Once the Dow challenges 33,000 or the Nasdaq trades past 14.5K, it will move to the “low level” mode. Market Update March 11, 2021

The Dow traded past 33,000, so we have officially crossed to the low-level mode we spoke of in the last update. Henceforth, the Dow shedding 2400 to 3000 points should be viewed as a stroll in the park type event. V readings surged another 300 points; wild weather patterns, downright insane action in and out of the markets should be expected. One should also be prepared to witness a surge in stupidity that will make the fools of yesteryear appear to be geniuses. If V-readings surge past 10,000, add 1000 points to the above ranges.

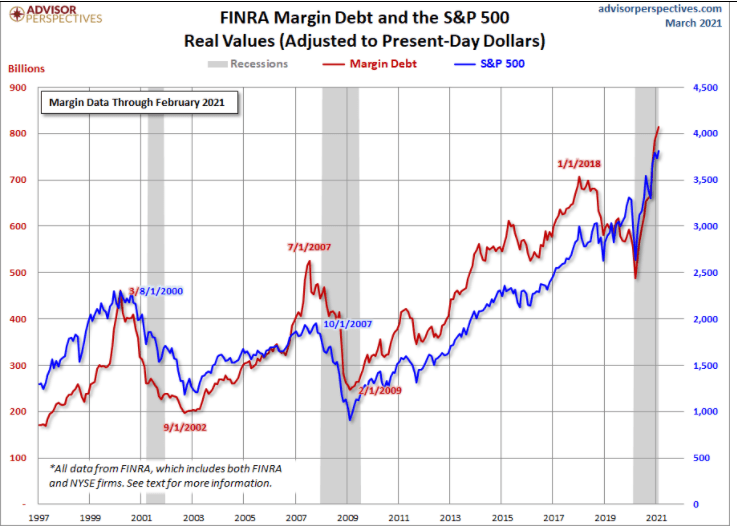

The number of retail investors will grow, and margin debt which is now roughly 780 million dollars, will surge to over 4 trillion before this bull market ends. If we have a ballistic feeding frenzy stage, we can expect the debt to surge to 6 trillion before this bull ends. Market Update March 11, 2021

One day individuals will look back at the current margin debt levels and refer to this as the good old days. Before this bull market ends, insanity levels will surge to 300-to-450-year new highs.

The market should be viewed as a game, for it is indeed a game. It’s the astute players against the emotional fools. If one keeps one’s emotions at bay, is patient and never forgets that discipline is the key to winning, the odds of walking away with a massive fortune before this bull market keels over are relatively high. Market Update March 11, 2021.

Conclusion

If the trend is up, no matter how sharply the markets pull back, do not panic, even if every expert and his grandma are telling you it’s time to flee for the hills. Market Update March 11, 2021

The Dow traded past 33K, V-readings have surged again, and finally, we are now at the next stage in the market of disorder (low level from very low level). Therefore, one needs to embrace volatility; in the same manner, one would welcome a lost love. Sounds hard to do, and that is precisely why it will work. When it comes to the Markets, one has to view events through a different lens. The least trodden path is often the one that will lead you to the pot of Gold.

Other Articles of Interest

Stock Market Crash History: Learn from the Past or Be Doomed

Graceful Money Moves: 6 Powerful Tips on How to Manage Your Money

The Prestigious Journey to Financial Wellness: How to Achieve Financial Wellness with Distinction

What is Inductive and Deductive Reasoning: Unveiling the Mystery

Savings Bonds 101: How Do Savings Bonds Work for Dummies

Finessing Your Finances: How to Manage Your Money When You Don’t Have Any

Copper Stocks to Buy: Seizing Wealth Opportunities In The Metal’s Market

Unveiling the Mysteries: How ESOPs are Typically Invested in and Why It Matters

I’m Never Going to Be Financially Secure, So Why Try?

Boost Your Financial Freedom and Secure a Home Equity Loan with a 500 Credit Score

Stock Market Investing for College Students: Navigating the Path to Financial Grace and Poise

Which Situation Would a Savings Bond Be the Best Investment?

How to Start Saving: Effective Strategies to Achieve Your Savings Goals

Stock Investing For Children: Ensuring Their Financial Success