Panic Buying & Losses: Best bed Partners

Updated April 2023

Panic buying can be contrasted with panic selling, in which people sell goods in large volumes, driving their prices down, usually caused by a fear of a market crash. Investopedia

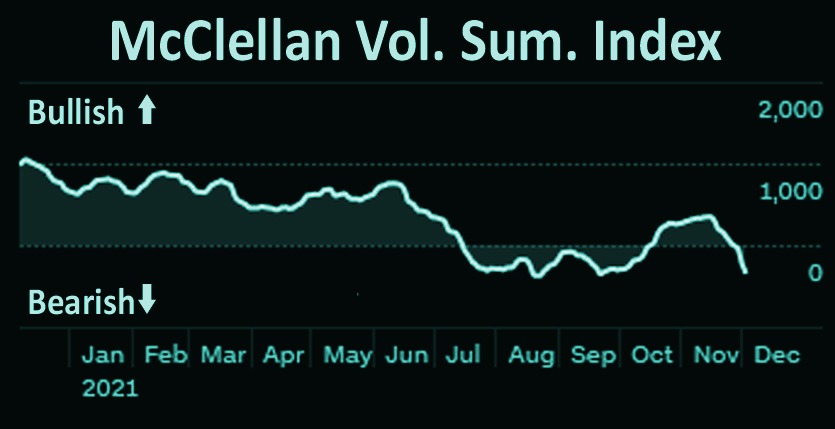

Looking at the two indicators posted below, one can see that the market is still experiencing a silent correction. The market of disorder could (could be the operative word) be pulling the wool over all the expert’s eyes. Everyone keeps stating that the market needs to let out steam, and maybe the opposite might pass. We know that market tops occur when the masses are euphoric. Panic buying usually leads to Euphoria, which is almost always short-lived. Sentiment analysis reveals that the herd is far from ecstatic. Additionally, the number of experts calling for a pullback continues to increase.

The number of new 52-week highs keeps dropping, and the McClellan index keeps shedding weight, indicating that a silent correction is underway. Combining these developments with the sentiment readings, one would almost be tempted to state that the markets are close to putting in a bottom. And if you responded by saying, “what bottom” we would sympathise with your reaction. We speak of a technical and sentiment bottom, not a market bottom based on price action. Given the current market action, panic selling seems more likely than a panic buying-based event.

Excited by a meme-crazed market and encouraged by the success of Cathie Wood’s Ark Investment Management, stock pickers are storming the $6.6 trillion US exchange-traded fund universe like never before — adding a new twist in the 50-year invasion from passive investing.

Passive funds still dominate the industry, but actively managed products have cut into that lead, scooping up three times their share of the unprecedented $500 billion ploughed into ETFs in 2021, according to data compiled by Bloomberg. New active funds are arriving at double the rate of passive rivals, and the cohort has boosted its market share by a third in a year. https://cutt.ly/oQkLEBJ

And we have another development that will provide additional long-term firepower to the markets. More ETF managers will want to follow in the footsteps of Cathie Woods. This trend will provide vast amounts of additional liquidity to the markets.

Looking at all the stocks and ETFs we have reviewed below, one thing stands out; many sectors are pulling back while the market trends are higher. This type of action clearly illustrates that a large portion of the market is experiencing a silent correction. So, we have two potential scenarios.

In the first scenario, they might break out sharply instead of the markets pulling back. If this hypothesis comes to pass, it will provide yet another robust signal that all traditional forms of analysis (technical and fundamental) are heading for the dustbin of time. The former highflyers will correct, while the low flyers could power the Dow and Nasdaq to a series of new highs. Almost 60% of the Dow components are trading in the oversold or neutral range.

More experts are calling for a market correction/crash. Hence, from a contrarian perspective, the market will crash argument might not be that sound. What if something in between both scenarios were to occur– it would confound almost everyone. In this scenario, the following could happen:

For one, the markets could let out a healthy dose of steam. At this game stage, the Dow shedding 2900 to 4500 points would be equivalent to the Dow shedding roughly 2200 points from July to August 2015 (look at the green oval in the chart above). Then the markets trod water for approximately six months. During that period, the bears built a case for further downside action. In Jan of 2016, when the Dow tested its July-August 2015 lows, they were almost sure that the next leg of the bear market was underway. However, they failed to spot that the Dow put in a higher low and that sentiment was decidedly bearish – and the rest, as they say, is history.

The Dow could repeat this pattern and (in doing so) confound both the bullish and the bearish camps, which is the ideal strategy as it generates the largest profits for the big players. Another thing to remember is that even though it took the Dow 6 months to break out, many stocks had bottomed out and surged to new highs before the Dow traded to new highs.

Hence, if the above pattern comes into play, we would view it as a tremendous buying opportunity, notably if the number of individuals in the neutral camp surged to the 48 to 54 range. High levels of uncertainty are the perfect sign that the market is on the verge of mounting a very sharp rally. Note that many stocks/ sectors have experienced corrections in the 20% to 30% ranges. The airline, travel, and financial sectors come to mind. Hence, the likely outcome is that they are poised to rally over the next 6 to 12 months.

Either scenario is acceptable. We prefer the scenario that leads to a sharp drop in the markets, which would make for a magnificent opportunity. As we stated recently, the trend is firm- even if the Dow were to drop to the 27K ranges and the Nasdaq fell to the 12K ranges, the trend would still remain bullish. It is improbable that the Fed would allow the markets to drop that much.

If they did, we would be almost tempted to say that one should sell everything they own to raise the cash to deploy into the markets. Such a situation would most likely trigger the father of all buying opportunities. We had the mother of all buying opportunities last year, and look at the massive gains we banked. One can only imagine the profits one would bank if the incredibly rare father of all buying opportunities were triggered.

Originally published Dec 14, 2021; Latest update April 2023

Enrich Your Knowledge: Articles Worth Checking Out

Blooms and Busts: Navigating the Tulip Bubble Chart Phenomenon

Herd Mentality: Understanding the Pros and Cons of Conformity

Projected Silver Prices: Setting Sail for Precious Metal Ascension

Which Of The Following Is A Cause Of The Stock Market Crash Of 1929

Stock Bubble: Act Quickly or Lag Behind

The Dow Theory: Does It Still Work?

Tactical Tools: Unleash the Power of Trend Prediction

The Pitfalls of Investing: Why People Lose Money in the Market

Stock Market Tips For Beginners: Surfing the Trends for Success

Panic Selling Mastery: Buying the Fear & Selling the Joy

Catch the Wave: Decoding Trading Cycles with the Esoteric Edge

Are Economic Indicators Finally In Sync With the Stock Market

Perception Manipulation: Mastering the Market with Strategic Insight

Market Uncertainty: A Challenge for Investors