Mastering Panic Selling: The Tactical Investor’s Strategic Response to Market Turbulence

Updated Feb 27, 2024

Many subscribers (mistakenly) assumed that we were stating that the markets were ready to Drop. And they started to close their longs because they felt a crash was imminent. One thing needs to be stated clearly. We never panic, for situations that trigger panic are nothing but hidden opportunities that the masses are too blind to see. Banks some money when the position is showing hefty gains is always prudent. Market Update Aug 29, 2021

The anticipated significant market correction may be somewhat tempered if the hypothesis above proves correct. Utilize the subsequent pullback as an opportunity to establish a trading journal, especially if you are new to trading. This practice provides invaluable insights into the prevailing emotions of 90% of traders. To conquer fear and panic, one must first comprehend them. Attempting to control these emotions is futile, as suppressing them may result in an eventual explosive release with dire consequences. Instead, it is crucial to recognize fear for what it truly is—a completely useless emotion that compels one to make ill-timed decisions. Fear triggers panic selling, leading the masses to relinquish high-quality stocks at drastically reduced prices when this pointless emotion overrides logic.

Not one investor can prove that giving into panic paid off over the long run.

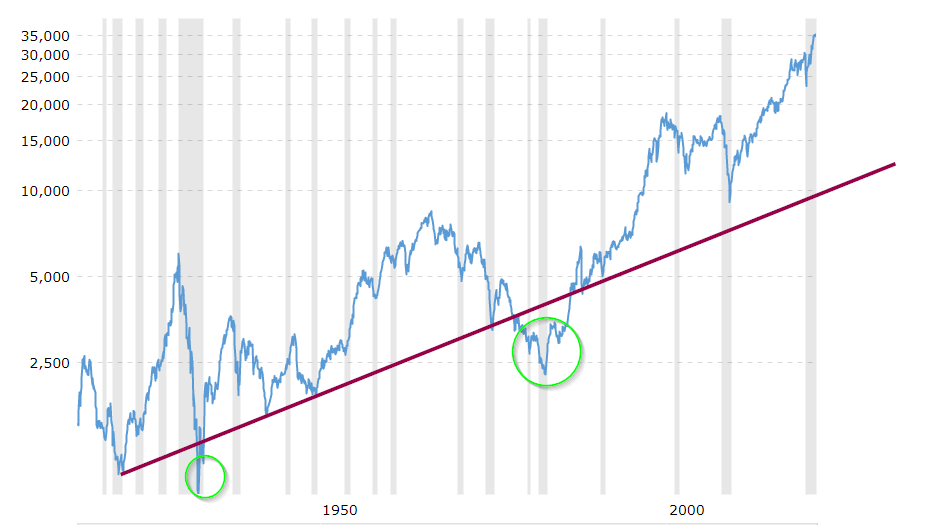

-If they dare attempt to take this challenge, this graph will end any rubbish argument they come up with.

Unleashing Opportunity: The Tactical Investor’s Fearless Approach to Panic Selling

A remarkable 100-year chart of the Dow is presented here, demonstrating a pattern where every disaster has ultimately emerged as a long-term buying opportunity. By fully capitalizing on mega-disaster events, individuals would have multiplied their wealth by at least 20 times, if not more, within a relatively short timeframe. This trend became even more pronounced after 1990 when the Dow temporarily fell below its main trend line, causing panic among many technicians. However, this development ultimately presented an even more lucrative opportunity.

Confidently Tackling Panic Selling: The Tactical Investor’s Approach

At Tactical Investor, our guiding motto is simple yet powerful: panic selling is an alien term, as we never allow fear to infiltrate our decision-making process.

At Tactical Investor, our motto is simple yet powerful: we never allow fear to infiltrate our decision-making process. Panic selling is an alien term to us. We firmly believe in staying calm and rational, even during market turbulence. This unwavering commitment guides us in all our investment decisions.

Disasters like the COVID-19 crash are viewed through an inherently bullish lens. We see these challenging times as opportunities rather than setbacks. We have proven our ability to capitalize on such opportunities in real-time. The COVID-19 crash was a notable example where we successfully navigated the market and made profitable investment moves.

We understand that different investors may have varying approaches to investing. Our focus, however, remains on maintaining composure and avoiding panic selling. We believe that making decisions based on fear can negatively impact investment outcomes. By staying calm and rational, we can assess the market objectively and make informed choices.

It is important to note that our approach does not disregard the need for thorough research and analysis. We consider market trends, economic indicators, and individual risk tolerance in our decision-making process. We aim to provide our clients with investment strategies that align with their goals and help them navigate market fluctuations.

At Tactical Investor, we emphasize maintaining a mindset free from fear and panic selling. We believe that disasters can represent opportunities, and we have a proven track record of successfully capitalizing on them. Our focus on staying composed and making informed decisions sets us apart. However, each investor needs to evaluate their risk tolerance and investment objectives to determine the most appropriate approach for their unique circumstances.

Strategic Principles

1. Prudent Deployment: We never deploy all our funds in one fell swoop; instead, we choose a strategic and gradual approach to maximize opportunities while minimizing risk.

2. Steady Progress: Rather than frantic stampeding, we adopt a calm and measured approach, ensuring that our health and well-being remain our top investment priority. Panicking is not an option.

3. Embracing Fun: We firmly believe investing should be enjoyable and fulfilling, free from unnecessary stress. As one delves deeper into the inner workings of the markets, it becomes evident that allocating time to watching the news or heeding expert opinions is futile. Investing that valuable time in other meaningful pursuits is far more productive.

We can unlock the market’s potential by embracing opportunities, conquering fear, and adhering to a strategic approach. The 100-year Dow chart is a testament to the long-term rewards that await those navigating turbulent times with unwavering confidence. Let us put fear aside, cultivate a bullish perspective, and channel our energy into pursuits that truly enhance our financial and personal well-being.

Strategically Cautious: Optimizing Opportunities in Uncertain Markets

The recovery rate from crash to boom will accelerate as the money supply rises. Look at how fast the markets recouped from the COVID-19 crash.

: We adopt an approach of strategic caution, not driven by nervousness but by the anticipation of potential market developments that might offer us an even more favourable opportunity shortly. Should this opportunity fail to materialize, we are well-prepared with a range of alternative stocks to redeploy our capital effectively. With multiple contingency plans in place, including a backup Plan C, we remain confident that such measures may not be necessary at this stage of the game.

Everybody panics when the word correction or crash comes to mind, but what 99% forget is that those that buy during this phase bank massive profits. The only intelligent game plan is to look at the masses and take the opposite stance. Jump in when they panic and vice versa. This is the game plan the top players have relied on since the inception of the stock market. Market Update August 21. 2021

How do you find bargains if the system is flooded with money, you cause tension, and you let that tension boil until the masses panic? Even better than creating a stampede is to make the masses think that the markets are erratic and have no rhyme or rhythm. Have you noticed that not every stock will rally when it declares breakout earnings? Conversely, companies that fail to deliver don’t always crash. This attack leads to more bargains because it is a psychological attack that triggers fear, anxiety and uncertainty, known as the terrible trio in the inner circles.

The ideal strategy would call for a mix of the above two. Start with the terrible trio and then shock the masses by creating a sharp sell-off but one that is short. The already stressed minds of most investors will not be able to deal with the terrible three and a market sell-off. So, they will dump top-quality shares for next to nothing.

Remember that as more money enters the system, the volatility increases. Because the only way the top players can deploy the additional sums of money they have accumulated is to trigger a sell-off. For now, shares are not being created as fast as money is added to the system. The top players will never buy at the market; they always want a bargain. They are masters of this game. They have conned the masses for millennia. They ensure their progeny understands history’s pivotal role in and out of the markets. Hence, their offspring hit the ground running while the masses still learned to crawl. It is easy to play catch up, for their entire strategy utilises fear as a weapon. If the herd understood this, they would no longer have to crawl. Instead, they could also hit the ground running.

Always focus on the opportunity factor when the masses are in panic mode. That is what the top players do. When the trend is positive, panic-based events should be viewed as a Godsend. Learn to take the opposite stance and be a true contrarian when everyone panics, celebrate and vice versa. Most contrarians are nothing but fashion contrarians, AKA fake and flaky contrarians. When the going gets tough, they fold like paper tigers and seek safety in the caves of misery.

Some early signals indicate that the correction might occur in two phases—one during the Sept-Oct period and a stronger one somewhere in the Jan-Feb 2022 timelines. The number of experts expecting a correction is rising, and such a development could throw them all off guard. If the signs strengthen, we will discuss this development in more detail. For now, just consider it as an extra morsel of information.

Other Articles of Interest

What is a Bullish Market: Debunking the Illusion of Stock Market Crashes

Profit Surge Unleashed: Mastering the Craft of Selling Puts for Income

Mastering Stock Market Psychology: Neutralizing Emotions & Biases

The Uptrend Alchemy: Transmuting Market Insights into Wealth

Take Control of Your Future: The Empowering Investing for Dummies PDF Handbook

How Did Many Banks Fail Consumers in the Stock Market Crash of 1929?

Factors Behind the Stock Market Crash and the Great Depression

US Rising Food Prices: Analyzing FOMO and Other Market Dynamics

Mastering Elegance in Economics: How to Define Financial Freedom in 5 Years

Market Timing Indicator: Genuine Gauge or Just Empty Hype?

Navigating the Palladium Market

Breaking Free: How Avoiding Debt Can Lead to Financial Freedom and Hope

In the Shadows of Crisis: The Stock Market Crash Recession Unveiled

John Hussman: A Track Record of Inaccuracy?