Shanghai SE Composite Index Outlook

Updated Aug 2019

Some experts are claiming that stocks in China have rallied sharply from their lows because of state-backed entities such as the unit known as the “National Team”, which is equivalent to the PPT (Plunge Protection Team) in the U.S. Even if this is the case, why point a finger when we are guilty of the same scandalous game? We taught the World that propping the markets is the way to go when one is trying to mask economic weakness. Our economic recovery is a hoax and is supported by hot money. Take away the money, and the recovery ends.

Must Read: Fed’s primary objective to Manipulate Masses & Markets

However, we feel the reason that the markets are moving higher is that astute individuals have stepped in to open long-term positions; they recognize a great deal when they see it after all the Shanghai Index shed over 50% from high to low.

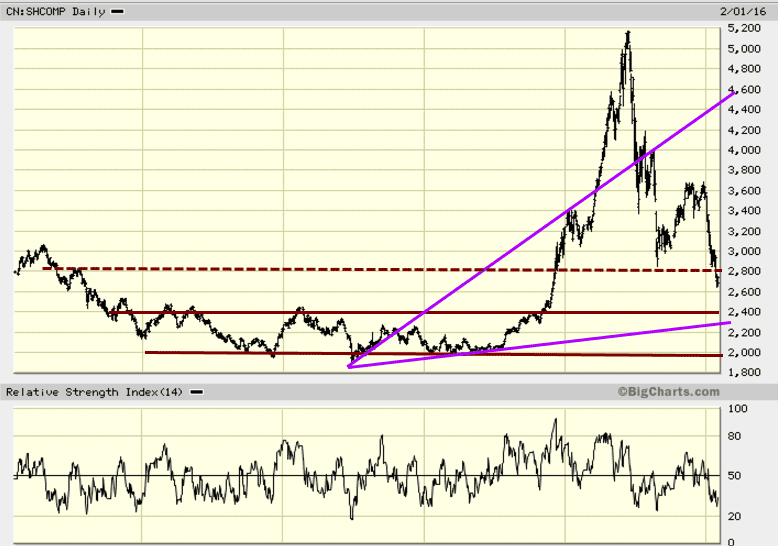

The chart above illustrates how strongly the Shanghai Index pulled back; history clearly indicates that the best time to buy is when blood is flowing in the streets. And one can safely assume that a lot of blood flowed in the streets and is still flowing after this back-breaking correction.

However, an additional factor could provide even more fuel to the current rally as Margin rules are expected to be eased once again.

Has The Shanghai SE Composite Index Bottomed or

Bloomberg states that the CSFC (China Securities Finance Corporation) will start offering loans again for 7 to 182 days. This announcement was later posted on the CSFC’s website, and interest rates will be in the 3% range, which is relatively low and will most likely attract a lot of speculators.

“The loosening could reignite interest in the equity market, particularly as the regulators’ actions last year — to rein back private sector broker leverage — helped trigger the correction in equity prices,” Koon Chow, senior macro and currency strategist at Union Bancaire Privee in London told Bloomberg. “It does look like they want a second chance at growing the equity market. We shall all be watching very closely whether leveraged buying of the equity market balloons again.”

We have been stating all along that China makes for a great long term investment as it is set to become the world’s largest economy. Astute investors should start compiling a list of stocks now and slowly opening long term positions in blue-chip companies or corporations that have strong quarterly earnings growth rates.

“The potential risks could be the brokerage firms misusing the leverage,” Wayne Lin, a New York-based money manager at QS Investors told Bloomberg. “If they use it for market-making then it’s good. If they use it for speculation, then it’s bad.”

Yes, the potential for abuse is always there, but that has not stopped Western firms from offering margins, and our markets are still doing well. Market booms and busts are part of the scheme the Federal Reserve orchestrates, and they are here to stay until the Fed is eliminated. Unfortunately, we do not see that happening anytime shortly; so the best game plan is to view all so-called market crashes as buying opportunities.

Tactical Investor China Stock Market Outlook Update Aug 2019

The above views were held back in 2016, and the Shanghai SE Composite Index did mount a rally, which then fizzled out due to the tariff war. Things don’t appear to be easing up; take a look at the latest chart below:

The index has put in a lower high, as indicated in the picture, and the momentum could change at any point as it appears poised to test its lows again. If 2920 is taken out on a monthly basis, It should lead to a series of new lows before a bottom is in place. At this point in time, we would avoid committing significant funds to China, but one can invest in individual stocks or ETFs that are defying the trend. For example (at least for now), NTES and TCHEY appear to be holding up well, while BABA is taking a beating.

Other Stories of Interest:

Are Doppelgangers Real: Enter the Age of AI Identity Replication

Dogs of the Dow 2024: Barking or Ready to Bite?

What happens when the stock market crashes? Opportunity!

The Trap: Why Is Investing in Single Stocks a Bad Idea?

How Can Stress Kill You? Unraveling the Fatal Impact

Investment Pyramid: A Paradigm of Value or Risky Hail Mary?

Contrarian Investing: The Art of Defying the Masses

Quantitative Easing: Igniting the Corruption of Corporate America

Uranium Market Outlook: Prospects for a Luminous Growth Trajectory

Stock Investing for Kids: Surefire Path to Success!

An Individual Who Removes the Risk of Losing Money in the Stock Market: A Strategic Approach

Palladium Forecast: Unveiling the Stealth Bull Market

I Keep Losing Money In The Stock Market: Confronting the Stupidity Within

Is Value Investing Dead? Shifting Perspectives for Profit

Analyzing Trends: Stock Market Forecast for the Next 6 Months