its bull market, even as the investing world seems to be looking elsewhere. A careful analysis of the weekly, monthly, and quarterly charts reveals highly oversold conditions, hinting at a brewing opportunity in the palladium market. These oversold positions are illustrated not by a single indicator but by a constellation of technical indicators that together form a compelling investment case.

One such indicator is the Relative Strength Index (RSI), a robust tool for identifying oversold or overbought conditions. A look at the weekly charts shows that the RSI for palladium has dipped well below the 30 mark, a level typically associated with oversold conditions. This was also observed during the 2008 financial crisis, followed by a prolonged bull market that saw the price of palladium surge from $200 to $3,000 per ounce over the next decade.

A similar pattern is seen in the monthly and quarterly charts, with indicators like the Moving Average Convergence Divergence (MACD) and the Bollinger Bands echoing the same sentiment. The MACD, for instance, has been trending below the signal line, signalling a bearish market sentiment in the short term and hinting at a potential bullish reversal in the long term.

The case for palladium becomes even more compelling when viewed through the lens of the hydrogen economy. Palladium plays a crucial role in hydrogen fuel cells, acting as a catalyst in the electrochemical process that combines hydrogen and oxygen to produce electricity. As the world moves towards cleaner and more sustainable energy sources, the demand for hydrogen fuel cells, and consequently palladium, is expected to surge.

The burgeoning interest in Artificial Intelligence (AI) stocks has somewhat overshadowed the silent bull market in palladium. The investing world seems to be in a trance, captivated by AI’s dazzling growth prospects. This has led to a ‘hive mind‘ mentality, with investors flocking towards AI stocks while ignoring or despising other investment opportunities.

This is where the principles of mass psychology come into play. Often, the best investment opportunities are those that are being ignored or forgotten by the majority. Palladium, in its present state, fits this description perfectly. It’s being overlooked even as it shows signs of a potential bull market, making it an attractive contrarian investment.

The silent bull market unfolding in palladium presents a unique investment opportunity. The oversold conditions, rising demand due to the hydrogen economy, and the current state of mass psychology all point towards a potential upswing in palladium prices. As investors, we must keep our eyes open to such opportunities, even if they are not in the limelight. After all, the best investments are often made away from the crowd.

Palladium Forecast: A Shrewd Investor’s Frontier

In the arena of precious metals, Palladium distinguishes itself as the prime contender for astute investment. Gold and Silver are also appealing, but they are currently in a phase where they’re expected to shore up their bases for a future ascent. Projections suggest Gold could rise beyond $2400, and Silver might march towards a $39 to $45 interval, with an outside shot at reaching $60. Caution dictates, however, that we not fixate on the peak of $60 until the intermediate benchmark of $45 is surpassed. Market Update January 15, 2024

Amidst its peers, Palladium is the jewel most markedly undervalued, and it has earned the title of the most undervalued market entity to date. Gold and Silver are accumulating, having rallied from their respective low points in September 2022. While the trajectory is generally upward, the current climate demands patience and a measured approach.

Silver seems to be outpacing Gold in the weekly technical charts, hinting at an approach towards the $24-$25 threshold. However, both metals are expected to experience swings until their monthly chart patterns depict a more definitive bullish trend.

With its potential to ignite substantial market shifts, Palladium is uniquely positioned. Its market is less saturated than Gold and Silver, making it more vulnerable to sharp price changes often enacted by heavyweight market participants.

On various timescales—quarterly, monthly, and weekly—Palladium’s valuation ranges from exceedingly to extraordinarily undervalued, a condition that rarely occurs and may signal an impending significant rally.

Delving into Palladium’s monthly chart reveals an unprecedented situation: over 15 specialized indicators signal the most undervalued state since 2002. But in the spirit of Tactical Investing, it’s essential to heed the lesson of diversifying and not overly concentrating funds in a single investment.

For the speculative-minded, diverting funds from superfluous expenses to more daring investment endeavours is prudent. Resources that remain idle might be put to work in ventures with higher risk and reward profiles. Adopting a more straightforward way of life, living modestly below one’s means, can generate surplus funds for investment. Given the widespread tendency towards extravagant living, even a modest downshift in lifestyle can yield significant savings for investment. “Thriving by Living Below Your Means” contains more tips on how to save effectively.

Drawing inspiration from Socrates, who championed the pursuit of knowledge and self-reflection, investors are encouraged to deeply understand the markets and themselves before committing capital. Socratic wisdom suggests that an investor’s true knowledge comes from understanding the value and timing of their investments.

Echoing the sentiments of Jesse Livermore, a legendary figure in the world of trading, the current state of Palladium may be likened to the moments before a big market move—a time when Livermore would advise keen observation and readiness to strike when the moment is ripe.

Mark Twain’s famous remark, “History doesn’t repeat itself, but it often rhymes,” could aptly apply to Palladium’s situation. The historical undervaluation mirrored in today’s market could hint at a repeat, or at least a similar pattern, to past rallies.

In summary, Palladium’s current market status presents a compelling opportunity for discerning investors who take cues from the sagacity of ancient philosophy, the keen insights of historical trading legends, and the timeless wit of literary greats. The convergence of these perspectives reinforces a strategy of cautious optimism and deliberate investment in Palladium’s forecasted rise.

Palladium Production Snapshot: 2023 Recap and 2024 Projections

– In 2023, global palladium production was estimated to be around 295 metric tons. Russia and South Africa remained the leading producers, accounting for over 50% of production. Russian production increased slightly to around 107 metric tons, while South African production remained at around 62.

– Other vital producers such as Canada, the US, and Zimbabwe maintained their production levels, with Canadian production remaining at around 52 metric tons.

– Looking ahead to 2024, global palladium production is expected to reach approximately 305 metric tons. Russian production is anticipated to rise to around 112 metric tons, while South African production is forecasted to stay at around 63 metric tons.

Investment in Palladium: A Long-Term Opportunity

Long story short, the overall picture has turned very bullish, and what is more interesting is that Palladium is almost guaranteed to take a similar path. Note how far Bonds were pushed before they stabilised. It’s the big players’ new “modus operandi”; they drive the small players insane simply because they have the financial means. However, pursuing this strategy inadvertently creates outstanding opportunities for those who grasp their new prime directive. Market Update Dec 18, 2023

Investing in palladium presents a compelling opportunity, especially when its value dips. This precious metal has shown a consistent upward trend, making it a potentially profitable long-term investment. However, it’s crucial to allocate funds not essential for daily living expenses and be prepared to commit for 18 to 24 months.

The key to success in this venture is maintaining a steadfast focus on the extended, long-term outlook and remaining unfazed by short-term market fluctuations. This approach aligns with the principles of mass psychology, which suggest that investors often move in herds, driven by emotion rather than logic. By resisting the urge to follow the crowd during short-term market fluctuations, you can stay focused on the long-term potential of your investment.

One who has imagination without learning has wings without feet.

Joseph Joubert, 1754-1824, French Moralist

Articles That Cover a Spectrum of Timeless Topics

Student Loan Refinance: A Smart Move Towards Financial Freedom – Poise in Debt Reduction”

How to Lose Money: The Dangers of Ignoring Market Trends and Psychology in Stock Investing

How much has the stock market gone up in 2023? -A Refined Analysis

How to Achieve Financial Goals: The Midas Touch for Your Financial Dreams

Sophisticated Strategies for US Dollar Index Investing: Elevate Your Forex Game

How much has the stock market dropped in 2023?

Visionary Views: How to Achieve Financial Freedom Before 40

A Major Problem with ESOPs is That Employees Can Lose Big

The Sophisticated Guide to Cryptocurrency Investing for Dummies PDF

Considering the Impact of Inflation, Why Is Investing Important for Long-Term Financial Stability?

What the NASDAQ Composite is Trading at in Today’s Market

What Is Contrarian Investing Unleashing Creative Perspectives

ETF Newsletter: Customized Options for Astute Investors

ETF Service Providers: In-House Options for the Tactical Investor

Fearlessly Trade Your Way to Financial Freedom

Living the Dream: How Much Money Do You Really Need for a Life of Comfort?