The Gamblers Mindset: Exploring the Secret Desire to Lose Syndrome

Updated Feb 11, 2024

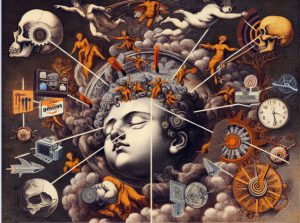

Introduction: The Investor’s Paradox: Unraveling the Hidden Desire for Defeat

Have you ever noticed how we’re often more drawn to tales of disaster than stories of success? This peculiar attraction to negativity is a hurdle that many investors must overcome to succeed in the markets. This mindset, often called the ‘secret desire to lose syndrome,’ can harm your investment strategy. Instead of focusing on uncontrollable factors, it’s crucial to concentrate on what’s within your reach. Market crashes, for instance, can be seen as opportunities or catastrophic losses, depending on your perspective.

Stock market crashes can be viewed as opportunities or monumental losses; it all comes down to the angle of observation. As a rule, individuals seem far more inclined to listen to and act on negative information rather than on positive info. Don’t believe me. Allow me to illustrate this point to you.

The Investor’s Dilemma: A Tale of Four Glasses

Imagine there are four glasses of water on a table. Someone mentions that one of the glasses contains water from a jug with a dead fly. Despite not knowing this person, most people would avoid the glasses, even if they were extremely thirsty. Few would attempt to verify the accuracy of this information.

Suppose someone else claims that one of those glasses holds water from the purest spring in the Swiss Alps. It’s unlikely that anyone would rush to drink all four glasses in hopes of finding the purest water.

This scenario extends to financial markets as well. When doom-and-gloom predictions about the financial world surface, we’re all ears. But when someone suggests everything is fine, we’re often sceptical or only half-listening.

Market Crash Myths: Decoding the Gamblers Mindset

Market crashes are a prime example of this phenomenon. When market gurus predict a crash, panic ensues, and investors start selling their quality shares. Conversely, they’re often ignored if someone suggests that the market will rise. However, this can also work the other way around, depending on the current sentiment and perception of the crowds.

Life is inherently unpredictable and unfair. It’s what you make of it that counts. Instead of worrying about things you can’t control, look for ways to leverage these situations. Identify the long-term trend and follow it. Regardless of market manipulation, there’s always a trend. If you stick with it, you have nothing to worry about.

Life was, is, and will never be fair. Life is what you make of it. So don’t fret about things you cannot control; look for ways to take advantage of these situations.

Investing and the Desire for Defeat: Unmasking the Hidden Urge

So far, we’ve explored the paradoxes of investing. We’ll delve into the ‘secret programmed desire to lose Syndrome.’ From birth, we’re bombarded with information, much of which is a mix of cultural and religious values and societal norms. Unfortunately, much of this information, particularly regarding science and logic, is biased and untested. We’re often told to believe things based on tradition or because “that’s how things have always been.”

As we move forward, we must question these ingrained beliefs and strive for a mindset that embraces positivity and opportunity. By doing so, we can overcome the ‘secret desire to lose syndrome’ and set ourselves up for success in investing.

The Gamblers Mindset: Succumbing to the Herd Mentality of Loss

As time goes by, we are told how we should behave, how we should eat, what we should eat, who our friends should be, what type of career to aim for, what is socially acceptable and what is not, around what age we should look to settle down and what type of woman or man would we should choose to settle down with. Individuals are also taught that working for the group or community is the right thing to do and that being selfish is very bad.

We are taught to dedicate our lives to one person and promise to do this, even though we struggle to keep our New Year’s resolutions. People are not told that instead of saying I promise, we should say I will try my very best, but being weak and human, I might fail along the line. In most cases, this promise is guaranteed to achieve the exact opposite result, and if one looks at the statistics, the evidence is overwhelmingly in favour of this. It’s this fear of trying to live up to an ideal that most of us know that we cannot live up to that ends up causing the relationship to end.

Think out of the Box

Thinking out of the box is valuable in various aspects of life, including relationships and personal growth. Individuals can often discover new solutions, insights, and opportunities by taking a different perspective and exploring unconventional ideas. Let’s delve deeper into the significance of thinking out of the box and how it can contribute to personal development and understanding.

In relationships, thinking out of the box entails approaching them with a mindset of self-fulfilment rather than seeking happiness solely through another person. When individuals are content and fulfilled within themselves, they bring a sense of completeness and authenticity to their relationships. Instead of relying on their partner for happiness, they enhance their own well-being and contribute positively to the relationship dynamics.

Thinking out of the box encourages individuals to examine situations from multiple angles rather than being limited to a single perspective. This broadens their understanding and enables them to consider alternative possibilities and solutions. By challenging conventional thinking and exploring different viewpoints, individuals can overcome biases, think creatively, and find innovative approaches to problem-solving.

It is crucial to understand that thinking outside the box does not necessarily mean that one has all the answers or that one’s viewpoint is always correct. It is instead a humble recognition that one’s opinions and ideas are liable to evolve, change, and may be faulty. Embracing this attitude encourages open-mindedness, continuous learning, and willingness to acknowledge and rectify errors when proven wrong.

Life is a quest for knowledge, and thinking out of the box allows individuals to expand their horizons, challenge assumptions, and gain fresh insights. By approaching old data with new eyes, individuals can uncover hidden patterns, discover more profound meanings, and make better-informed decisions.

To sum up, adopting a mindset that thinks outside the box is a valuable approach that can lead to personal growth, improved relationships, and better decision-making. By embracing diverse viewpoints, exploring unconventional ideas, and remaining open to new information, individuals can expand their understanding, discover innovative solutions, and embark on continuous self-improvement. Through this pursuit of knowledge and the readiness to challenge our thinking, we can genuinely broaden our horizons and make a positive impact in our own lives and the lives of others.

Published on Dec 27, 2004, this article was regularly updated and last updated in Feb 2024

FAQ: Decoding the Gamblers Mindset

Q: What is the significance of negativity in investing?

A: Negativity perpetuates the secret desire to lose syndrome, hindering investors from achieving success.

Q: How do people react to negative information compared to positive information?

A: Individuals are more inclined to act upon and believe negative information rather than positive information.

Q: Can you provide an example illustrating this affinity for negativity?

A: Imagine four glasses of water; if someone mentions a dead fly in one glass, people will avoid all the glasses, even if one contains pure water. We tend to give more weight to negative information.

Q: How does the herd mentality affect market crashes?

A: When gurus predict a market crash, people panic and start selling quality shares. Conversely, optimistic predictions are often ignored. Herd mentality plays a significant role in these situations.

Q: How can individuals take advantage of market situations and overcome negativity?

A: Instead of fretting about things beyond your control, focus on identifying long-term trends and aligning your investments accordingly. By following the movement, you can thrive in the market.

Q: What is the “secret programmed desire to lose Syndrome”?

A: We are bombarded with biased information from birth, shaping our beliefs and behaviours. Many of these societal norms and values are untested, leading to a subconscious desire for defeat.

Q: How does thinking out of the box help counter the secret desire to lose syndrome?

A: Thinking outside the norm allows you to examine situations from multiple perspectives, breaking free from societal programming and biases.

Q: What is the purpose of sharing this information?

A: We aim to offer our perspective and promote open-mindedness. We acknowledge the possibility of being wrong and seek to learn and grow from new information.

Articles That Push the Boundaries of Knowledge

Which of the Following Is the Biggest Pitfall of Economic Indicators: Analysis

Perception Manipulation: Mastering the Market with Strategic Insight

Contrarian Outlook: A Pathway to Breakthrough or Breakdown

Market Uncertainty: A Challenge for Investors

Stock market basics for beginners: Adapt or Die

The Unfortunate Truth: Why Covered Calls are a Bad Strategy

DJU Index: To Buy or Flee? Unraveling the Market Mystery

Stock Market Psychology 101: Learn, Thrive, and Profit

In 1929 the Stock Market Crashed Because of Greed

Palladium Forecast: Unveiling the Stealth Bull Market

Unshackling Minds: The Journey to Remove Brainwashing

Mastering the Trading Range: Unlocking the Potential for Explosive Gains

Unveiling the VIX Fear Indicator: A Case Study in Market Volatility

Mind Games: Unmasking Brainwashing Techniques in Institutions & Media

The Gamblers Mindset: The Enigmatic Urge to Embrace Loss

Inductive Versus Deductive reasoning

the Level Of Investments In A Markets Indicates

How to win the stock market game