Updated March 8, 2024

Market Timing Strategies: Embracing Opportunities Amidst Fear and Fluctuations

Can you point to one market crash or so-called end-of-the-world financial event that lead to the demise of the world or the financial markets? Nobody can, even those loud-mouthed slick snake oil salesmen can’t. Sol Palha

The financial world abounds with doom and gloom predictions. Yet, history has demonstrated that no market crash or event has ever brought about the demise of the world or financial markets. Instead of succumbing to fear-mongering tactics, investors should focus on the opportunities that arise during every fall or crash. Regeneration is an inherent aspect of the market cycle, and those who position themselves appropriately can reap the rewards.

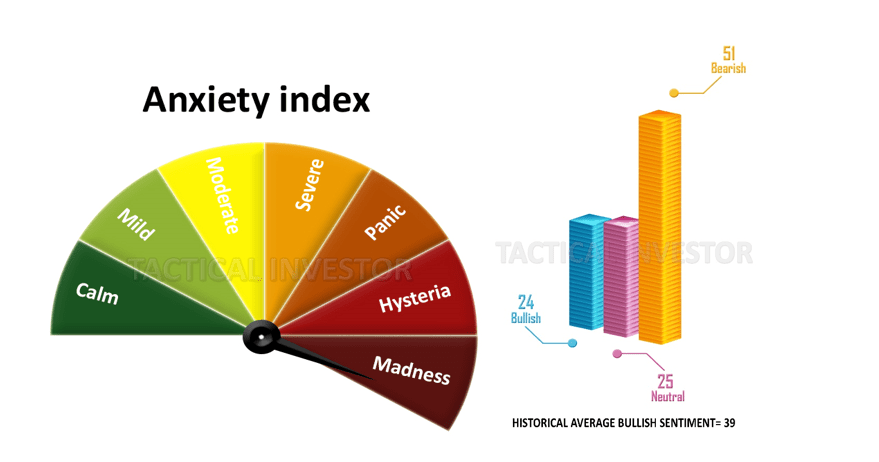

To avoid the most devastating events, it is essential to use tools such as trend indicators, mass psychology, and sentiment data. These tools aid investors in making informed decisions and avoiding losses. Additionally, it is crucial to secure profits from profitable positions and refrain from relying on commercial media, which often perpetuates fear and confusion.

The key to market success lies in avoiding herd mentality and focusing on the regeneration factor. By adhering to discipline and concentration, investors can conquer fear and capitalise on the opportunities that arise from market fluctuations.

Market Timing Strategies: Navigating Opportunity and Emotional Pitfalls

Saying that Could help fine-tune market timing strategies:

Before we continue, the following quotes from some brilliant individuals illustrate the value of keeping a cool head during the panic.

“the time to buy is when there’s blood in the streets.” – Baron Rothschild

Losing your head in a crisis is a good way to become a crisis. – C.J. Redwine

Sooner or later comes a crisis in our affairs, and how we meet it determines our future happiness and success. Since the beginning of time, every form of life has been called upon to meet such a crisis. – Robert Collier

Successful people recognize crisis as a time for change – from lesser to greater, smaller to bigger. – Edwin Louis Cole

It’s not always easy to do what’s unpopular, but that’s where you make money. Buy stocks that look bad to less careful investors and hang on until their real value is recognized. I’ve never bought a stock unless, in my view, it was on sale. Buy on the cannons and sell on the trumpets. – John Neff

To win as a contrarian, you need the right timing and have to put on a position in the appropriate size. If you do it too small, it’s not meaningful. If you do it too big, you can get wiped out if your timing is slightly off. The process requires courage, commitment and an understanding of your psychology. – Michael Steinhardt

I will tell you how to become rich…Be fearful when others are greedy. Be greedy when others are fearful. – Warren Buffett

To succeed as a contrarian, you must recognize what the crowd believes, have concrete justification for why the majority is wrong, and have the patience and conviction to stick with what is, by definition, an unpopular bet. – Whitney Tilson

One of the Best Market Timing Strategists

To buy when others are despondently selling and when others are euphorically buying takes the most incredible courage but provides the most significant profit. Bull markets are born in pessimism, grow on scepticism, mature on optimism and die on euphoria. Maximum pessimism is the best time to buy, and time of maximum optimism is the best time to sell.

If you want to have a better performance than the crowd, you must do things differently from the crowd. – Sir John Templeton

Humans are prone to herd because it is always warmer and safer in the middle of the herd. Indeed, our brains are wired to make us social animals. We feel the pain of social exclusion in the same parts of the brain where we feel real physical pain. So, being a contrarian is a little bit like having your arm broken on a regular basis. – James Montier

Many give advice, but few that offer guidance. – Anonymous

Market Timing Strategies: Harnessing Panic for Optimal Results

Tactical investors should view panic as bullish when the trend is up. Buy when the masses panic and sell when they jump up with joy.

In investing, panic is often seen as a negative emotion that leads to irrational decisions and financial losses. However, some of the most successful investors in history have learned to harness the power of panic, using it to identify opportunities and maximize returns.

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, famously said, “Be fearful when others are greedy, and greedy when others are fearful.” This contrarian approach to investing has served Buffett well over his long career. By buying when others are selling in a panic, Buffett has been able to acquire assets at a discount and profit handsomely when the market inevitably recovers.

Similarly, Benjamin Graham, the father of value investing and Buffett’s mentor advocated for a disciplined approach to investing that involves buying undervalued stocks and holding them for the long term. Graham believed that the market’s manic-depressive tendencies create opportunities for patient investors who are willing to go against the crowd.

Peter Lynch, the renowned manager of the Magellan Fund at Fidelity Investments, also understood the power of harnessing panic. Lynch once said, “The real key to making money in stocks is not to get scared out of them.” By staying invested during times of market turmoil, Lynch was able to capitalize on the inevitable rebound and generate outsized returns for his investors.

These investing giants understood that panic is often a sign of opportunity, not a reason to flee the market. When the masses are selling in a frenzy, it’s often an indication that the market has become oversold and that bargains are available for those with the courage and foresight to act.

Of course, this contrarian approach to investing is not for the faint of heart. It requires a strong stomach, a long-term perspective, and a willingness to go against the crowd. But for those who can master the art of harnessing panic, the rewards can be substantial.

While panic is often seen as an opposing force in investing, some of the most successful investors in history have learned to use it to their advantage. By buying when others are selling and staying invested during market turmoil, these investors have generated outsized returns and built lasting wealth. For those looking to emulate their success, the key is to develop a disciplined, contrarian approach to investing that allows you to see opportunity where others see only fear.

Navigating Panic: Debunking Gloom and Doom for Investors

In market turmoil, it’s easy to get caught up in the hysteria and succumb to the fear that the sky is falling. However, as **Warren Buffett** famously said, “The most important quality for an investor is temperament, not intellect.” Keeping a level head and focusing on the long term is crucial for navigating through periods of panic.

One key thing to remember is that, in the grand scheme of things, we will be okay. Despite the dire predictions and gloomy scenarios portrayed in the media, there is often little data to support these claims. As **Peter Lynch**, the legendary investor and former manager of the Magellan Fund, once said, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Astute investors understand that panic often creates opportunity. When the masses are selling in a frenzy, it’s usually a sign that the market has become oversold and that bargains are available for those with the courage to act. This is why we frequently see insiders and the ultra-wealthy “backing up the truck” and loading up on stocks during market distress. **Baron Rothschild**, the 18th-century British nobleman and member of the Rothschild banking family, is credited with saying, “The time to buy is when there’s blood in the streets.”

Of course, this contrarian approach to investing is not without risk. It requires a strong stomach and a willingness to go against the crowd. But as **John Templeton**, the renowned investor and founder of the Templeton Growth Fund, once said, “To buy when others are despondently selling and to sell when others are avidly buying requires the greatest fortitude and pays the greatest ultimate rewards.”

In conclusion, while panic can be a powerful force in investing, it’s important to remember that it is often short-lived and that the long-term prospects for the market remain strong. By keeping a level head, focusing on the fundamentals, and being willing to go against the crowd, investors can navigate through periods of market distress and emerge stronger on the other side. As Warren Buffett once said, “The stock market is a device for transferring money from the impatient to the patient.” Those who can master the art of patience and discipline in the face of panic will be well-positioned to reap the rewards over the long term.

If you want to rob a man, the best way is to polarise those around him. If you’ll steal from the masses for decades to come, the best approach is to induce a state of helplessness via hysteria. Please step back and look at how easily the crowd has allowed Congress to rob them blindly for decades.

Let’s delve into history to observe how our discussed strategies played out in real-life situations. This mirrors what we previously shared with both our audience here and our subscribers. We articulate and implement these strategies in our actions, aligning our words with tangible results.

Unprecedented Monetary Measures: A Paradigm Shift

There was no way in hell that even one of the following packages would have been approved three weeks ago.

- 150 basis point reduction in rates

- $700 billion bailout package

- Another 2 trillion-plus bailout package

- 2 trillion dollars injected into the markets by the Fed to provide liquidity

- Now the Fed has stated they will inject as much money as they see fit. In other words, the Feds are openly admitting to forever Q.E.

Instead of creating a stir, the masses demand the Fed do more. In other words, they are now begging the governments to make more money out of thin air just because the picture appears to have changed. Suddenly, their arguments that too much money would be bad for the system are no longer an issue, for they are only concerned with improving the outlook now. They will rue the day they gave their governments so much power, hence the saying, those that don’t learn from history are doomed to repeat it.

Regardless of the expert’s state, one should never fight the Fed, for if you do, you will end up dead. Dead as in dead broke.

Market Timing Strategies: Unleashing the Power of Mass Psychology

Just remember, before you state you wish more people were/are more brilliant, picture how much harder it would be for you to navigate if all those around you were as sharp as you are. In the end, be thankful for the morons of the world, for they provide investors with valuable data that can be used to increase one’s net worth and stay out of harm’s way. Furthermore, this data reveals what we have always stated: that no good deed goes unpunished and that a good Samaritan usually ends up as a dead Samaritan. Never offer to help someone who does not seek it; they will likely string you up the nearest pole if you do so.

The masses are still nervous, so the game plan is simple. Panic should be viewed as the code word for buying. Hence, when the groups panic and sell their shares, they jump in, buy, and keep doing this until the trend turns negative.

The Perils of Emotional Investing: Lessons from Mass Mindset

Now, these wise guys who felt so bright by blasting the hell out of us during the market meltdown will weep tears of blood shortly if they are not already doing so. They made the same mistake, promising never to fall for the fake news/hysteria that made them dump their shares at the bottom. But like mentally deranged individuals, they did precisely the same thing at the worst possible time, and what was their excuse; “it’s different this time”.

Well, it will always be different, and that’s the excuse the masses will use forever to justify letting emotion overrule logic and selling when they should have been buying. Ultimately, this story will be repeated repeatedly because the mass mindset knows no better.

Hence the saying misery loves company, and stupidity demands it. Success is based on taking an approach bound to draw shouts of criticism from the masses. The only saying that comes to mind is the truth hurts, and boy does it.

originally published on Sep 1, 2020, and updated March 8, 2024

Other Articles of Interest

The Successful Investor: Embracing Market Trends

IPI Stock Price: Ascending Star or Descending Dagger?

Immoral Behavior and the Religious Provocation Index

Silver and Gold Bull: Charging-Poised for a Powerful Move

Stock Market Manipulation: The Dominion of Financial Engineers

Strategic Safeguard: How to Prepare for a Stock Market Crash

Flush with Cash: Investors on Edge, Hesitant to Deploy Capital

Permabear Doomster Debacle: Daring to Defy the Dire Predictions!

How Much Money Do You Need to Invest in Real Estate?

Mass Media Manipulates: Balancing Awareness and Trend Adoption

What is Mainstream Media? Navigating the Web of Truth & Deceit

Market Mastery: Unconventional Paths to Stock Market Success

The Pillars of Investment Success: Cultivating Patience and Discipline

Contrarianism and Mass Psychology: A Dynamic Duo for Market Success

How much money do i need to invest to make $1000 a month?

Investment Pyramid: Valuable Concept Or?

Strong Buy Stocks: Focus on The Trend & Not the Fear Factor

Dow Jones Industrial Average Index Set To Defy Naysayers

Smart Money Acting Like Ignorant Money

Market Crash 2020 Or Is This A Manufactured Crisis?

Dollar Strength Or Dollar Crash

The Angry Mob & The New Polarised World

Social Unrest And The US Dollar

Stock Buying Opportunity Courtesy Of Coronavirus

Market Timing Strategies: Debunking Flawless Predictions

Buy When There’s Blood in the Streets: Adapt or Die

Gold as a hedge against inflation