Stock Market Sentiment Analysis: Euphoria Decoded for Market Peaks

Updated Feb 2023

Even though things are viewed as bad now, these times will be viewed as the good old days in the not-too-distant future. We also expect the polarisation mega-trend to gather even more traction. Most importantly, the Market of Disorder will move into the second phase.

In this phase, things will appear even more disorderly, at least to the masses and experts of yesteryear. Expect many well-known and renowned experts to stumble and make fools of themselves as their predictions fail to materialise.

We believe that the markets are setting up for a substantial correction next year. Almost every asset class except for precious metals has soared in value. A strong stock market correction could lead to secondary effects, such as cooling the steaming hot housing market. Market Update Nov 11, 2022

Federal Influence Unraveled: Mastering Stock Market Sentiment Analysis

The Fed need an “oops, I did it again Britney Spears moment” so they can renege on their promise to taper. Hence, the Fed is likely to engineer a substantial correction. Nothing shocks the crowd more than when their pie-in-the-sky dreams are shattered. This will address the labour shortage problem in one shot, and the Fed will have a valid reason to default on its promise to taper. Market tops provide central bankers with an almost 100% chance of reneging on their old promises. More importantly, market sentiment will turn bearish, providing the impetus for the next bull run.

The Fed’s mission is to keep printing money forever. We are in the forever QE mode. They will use all sorts of tricks to achieve this. One will be via the IRS, where monthly checks are sent out to help families meet their daily expenses. This is already underway.

Eventually, this will morph into universal income, which, believe it or not, will be the ultimate QE. Ultimate because most individuals will never consider that free handouts equate to QE. The Fed’s goal is to debase a given currency. Handing money is a nifty way of achieving this objective while pretending to help the needy.

Epochal Stock Market Sentiment Analysis

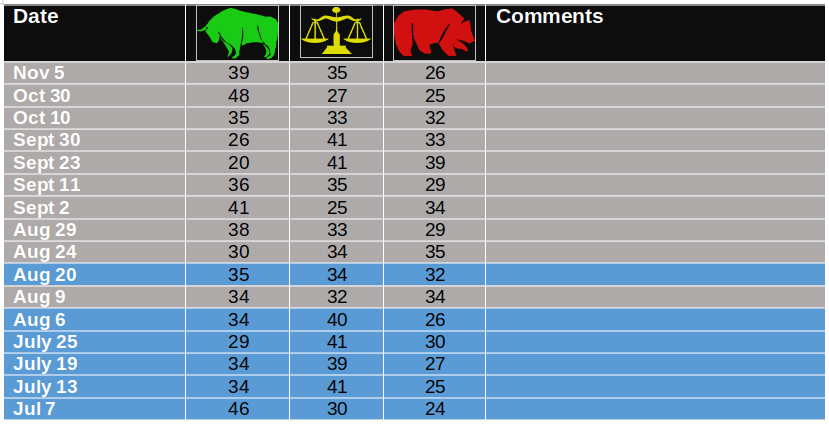

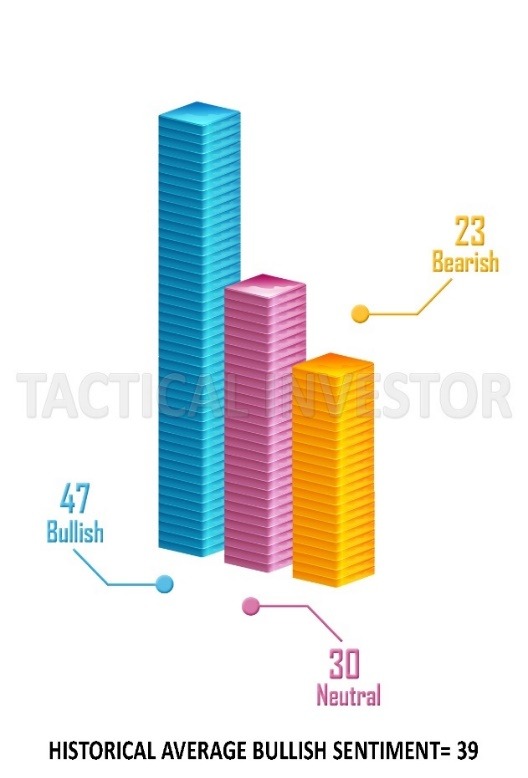

Market Tops tend to occur when Bearish sentiment is trading in extremely low ranges.

For the first time this year, we have three back-to-back readings where bullish sentiment is trading above its historical average. The first strong confirmation is that the markets will put in a multi-week top next year. Market Update Nov 11, 2021

The Fed needs a solid correction to scare the living daylights out of the masses. When panic sets in, the mass mindset is open to any and all suggestions, even if they are detrimental to the individual’s health in the long term. Many good men have tried to argue and prove that the masses can be saved, but thousands of years later, the masses are still cannon fodder.

They do what they excel at, running instead of strolling and strolling when they should be running. In other words, the secret desire to lose syndrome is so strong that they go out of their way to destroy any chance of achieving long-term success.

Signs to watch for that the market will top next year

The first sign that a top is in place is that a series of lower highs follow a new bliss. The market lacks the oomph to take out its old highs. In some instances, it comes dangerously close to doing so. This provides the latecomers to the party with enough fodder to create the illusion that the market is building steam for a higher move. These lower highs lead to a “channel formation”. Channel formations are very bullish if they form after the markets have sold off or are trading in the oversold ranges. The opposite applies when they take shape in a highly overbought market.

One of the more apparent signs of a top is that bullish readings remain unusually high during this sideways action. The dumb money is sure that this sideways action represents another buy-the-dip opportunity. However, they fail to take note of the unusually high bullish sentiment. An offshoot is that bullish sentiment trades slightly above its historical value, but Neutral sentiment surges. When the market is trending sideways, either development indicates that a top is in place.

Other Articles of Interest

Buy When There’s Blood in the Streets: Adapt or Die

Bitcoin Crash: The Bull’s Demise or Rebirth?

It’s the Economy, Stupid: Not Exactly

Tomorrow’s Stock Market Prediction: A Silly Pursuit?

Unveiling the Phrase ‘Panic Selling is also known as

Unlocking the Secrets: Mastering How to Read Stock Trends

Cracking the Code: Secrets of Stock Market Timing

BTC vs Gold: Decisive Victory Unveiled

Mind Control Techniques: Mastering Market Dynamics for Success

Bitcoin vs Cousin Ethereum: Unraveling the Cryptocurrency Conundrum

Federal Reserve Unmasked: The Silent Plunderer

When will the stock market bottom, igniting lucrative Rally?

Bitcoin Price Prediction Insights: A Precious Metal-Beating Trail

Bond Crash: To Invest or Not to Invest